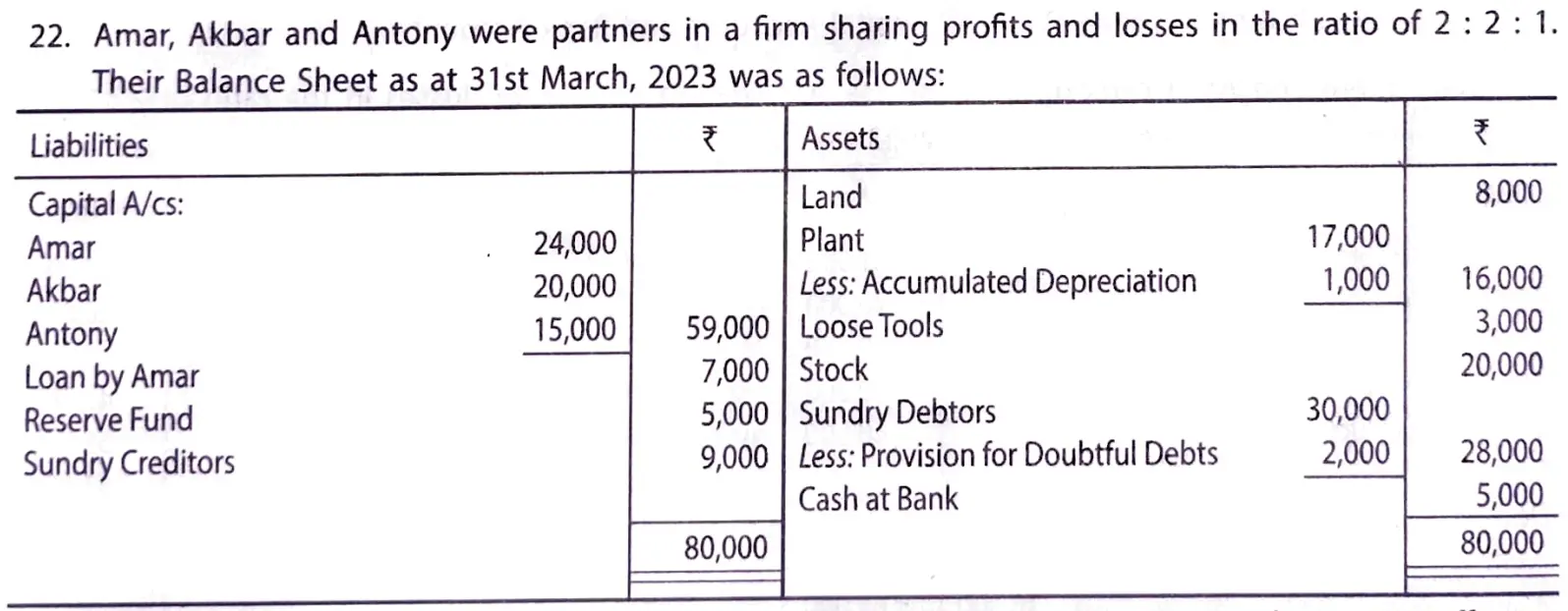

Amar, Akbar and Antony were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. Their Balance Sheet as at 31st March, 2022 was as follows:

Amar, Akbar and Antony were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. Their Balance Sheet as at 31st March, 2022 was as follows:

| Liabilities | ₹ | Assets | ₹ | |

|

Capital A/cs: Amar Akbar Antony Loan by Amar Reserve Fund Sundry Creditors |

24,000 20,000 15,000 7,000 5,000 9,000 |

Land Plant Less: Accumulated Depreciation Loose Tools Stock Sundry Debtors Less: PDD Cash at Bank |

