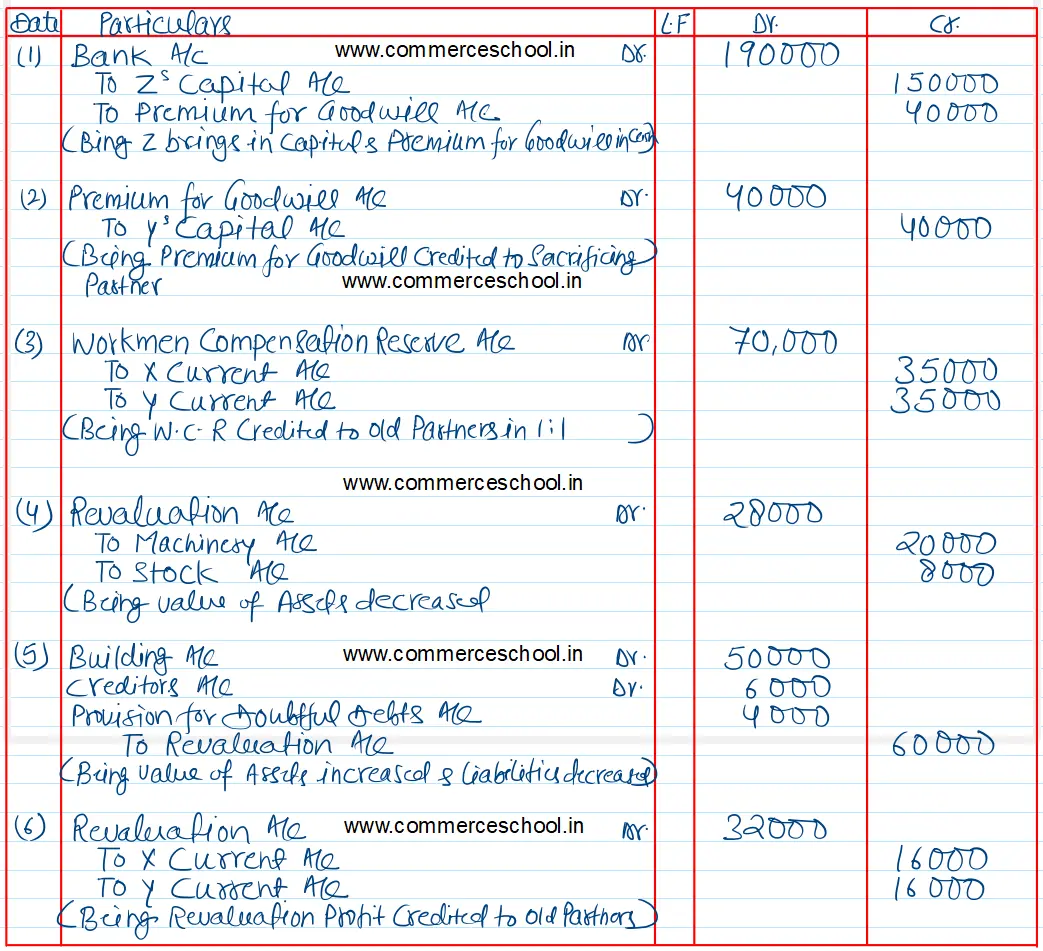

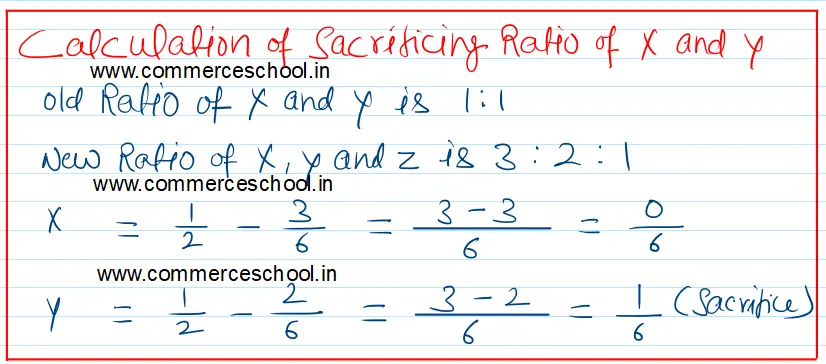

X and Y are partners. They admit Z as a partner and new profit sharing ratio is agreed at 3 : 2 : 1. Z brings in Capital of ₹ 1,50,000 and ₹ 40,000 as premium for goodwill in Cash

X and Y are partners. They admit Z as a partner and new profit sharing ratio is agreed at 3 : 2 : 1. Z brings in Capital of ₹ 1,50,000 and ₹ 40,000 as premium for goodwill in Cash.

Their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | Cash at Bank | 44,000 | |

|

Capital Accounts: X Y |

4,00,000 2,50,000 |

Debtors 2,00,00 Less: Provision 14,000 |

1,86,000 |

|

Current Accounts: X Y |

30,000 10,000 |

Stock | 2,50,000 |

| Workmen Compensation Reserve | 70,000 | Machinery | 1,20,000 |

| Building | 2,00,000 | ||

| 8,00,000 | 8,00,000 |

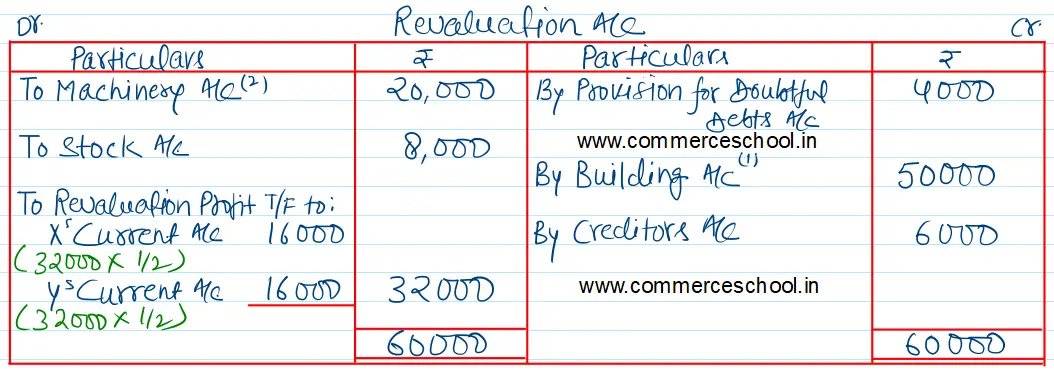

The assets and liabilities are revalued as under: (i) Provision for Doubtful Debts is found in excess by ₹ 4,000. (ii) Building was found under valued by 20% and Machinery overvalued by 20%. (iii) Part of stock which had been included at a cost of ₹ 10,000 had been badly damaged in storage and could only expect to realise ₹ 2,000. (iv) Creditors were written off ₹ 6,000. Pass necessary journal entries. [Ans. Gain on Revaluation ₹ 32,000 be credited to X and Y in equal proportion]