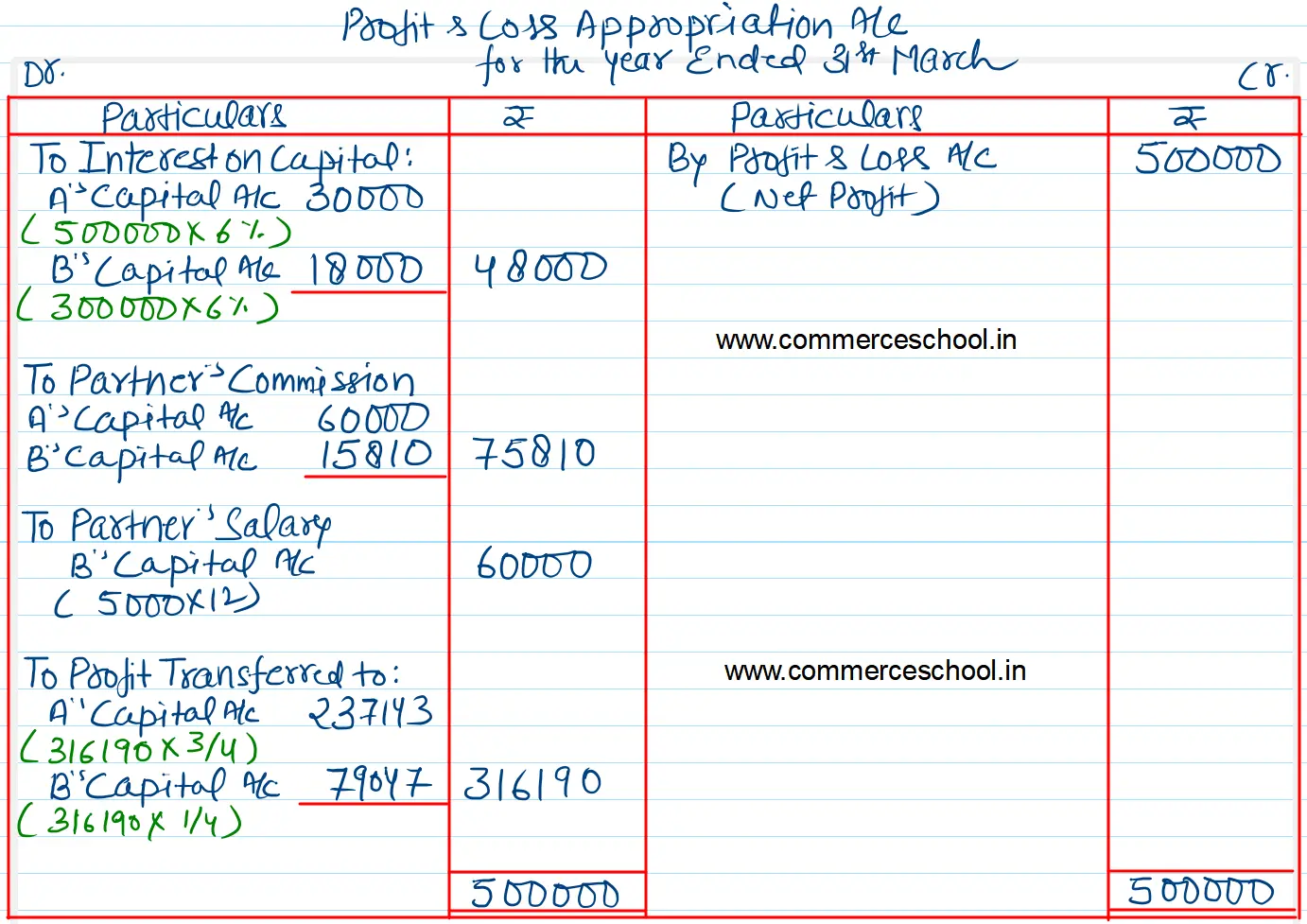

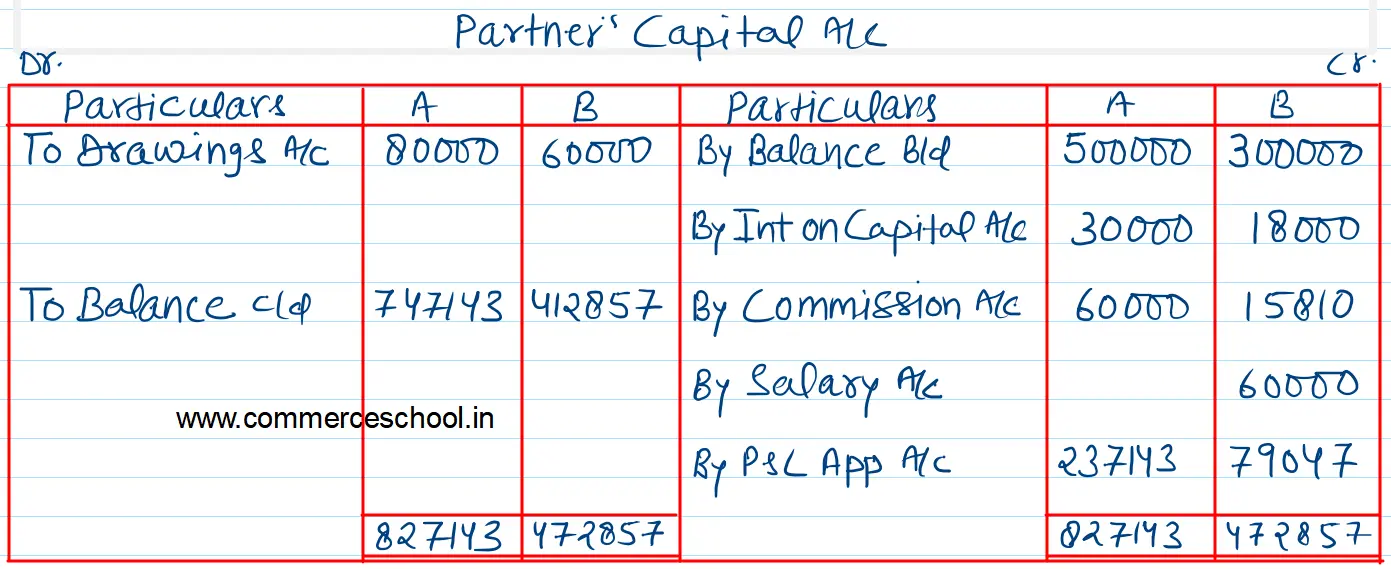

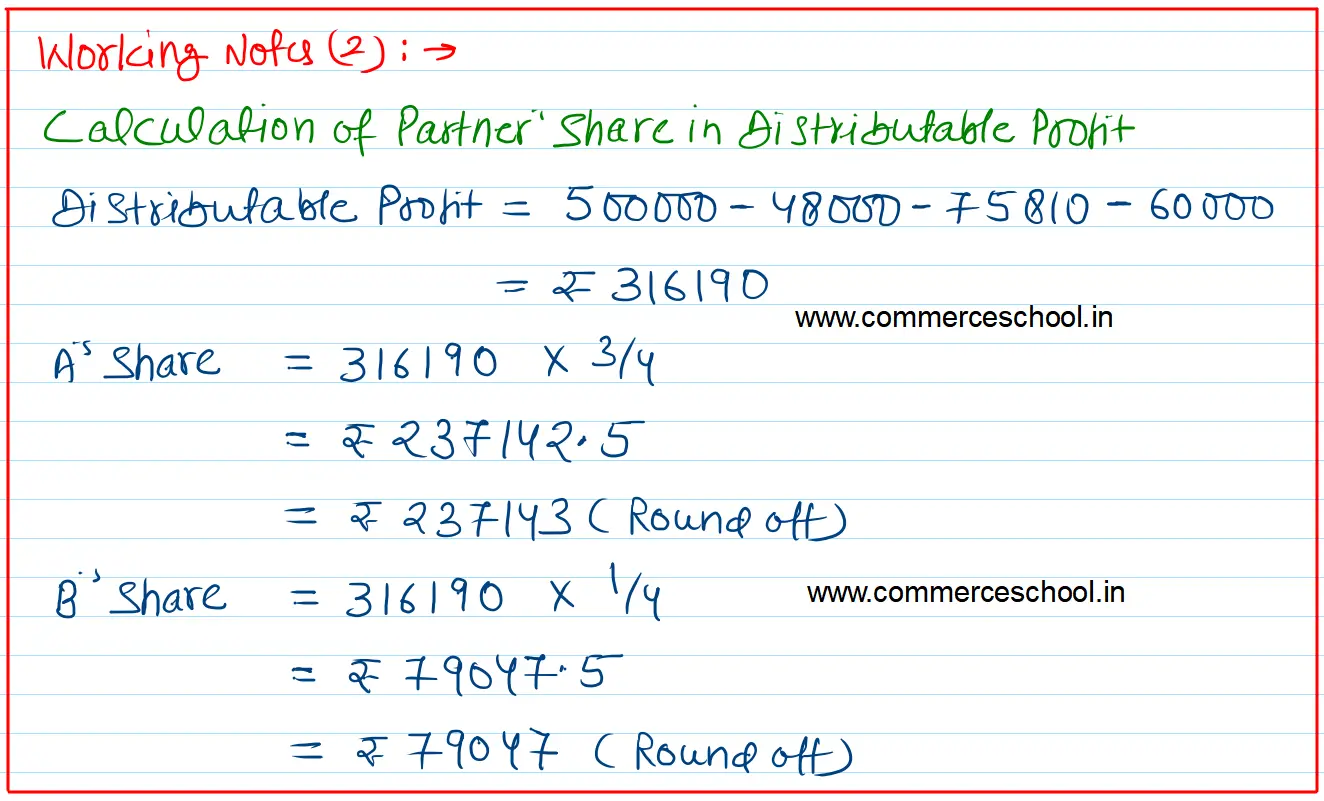

A and B are partners sharing profits and losses in the ratio of 3 : 1. On 1st April 2022, their capitals were: A ₹ 5,00,000 and B ₹ 3,00,000

A and B are partners sharing profits and losses in the ratio of 3 : 1. On 1st April 2022, their capitals were: A ₹ 5,00,000 and B ₹ 3,00,000. During the year ended 31st March 2023. the firm earned a net profit of ₹ 5,00,000. The terms of the partnership are:

(a) Interest on capital is to be allowed @ 6% p.a.

(b) A will get a commission @ 2% on net sales

(c) B will get a salary of ₹ 5,000 per month.

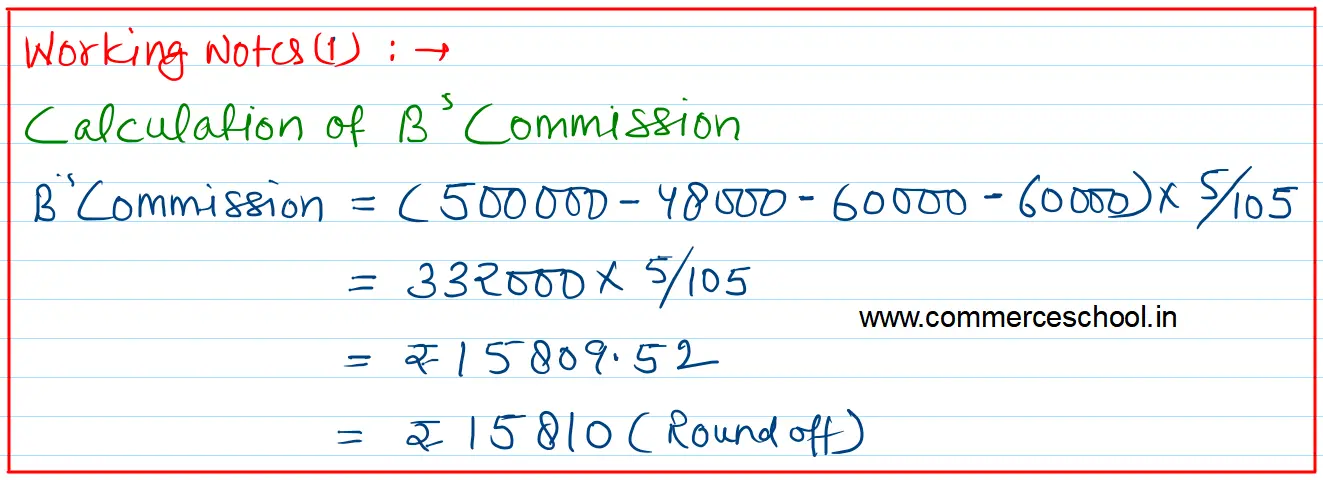

(d) B will get a commission of 5% on profits after the deduction of all expenses including such commission.

Partner’s drawings for the year were: A ₹ 80,000 and B ₹ 60,000. Net sales for the year were ₹ 30,00,000.

After considering the above facts, you are required to prepare Profit and Loss Appropriation Account and Partner’s Capital Accounts.

[Ans: Commission of B – ₹ 15,810; Share of Profit: A – ₹ 2,37,140; B – ₹ 79,050; Capital A/cs: A – ₹ 7,47,140; B – ₹ 4,12,860.]