17,000 1,000

30,000 2,000 |

8,000

16,000 3,000 20,000

28,000 5,000 |

| 80,000 | 80,000 |

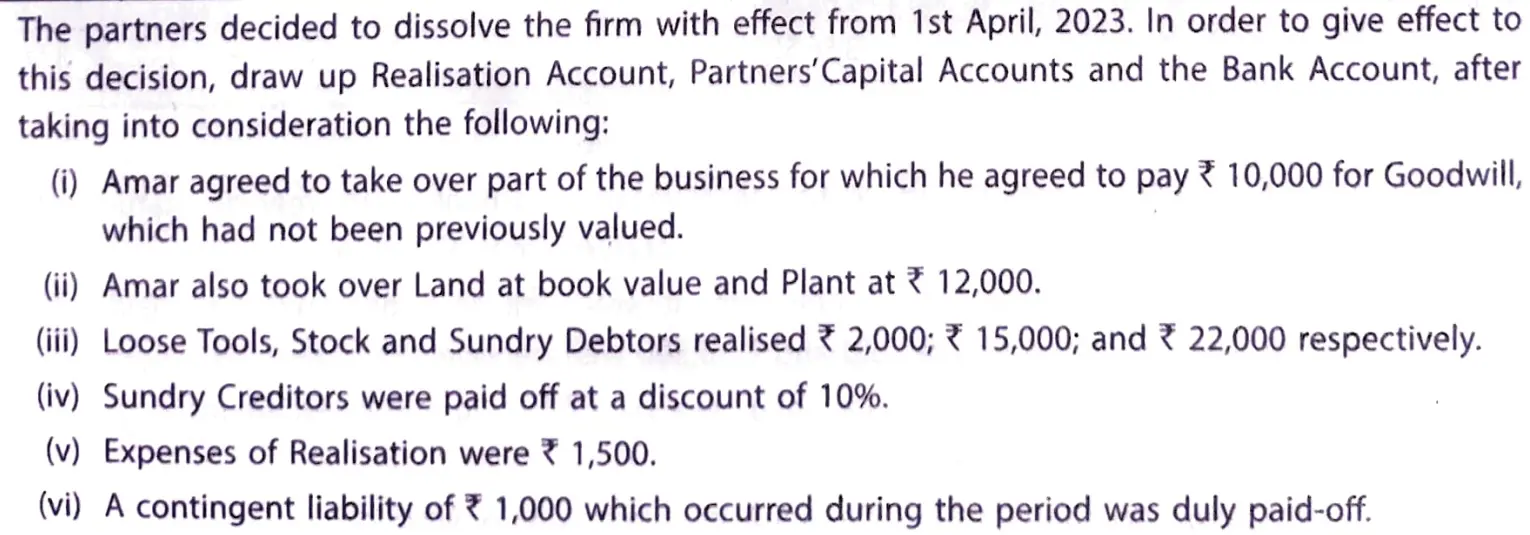

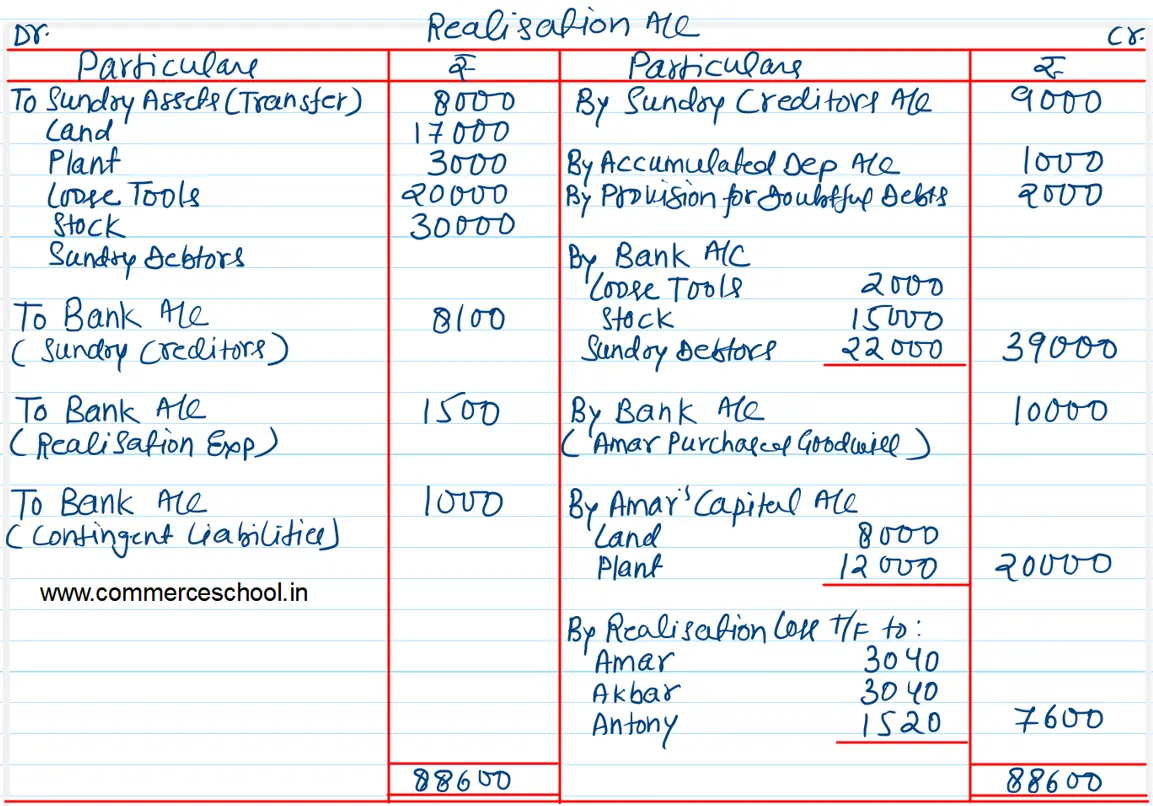

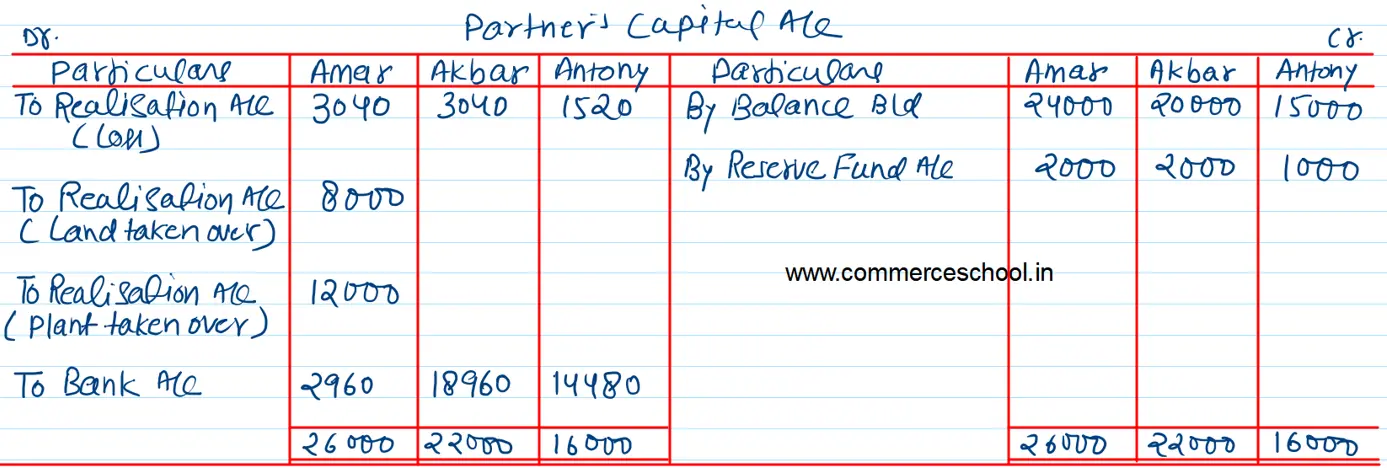

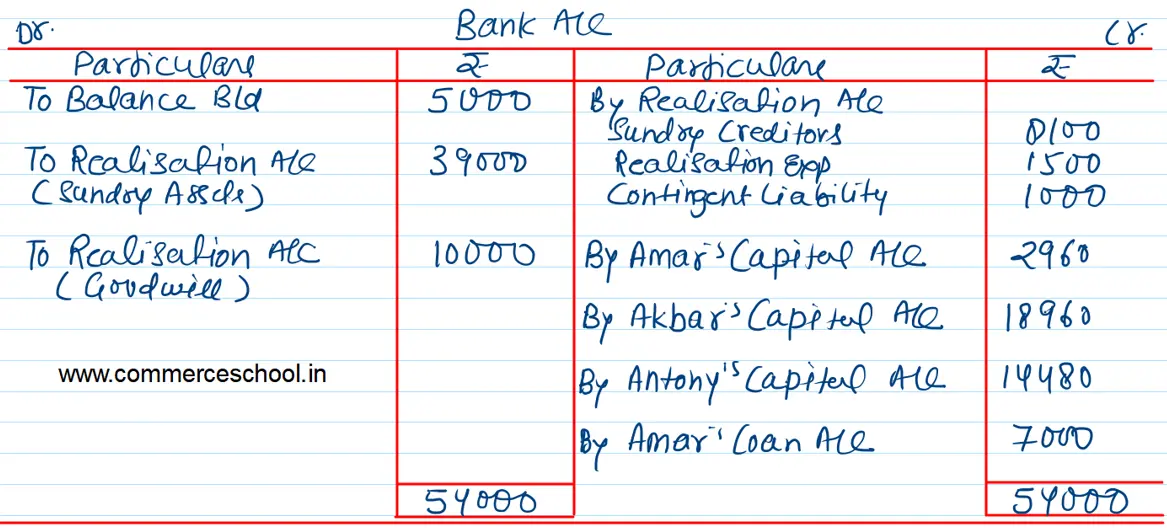

The partners decided to dissolve the firm with effect from 1st April, 2022. In order to give effect to this decision, draw up Realisation Account, Partner’s Capital Accounts and the Bank Account, after taking into consideration the following:

(i) Amar agreed to take over part of the business for which he agreed to pay ₹ 10,000 for Goodwill, which had not been previously valued.

(ii) Amar also took over Land at book value and Plant at ₹ 12,000.

(iii) Losse Tools, Stock and Sundry Debtors realised ₹ 2,000; ₹ 15,000; and ₹ 22,000 respectively.

(iv) Sundry Creditors were paid off at a discount of 10%.

(v) Expenses of Realisation were ₹ 1,500.

(vi) A contingent liability of ₹ 1,000 which occurred during the period was duly paid-off.