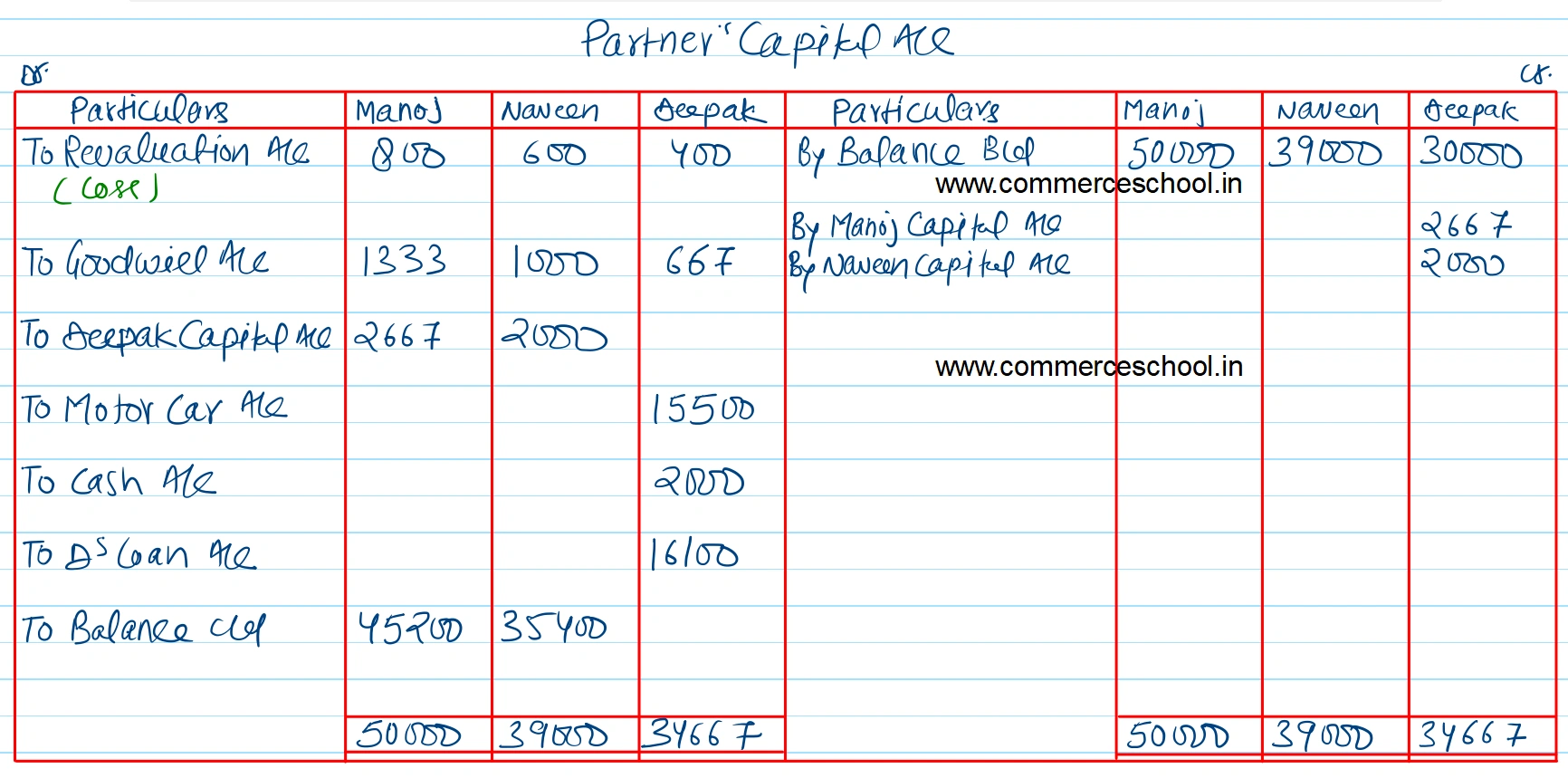

Manoj, Naveen and Deepak were partners sharing profits and losses in the ratio of 4 : 3 : 2. As at 1st April 2022, their Balance Sheet was as follows:

Manoj, Naveen and Deepak were partners sharing profits and losses in the ratio of 4 : 3 : 2. As at 1st April 2022, their Balance Sheet was as follows:

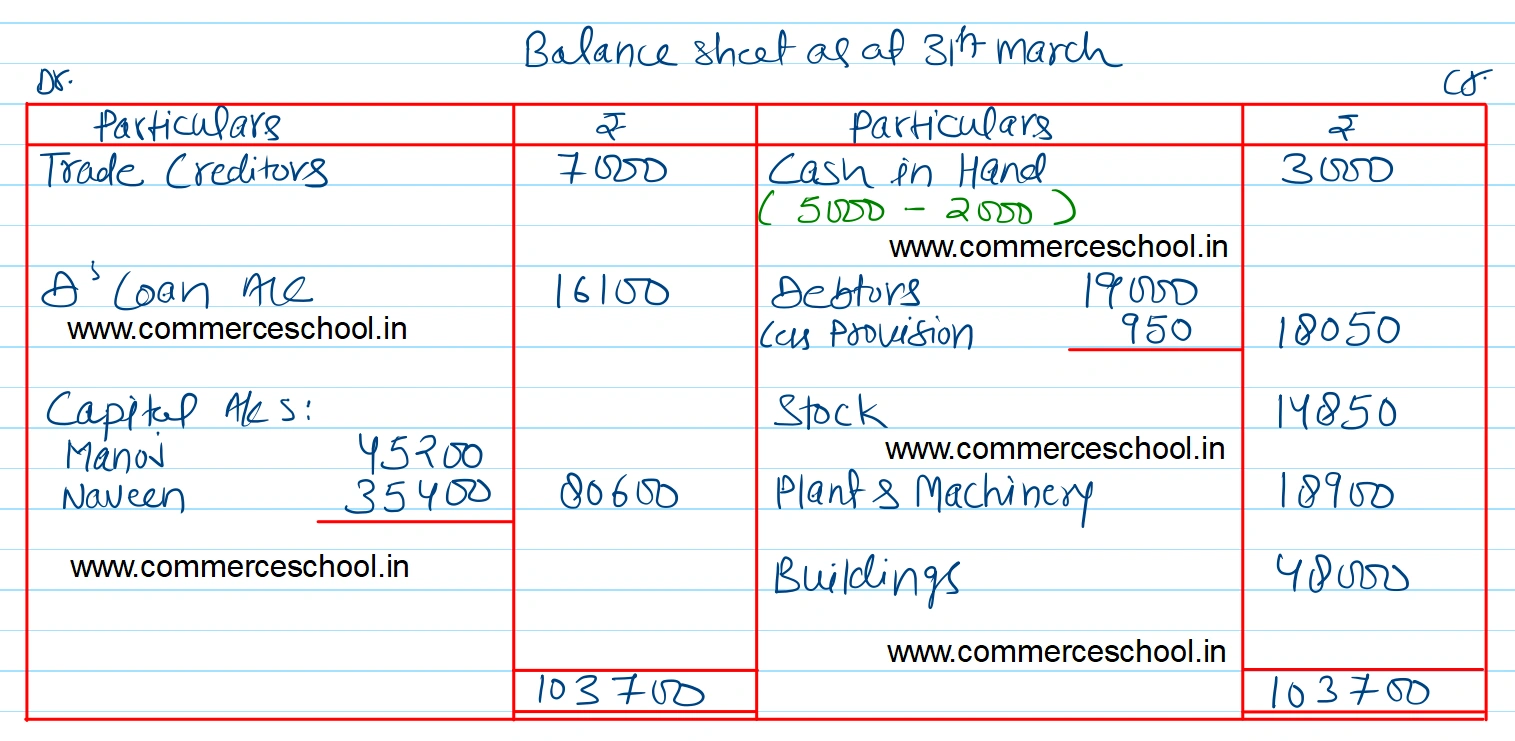

| Liabilities | ₹ | Assets | ₹ |

| Trade Creditors | 7,000 | Cash in Hand | 5,900 |

| Capitals: Manoj Naveen Deepak | 50,000 39,000 30,000 | Debtors 19,000 Less: Provision 1,400 | 17,600 |

