A and B are partners in a firm sharing profits in the ratio of 1 : 2. Their capitals on 1st April 2023 were ₹ 4,00,000 and ₹ 6,00,000 respectively

A and B are partners in a firm sharing profits in the ratio of 1 : 2. Their capitals on 1st April 2023 were ₹ 4,00,000 and ₹ 6,00,000 respectively. As per partnership deed, A is to get a monthly salary of ₹ 15,000 and interest on capitals is to be provided @ 10% p.a. and charged on drawings @ 12% p.a. During the year A withdrew ₹ 30,000 and B withdrew ₹ 50,000.

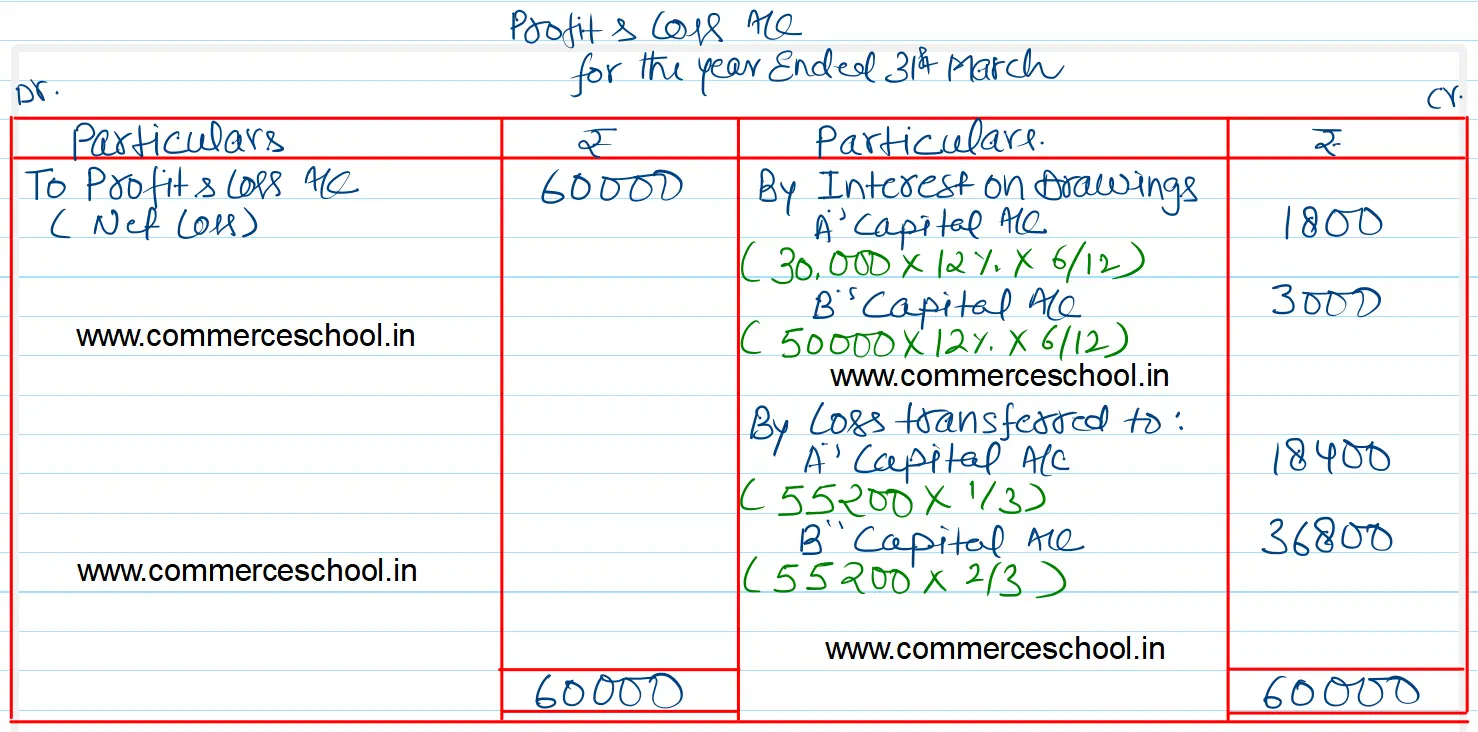

The firm incurred a loss of ₹ 60,000 during the year ended 31st March, 2024 before above adjustments. You are required to prepare an account showing the distribution of Profit/Loss.

[Ans. Share of Loss A ₹ 18,400 and B ₹ 36,800.]

Anurag Pathak Answered question