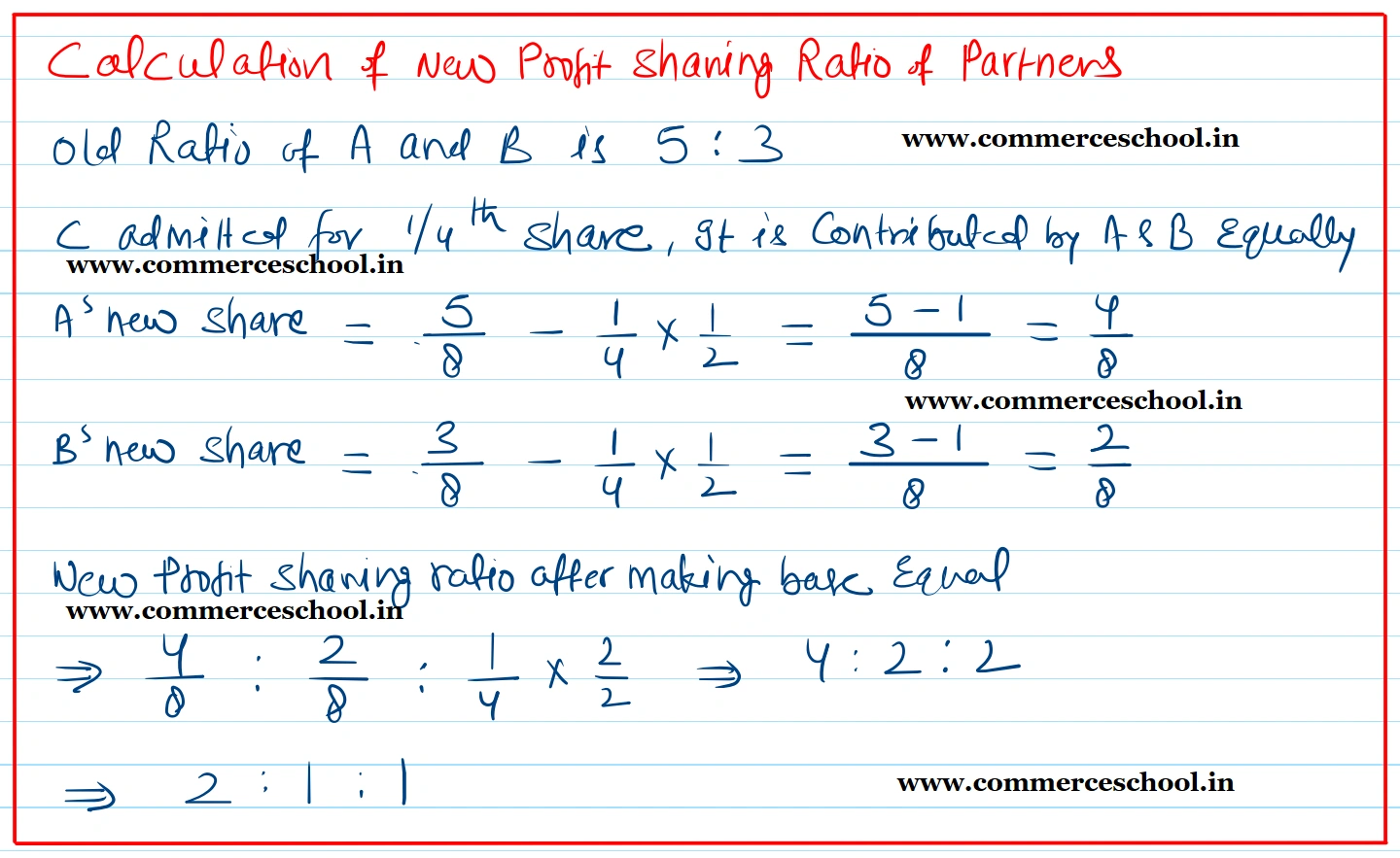

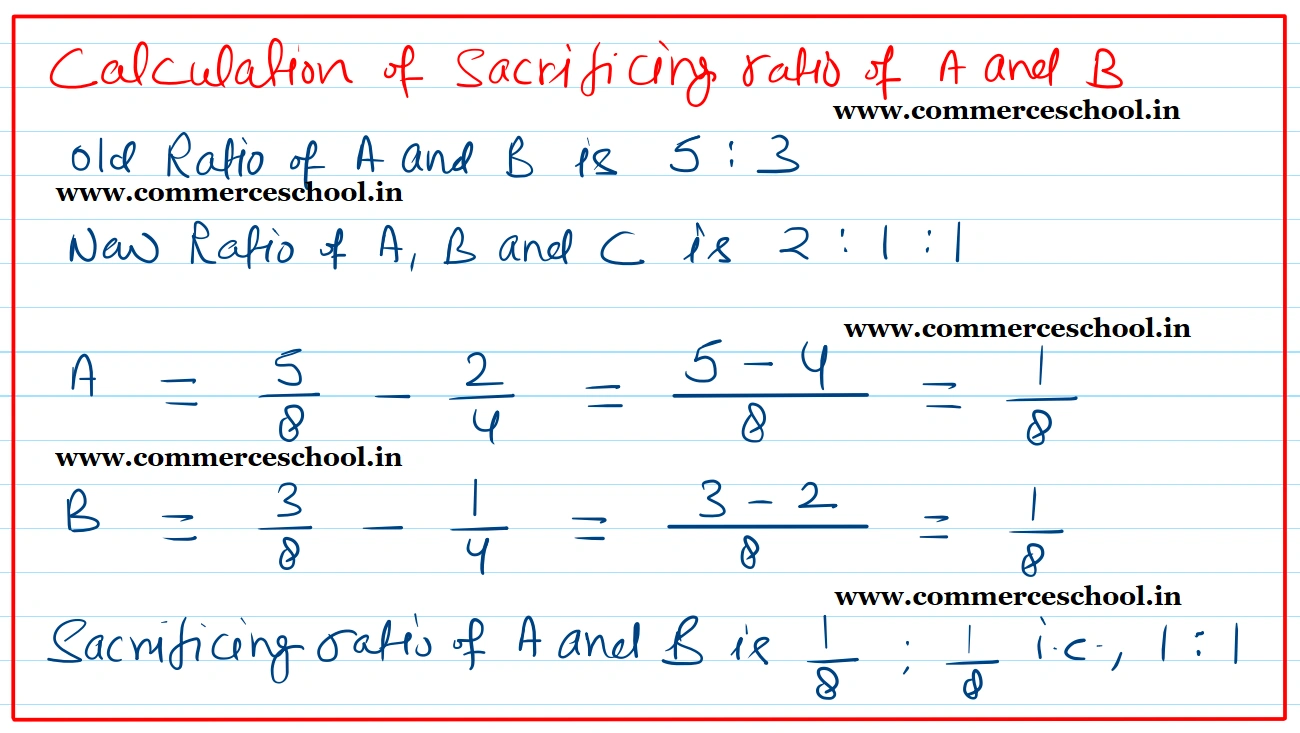

A and B share the profits of a business in the ratio of 5 : 3. They admit C into the firm for a 1/4th share in the profits to be contributed equally by A and B

A and B share the profits of a business in the ratio of 5 : 3. They admit C into the firm for a 1/4th share in the profits to be contributed equally by A and B. On the date of admission of C, the Balance Sheet of the firm was as follows:

| Liabilities | ₹ | Assets | ₹ |

| A’s Capital | 3,00,000 | Machinery | 2,60,000 |

| B’s Capital | 2,00,000 | Furniture | 1,60,000 |

| Workmen’s Compensation Reserve | 40,000 | Stock | 1,20,000 |

| Bank Loan | 1,20,000 | Debtors | 80,000 |

| Creditors | 20,000 | Bank | 60,000 |

| 6,80,000 | 6,80,000 |

Terms of C’s admission were as follows:

