You are required to prepare Cash Flow Statement from the following information Interim Dividend paid during the year ₹ 7,000

You are required to prepare Cash Flow Statement from the following information:-

| ₹ | |

| (i) Interim Dividend paid during the year | 7,000 |

| (ii) Plant Purchased | 20,000 |

| (iii) Intangible Assets written off during the year | 10,000 |

| (iv) Debentures redeemed on 1st Feb. 2024 | 12,000 |

| (v) Interest on debentures has been paid up-to date |

| Particulars | Note. No. | 31st March, 2023 | 31st March, 2022 |

| I. EQUITY AND LIABILITIES: | |||

|

(1) Shareholder’s Funds: (a) Share Capital (b) Reserves & Surplus |

1,48,000 21,120 |

1,40,000 20,000 |

|

|

(2) Non-Current Liabilities: Long-term Borrowings |

12,000 | 24,000 | |

|

(2) Current Liabilities: (a) Trade Payables (b) Short-term Provisions |

23,680 1,600 |

20,720 1,400 |

|

| Total | 2,06,400 | 2,06,200 | |

| II. ASSETS: | |||

|

(1) Non-Current Assets: (a) Property, Plant and Equipment and Intangible Assets (i) Property, Plant and Equipment (Plant & Machinery) (ii) Intangible Assets |

60,000 10,000 |

40,000 20,000 |

|

|

(2) Current Assets: (a) Inventory (b) Trade Receivables (c) Cash & Cash Equivalents |

