Prepare Comparative Statement of Profit & Loss from the following Statement of Profit & Loss: Revenue from Operations (Net Sales) ₹ 3,50,000

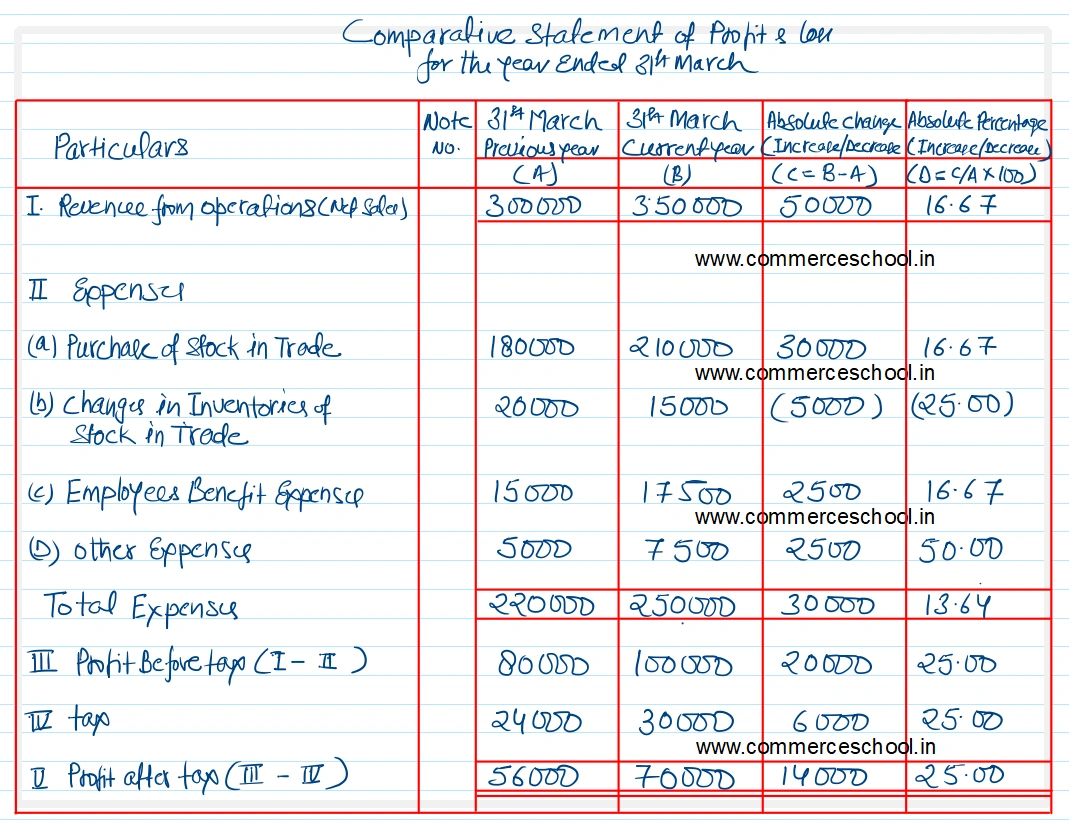

Prepare Comparative Statement of Profit & Loss from the following Statement of Profit & Loss:

| Particulars | Note. No. | 31st March, 2024 (₹) | 31st March, 2023 (₹) |

| I. Income | |||

| Revenue from Operations (Net Sales) | 3,50,000 | 3,00,000 | |

| II. Expenses | |||

| Purchases of Stock-in-Trade | 2,10,000 | 1,80,000 | |

| Change in Inventories of Stock-in-Trade | 15,000 | 20,000 | |

| Employees Benefit Expenses | 17,500 | 15,000 | |

| Other Expenses | 7,500 | 5,000 | |

| Total | 2,50,000 | 2,20,000 | |

| III. Profit before Tax (I-II) | 1,00,000 | 80,000 | |

| IV. Tax | 30,000 | 24,000 | |

| V. Profit after Tax (III – IV) | 70,000 | 56,000 |

[Ans.:]

| Particulars | Absolut Change (₹) | Percentage Change (%) |

| Revenue from Operations | 50,000 | 16,67 |

| Purchase of Stock-in-Trade | 30,000 | 16.67 |

| Change in inventories of Stock-in-Trade | (5,000) | (25.00) |

| Employees Benefit Expenses | 2,500 | 16.67 |

| Other Expenses | 2,500 | 50.00 |

| Profit before Tax | 20,000 | 25.00 |

| Tax | 6,000 | 25.00 |

| Profit after Tax | 14,000 | 25.00 |

Anurag Pathak Changed status to publish