Y and Z are partners with capitals of ₹ 2,50,000 and ₹ 1,50,000 respectively on 1st April, 2023. Each partner is entitled to 9% p.a. interest on his capital. Z is entitled to a salary of ₹ 60,000 p.a. together with a commission of 6% of Net Profit after charging his commission

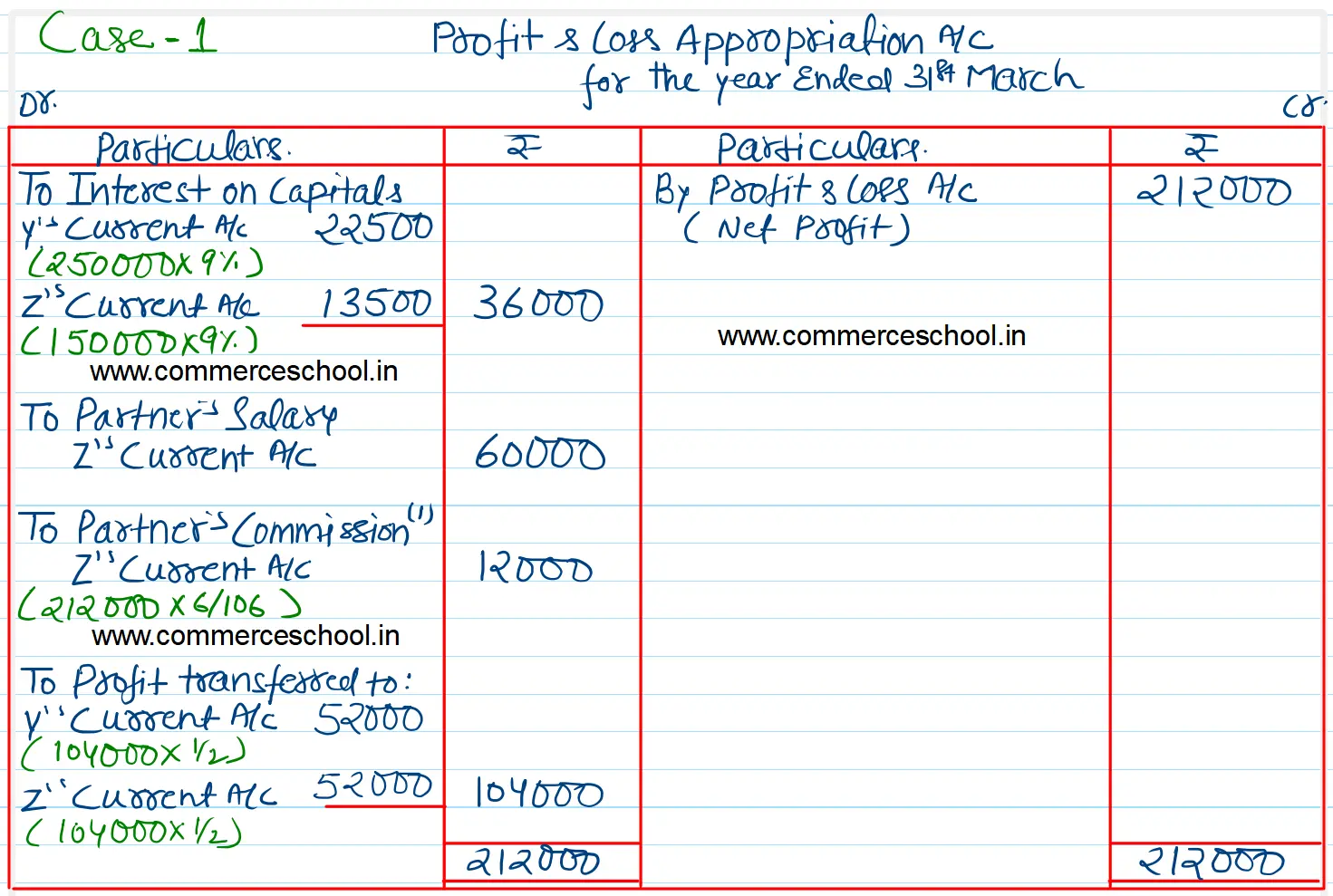

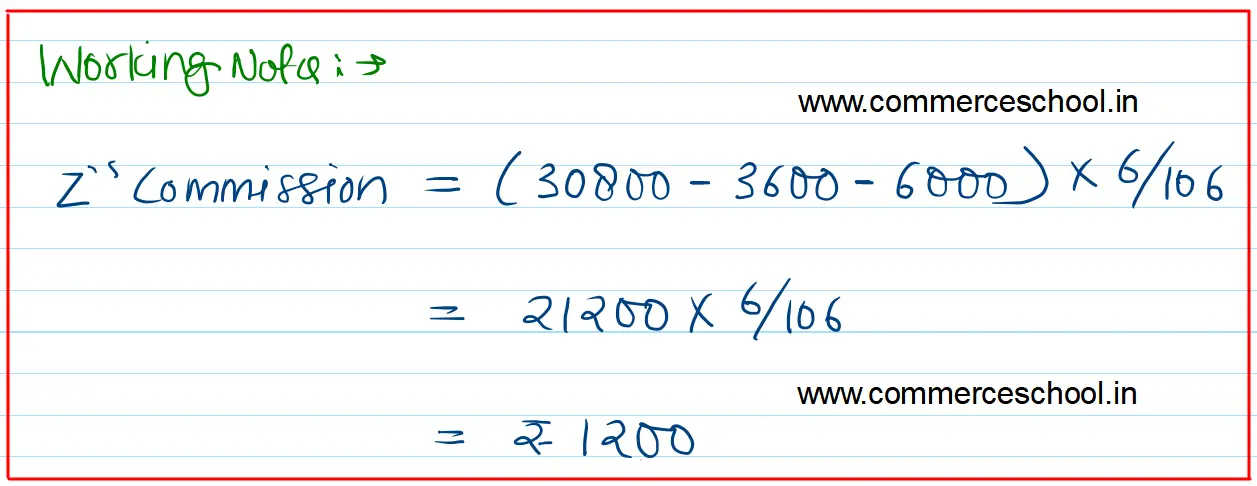

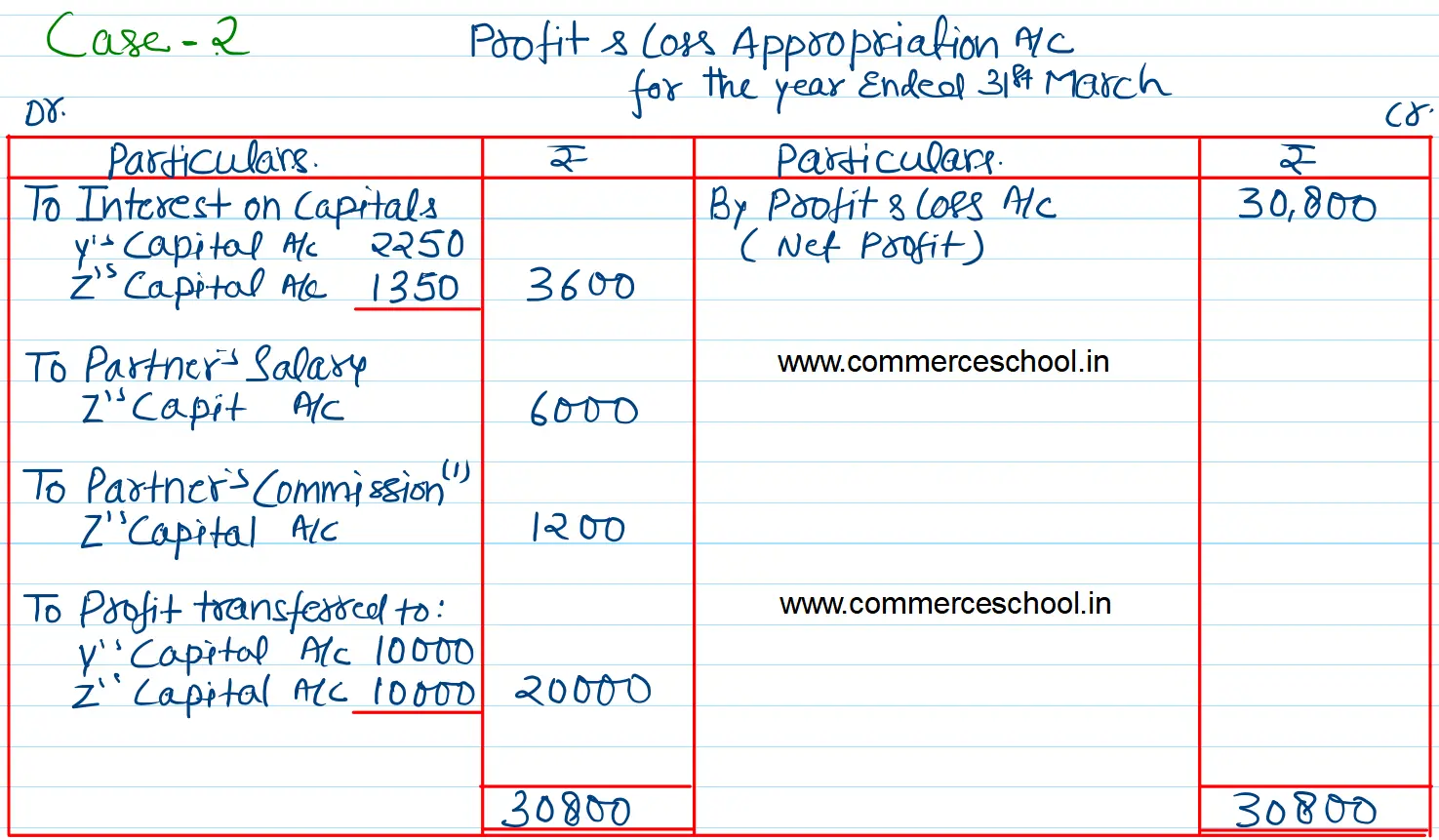

Y and Z are partners with capitals of ₹ 2,50,000 and ₹ 1,50,000 respectively on 1st April, 2023. Each partner is entitled to 9% p.a. interest on his capital. Z is entitled to a salary of ₹ 60,000 p.a. together with a commission of 6% of Net Profit after charging his commission. Net Profit for the year ended 31st March, 2024 amount to ₹ 2,12,000. Prepare Partner’s Capital Accounts: (i) When capitals are fixed, and (ii) when capitals are fluctuating.

[Ans. Divisible Profits ₹ 1,04,000; Commission to Z ₹ 12,000.]

