The Balance Sheet of X, Y and Z who were sharing profit in proportion of capitals is as follows: Sundry Creditors ₹ 7,000

The Balance Sheet of X, Y and Z who were sharing profit in proportion of capitals is as follows:

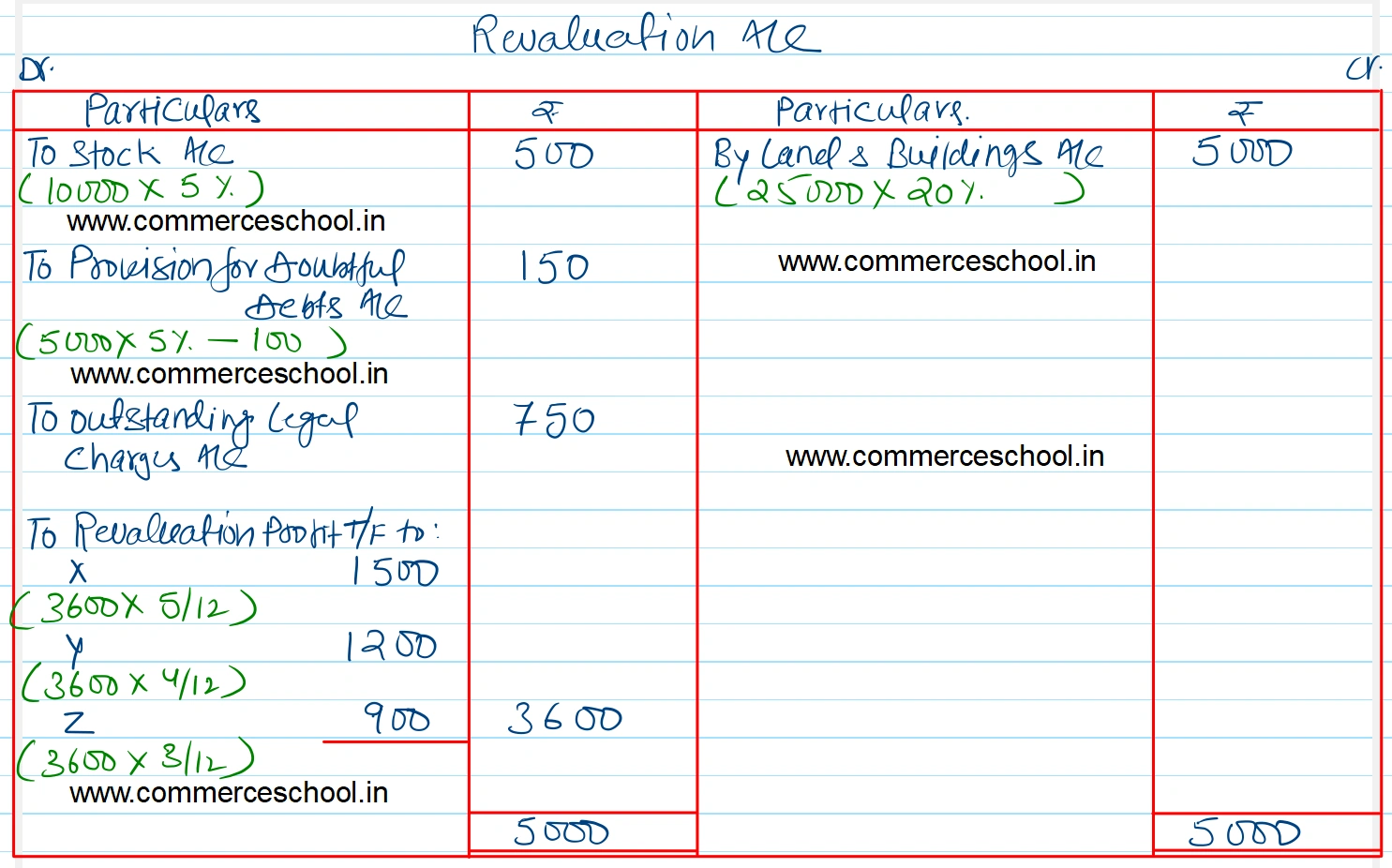

Y retires and the following adjustments of the assets and liabilities have been made before the ascertainment of the amount payable by the firm to Y:

(I) That the stock be depreciated by 5%.

