Following are the Balance Sheets of Pawan Ltd Share Capital ₹ 3,00,000 Reserves & Surplus ₹ 2,07,000

Following are the Balance Sheets of Pawan Ltd:-

| Particulars | Note. No. | 31st March, 2023 | 31st March, 2022 |

| I. EQUITY AND LIABILITIES: | |||

|

(1) Shareholder’s Funds: (a) Share Capital (b) Reserves & Surplus |

3,00,000 2,07,000 |

2,50,000 1,75,000 |

|

|

(2) Current Liabilities: (a) Short-term Borrowings (b) Trade Payables (c) Short-term Provisions |

20,000 31,000 84,000 |

15,000 54,000 81,000 |

|

| Total | 6,42,000 | 5,75,000 | |

| II. ASSETS: | |||

|

(1) Non-Current Assets: (a) Property, Plant and Equipment and Intangible Assets (i) Property, Plant and Equipment (ii) Intangible Assets (Goodwill) (b) Non-Current Investments |

2,70,000 50,000 45,000 |

2,70,000 30,000 50,000 |

|

|

(2) Current Assets: (a) Trade Receivables (b) Cash & Cash Equivalents |

2,67,000 10,000 |

2,19,000 6,000 |

|

| Total | 6,42,000 | 5,75,000 |

Notes to Accounts:-

| 31.3.2023 | 31.3.2022 | |

|

(1) Reserve & Surplus Securities Premium |

1,97,000 10,000 |

1,75,000 — |

| 2,07,000 | 1,75,000 | |

|

(2) Short-term Borrowings Bank Overdraft |

20,000 | 15,000 |

|

(3) Short-term Provision: Provision for Tax Provision for Doubtful Debts |

62,000 22,000 |

65,000 16,000 |

| 84,000 | 81,000 | |

|

(4) Property, Plant and Equipment Land Machinery |

1,50,000 1,20,000 |

70,000 2,00,000 |

| 2,70,000 | 2,70,000 |

Additional Information:-

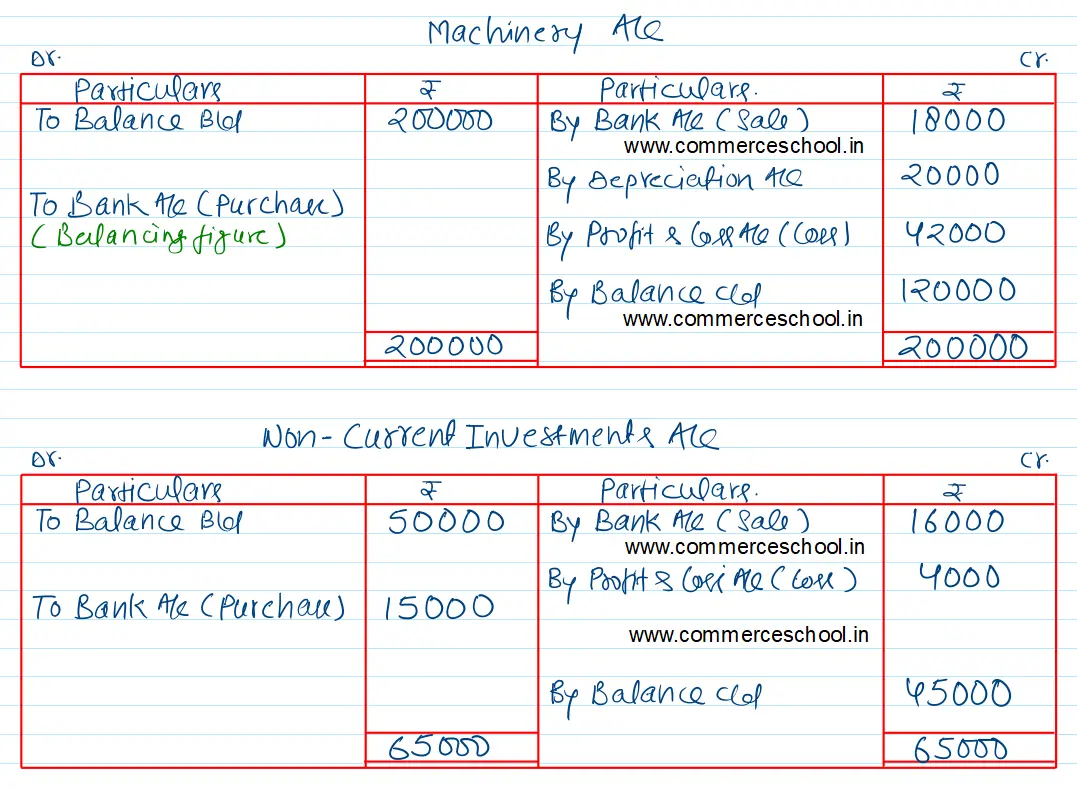

(I) Machinery of the book value of ₹ 60,000 was sold for ₹ 18,000 during the year.

(II) Interim Dividend paid during the year ₹ 25,000.

(III) During the year Company sold 40% of its original non-current investments at a loss of 20%.