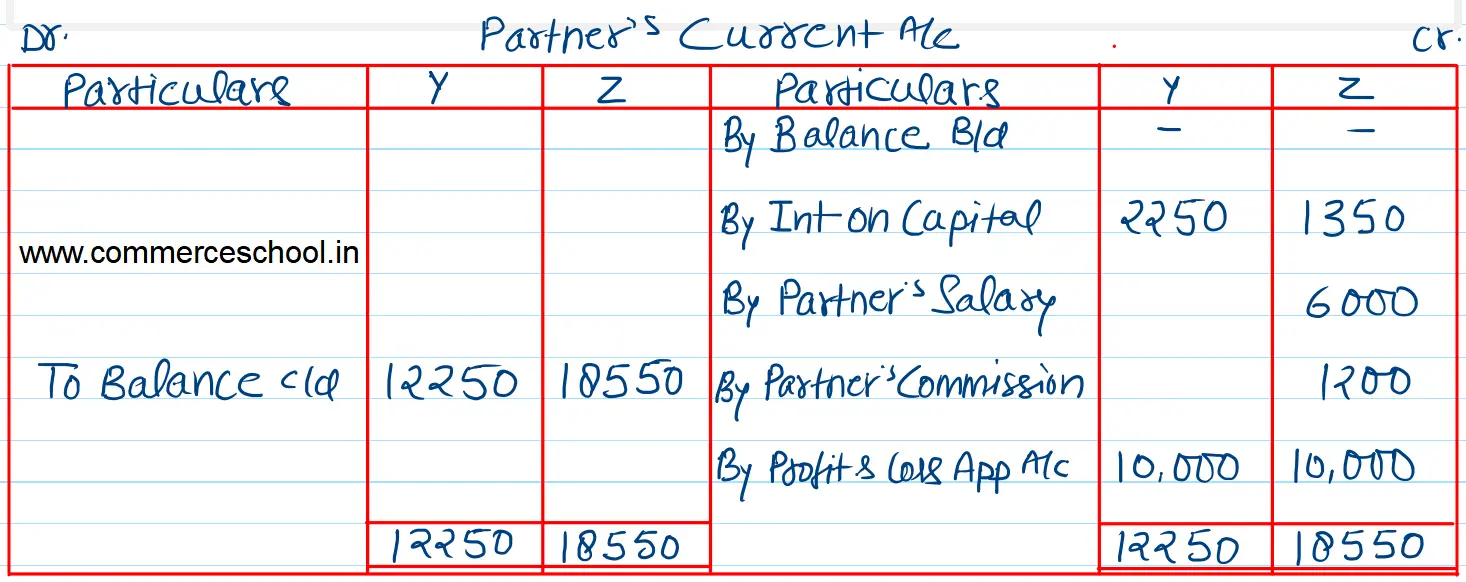

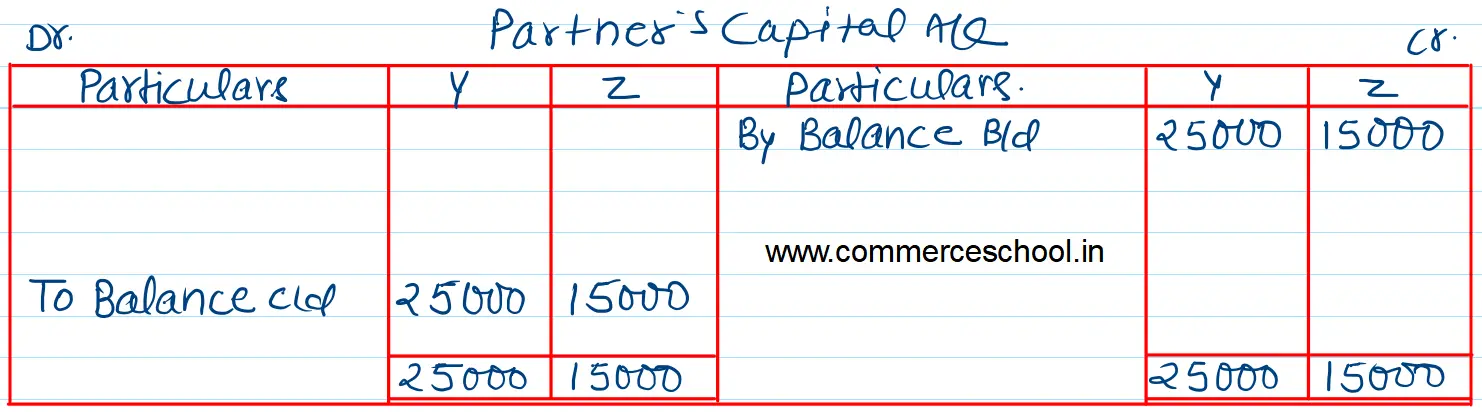

(i) When Capitals are fixed:

Current A/c balances : Y ₹ 74,500 (Cr.); Z ₹ 1,37,500 (Cr.)

