Hemant and Sameer are partners in a firm. On 1st December 2023, Hemant gave a loan to the firm of ₹ 5,00,000. On the same date, the firm gave a loan of ₹ 2,00,000 to Sameer

Hemant and Sameer are partners in a firm. On 1st December 2023, Hemant gave a loan to the firm of ₹ 5,00,000. On the same date, the firm gave a loan of ₹ 2,00,000 to Sameer. They do not have an agreement as to interest.

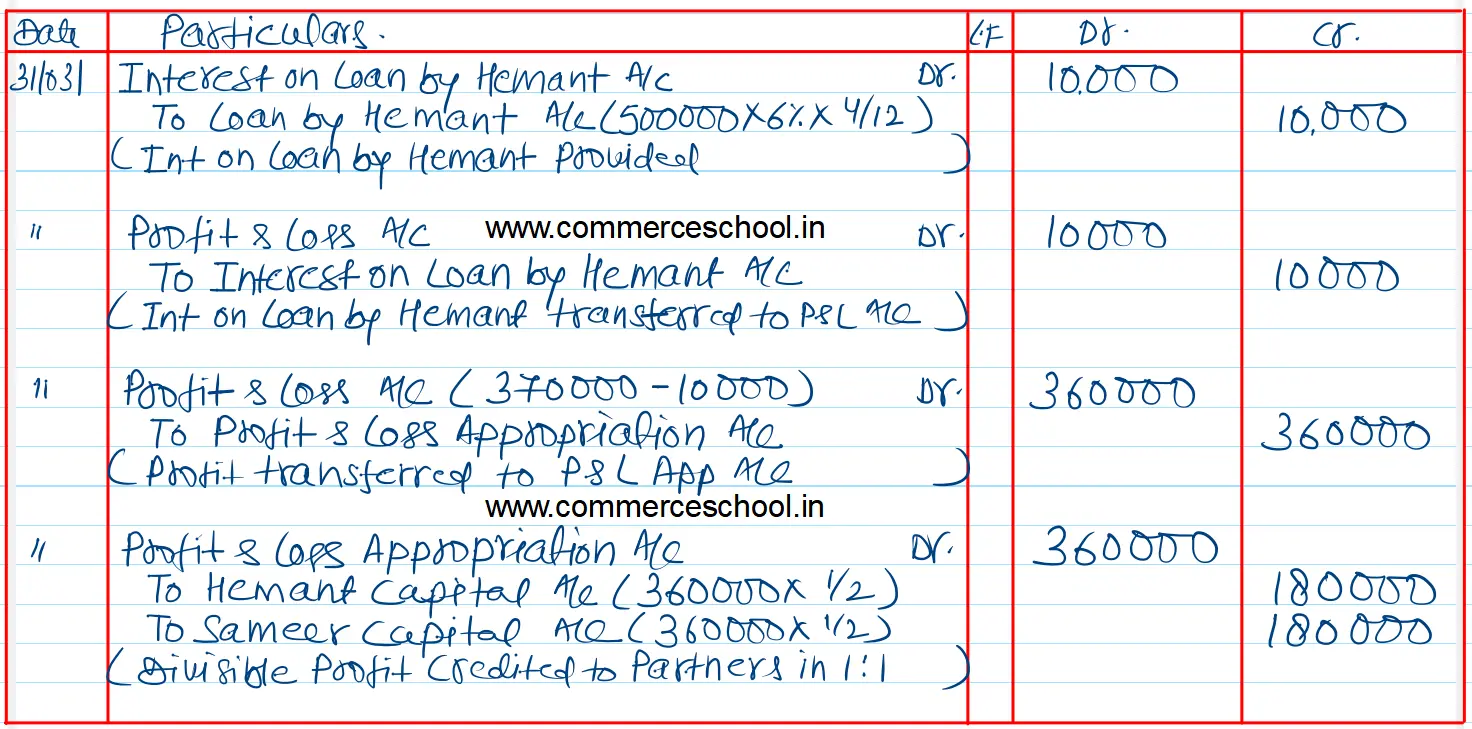

Firm earned a profit of ₹ 3,70,000 (before any interest) for the year ended 31st March, 2024. Pass Journal entries for interest on loans and distribution of profit for the year ended 31st March, 2024.

[Ans. Share of Profit ₹ 1,80,000 each.]

(i) Interest on Loan by Heman will be provided @ 6% p.a.

(ii) Interest on Loan by Sameer will not be charged.

Anurag Pathak Answered question