Anil and Bindoo are partners sharing profits and losses in the ratio of 3 : 1. On 1st April 2022, their capitals were

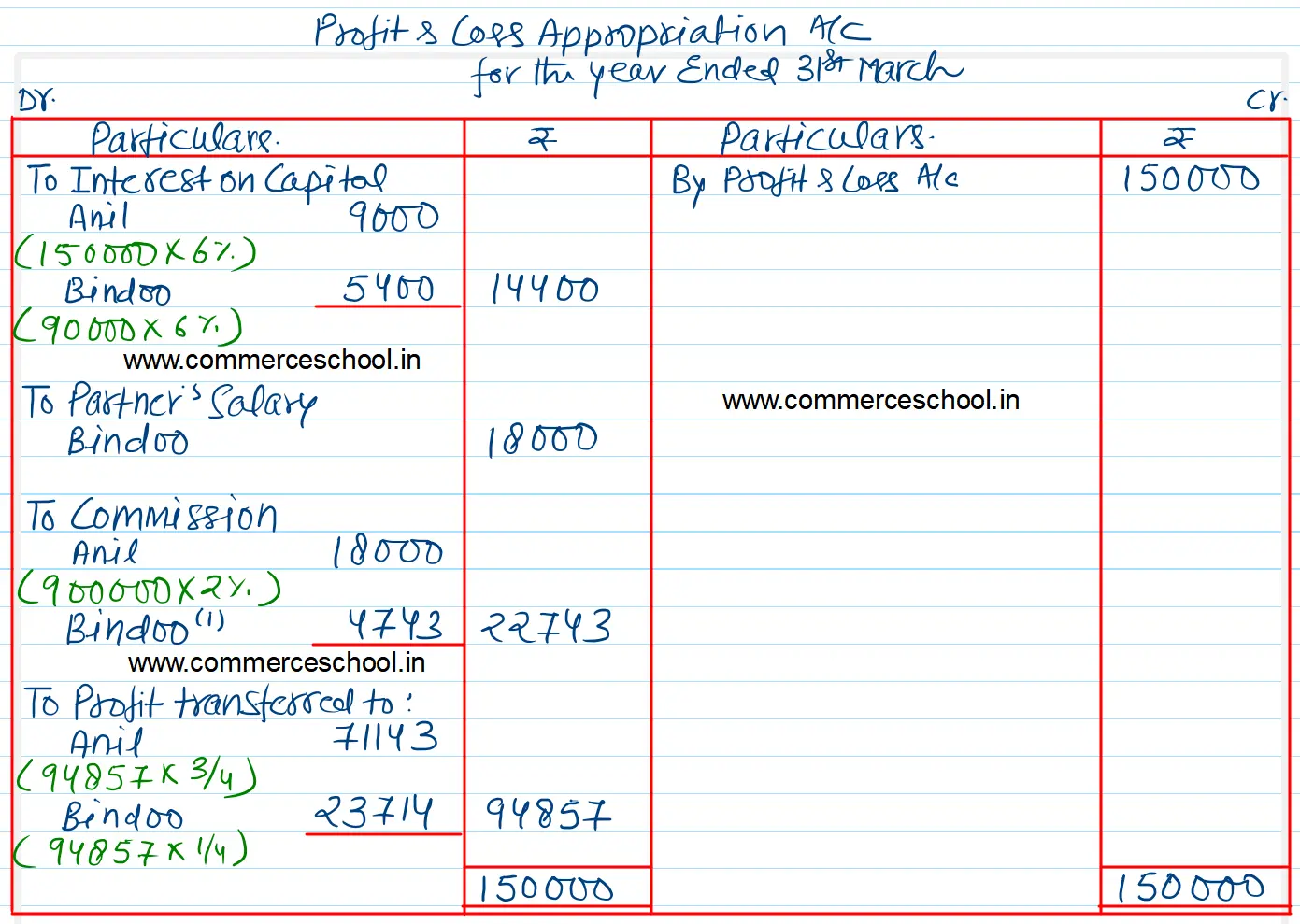

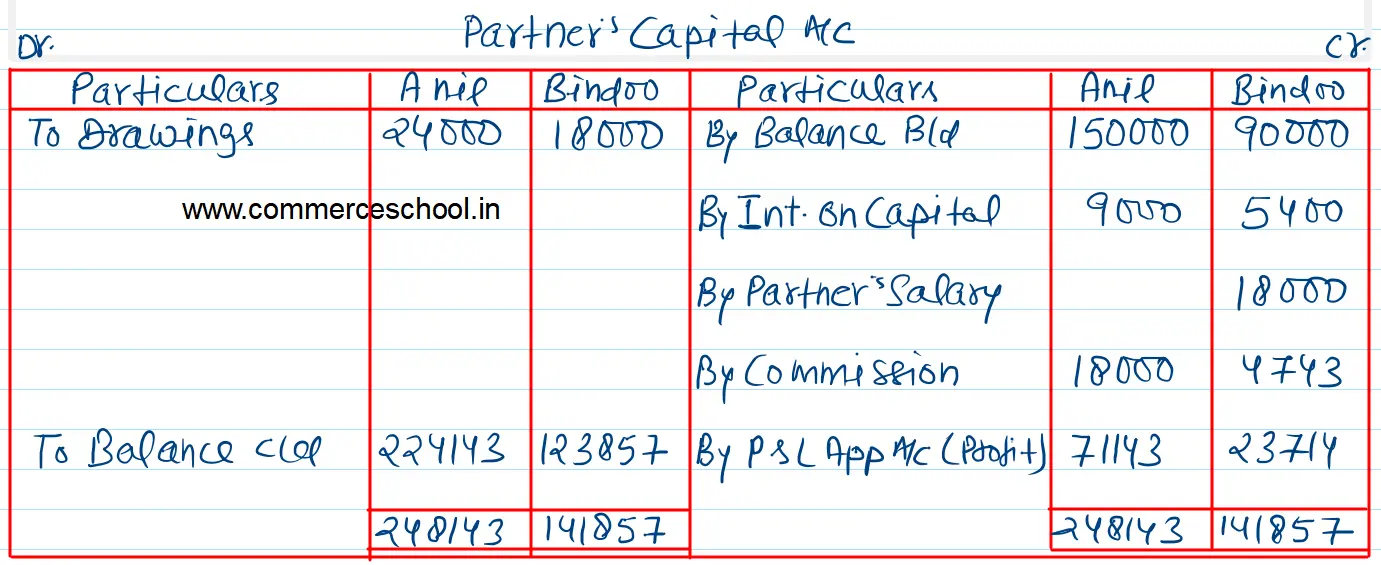

Anil and Bindoo are partners sharing profits and losses in the ratio of 3 : 1. On 1st April 2022, their capitals were: Anil ₹ 1,50,000 and Bindoo ₹ 90,000. During the year ended 31st March 2023, the firm earned a net profit of ₹ 1,50,000. The terms of the Partnership Deed are as follows:

(i) Interest on capitals is to be allowed @ 6% p.a.