Capital A/c balances : Y ₹ 2,50,000 (Cr.); Z ₹ 1,50,000 (Cr.)

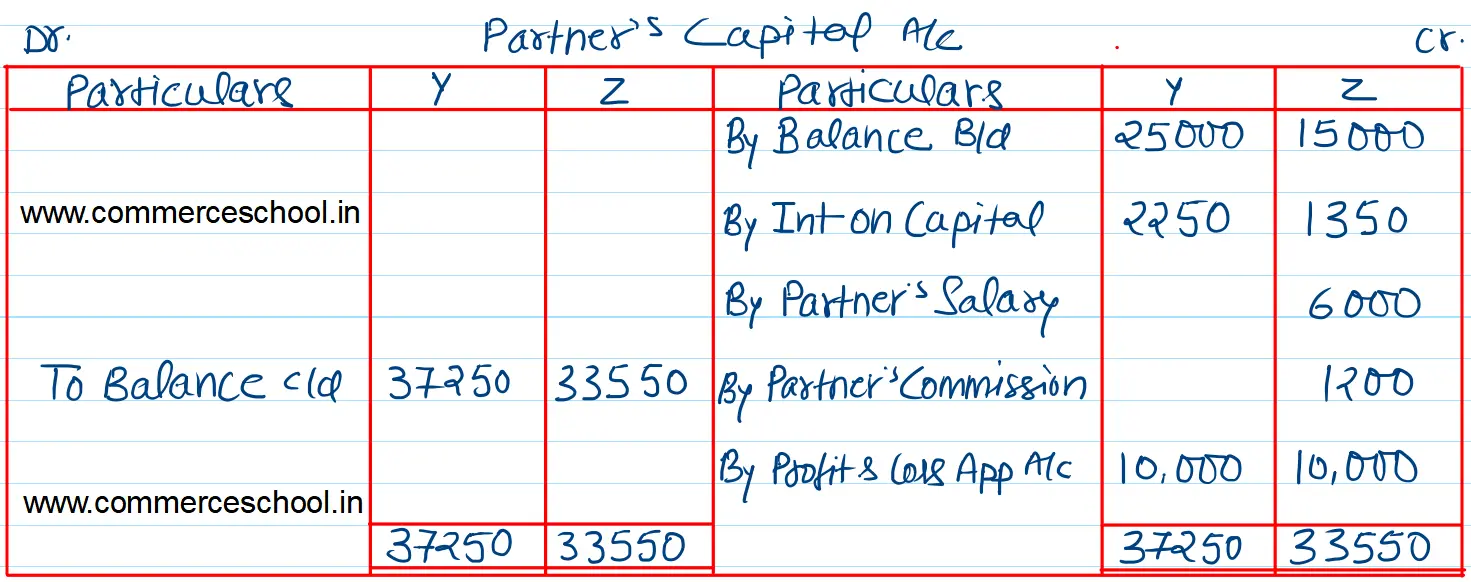

(ii) When Capitals are fluctuating:

Capital A/c balances : Y ₹ 3,24,500 (Cr.) Z ₹ 2,87,500 (Cr.)