Krish and Tarun were partners in a firm. Firm gave a loan of ₹ 5,00,000 to Tarun on 1st September 2023. Interest was agreed to be charged at 9% p.a

Krish and Tarun were partners in a firm. Firm gave a loan of ₹ 5,00,000 to Tarun on 1st September 2023. Interest was agreed to be charged at 9% p.a. Tarun paid interest up to 31st January 2024 by cheque on 4th February 2024 and balance was yet to be paid by him.

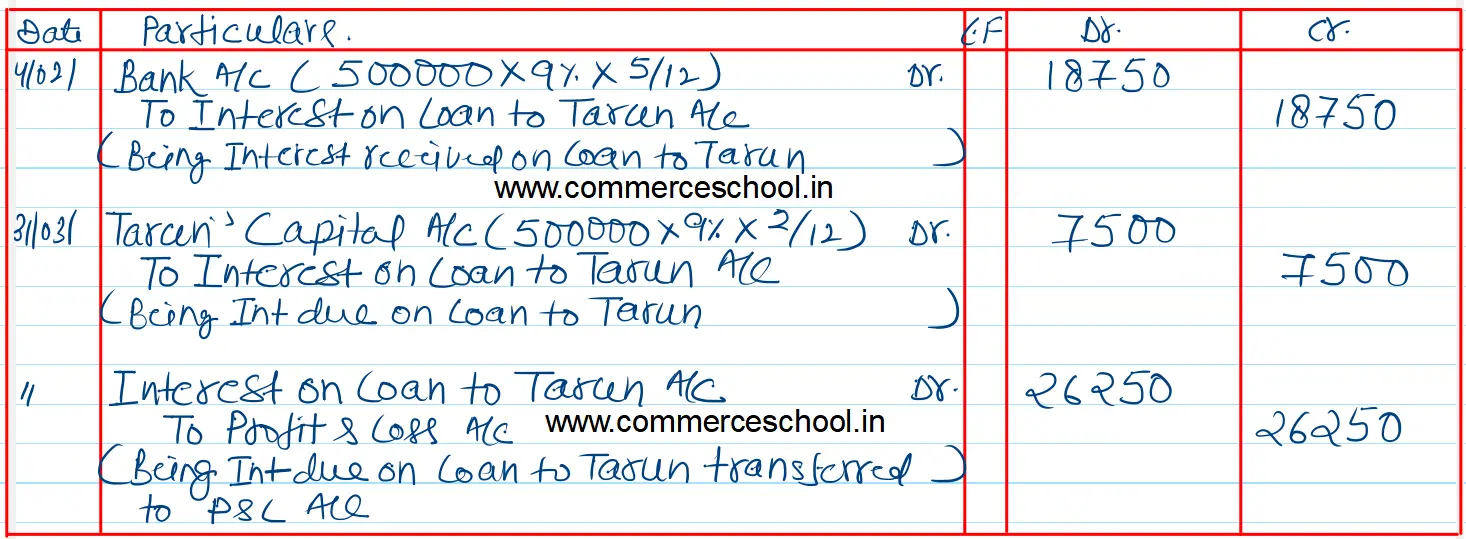

Pass journal entries for interest on loan to partner for the year ending 31st March, 2024.

[Ans. Interest received on loan to Tarun up to 31st Jan. 2024 ₹ 18,750; Interest transferred to Profit & Loss A/c ₹ 26,250.]

Anurag Pathak Answered question