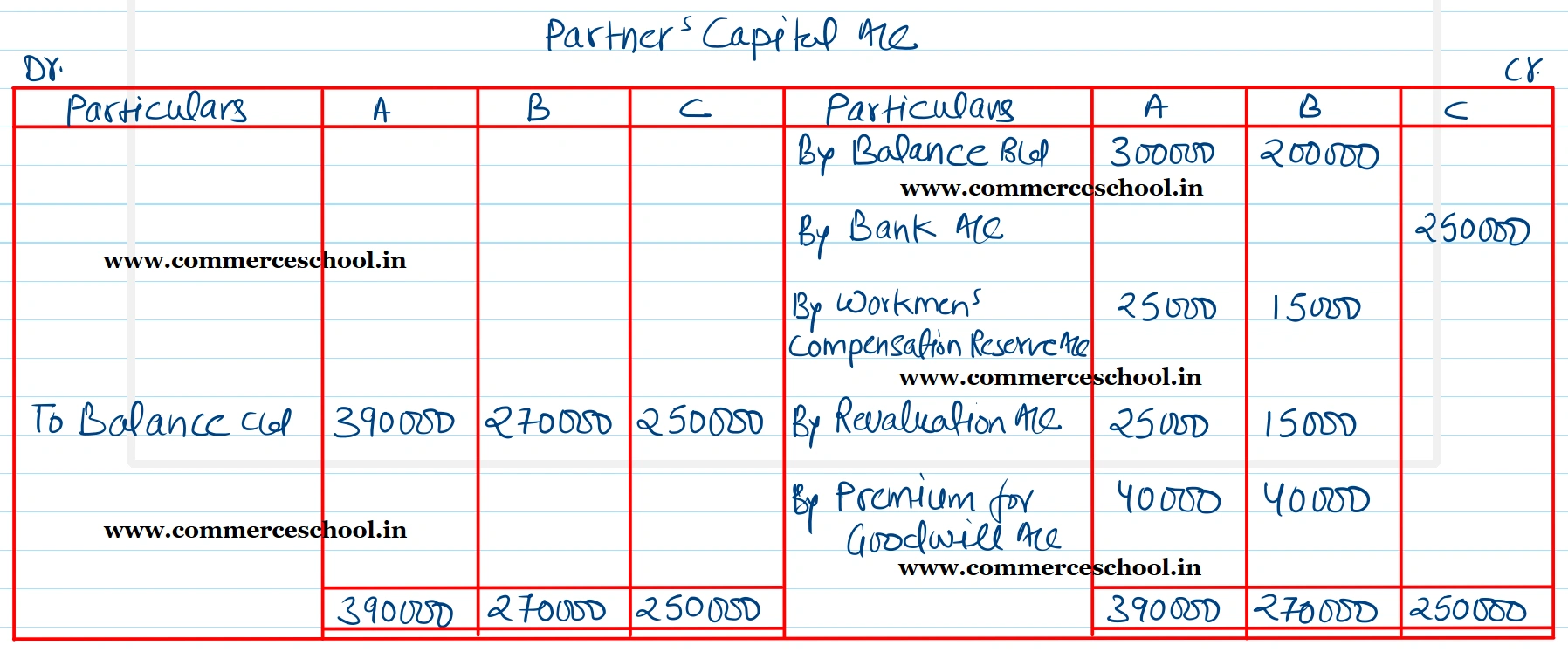

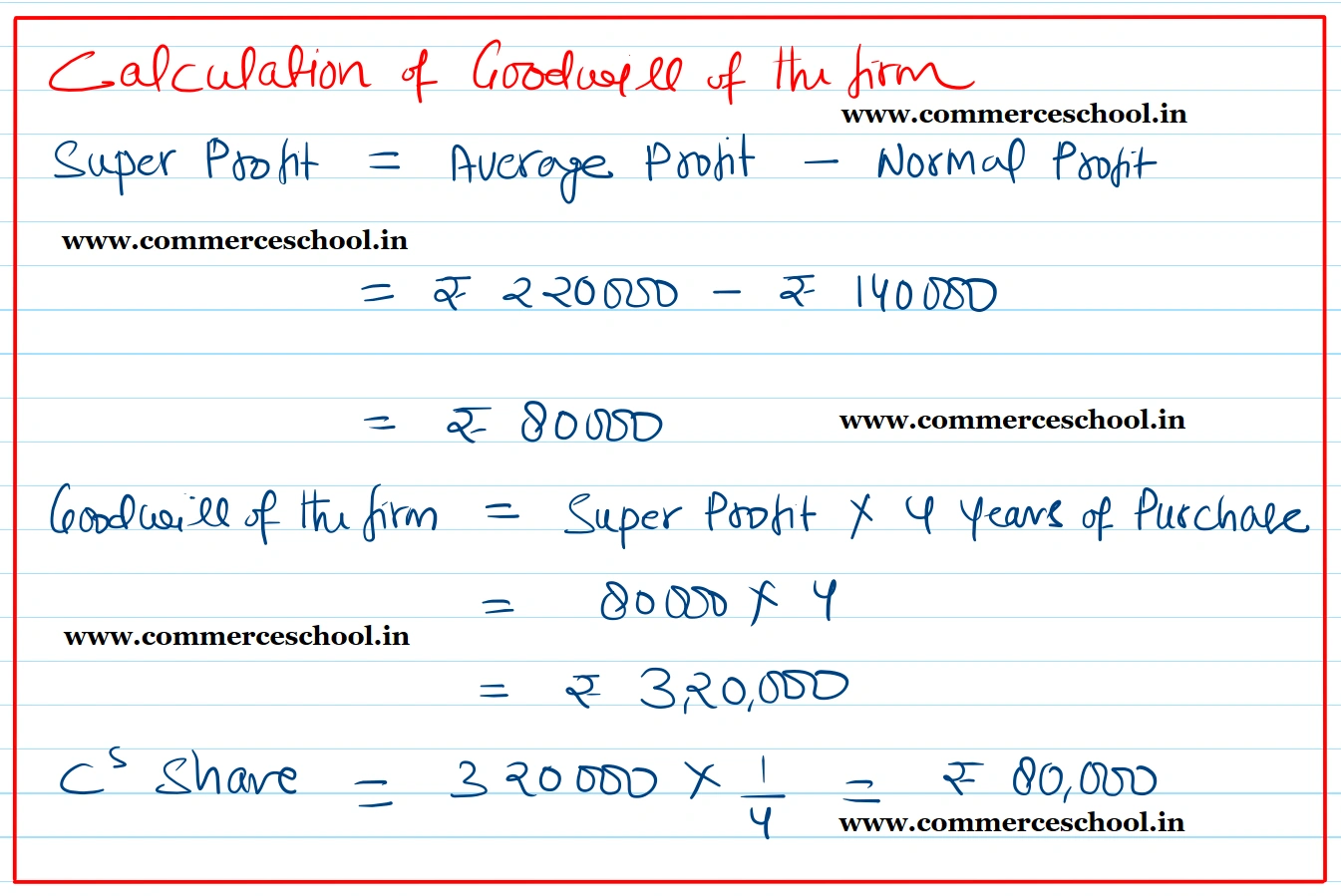

(i) C will bring ₹ 3,30,000 for his share of capital and goodwill.

(ii) Goodwill of the firm has been valued at 4 year’s purchase of the average super profits of last three years. Average profits of the last three years are ₹ 2,20,000 while the normal profits that can be earned with the capital employed are ₹ 1,40,000.

