Parul, Paresh, and Rahul are partners in a firm. The firm gave a loan to Rahul on 1st February 2022 of ₹ 6,00,000

Parul, Paresh, and Rahul are partners in a firm. The firm gave a loan to Rahul on 1st February 2022 of ₹ 6,00,000. Interest was agreed to be charged @ 6% p.a. Interest was paid by cheque up to February 2023 by Rahul on 5th March 2023 and the balance was yet to be paid by him.

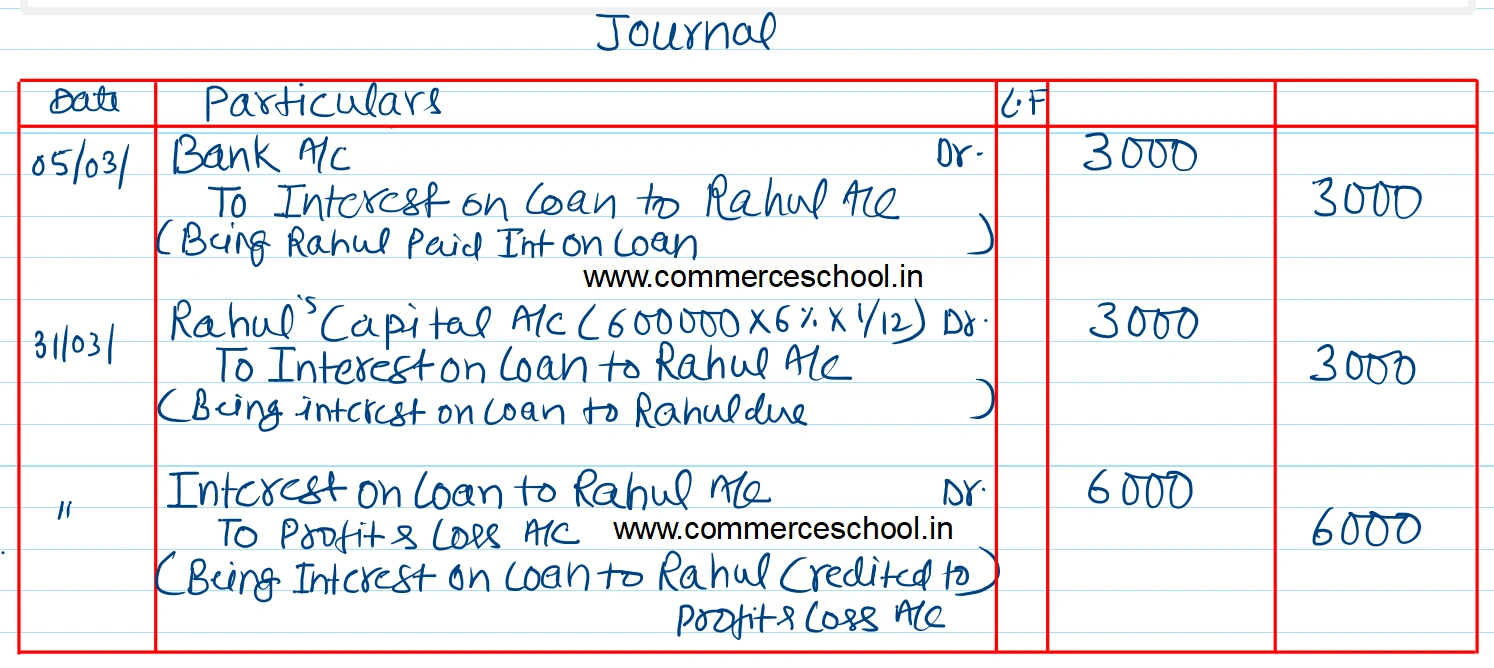

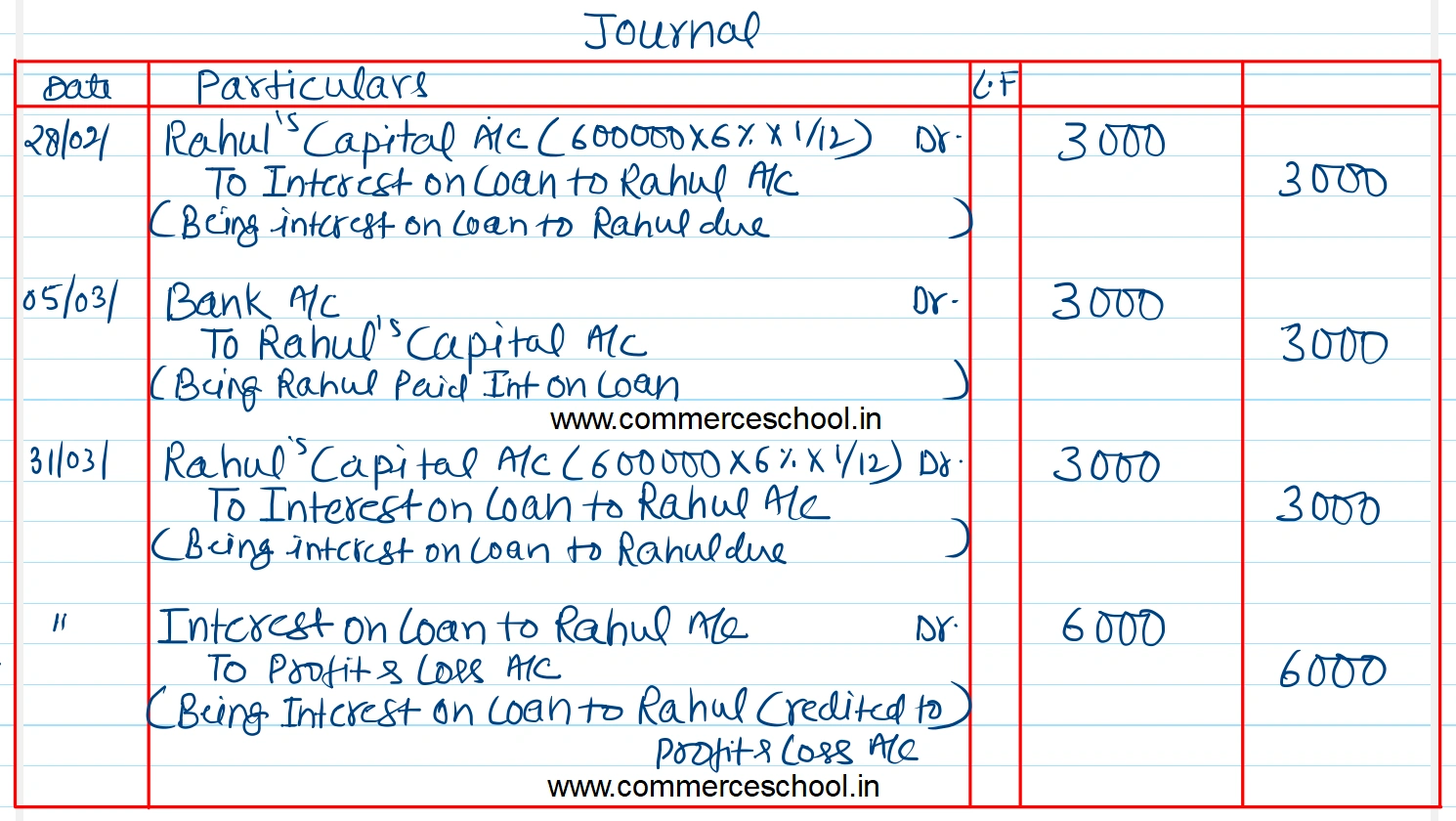

Pass the Journal entries for interest on a loan to the partner.

[Ans: Interest on Loan to Rahul (for February, 20230 – ₹ 3,000; Interest transferred to Profit and Loss A/c (up to 31st March 2023) – ₹ 6,000.]

Anurag Pathak Changed status to publish

Solution:-

| Video Solution | Link |

| Watch Video Solution | Click Here |

First Method:-

Second Method:-

| Video Solution | Link |

| Watch Video Solution | Click Here |

Anurag Pathak Changed status to publish