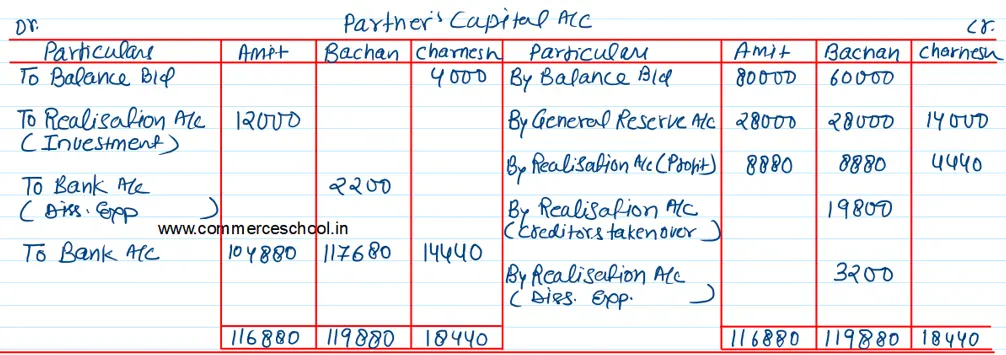

Amit, Bachan and Charnesh sharing profits in the ratio of 2 : 2 : 1 agreed upon dissolution of their partnership on 31st March, 2023

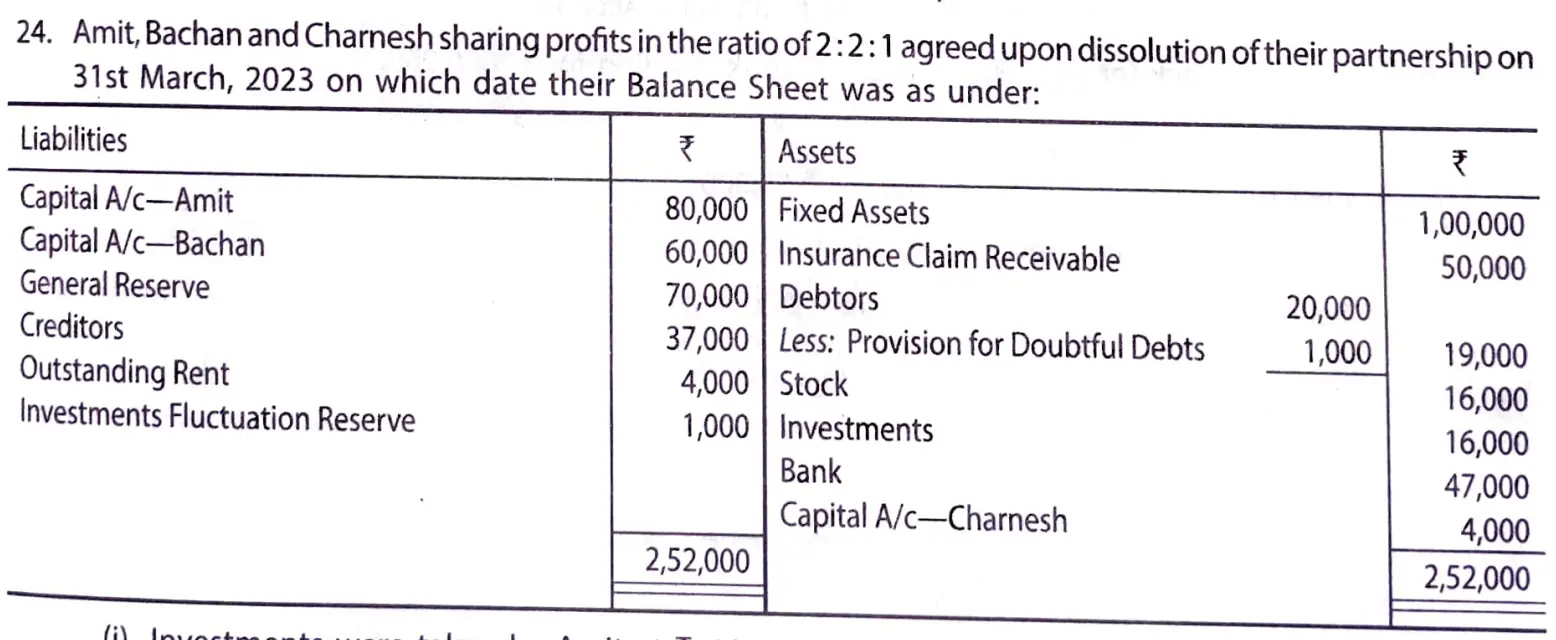

Amit, Bachan and Charnesh sharing profits in the ratio of 2 : 2 : 1 agreed upon dissolution of their partnership on 31st March, 2023 on which date their Balance Sheet was as under:

| Liabilities | ₹ | Assets | ₹ | |

|

Capital A/c – Amit Capital A/c – Bachan General Reserve Creditors Outstanding Rent Investments Fluctuation Reserve |

80,000 60,000 70,000 37,000 4,000 1,000 |

Fixed Assets Insurance Claim Receivable Debtors Less: PDD Stock Investments Bank Capital A/c – Charnesh |

20,000 1,000 |

1,00,000 50,000

19,000 16,000 16,000 47,000 4,000 |

| 2,52,000 | 2,52,000 |

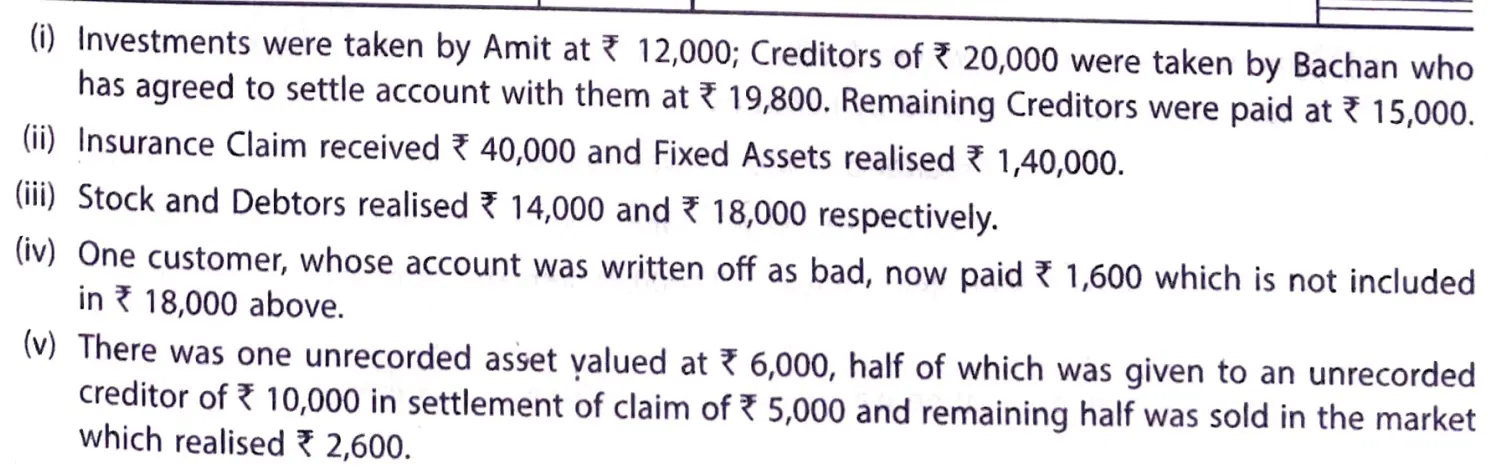

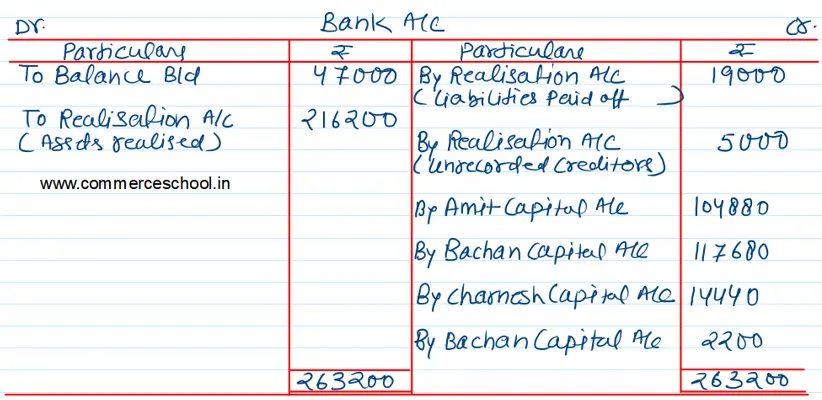

(i) Investments were taken by Amit at ₹ 12,000; Creditors of ₹ 20,000 were taken by Bachan who has agreed to settle account with them at ₹ 19,800. Remaining Creditors were paid at ₹ 15,000.

