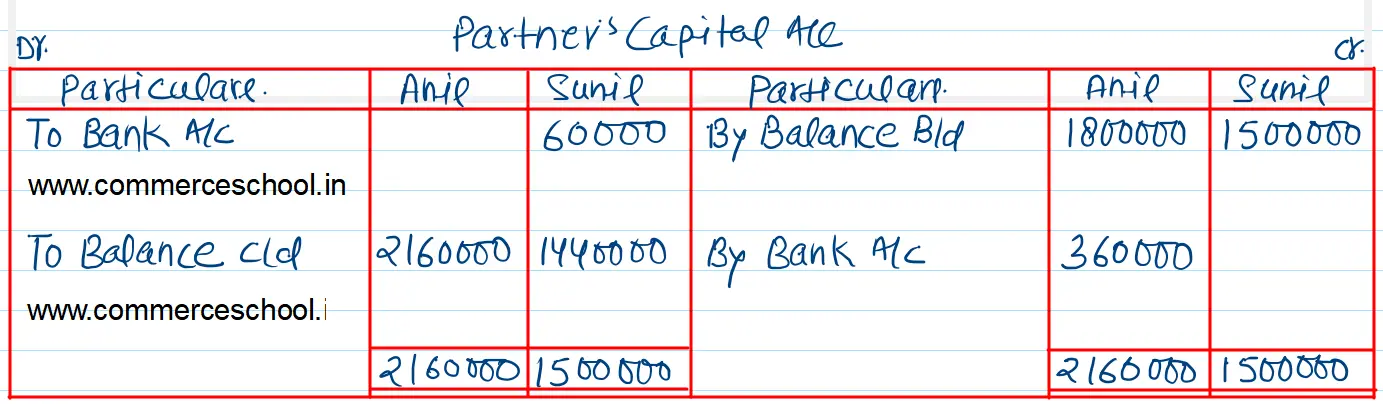

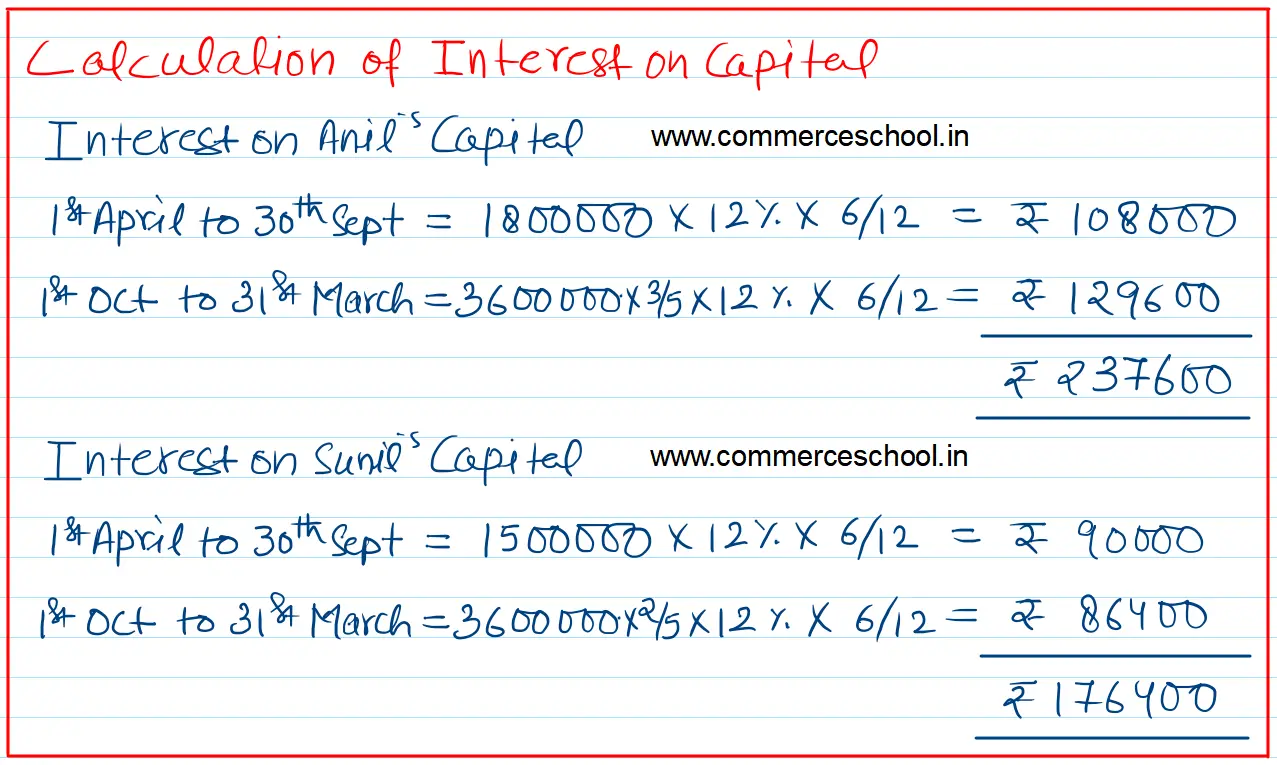

Anil and Sunil are partners in a firm sharing profits and losses in a ratio of 3 : 2. on 1st April 2022 their fixed capitals were ₹ 18,00,000 and ₹ 15,00,000 respectively

Anil and Sunil are partners in a firm sharing profits and losses in a ratio of 3 : 2. on 1st April 2022 their fixed capitals were ₹ 18,00,000 and ₹ 15,00,000 respectively.

On 1st October 2022, they decided that their total capital (fixed) should be ₹ 36,00,000 in their profit-sharing ratio.

Accordingly, they introduced further capital or withdrew excess capital. The partnership deed provided the following:

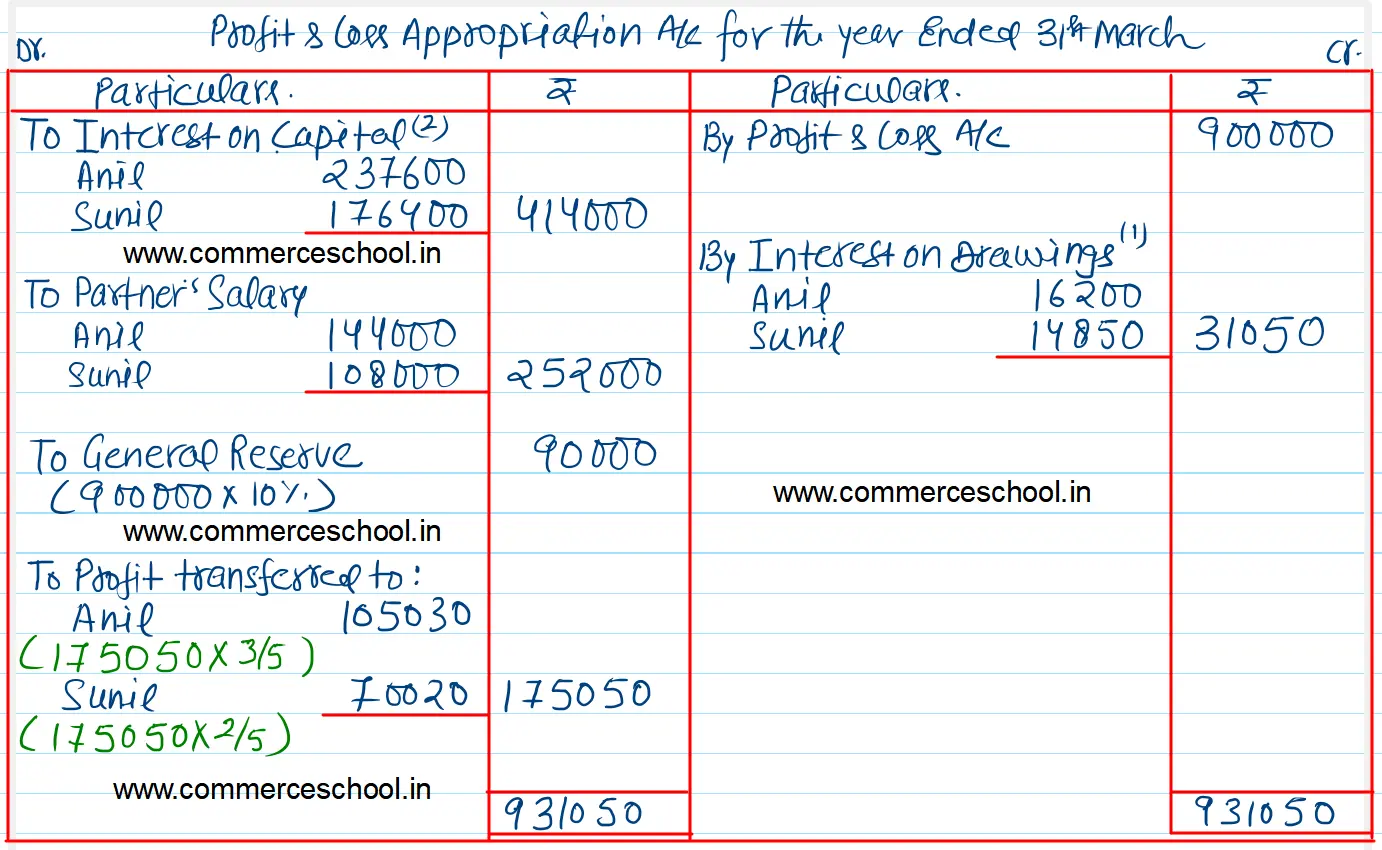

(i) Interest on Capital @ 12% p.a.