(ii) That the provision for doubtful debts be increased to 5% on debtors.

(iii) That the land and building be appreciated by 20%.

(iv) That a provision of ₹ 750 be made in respect of outstanding legal charges.

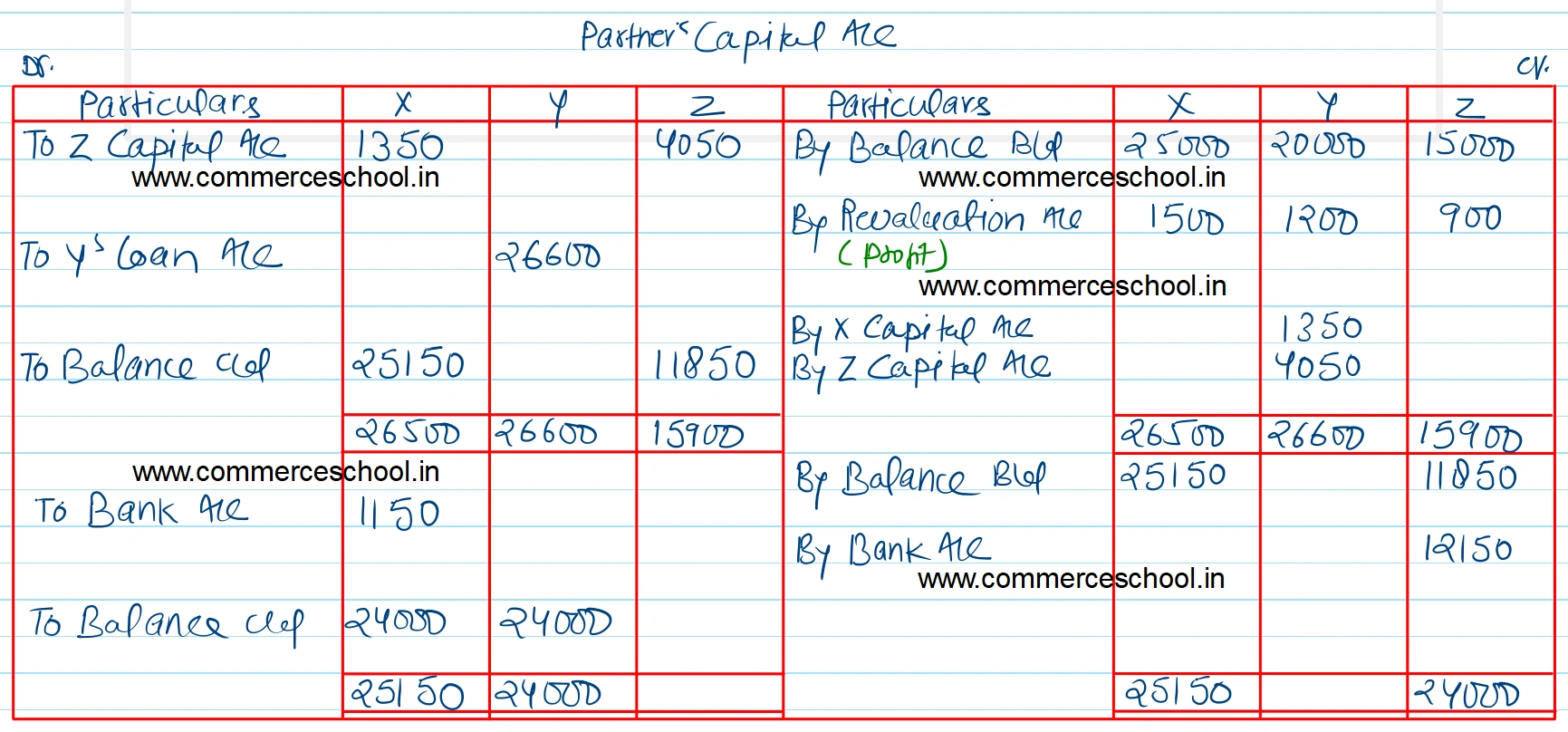

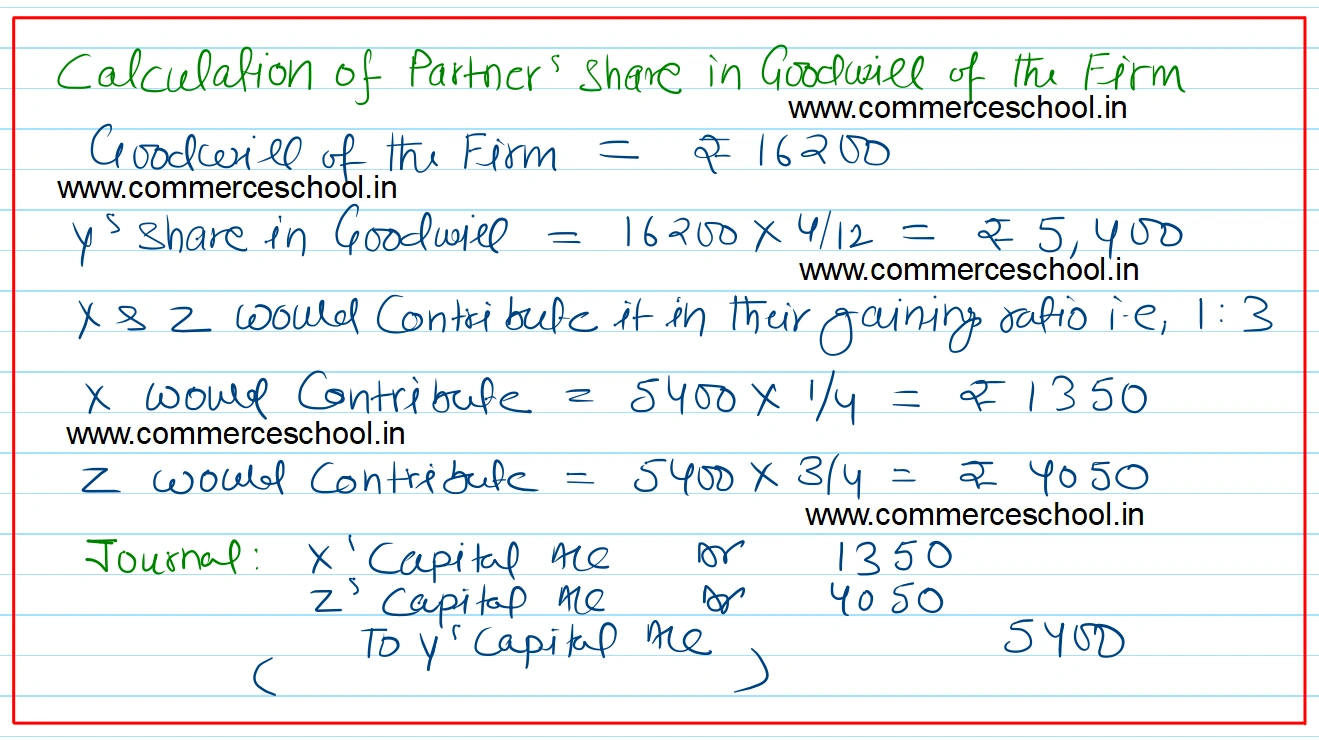

(v) That the Goodwill of the entire firm be fixed at ₹ 16,200 and Y’s share of the same be adjusted into the Accounts of X and Z.

