Leena and Rohit are partners in a firm sharing profits in the ratio of 3 : 2. On 31st March, 2018, their Balance Sheet was as follows:

Leena and Rohit are partners in a firm sharing profits in the ratio of 3 : 2. On 31st March, 2018, their Balance Sheet was as follows:

Balance Sheet of Leena and Rohit as at 31.3.2018

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 80,000 | Cash | 42,000 |

| Bills Payable | 38,000 |

Debtors 1,32,000 Less: Provision 2,000 |

1,30,000 |

| General Reserve | 50,000 | Stock | 1,46,000 |

|

Capital: Leena Rohit |

1,60,000 1,40,000 |

Plant and Machinery | 1,50,000 |

| 4,68,000 | 4,68,000 |

On the above date Manoj was admitted as a new partner for 1/5th share in the profits of the firm on the following terms:

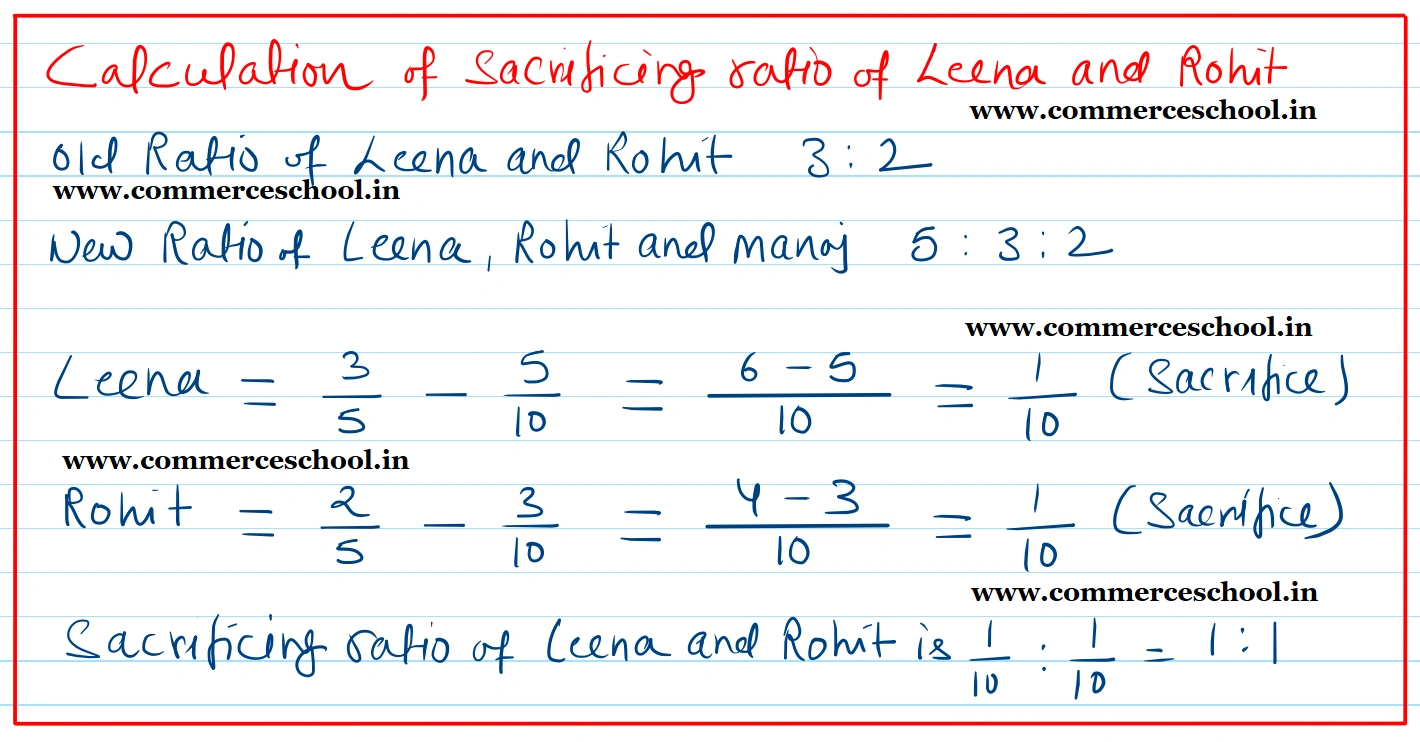

(i) Manoj brought proportionate capital. He also brought his share of goodwil premium of ₹ 80,000 in cash.

