Aakriti and Bindu entered into partnership for making garment on April 01, 2019 without any Partnership agreement

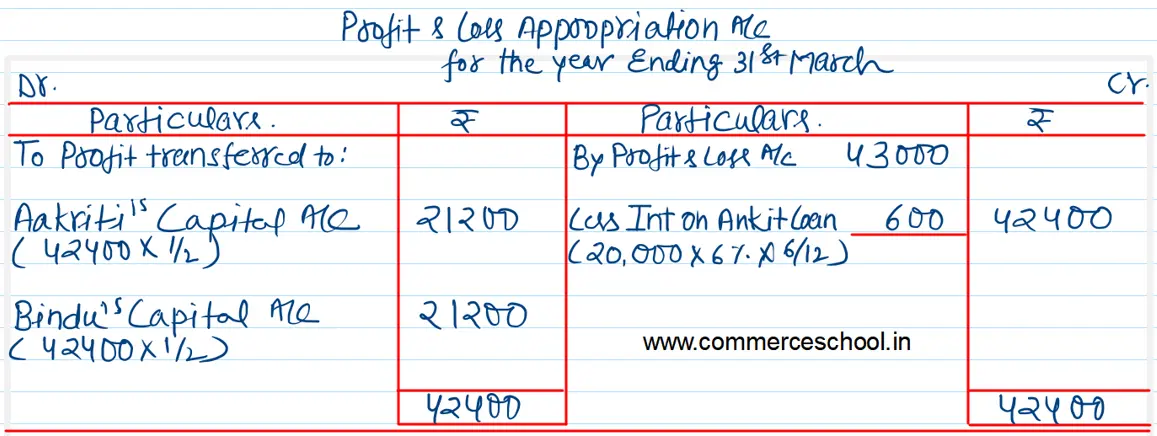

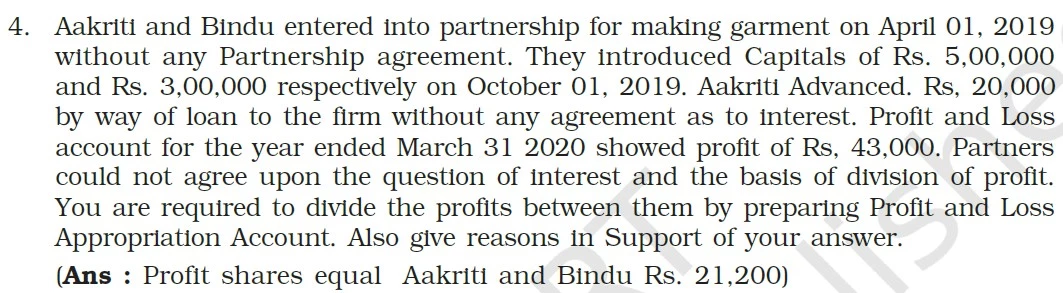

Aakriti and Bindu entered into partnership for making garment on April 01, 2019 without any Partnership agreement. They introduced Capitals of ₹ 5,00,000 and ₹ 3,00,000 respectively on October 01, 2019. Aakriti Advanced ₹ 20,000 by way of loan to the firm without any agreement as to interest. Profit and Loss account for the year ended March 31 2020 showed profit of ₹ 43,000. Partners could not agree upon the question of interest and the basis of division of profit. You are required to divide the profits between them by preparing Profit and Loss Appropriation Account. Also give reasons in Support of your answer.

(Ans : Profit shares equal Aakriti and Bindu ₹ 21,200)

Anurag Pathak Changed status to publish