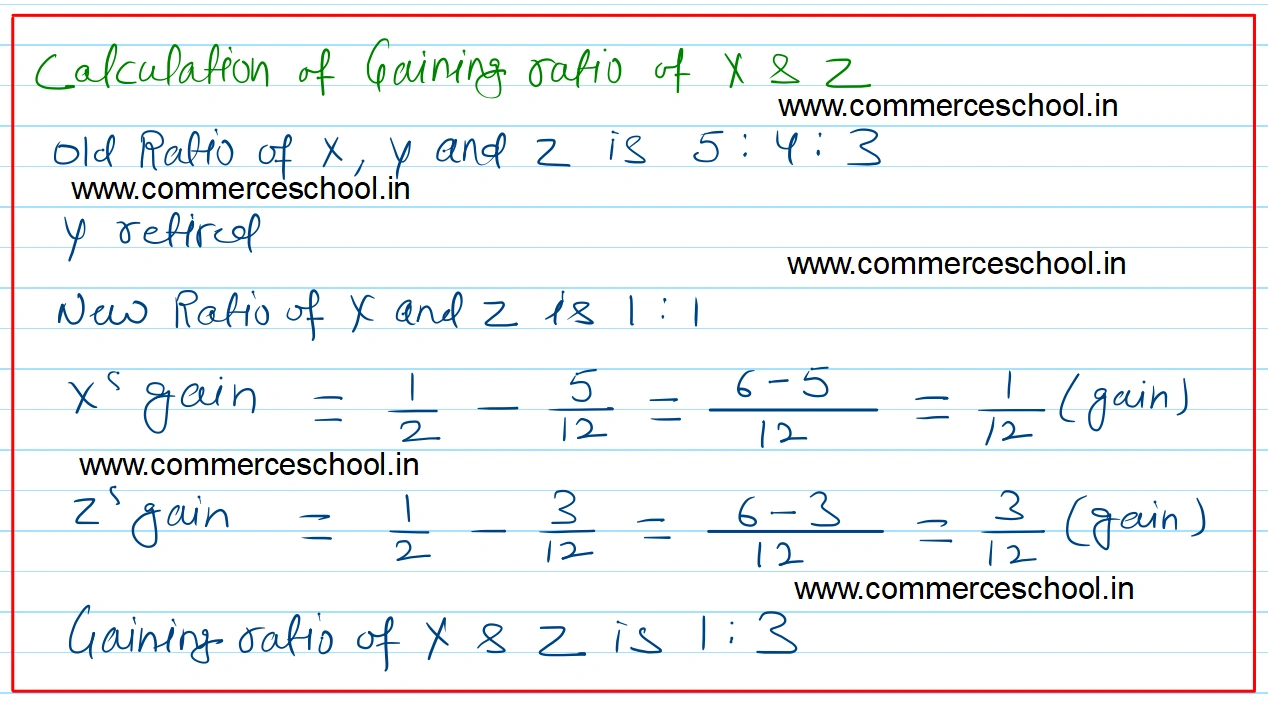

(vi) That X and Z decide to share future profits of the firm in equal proportion.

