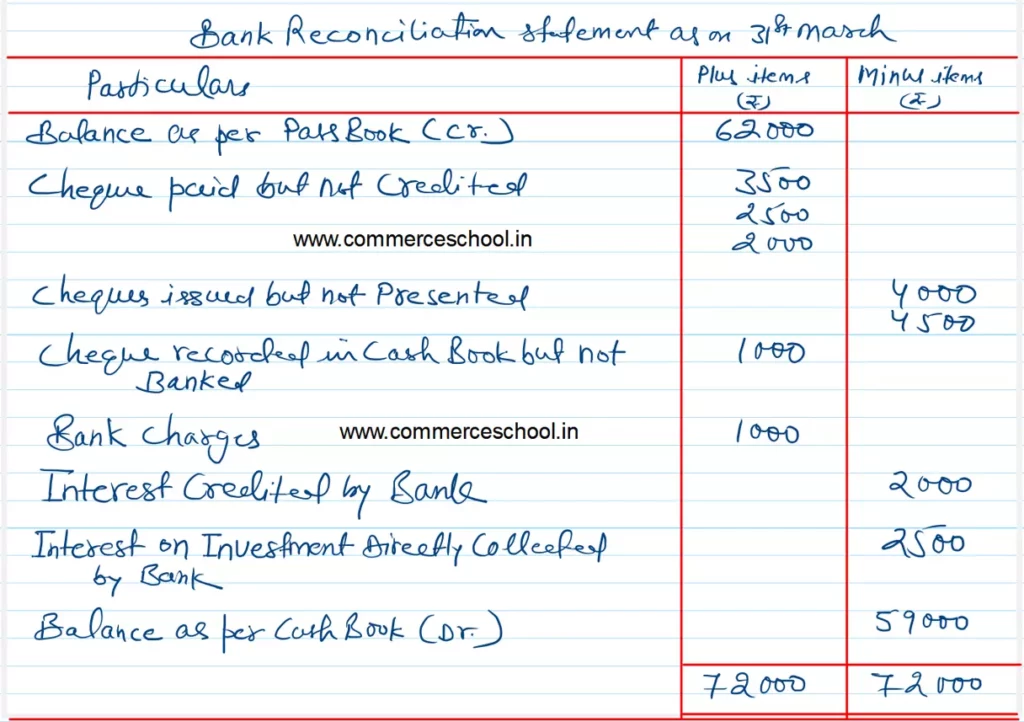

Bank Pass Book of a customer shows a bank balance of ₹ 62,000 on 31st March, 2023. On comparing it with the Cash Book the following discrepancies were noted

Bank Pass Book of a customer shows a bank balance of ₹ 62,000 on 31st March, 2023. On comparing it with the Cash Book the following discrepancies were noted:

(i) Cheques were paid into the Bank in March but were credited in April, 2023:

P – ₹ 3,500; Q – ₹ 2,500; R – ₹ 2,000.

(ii) Cheques issued in March were debited in April, 2023:

X – ₹ 4,000; Y – ₹ 4,500.

(iii) Cheque for ₹ 1,000 received from a customer was recorded in the Cash Book but was not banked.

(iv) The Bank Pass Book shows a debit of ₹ 1,000 for bank charges and credit of ₹ 2,000 as interest.

(v) Interest on investment ₹ 2,500 collected by the bank appeared in the Bank Pass Book.

Prepare Bank Reconciliation Statement with the balance as per Cash Book on 31st March, 2023.