Pranav, Karan and Rahim were partners sharing profits in the ratio of 3 : 2 : 1. Their capitals were ₹ 5,00,00, ₹ 3,00,000, and ₹ 2,00,000 respectively

Pranav, Karan and Rahim were partners sharing profits in the ratio of 3 : 2 : 1. Their capitals were ₹ 5,00,00, ₹ 3,00,000, and ₹ 2,00,000 respectively as on 1st April, 2022. According to the partnership deed, they were entitled to an interest on capital at 10% p.a. For the year ended 31st March 2022, a profit of ₹ 78,000 was distributed among the partners without providing for interest on capital.

Pass the necessary adjusting entry and show the working clearly.

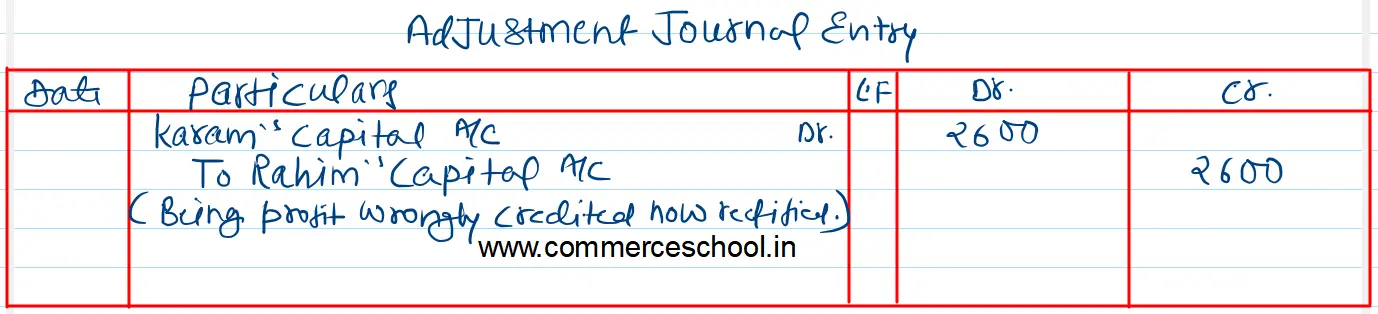

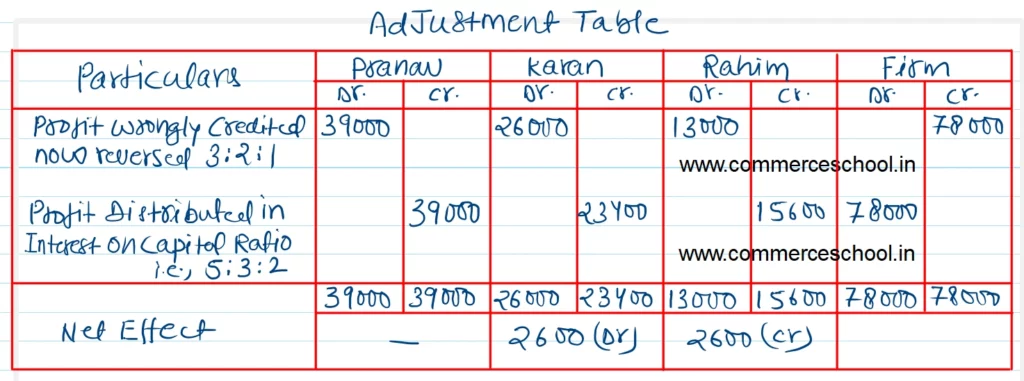

[Ans.: Dr. Karan’s Capital A/c and Cr. Rahim’s Capital A/c by ₹ 2,600]

[Hint: Profit will be distributed in the ratio of interest on capital due to insufficient amount]

Solution:-

Working Notes:-

Calculation of Interest on Capitals of the Partners:

Pranav’s Interest on Capital:- 5,00,000 ✕ 10% = ₹ 50,000

Karan’s Interest on Capital:- 3,00,000 ✕ 10% = ₹ 30,000

Rahim’s Interest on Capital:- 2,00,000 ✕ 10% = ₹ 20,000

Total Interest on capitals of all the partners = ₹ 50,000 + ₹ 30,000 + ₹ 20,000 = ₹ 1,00,000

= Total Appropriation > Available Profit

= ₹ 1,00,000 > ₹ 78,000

As appropriation (interest on capital) is more than the available profit. Thus interest on capital will be allowed upto the available profit in Interest on capital ratio

= ₹ 50,000 : ₹ 30,000 : ₹ 20,000

= i.e., 5 : 3 : 2