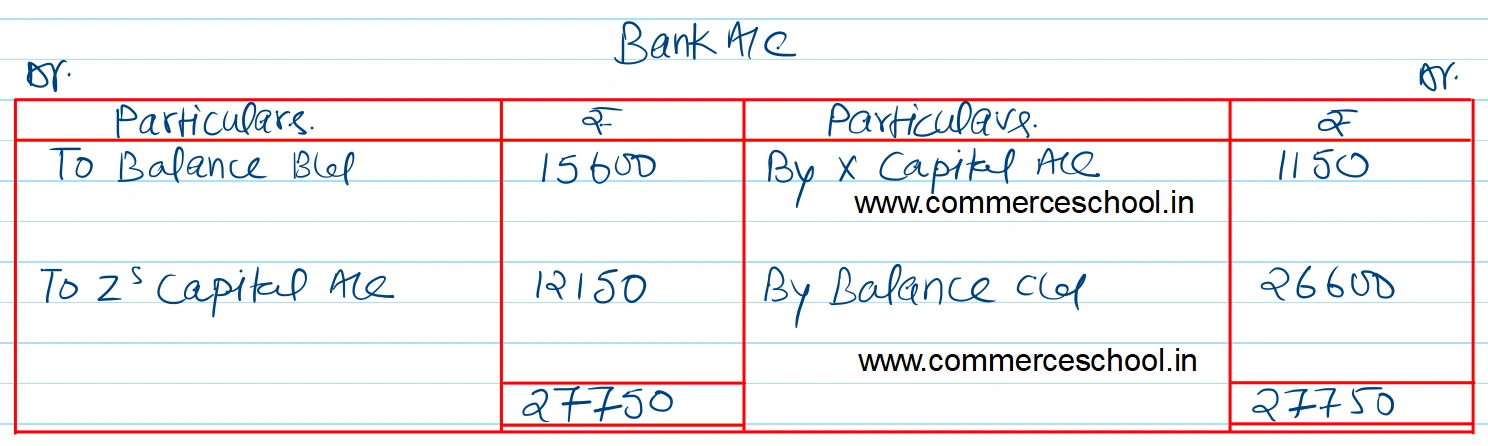

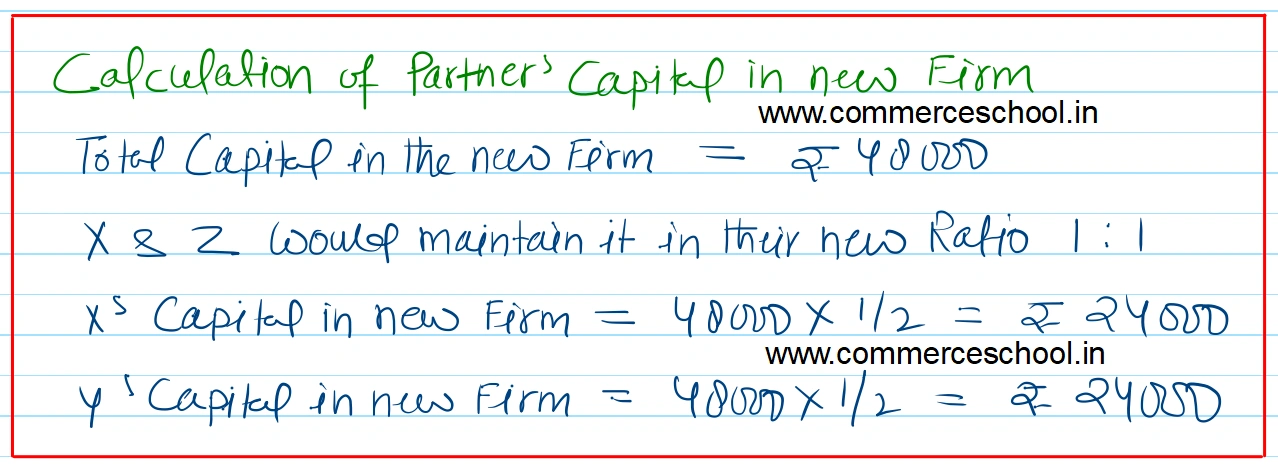

(vii) That the entire capital of the new firm is fixed at ₹ 48,000 between X and Z in equal proportions. For the purpose, actual cash is to be brought in or paid off.

