After the accounts of the partnership have been drawn up and the books closed off, it is discovered that interest on capitals @ 8% p.a. as provided

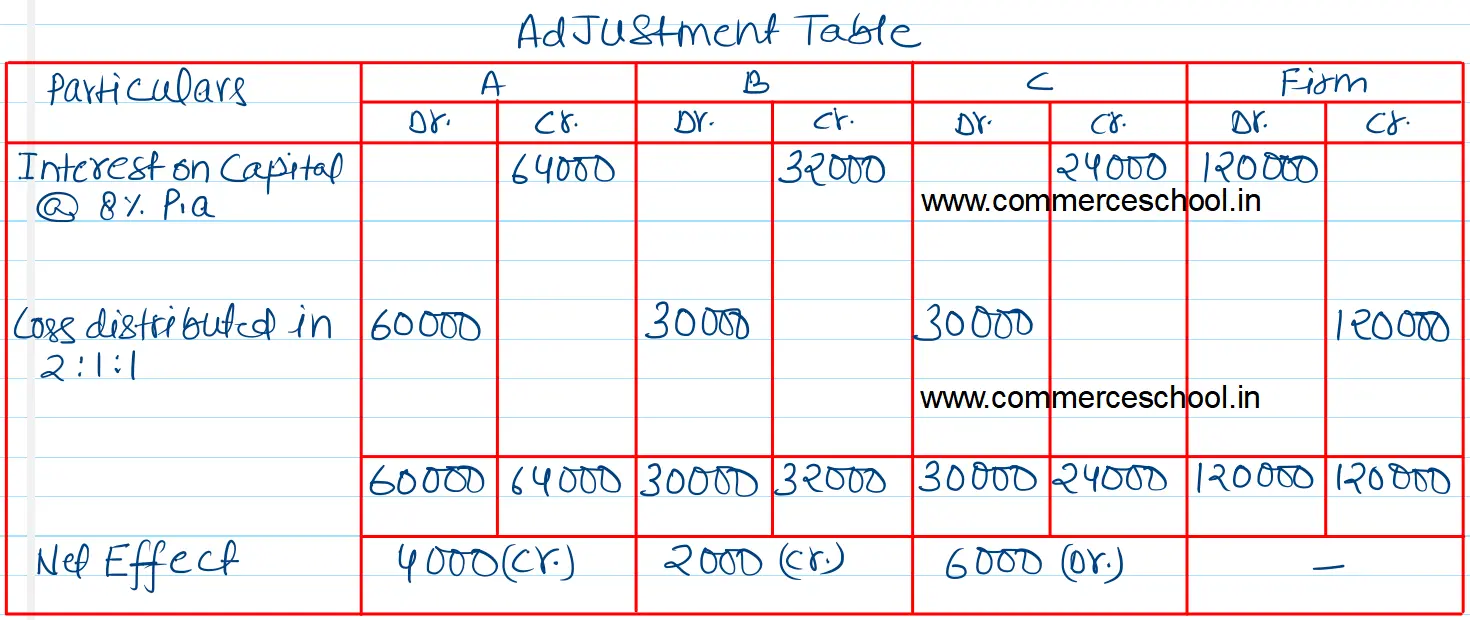

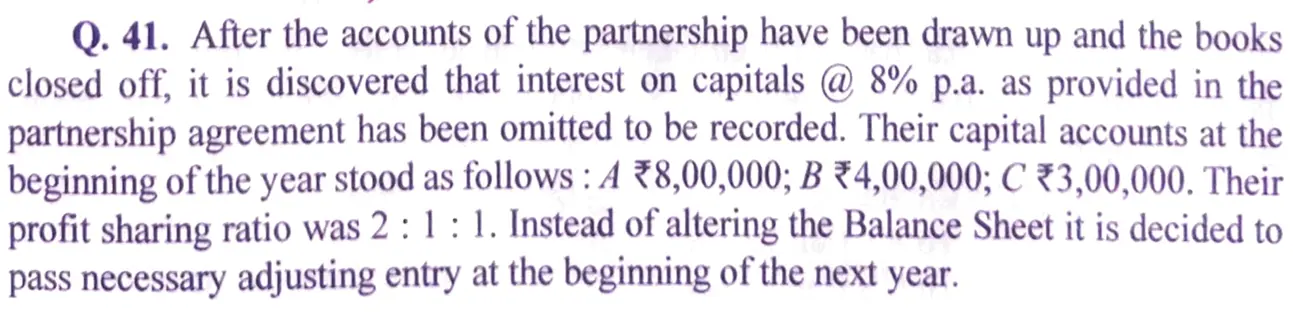

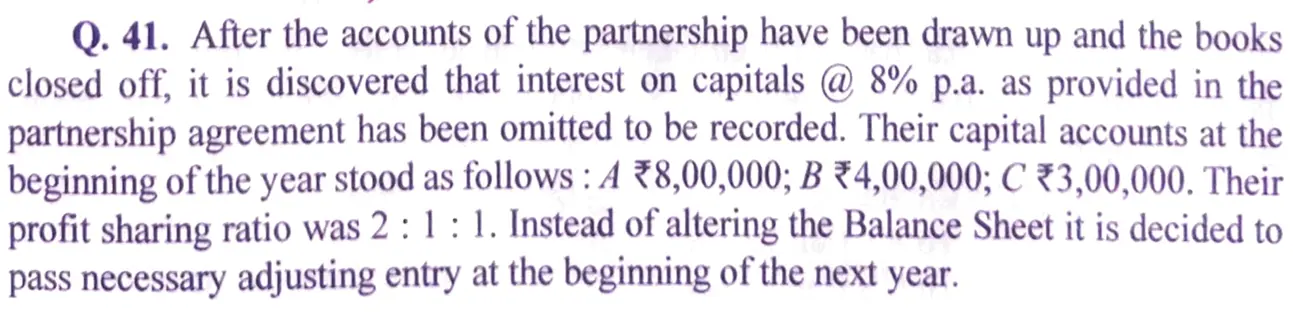

After the accounts of the partnership have been drawn up and the books closed off, it is discovered that interest on capitals @ 8% p.a. as provided in the partnership agreement has been omitted to be recorded. Their capital accounts at the beginning of the