Following is the Trial Balance of Paras on 31st March, 2023:

Following is the Trial Balance of Paras on 31st March, 2023:

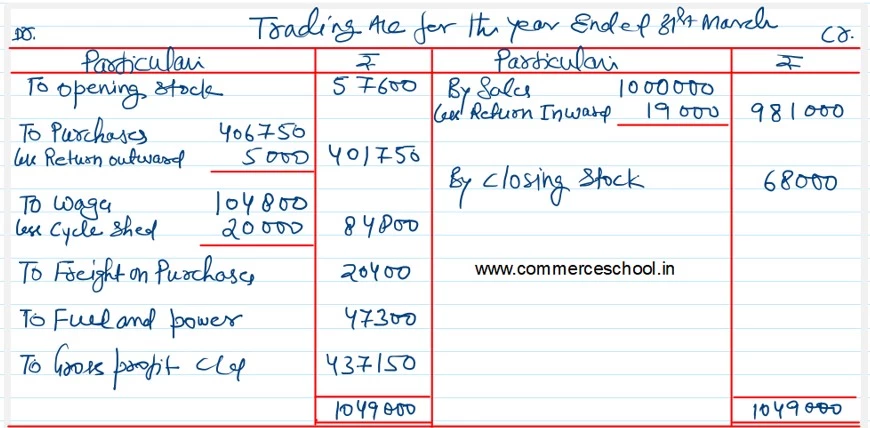

| Particulars | Dr. (₹) | Particulars | Cr. (₹) |

|

Sundry Debtors Drawings Insurance Rent General Expenses Salaries Patents and Patterns Machinery Freehold Land Building Stock (1st April, 2022) Cash at Bank Freight on Purchases Carriage on Sales Fuel and Power Wages Returns Inward Purchases Cash in Hand Input IGST |

1,45,000 53,450 6,000 10,000 20,000 1,50,000 75,000 2,00,000 1,00,000 3,00,000 57,600 26,300 20,400 32,000 47,000 1,04,800 19,000 4,06,750 5,400 40,000 |

