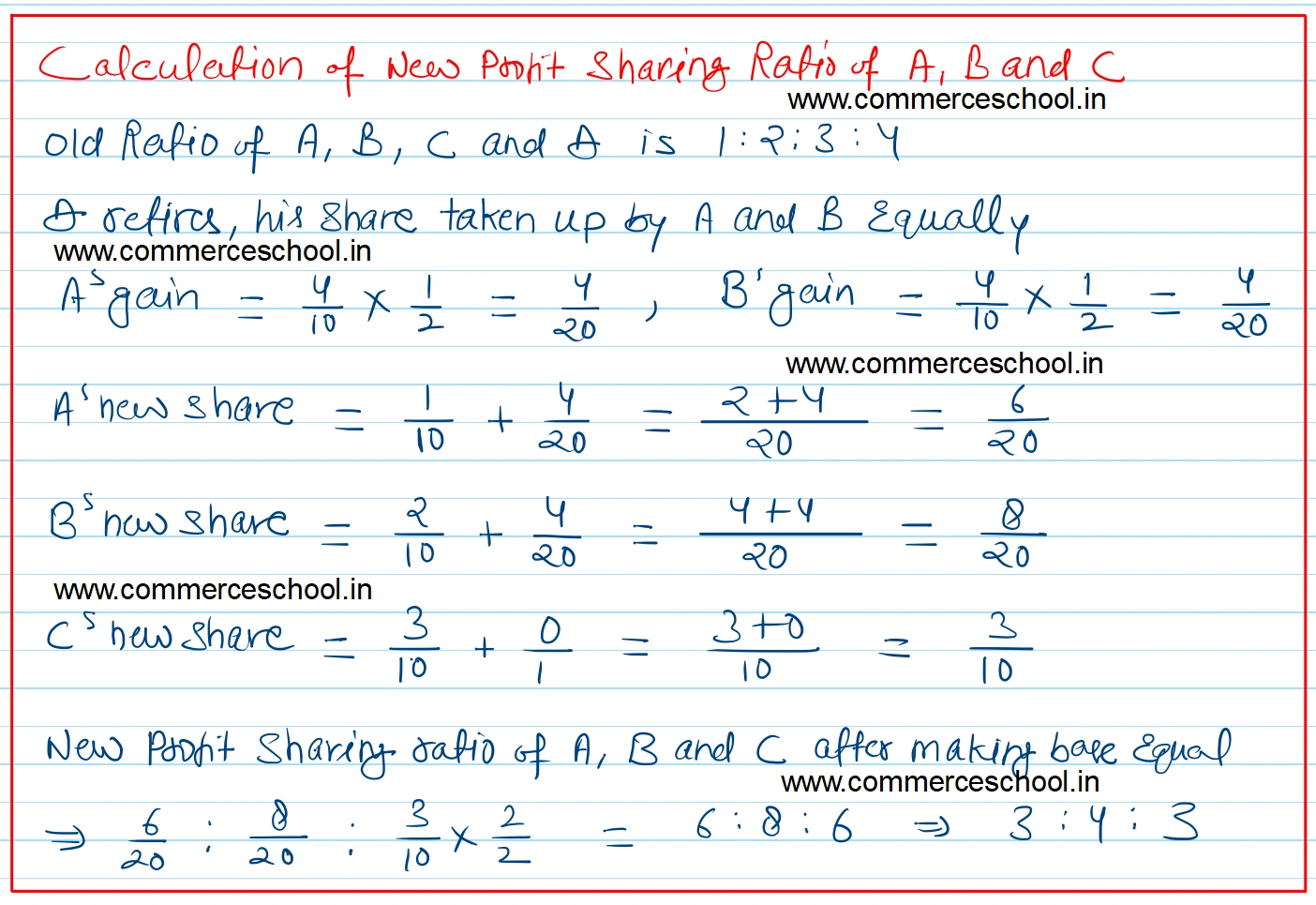

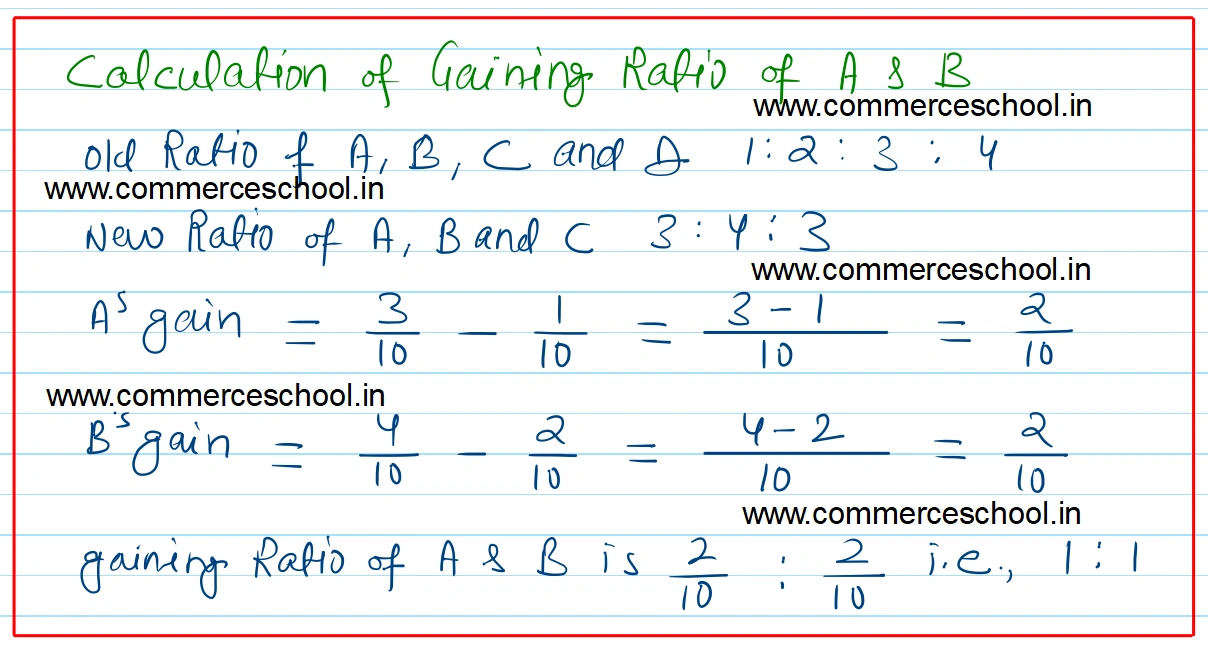

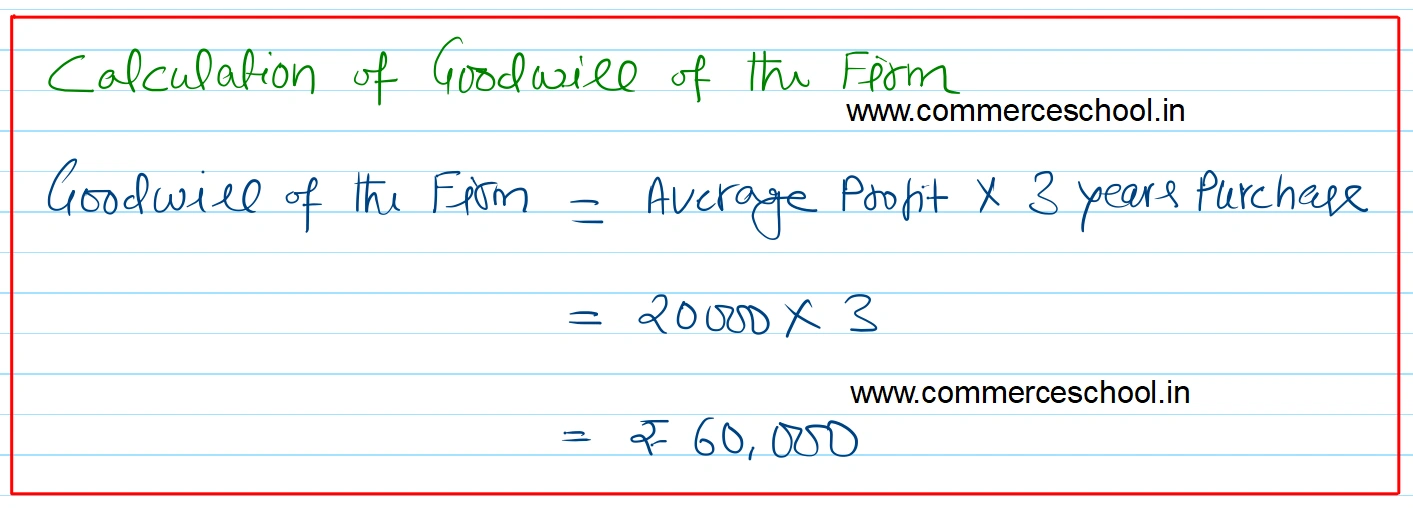