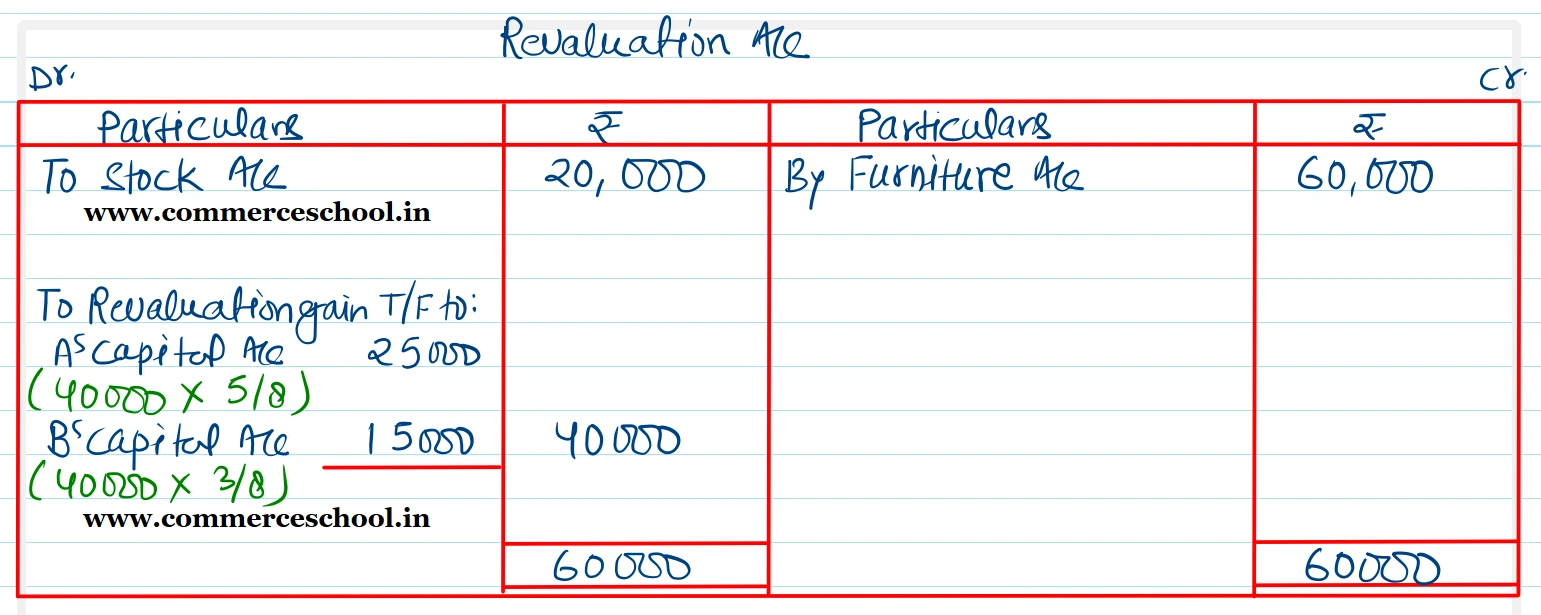

(iii) Furniture is to be appreciated by ₹ 60,000 and the value of stock is to be reduced by ₹ 20,000.

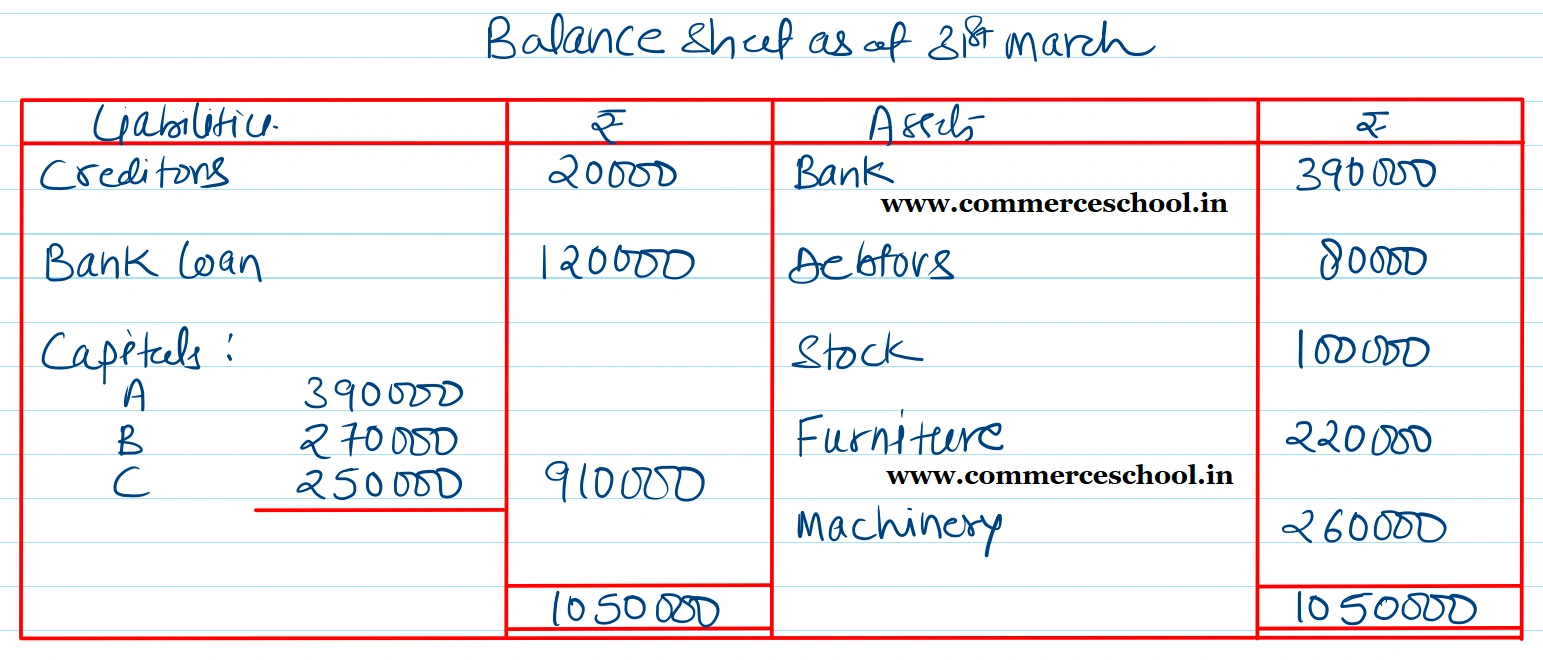

Prepare Revaluation Account, Partner’s Capital Accounts and the new Balance Sheet of A, B and C.

[Ans. Revaluation Gain ₹ 40,000; Partner’s Capital Accounts: A ₹ 3,90,000; B ₹ 2,70,000 and C ₹ 2,50,000; Total of Opening Balance Sheet ₹ 10,50,000.]