Sundry Creditors Capital A/c Returns Outward Sales Output CGST Output SGST |

63,000 7,10,000 5,000 10,00,000 20,000 20,000 |

| 18,18,000 | 18,18,000 |

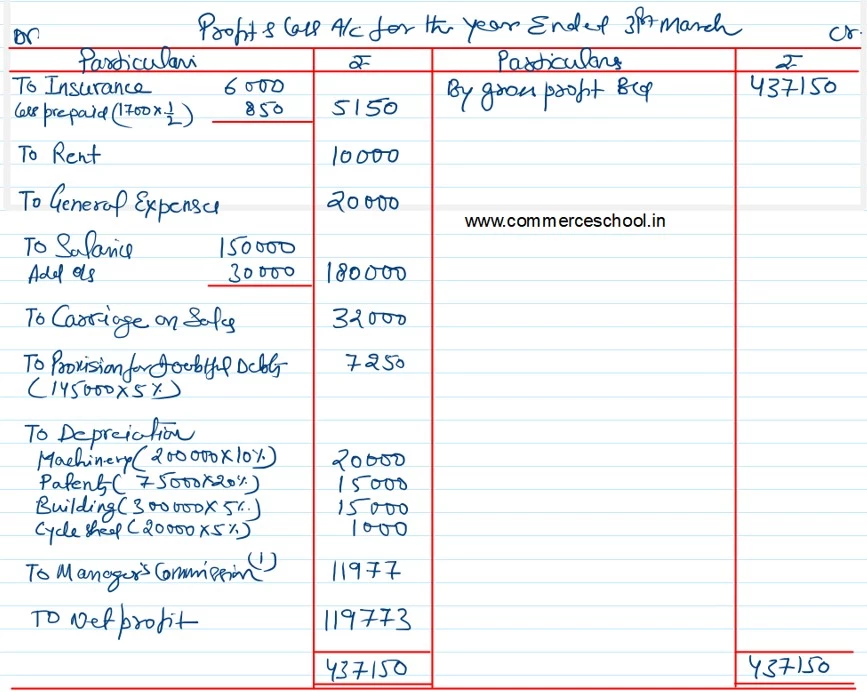

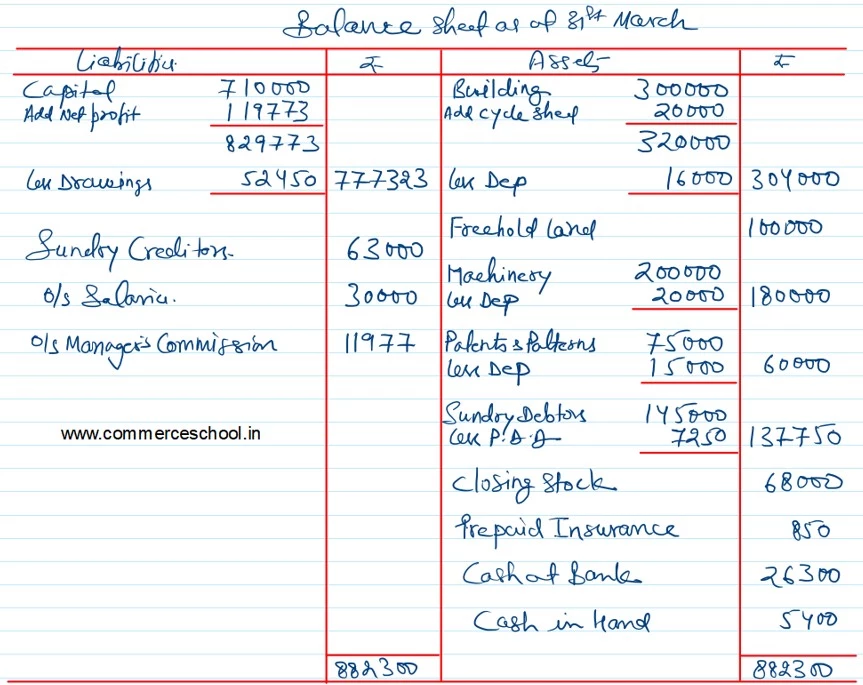

Following adjustments are made:

(a) Stock on 31st March, 2023 was valued at ₹ 68,000.

(b) Provision for Doubtful Debts is to be made to the extent of 5% on Sundry Debtors.

(c) Depreciate Machinery by 10%, patents by 20% and Building by 5%.

(d) Wages include a sum of ₹ 20,000 spent on construction of a cycle shed.

(e) Salaries for the months of February and March, 2023 were not paid.

(f) Insurance includes a premium of ₹ 1,700 on a policy expriring on 30th September, 2023.

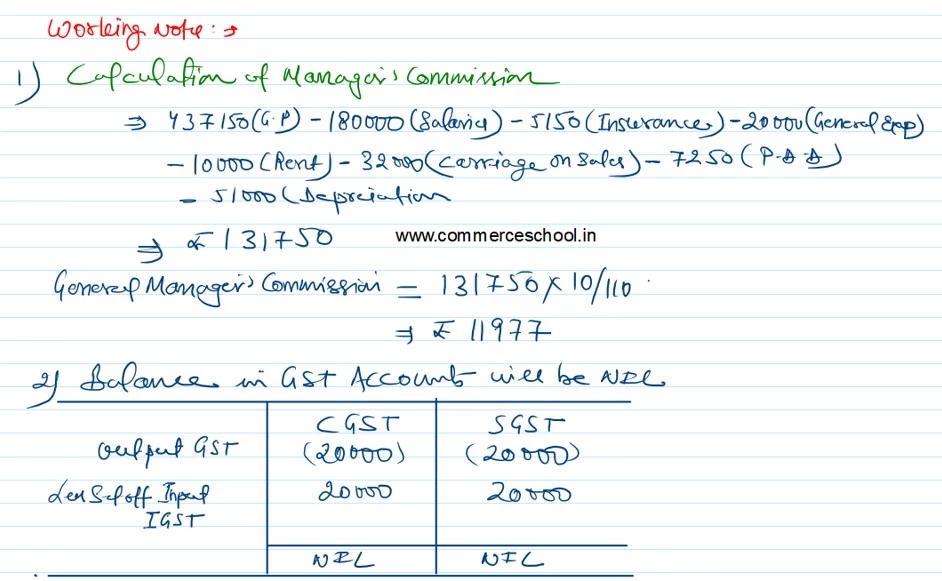

(g) General Manager is entitled to a commission of 10% on the profit after charging his commission.

You are required to prepare Final Accounts after giving effects to the adjustments.