Radha and Rukmani are partners in a firm with fixed capitals of ₹ 2,00,000 and ₹ 3,00,000 respectively. They share profits in the ratio of 1 : 2. Both partners are entitled to interest on capitals @ 8% per annum

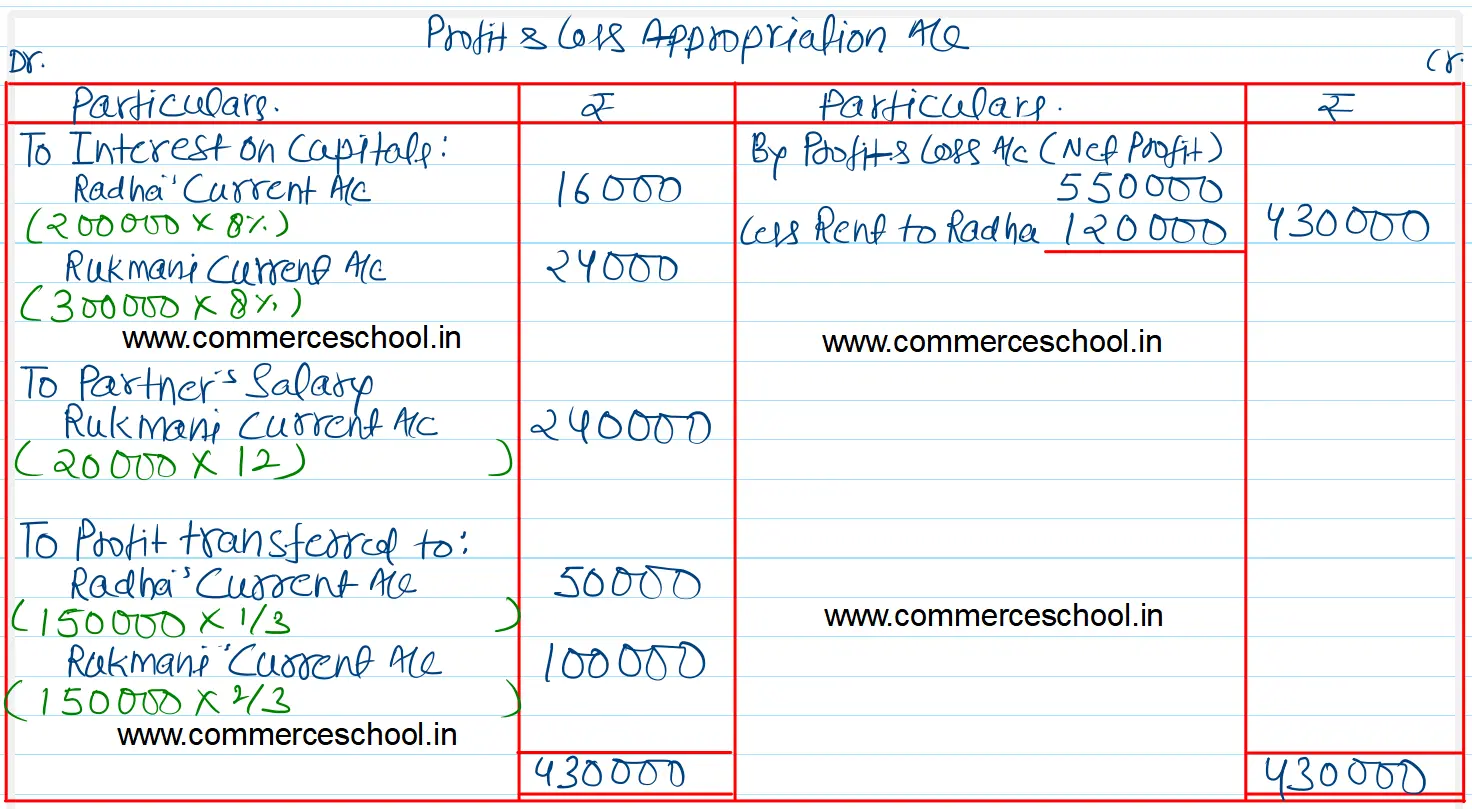

Radha and Rukmani are partners in a firm with fixed capitals of ₹ 2,00,000 and ₹ 3,00,000 respectively. They share profits in the ratio of 1 : 2. Both partners are entitled to interest on capitals @ 8% per annum. In addition, Rukmani is entitled to a salary of ₹ 20,000 per month. Business is being carried from the property owned by Radha on a yearly rent of ₹ 1,20,000. Net Profit for the year ended 31st March 2024 before providing for rent was ₹ 5,50,000.

You are required to draw Profit & Loss Appropriation Account for the year ended 31st March, 2024.

[Ans. Share of Profit transferred to Radha’s Current A/c ₹ 50,000 and Rukmani’s Current A/c ₹ 1,00,000.]

Anurag Pathak Answered question