| Stock | 13,500 | ||

| Plant and Machinery | 18,000 | ||

| Motor Car | 20,000 | ||

| Buildings | 48,000 | ||

| Goodwill | 3,000 | ||

| 1,26,000 | 1,26,000 |

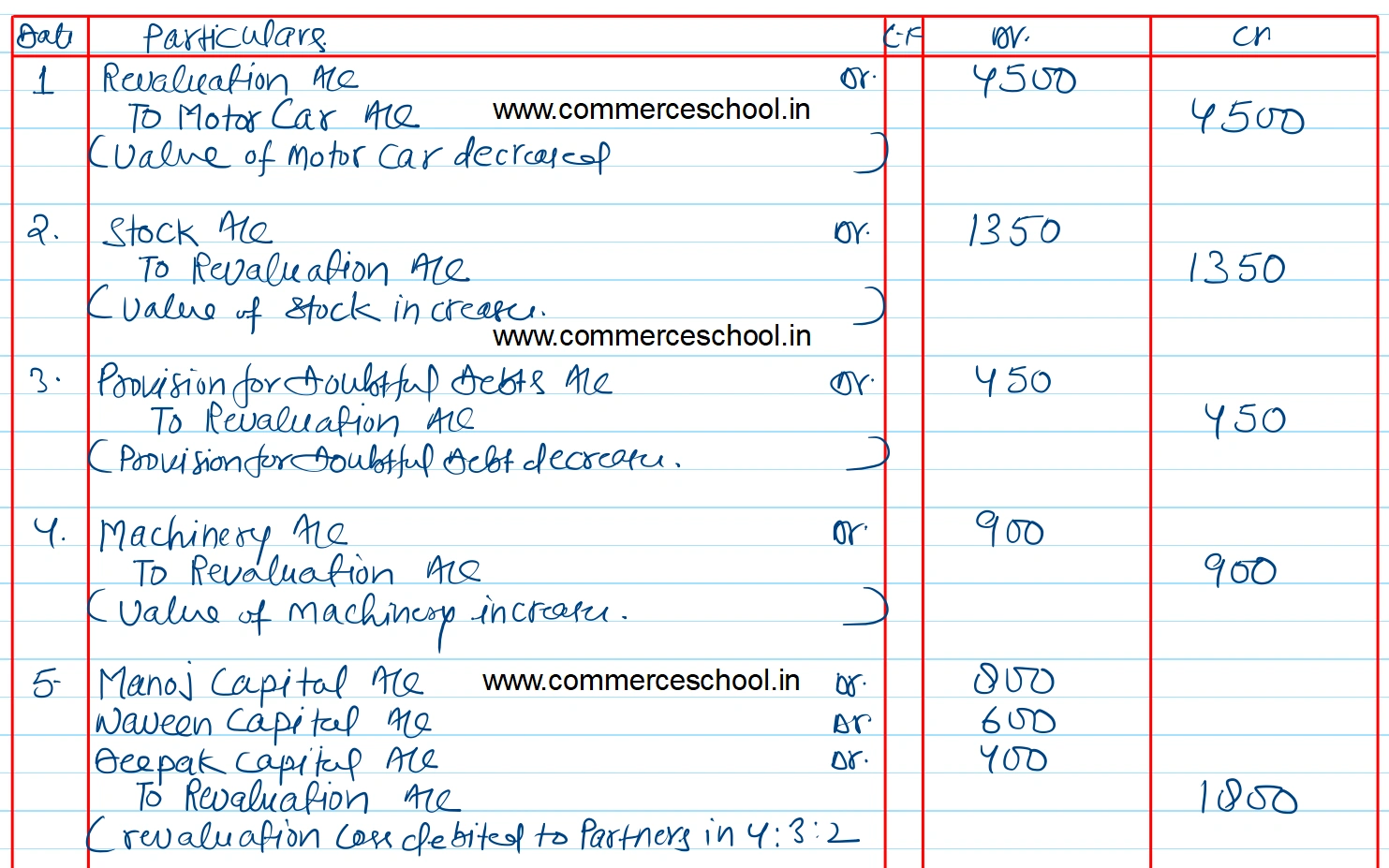

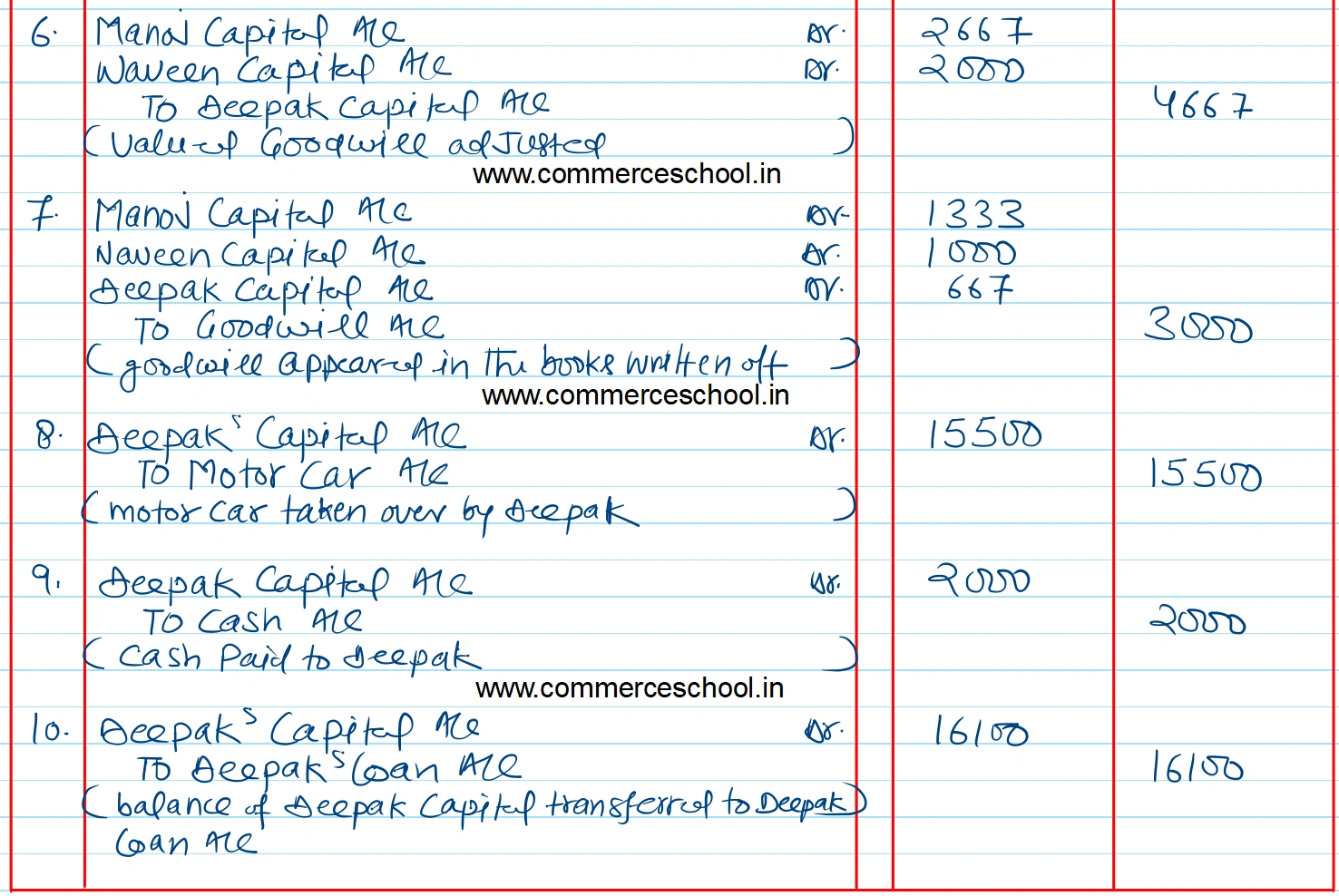

Deepak retired on the above date as per the following terms:

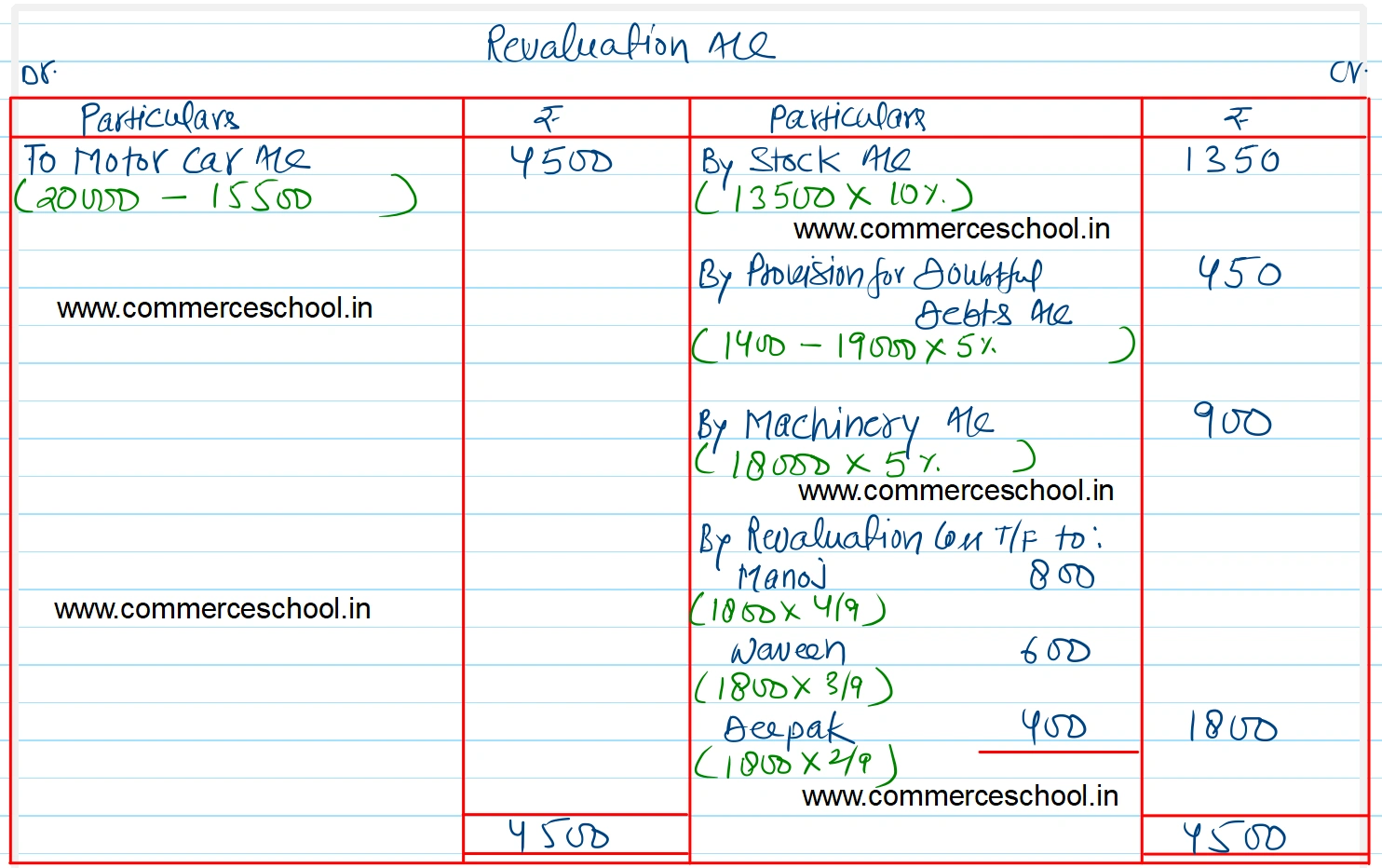

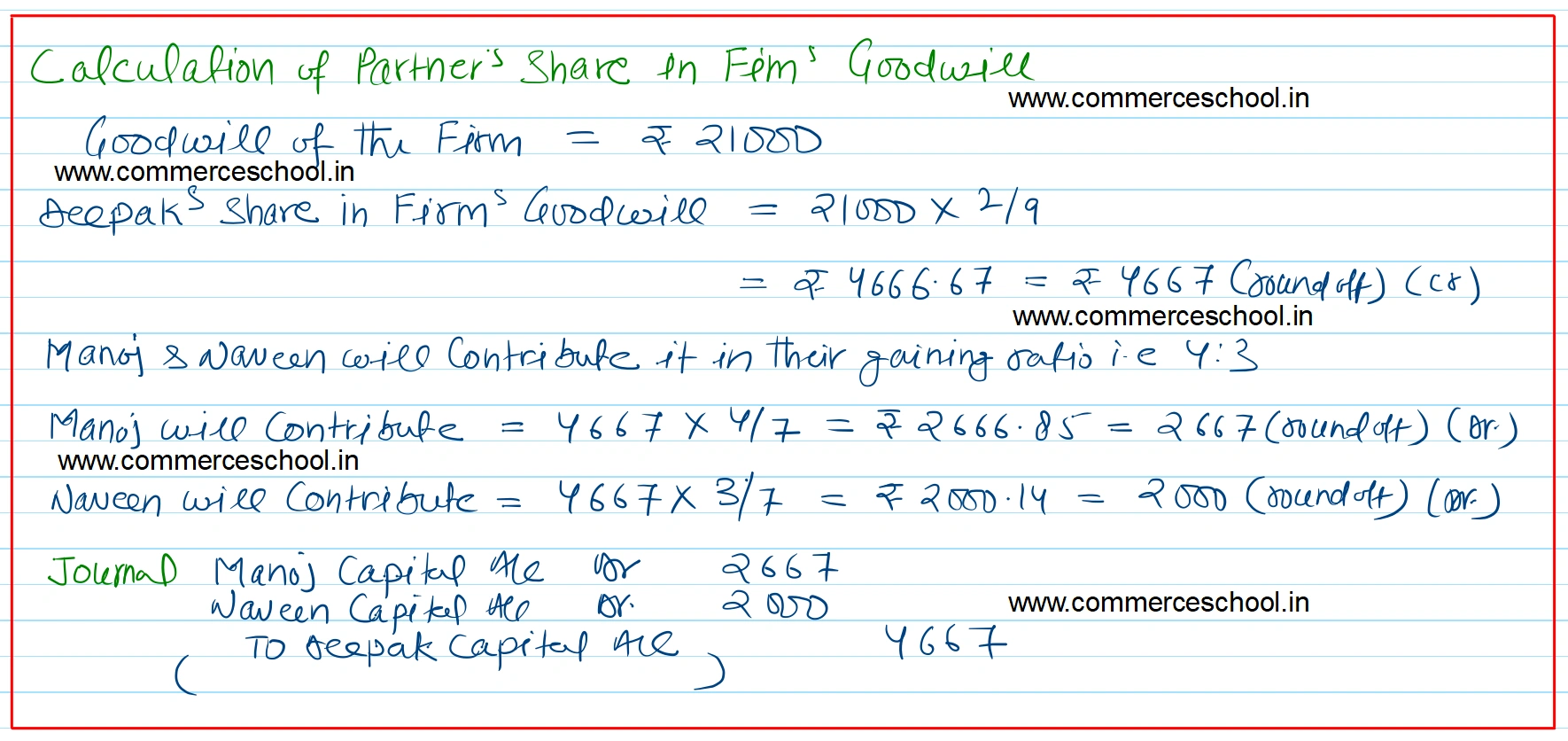

- Goodwill of the firm was valued at ₹ 21,000.

- Stock to be appreciated by 10%.

- Provision for doubful debts should be 5% on debtors

- Machinery is to be valued at 5% more than its book value.

- Motor car is revalued at ₹ 15,500. Retiring partner took over Motor Car at this value.

- Deepak be paid ₹ 2,000 in cash and balance be transferred to his loan account.

Show necessary journal entries. Prepare Revaluation Account, Capital Accounts and Opening Balance Sheets of continuing partners.

[Ans. Loss on Revaluation ₹ 1,800; Deepak’s Loan A/c ₹ 16,100; Capitals : Manoj ₹ 45,200; Naveen ₹ 35,400; B/S total ₹ 1,03,700.]

Hint: Goodwill amounting to ₹ 3,000 will be written off among old partners in old ratio and Deepak’s Share in ₹ 21,000 will be debited to the accounts of Manoj and Naveen in gaining ratio i.e., 4 : 3.

Anurag Pathak Changed status to publish