year stood as follows: A ₹ 8,00,000; B ₹ 4,00,000; C ₹ 3,00,000. Their profit sharing ratio was 2 : 1 : 1. Instead of altering the Balance Sheet it is decided to pass necessary adjusting entry at the beginning of the next year. You are required to give the necessary Journal entry.

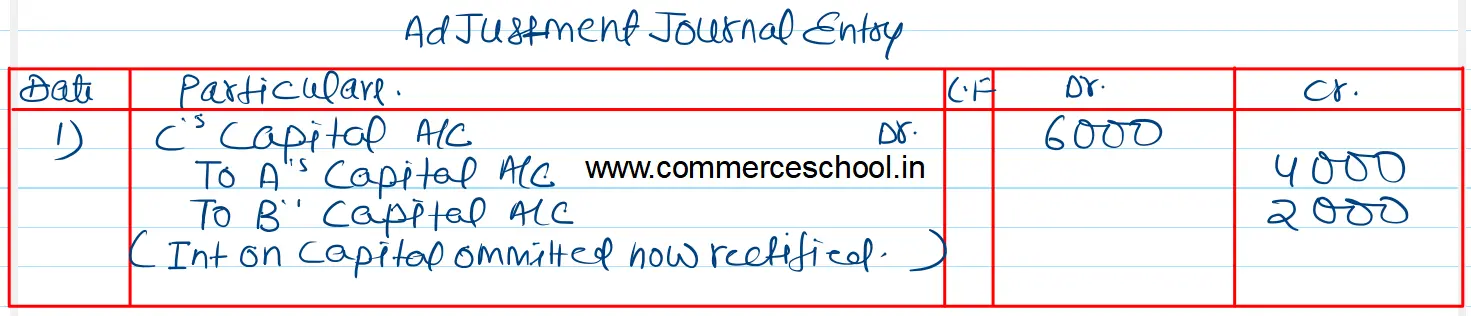

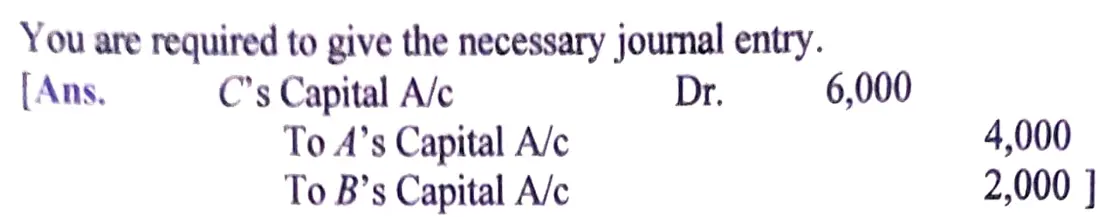

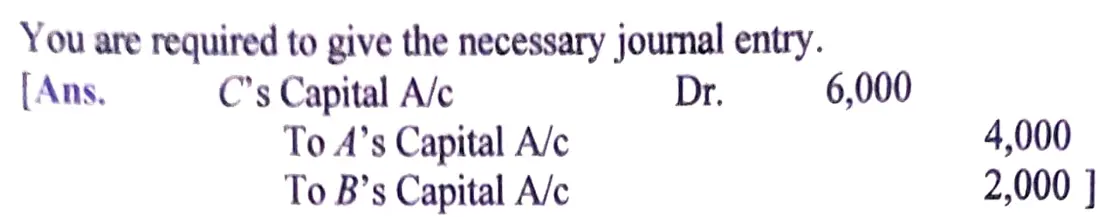

Ans.

| C’s Capital A/c Dr. | 6,000 |

| To A’s Capital A/c To B’s Capital A/c | 4,000 2,000 |

Anurag Pathak Answered question