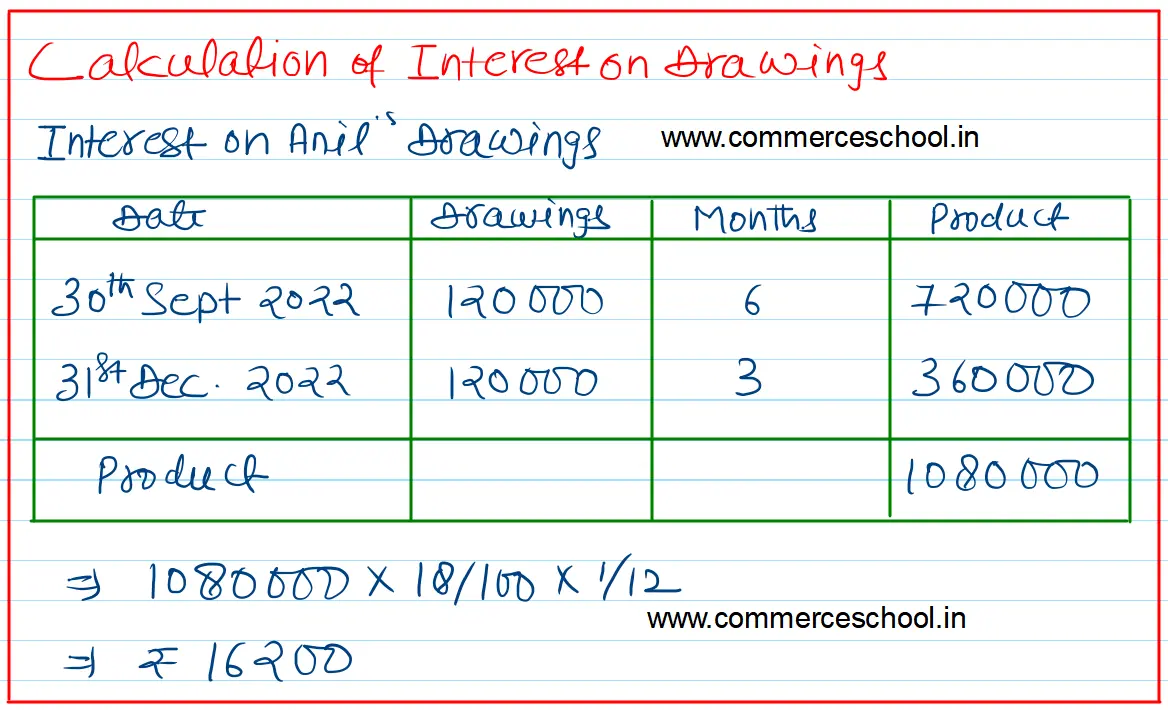

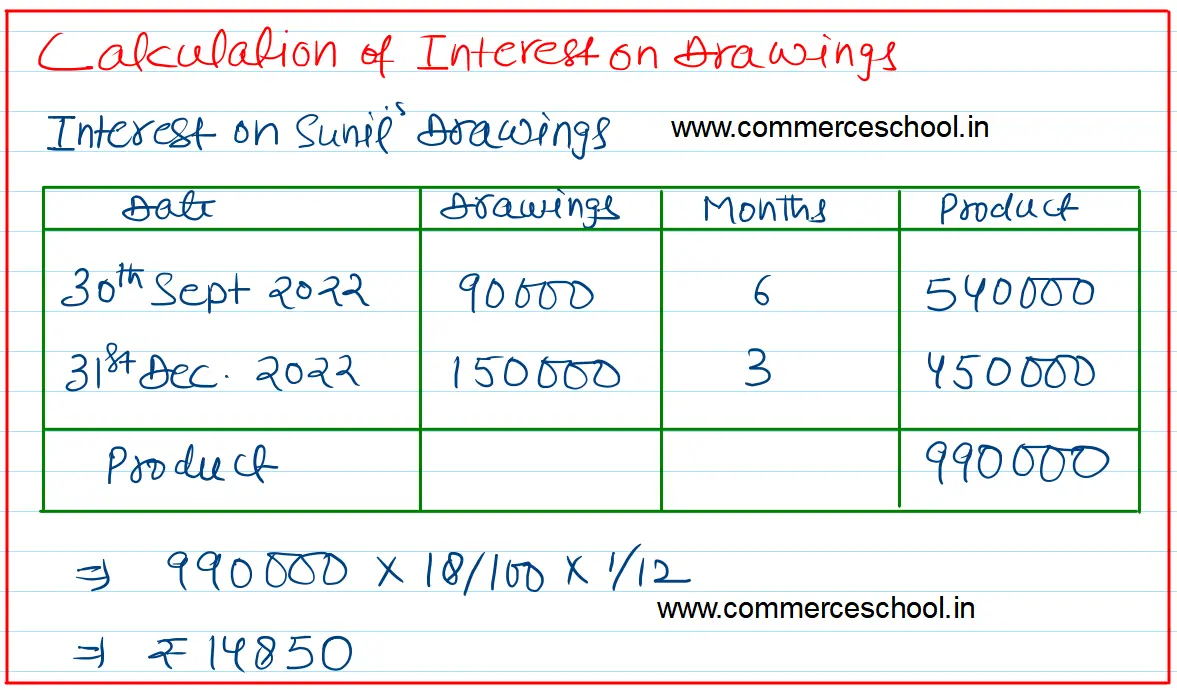

(ii) Interest on drawings @ 18% p.a.

(iii) A monthly salary of ₹ 12,000 to Anil and a quarterly salary of ₹ 27,000 to Sunil. The drawings of Anil and Sunil during the year were as follows:

| Date | Anil (₹) | Sunil (₹) |

| On 30th September 2022 | 1,20,000 | 90,000 |

| On 31st December 2022 | 1,20,000 | 1,50,000 |

During the year ended 31st March 2023, the firm earned a net profit of ₹ 9,00,000. 10% of the net profit was to be transferred to General Reserve. You are required to prepare:

(i) Profit and Loss Appropriation Account.

(ii) Partner’s Capital Accounts, and

(iii) Partner’s Current Accounts