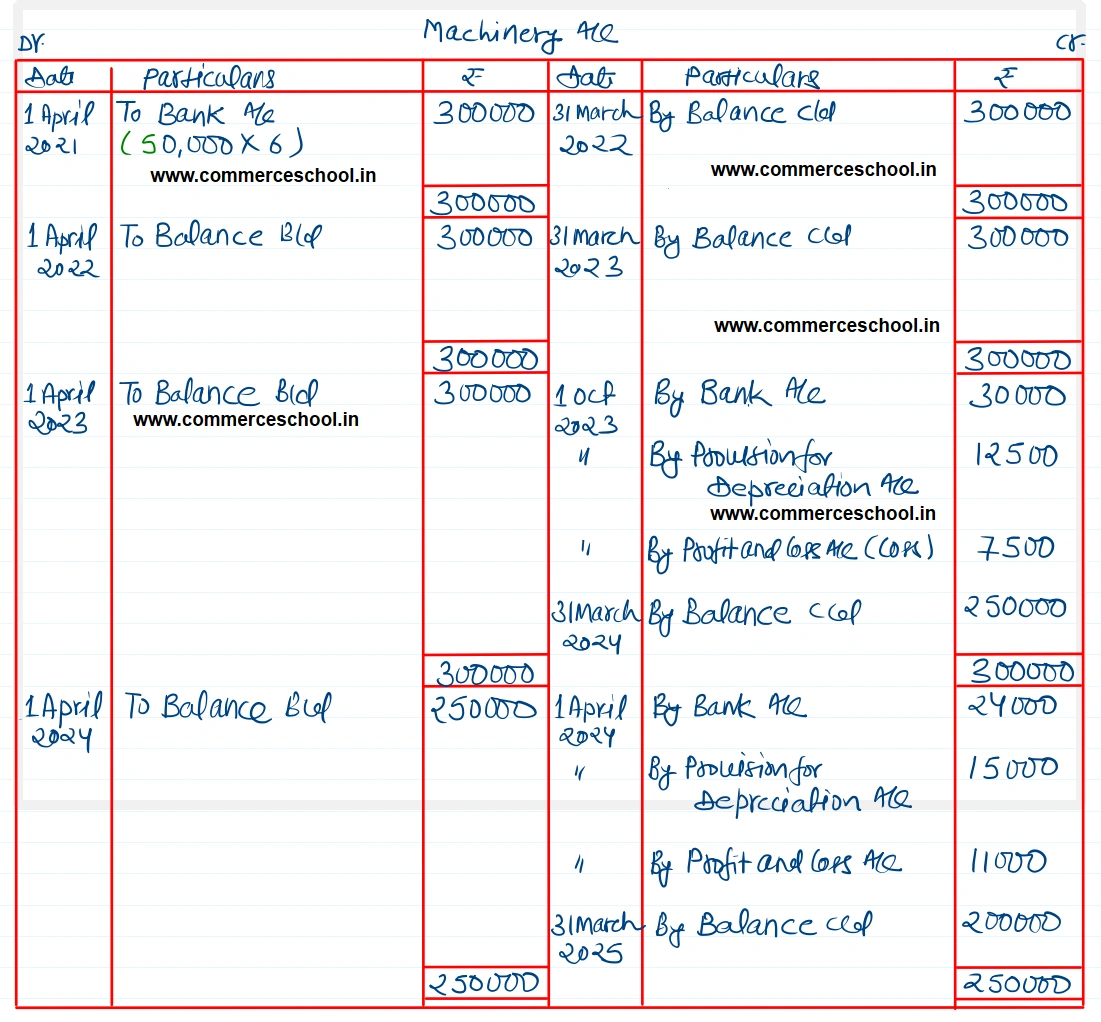

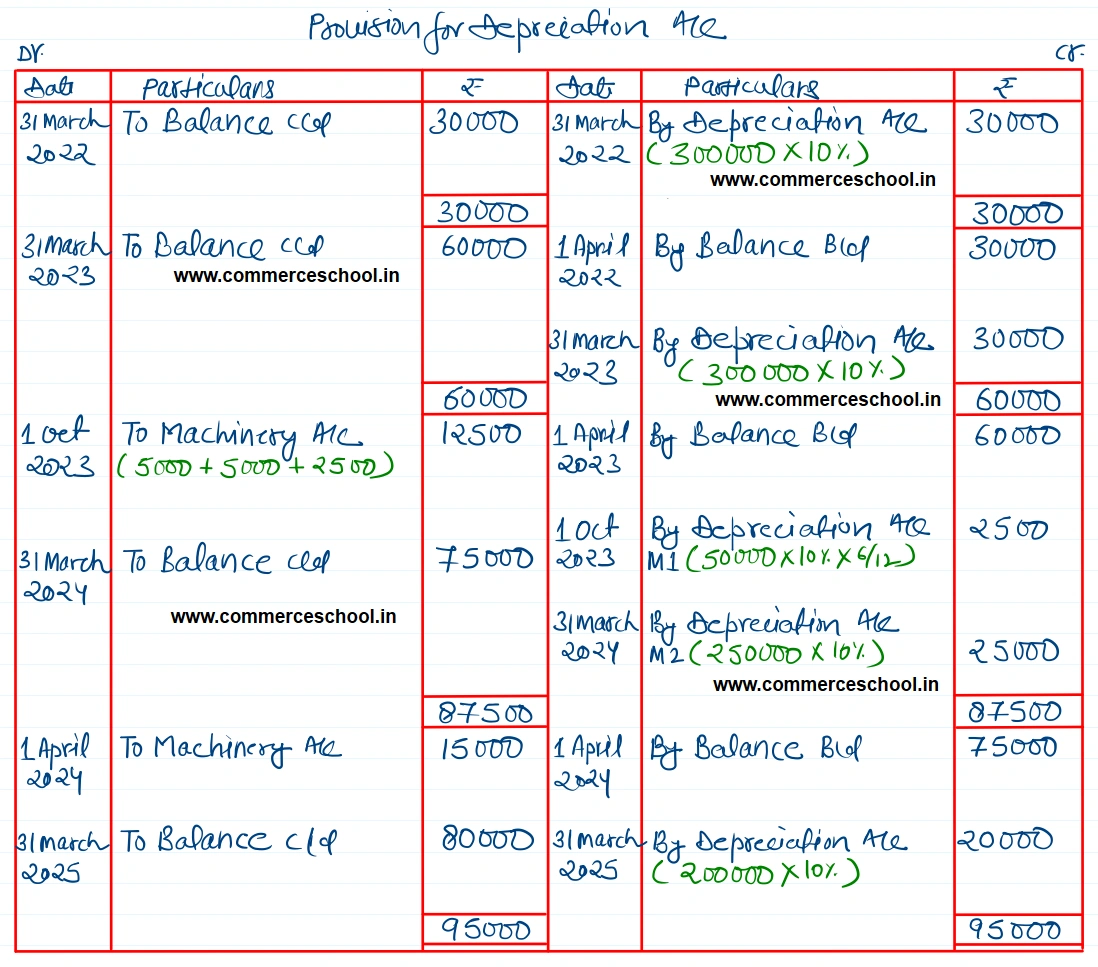

On 1st April, 2021, a Company purchased 6 machines for ₹ 50,000 each. Depreciation at the rate of 10% p.a. is charged on Straight Line Method

On 1st April, 2021, a Company purchased 6 machines for ₹ 50,000 each. Depreciation at the rate of 10% p.a. is charged on Straight Line Method. The accounting year of the Company ends on 31st March and the depreciation is credited to a separate ‘Provision for Depreciation Account’.