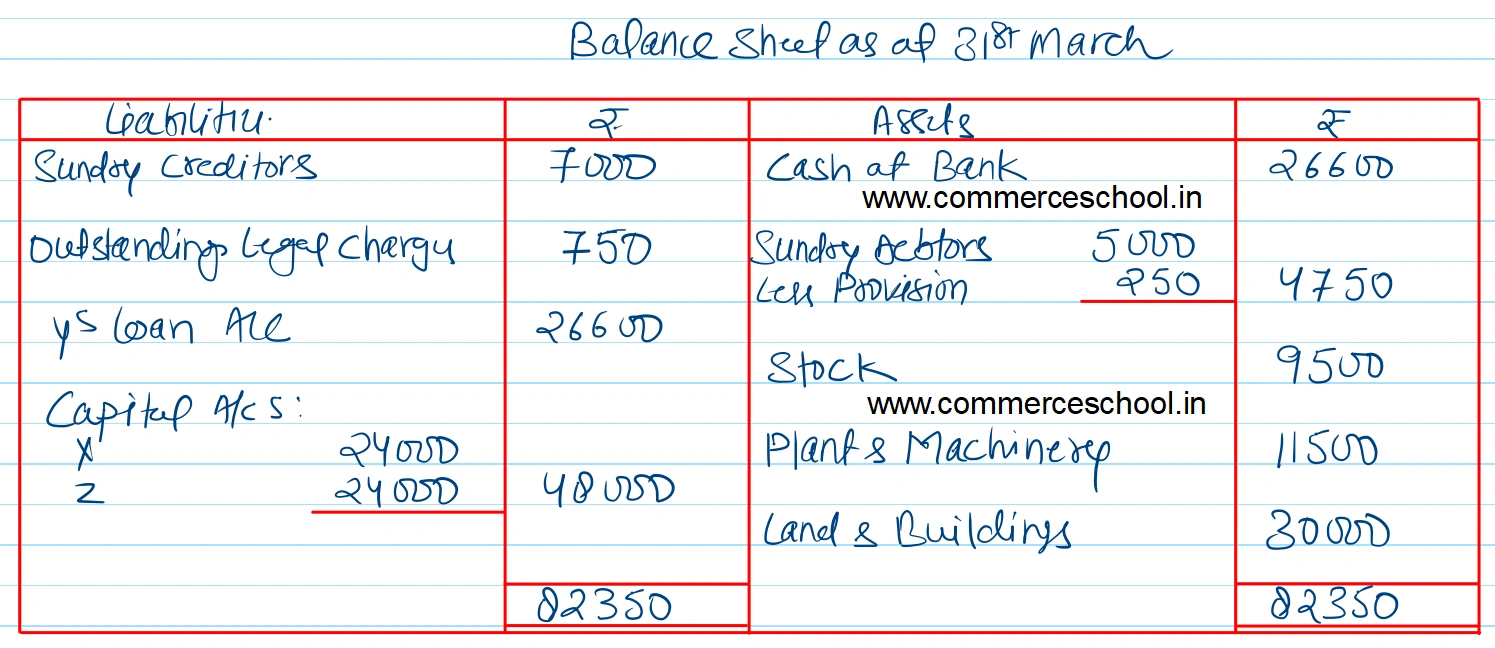

You are required to prepare the Revaluation Account, Partner’s Capital Accounts, Bank account and revised balance Sheet after Y’s retirement. Also indicate the gaining ratio.

[Ans. Gain on Revaluation ₹ 3,600; Y’s Loan Account ₹ 26,600; Capital A/cs – X ₹ 24,000 and Z ₹ 24,000; Cash withdrawn by X ₹ 1,150; and cash brought in by Z ₹ 12,150; Bank Balance – ₹ 26,600; Balance Sheet total ₹ 82,350.]

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 7,000 | Cash at Bank | 15,600 |

| Capital A/cs: X Y z | 25,000 20,000 15,000 | Sundry Debtors 5,000 Less: Provision 100 | 4,900 |

| Stock | |||

| Plant and Machinery | |||

| Land and Building | |||

| 67,000 | 67,000 |

Anurag Pathak Answered question