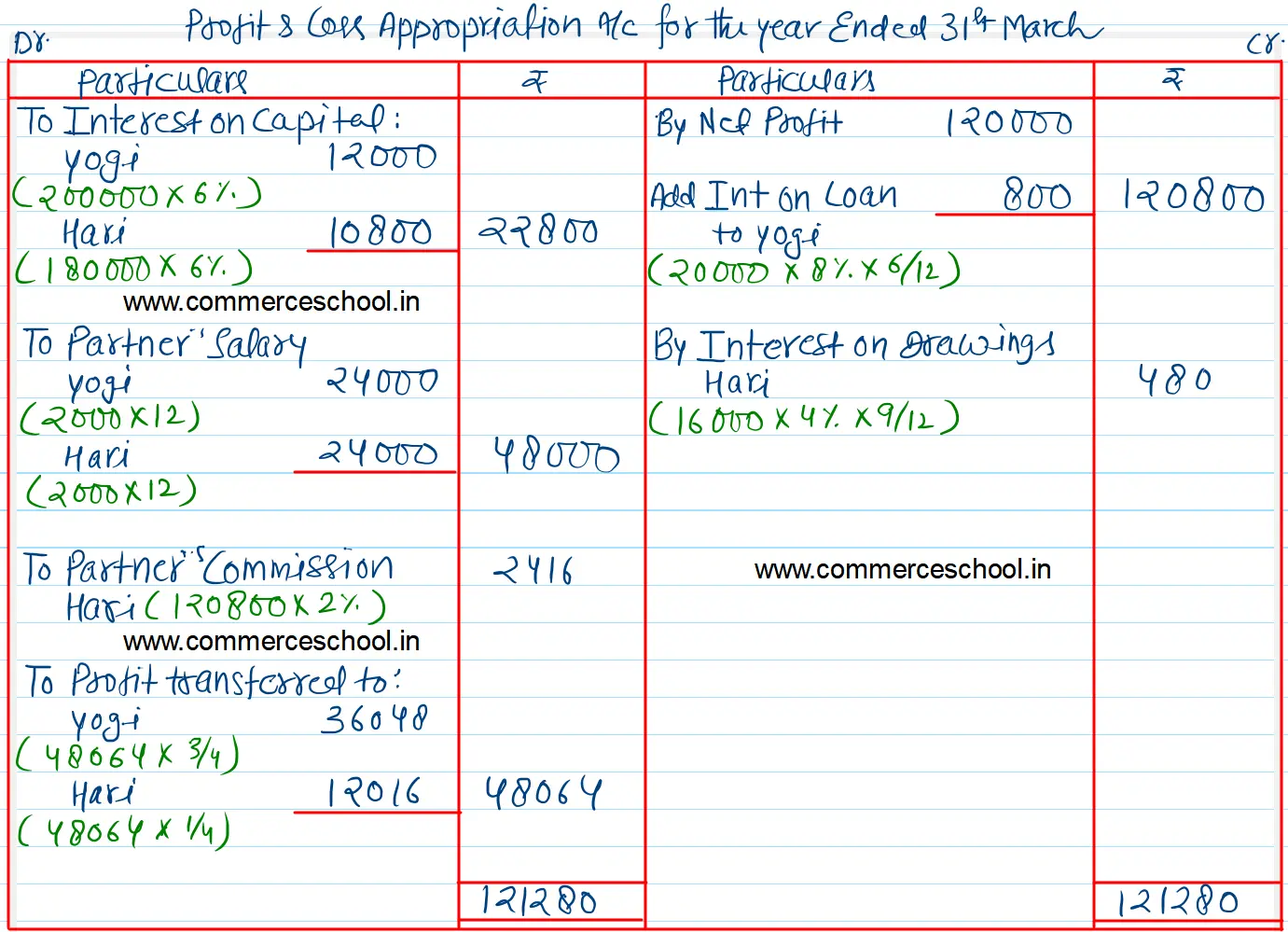

Yogi and Hari are in partnership sharing profits and losses in the ratio of 3 : 1. On 1st April 2021, their capitals were ₹ 2,00,000 and ₹ 1,80,000. The terms of their partnership are as follows:

Yogi and Hari are in partnership sharing profits and losses in the ratio of 3 : 1. On 1st April 2021, their capitals were ₹ 2,00,000 and ₹ 1,80,000.

The terms of their partnership are as follows:

(i) Interest on capital to be allowed @ 6% per annum.

(ii) Interest on drawings to be charged @ 4% per annum.

(iii) Partners to get a salary of ₹ 2,000 each per month

(iv) Hari to get a commission of 2% on the correct net profit.

(v) Any partner taking a loan from the firm to be charged interest on it @ 8% per annum.

Yogi had borrowed ₹ 20,000 from the firm on 1st October 2021.

Hari had withdrawn ₹ 16,000 on 1st July 2021.

During the year ending 31st March 2022, the firm earned a net profit of ₹ 1,20,000 before any of the provisions mentioned in the partnership deed.

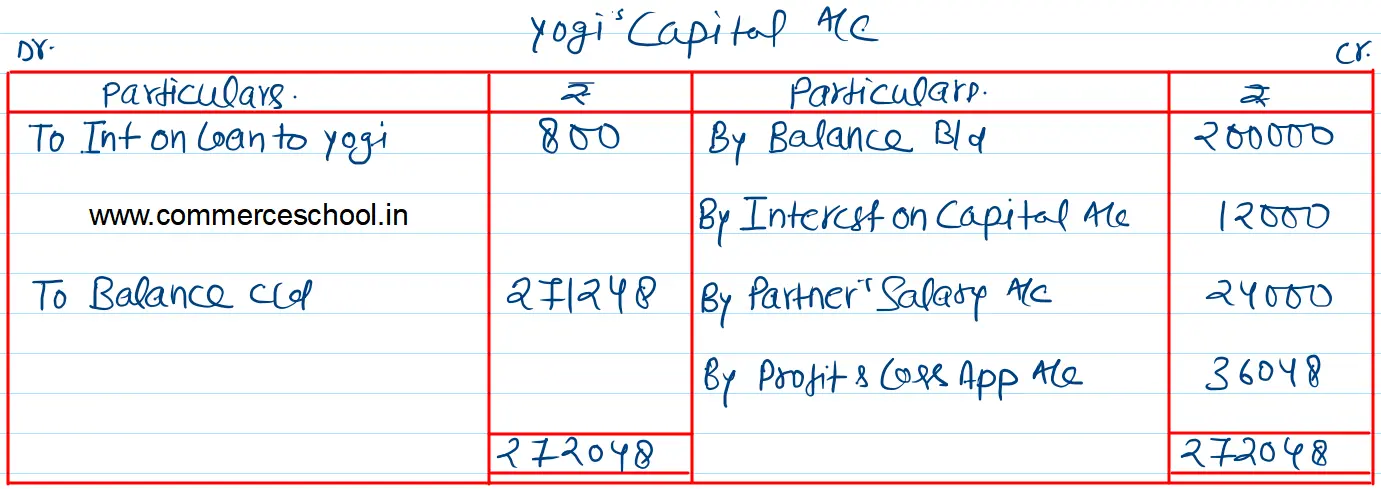

You are required to prepare for the year ending 31st March 2022:

(i) Profit and Loss Appropriation Account.

(ii) Yogi’s Capital Account.