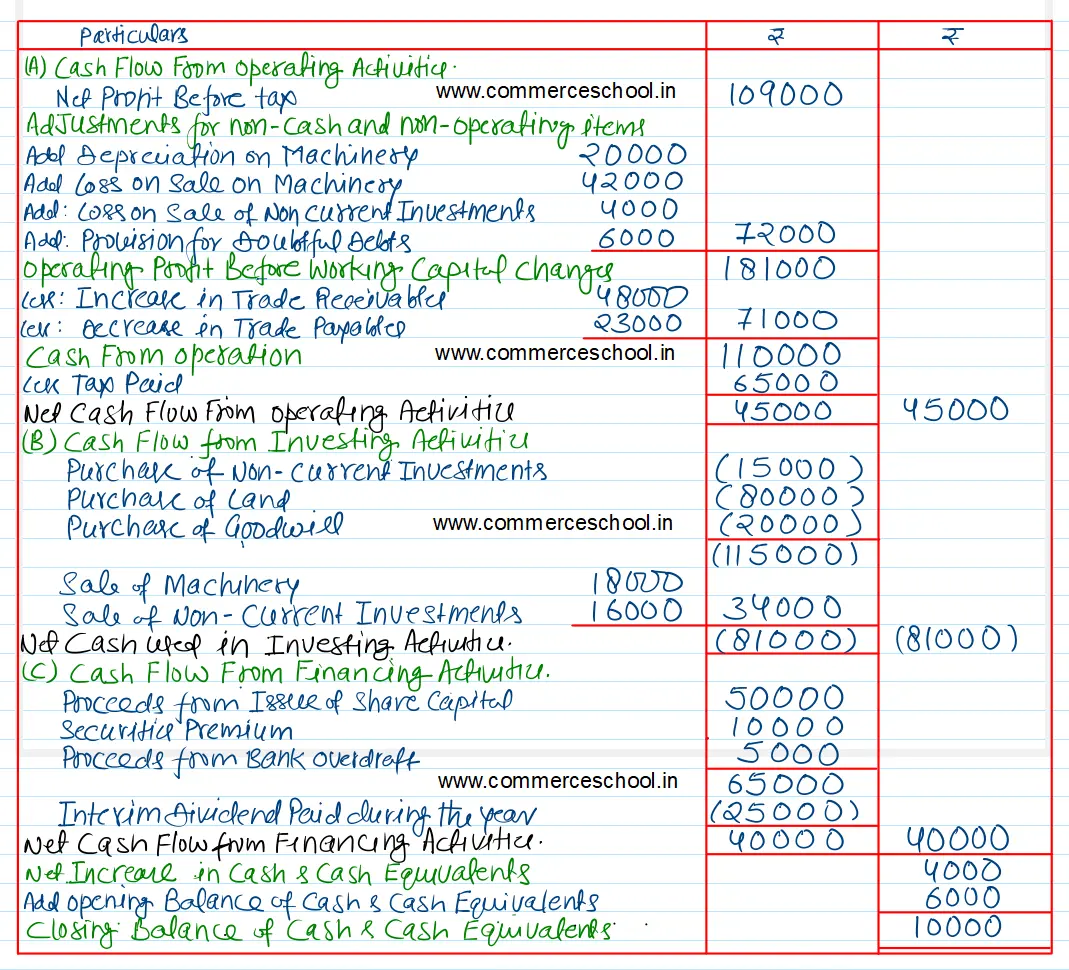

You are required to prepare Cash-Flow Statement.

[Ans. Cash from Operating activities ₹ 45,000; Cash used in investing activities ₹ 81,000; and Cash from financing activities ₹ 40,000.]

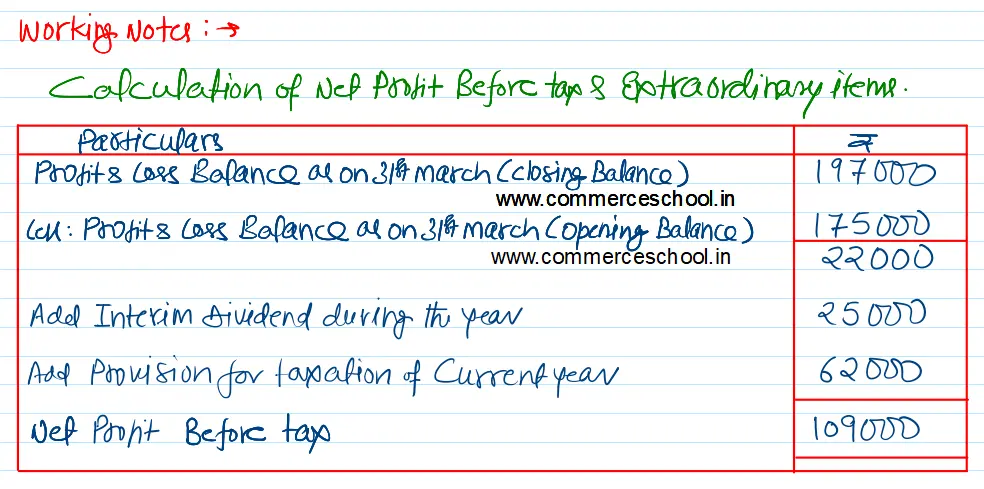

Solution:-

Hint:

(1) Current year’s Depreciation ₹ 20,000.

(2) Purchase of Non-Current Investments ₹ 15,000.

(3) Increase in Intangible Assets will be treated as purchase of Intangible Assets.