85,400 35,400 15,600 |

98,400 29,800 18,000 |

|

| Total | 2,06,400 | 2,06,200 |

Notes to Accounts:-

| 31.3.2023 | 31.3.2022 | |

|

(1) Long-term Borrowings: 12% Debentures |

12,000 | 24,000 |

|

(2) Short-term Provision: Provision for Doubtful Debts |

1,600 | 1,400 |

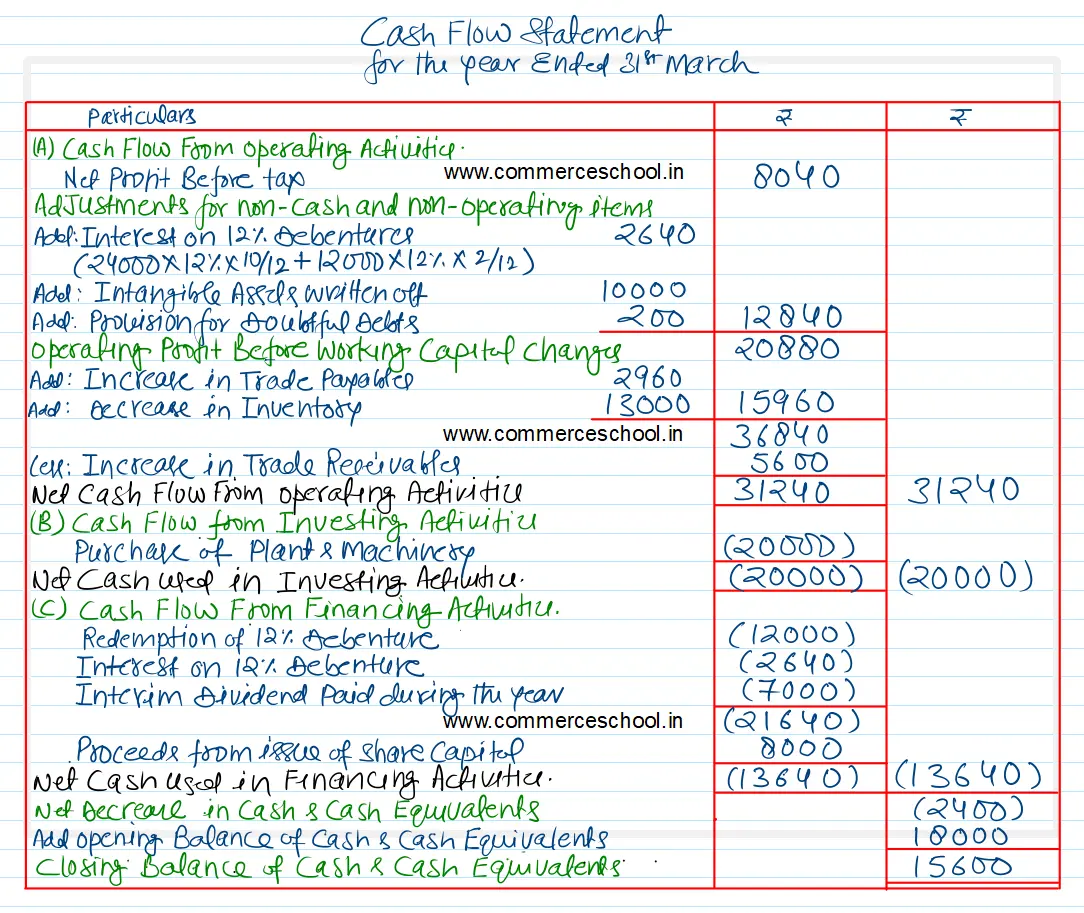

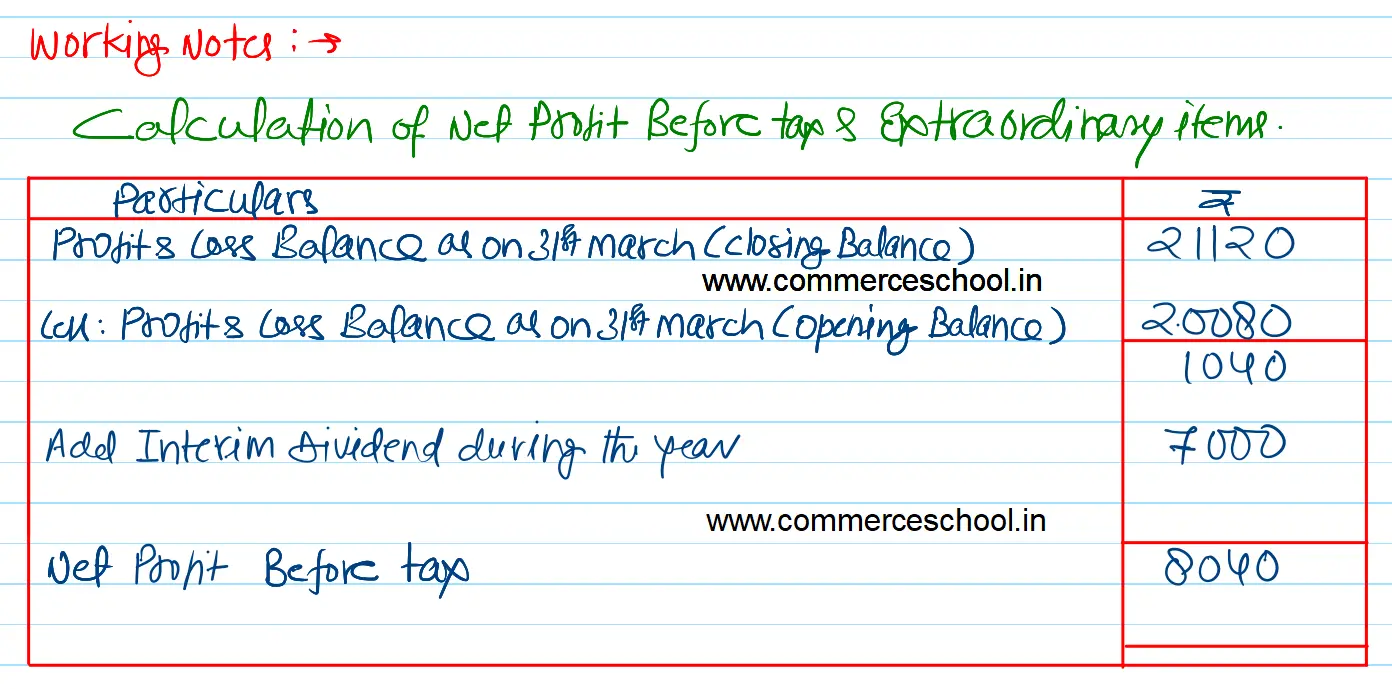

[Ans. Cash from operating activities ₹ 31,240; Cash used in investing activities ₹ 20,000; and Cash used in financing activities ₹ 13,640.]