(ii) Anil will get a commission @ 2% on the turnover.

(iii) Bindoo will get a salary of ₹ 18,000 p.a.

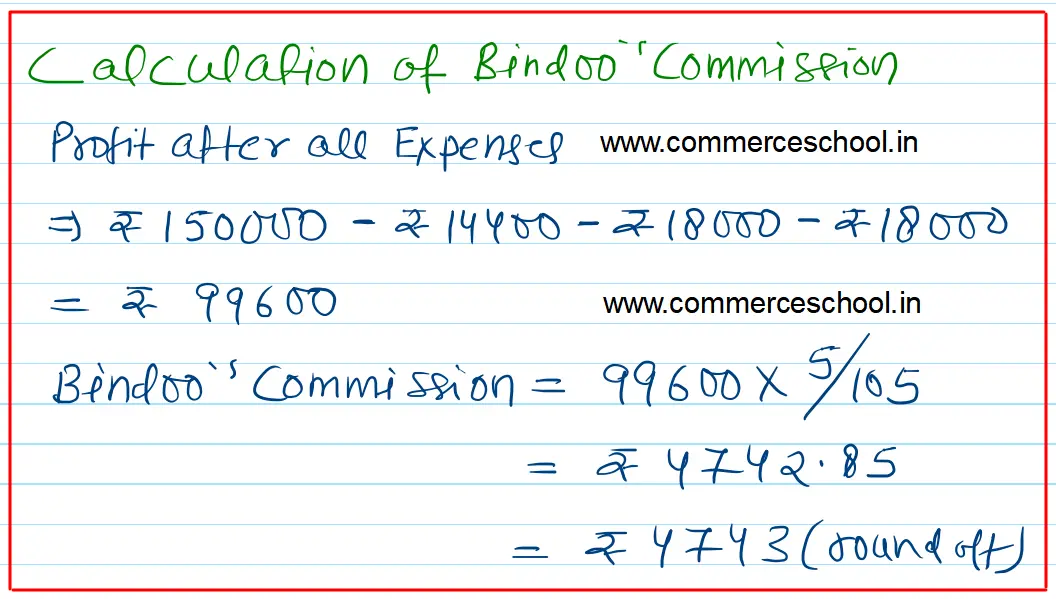

(iv) Bindoo will get a commission of 5% on profits after the deduction of all expenses (including her own commission).

Partner’s Drawings for the year were: Anil ₹ 24,000 and Bindoo ₹ 18,000. Turnover for the year was ₹ 9,00,000. After considering the above facts, you are required to prepare Profit and Loss Appropriation Account and Partner’s Capital Accounts.