X and Y are partners with capitals of ₹ 1,00,000 and ₹ 80,000 respectively on 1st April, 2022 and their profit sharing ratio is 2 : 1. Interest on capital is agreed @ 12% pa

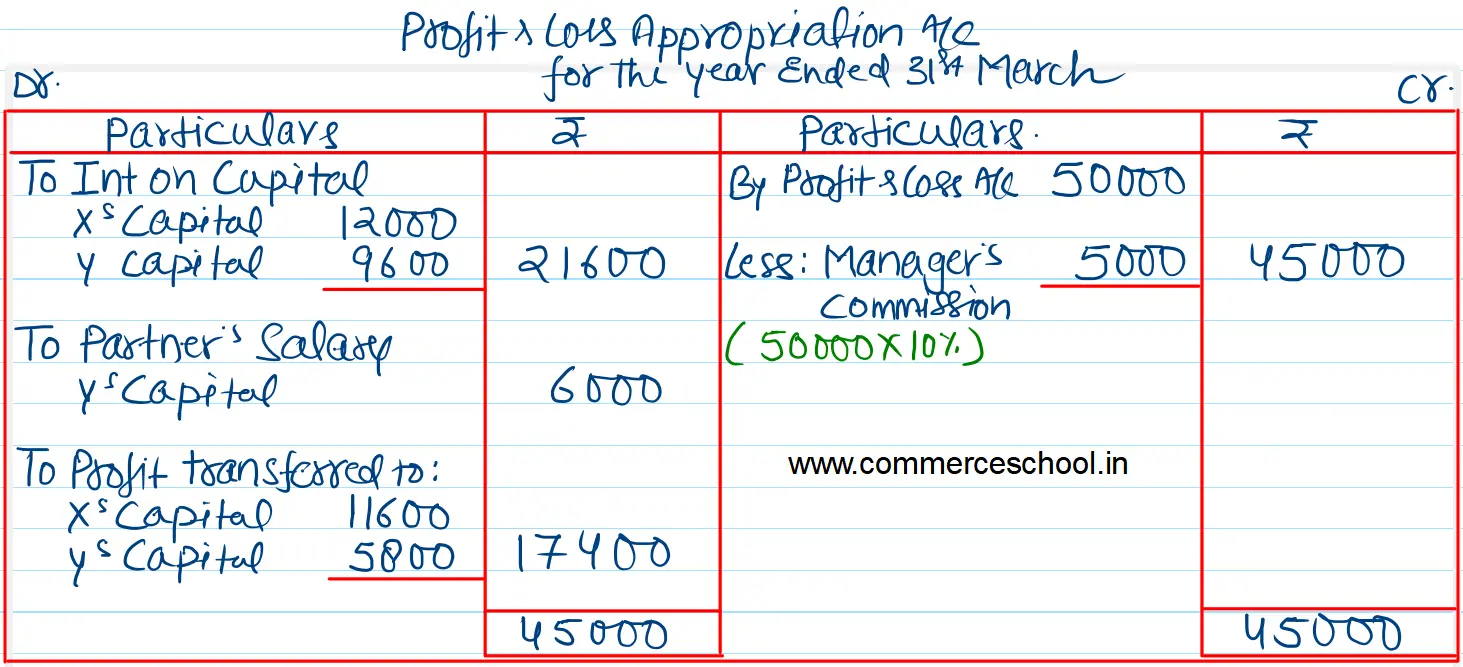

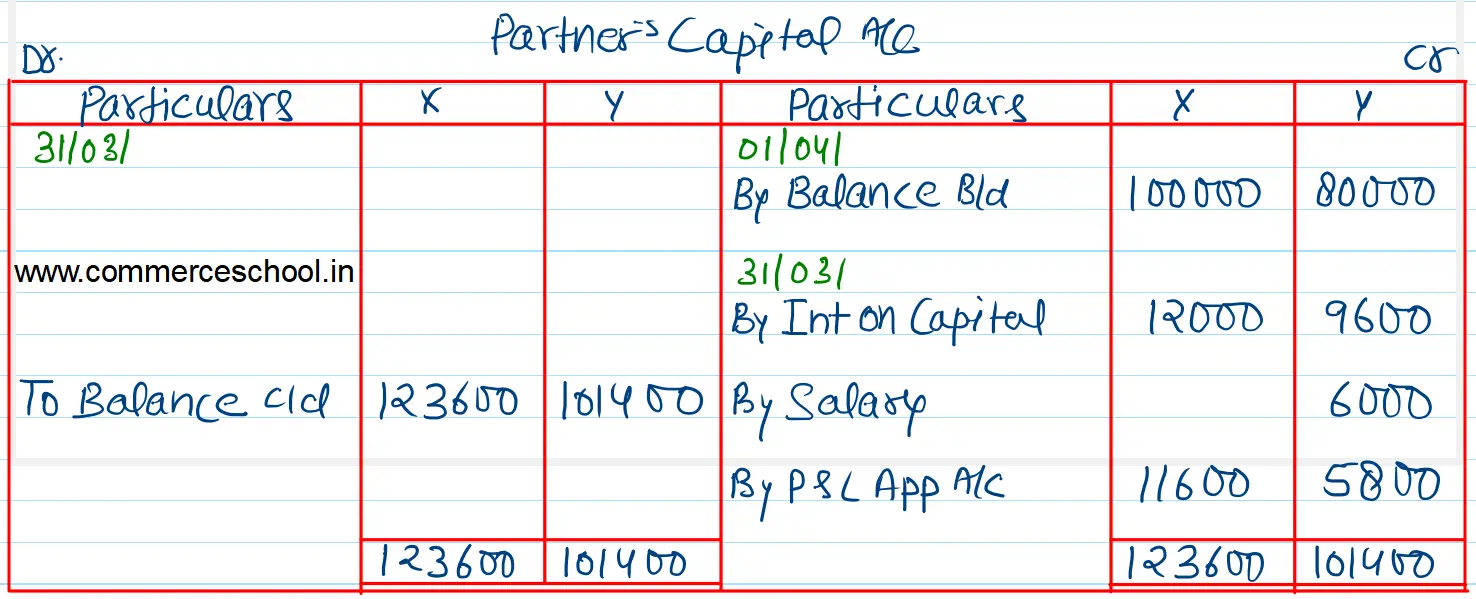

X and Y are partners with capitals of ₹ 1,00,000 and ₹ 80,000 respectively on 1st April, 2022 and their profit sharing ratio is 2 : 1. Interest on capital is agreed @ 12% pa. Y is to be allowed an annual salary of ₹ 6,000. The profit for the year ended 31st March, 2023 amounted to ₹ 50,000. Manager is entitled to a commission of 10% of the profits.

Prepare Profit and Loss Appropriation Account and Capital Accounts.

[Ans. Divisible Profit ₹ 17,400; Commission to Manager is 10% of ₹ 50,000, i.e., ₹ 5,000. Balances of Capital Accounts : X ₹ 1,23,600 and Y ₹ 1,01,400.]

Anurag Pathak Answered question