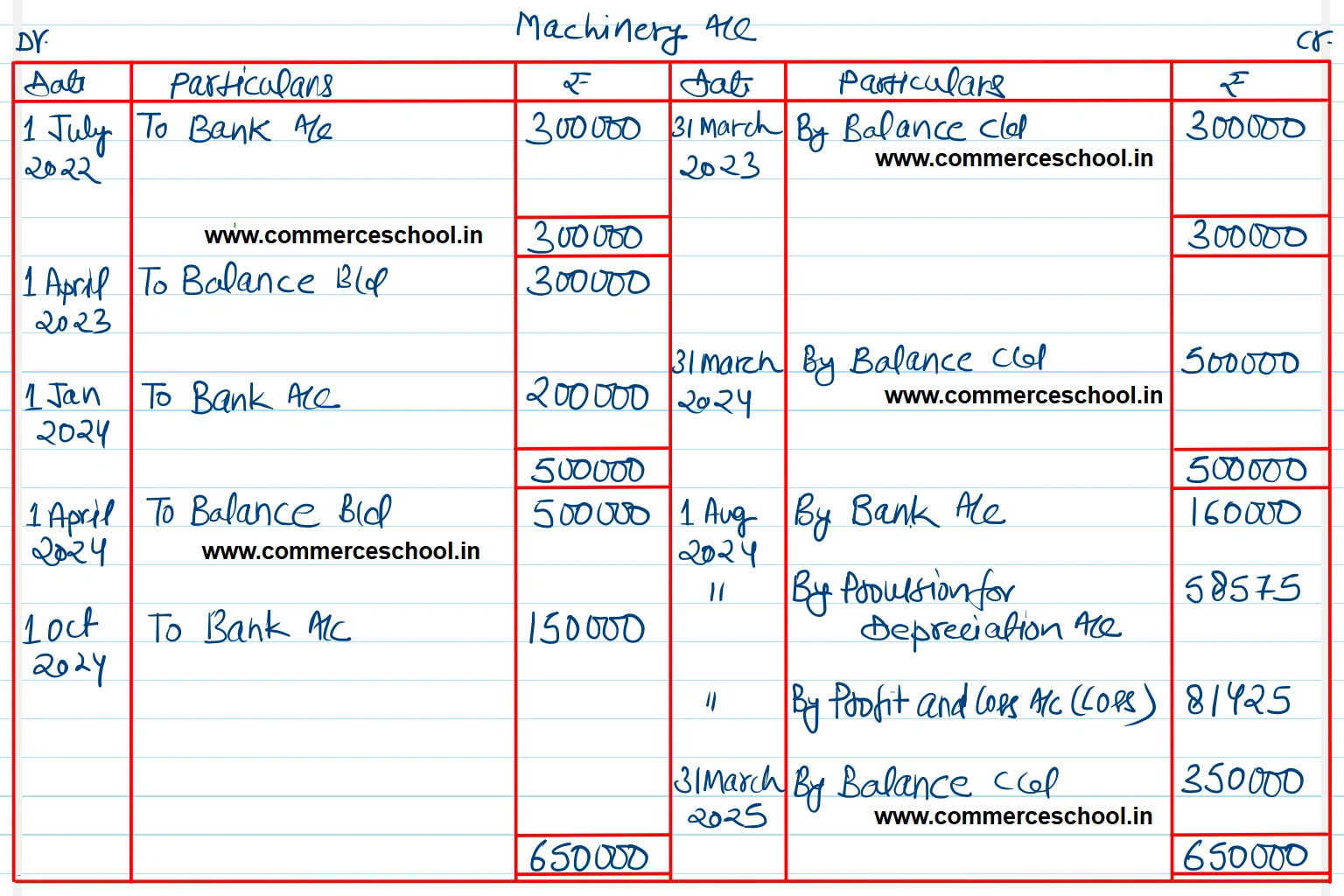

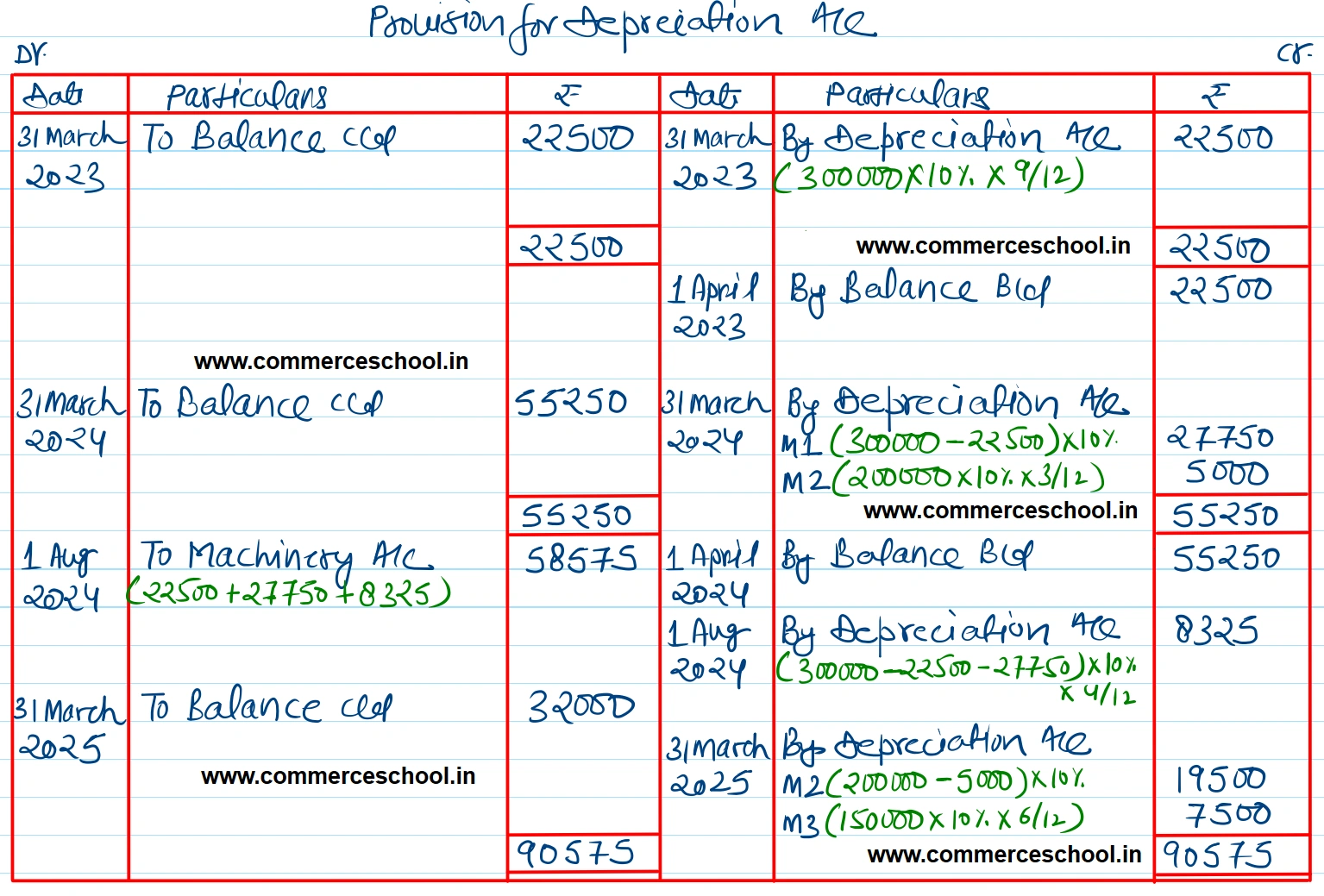

A Limited purchased a machine on 1st July 2022 for ₹ 3,00,000 and on 1st January 2024 bought another machinery for ₹ 2,00,000. On 1st August 2024 machine bought in 2022 was sold for ₹ 1,60,000

A Limited purchased a machine on 1st July 2022 for ₹ 3,00,000 and on 1st January 2024 bought another machinery for ₹ 2,00,000. On 1st August 2024 machine bought in 2022 was sold for ₹ 1,60,000. Another machine was bought for ₹ 1,50,000 on 1st October 2024.

It was decided to provide depreciation @ 10% p.a. on written down value method assuming books are closed on 31st March each year. Prepare Machinery Account and Provision for Depreciation account for 3 years.

[Ans. Balance of Machinery A/c on 31st March 2025 ₹ 3,50,000; Balance of Provision for Depreciation A/c on 31st March 2025 ₹ 32,000; Loss on sale of Machine ₹ 81,425.]

Anurag Pathak Answered question