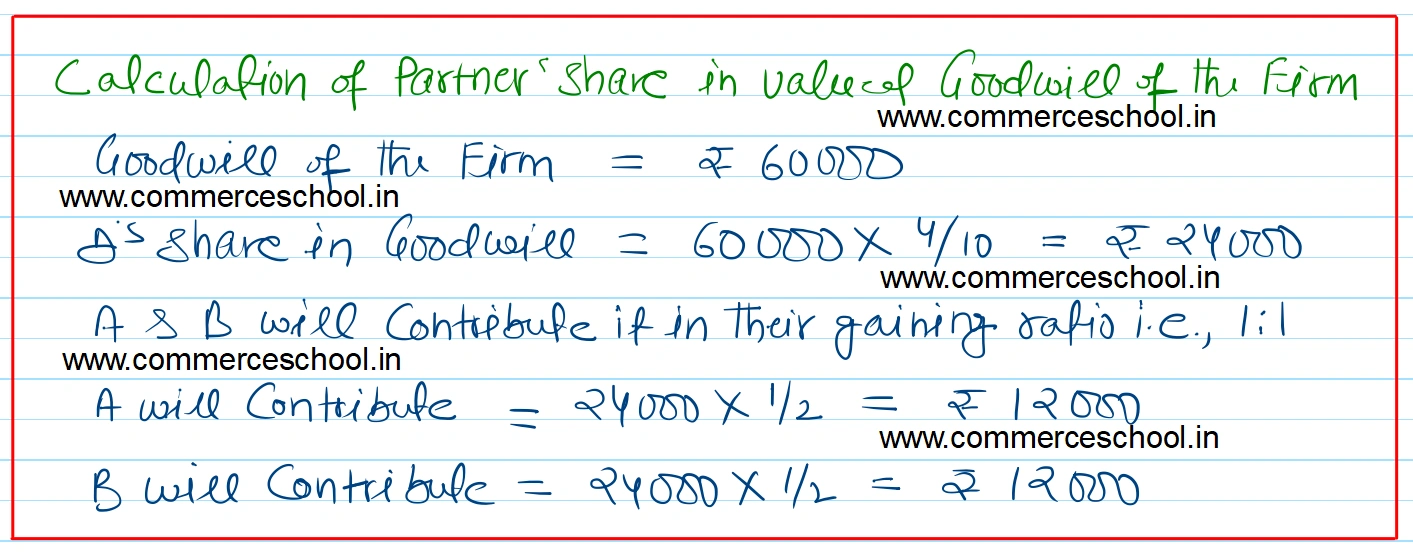

A, B, C and D are partners sharing profits in the ratio of 1 : 2 : 3 : 4. D retires and his share in taken up by A and B equally. Goodwill was valued at 3 year’s purchase of average profits which were ₹ 20,000