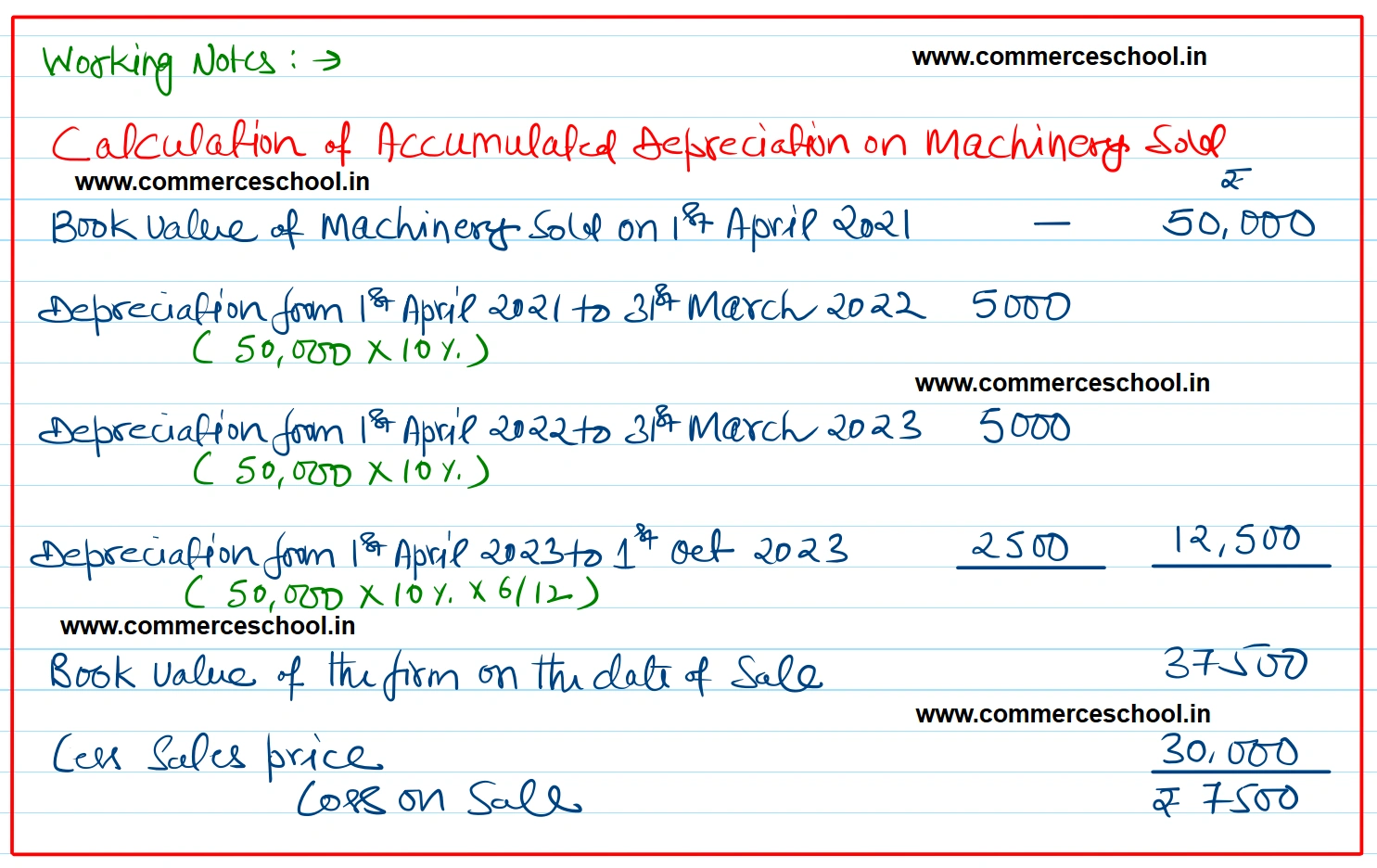

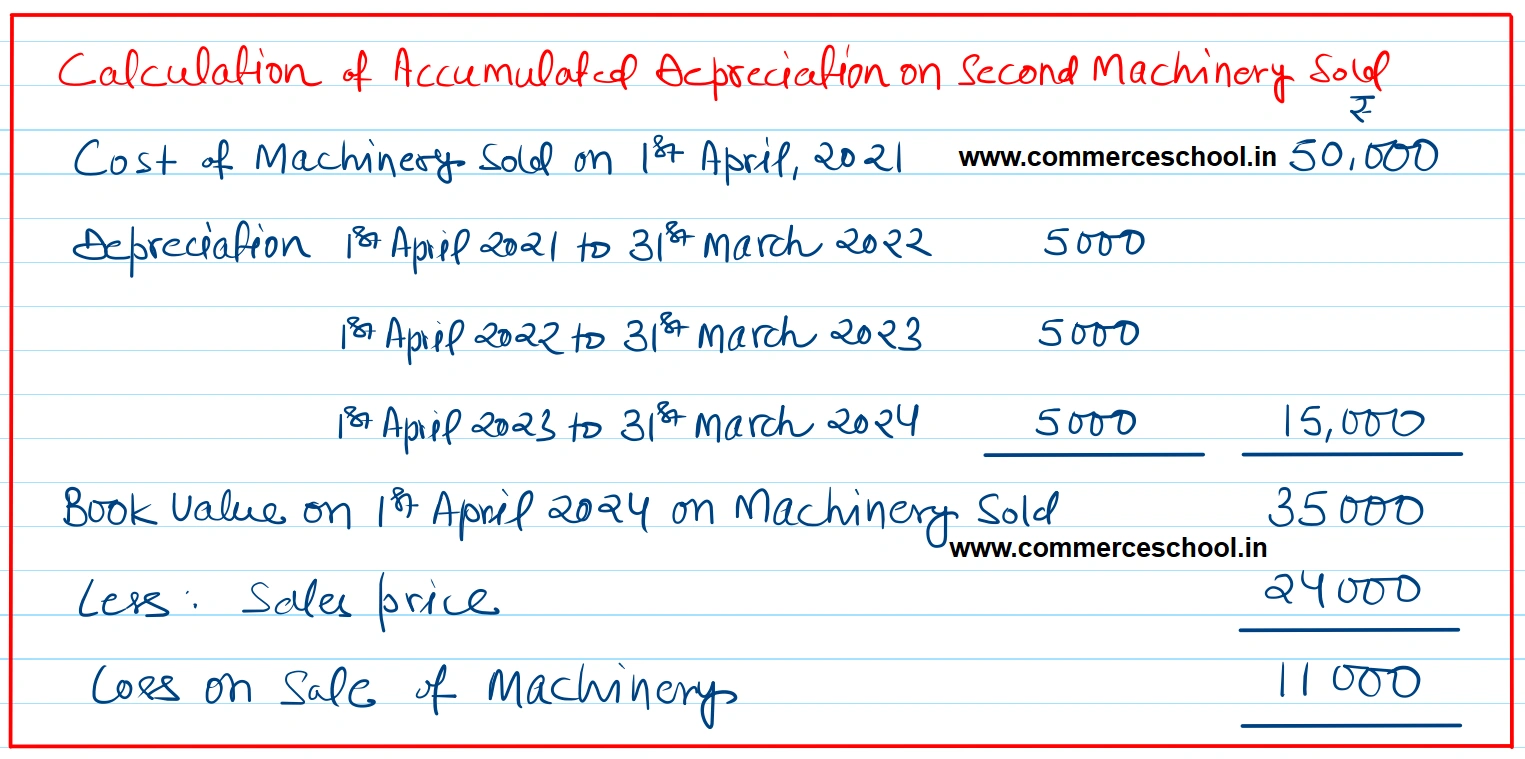

On 1st October, 2023, one machine was sold for ₹ 30,000 and on 1st April, 2024 a second machine was sold for ₹ 24,000.

You are required to prepare Machinery Account and Provision for Depreciation Account for four years ending 31st March, 2025.

[Ans. Balance of Machinery A/c on 31st March, 2025 ₹ 2,00,000; Balance of Provision for Depreciation A/c on 31st March, 2025 ₹ 80,000; Loss on sale of first Machine ₹ 7,500; Loss on sale of second Machine ₹ 11,000.]