(ii) Insurance Claim received ₹ 40,000 and Fixed Assets realised ₹ 1,40,000.

(iii) Stock and Debtors realised ₹ 14,000 and ₹ 18,000 respectively.

(iv) One customer, whose account was written off as bad, now paid ₹ 1,600 which is not included in ₹ 18,000 above.

(v) There was one unrecorded asset valued at ₹ 6,000, half of which was given to an unrecorded creditor of ₹ 10,000 in settlement of claim of ₹ 5,000 and remaining half was sold in the market which realised ₹ 2,600.

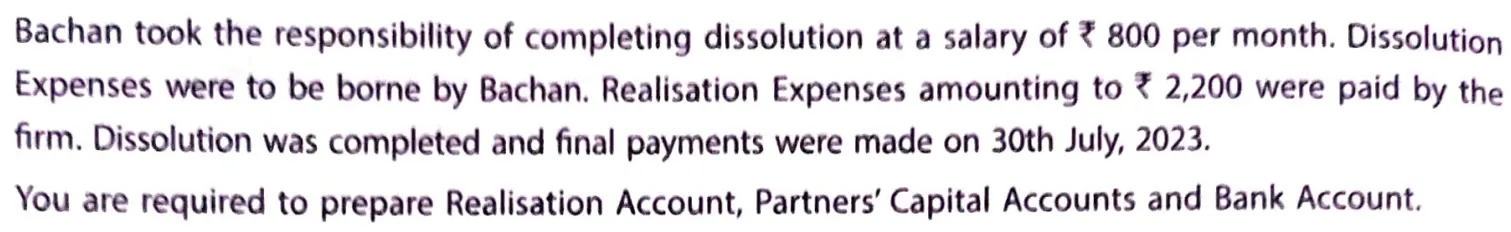

Bachan took the responsibility of completing dissolution at a salary of ₹ 800 per month. Dissolution Expenses were to be borne by Bachan. Realisation Expenses amounting to ₹ 2,200 were paid by the firm. Dissolution was completed and final payments were made on 30th July, 2022.

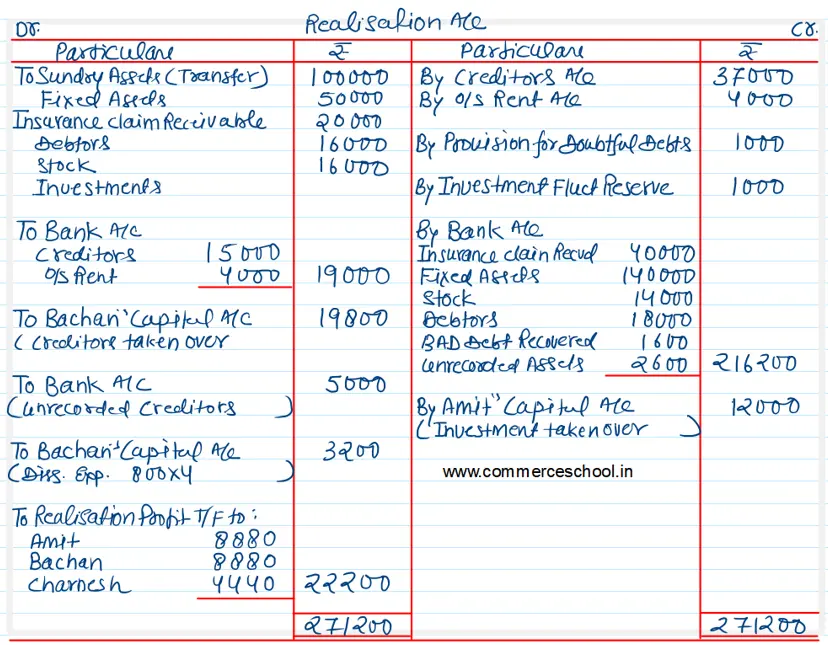

You are required to prepare Realisation Account, Partner’s Capital Accounts