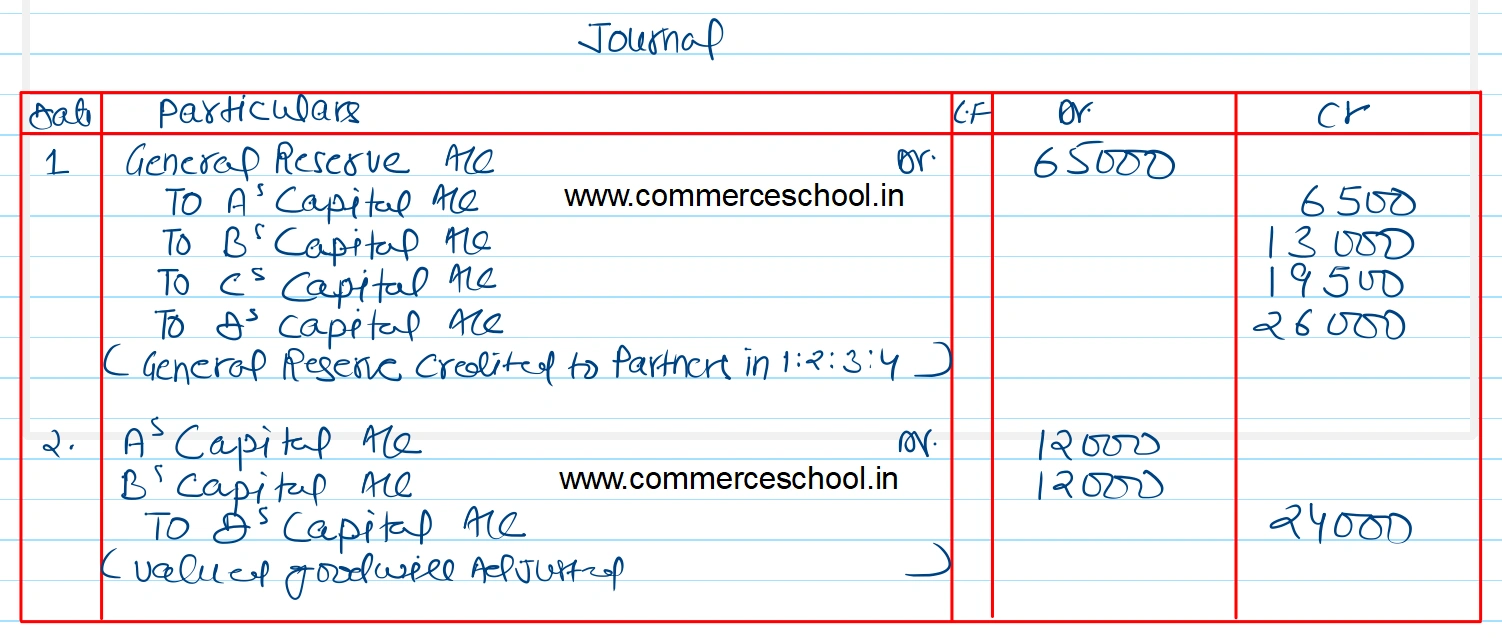

A, B, C and D are partners sharing profits in the ratio of 1 : 2 : 3 : 4. D retires and his share in taken up by A and B equally. Goodwill was valued at 3 year’s purchase of average profits which were ₹ 20,000. General Reserve showed a balance of ₹ 65,000 at the time of D’s retirement.

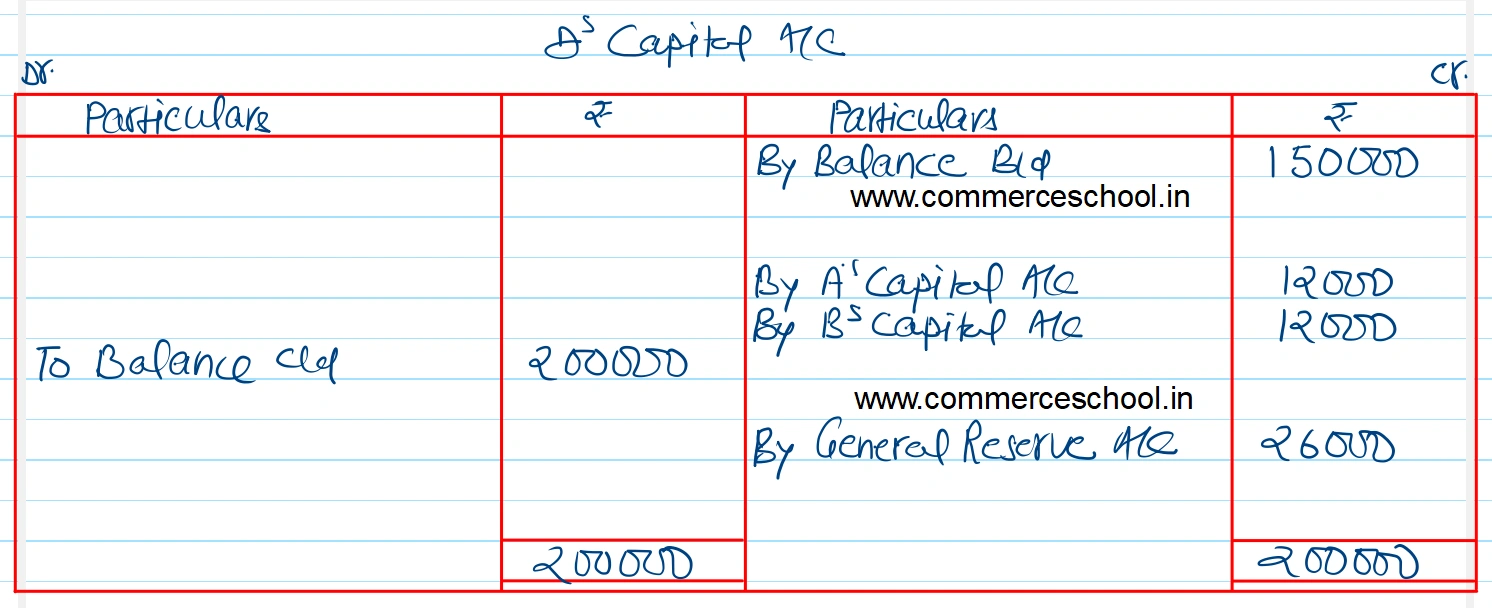

You are required to record necessary journal entries to record that above adjustments on D’s retirement. You are also required to prepare his capital account to find out the amount due to him when his capital balance in the balance sheet was ₹ 1,50,000 before any adjustment. Also calculate the new profit-sharing ratios.

[Ans. D’s share of goodwill amounting to ₹ 24,000 will be debited to A and B equally. Balance in D’s Capital A/c ₹ 2,00,000. New ratios 3 : 4 : 3.]