(ii) 10% of the general reserve was to be transferred to provision for doubtful debts.

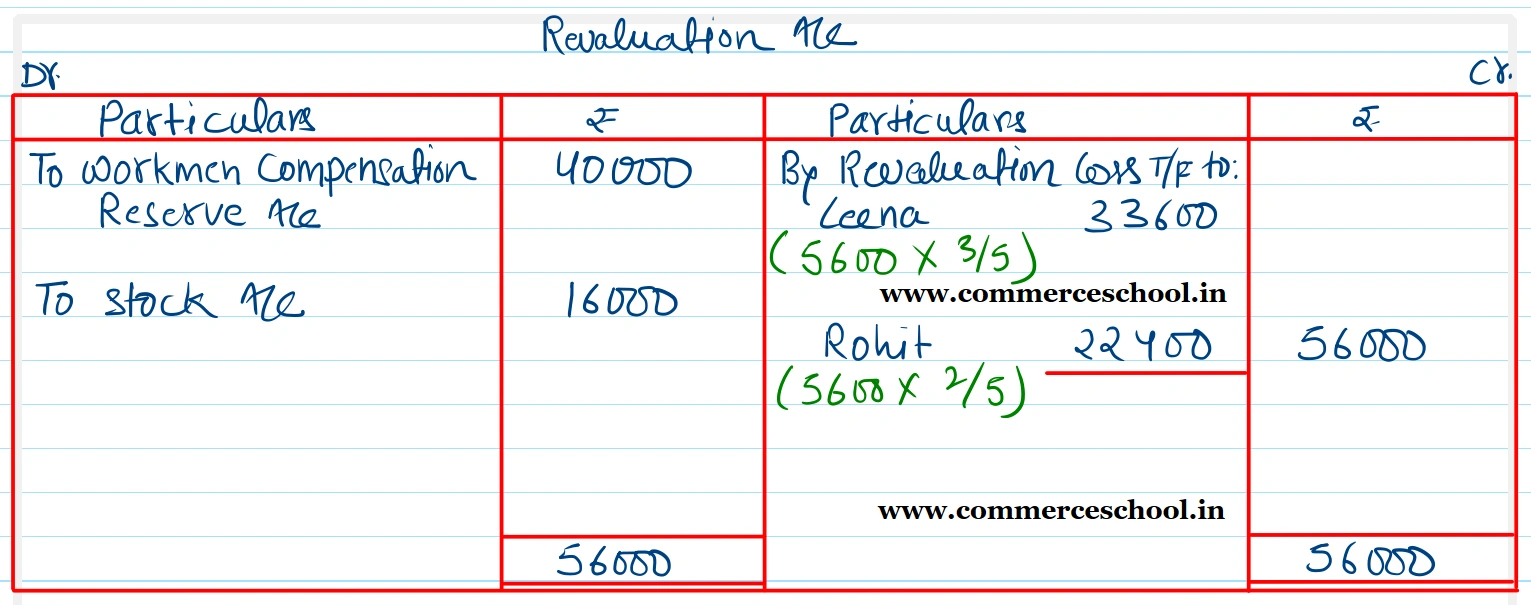

(iii) Clain on account of workmen’s compensation amounted to ₹ 40,000.

(iv) Stock was overvalued by ₹ 16,000.

(v) Leena, Rohit and Manoj will share future profits in the ratio of 5 : 3 : 2.

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the reconstituted firm.

[Ans. Loss on Revaluation ₹ 56,000; Capital Accounts: Leena ₹ 1,93,400; Rohit ₹ 1,75,600 and Manoj ₹ 92,250; B/S Total ₹ 6,19,250; Sacrificing Ratio 1 : 1.]