A firm whose accounting year is a financial year, purchased on 1st July, 2019 machinery for ₹ 30,000. It further purchased machinery on 1st January, 2020 for ₹ 20,000 and on 1st October, 2020 for ₹ 10,000

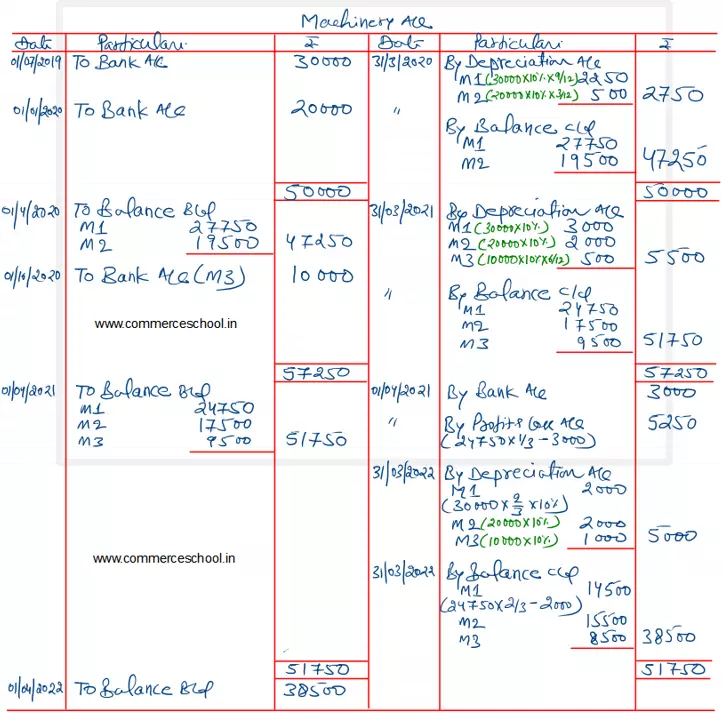

A firm whose accounting year is a financial year, purchased on 1st July, 2019 machinery for ₹ 30,000. It further purchased machinery on 1st January, 2020 for ₹ 20,000 and on 1st October, 2020 for ₹ 10,000. On 1st April, 2021 one-third of the machinery installed on 1st July, 2019 became obsolete and was sold for ₹ 3,000.

Show Machinery Account in the books of the company. Machinery was depreciated by Fixed Instalment Method @ 10% p.a. What will be the value of Machinery Account on 1st April, 2022?

Anurag Pathak Changed status to publish