On 1st July, 2017, X Ltd. purchased a machinery for ₹ 15,00,00. Depreciation is provided @ 20% p.a. on the original cost of the machinery and books are closed on 31st March each year

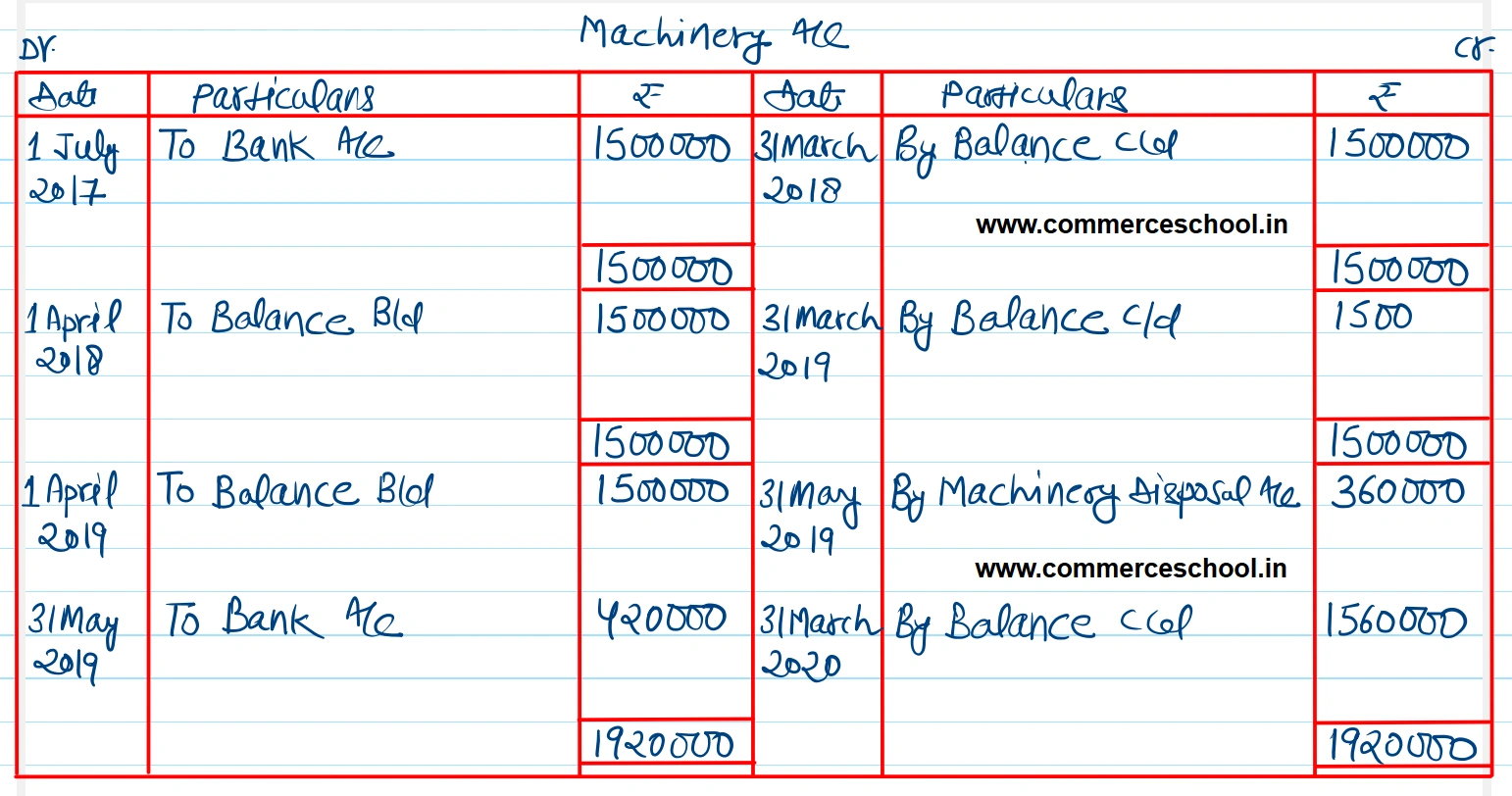

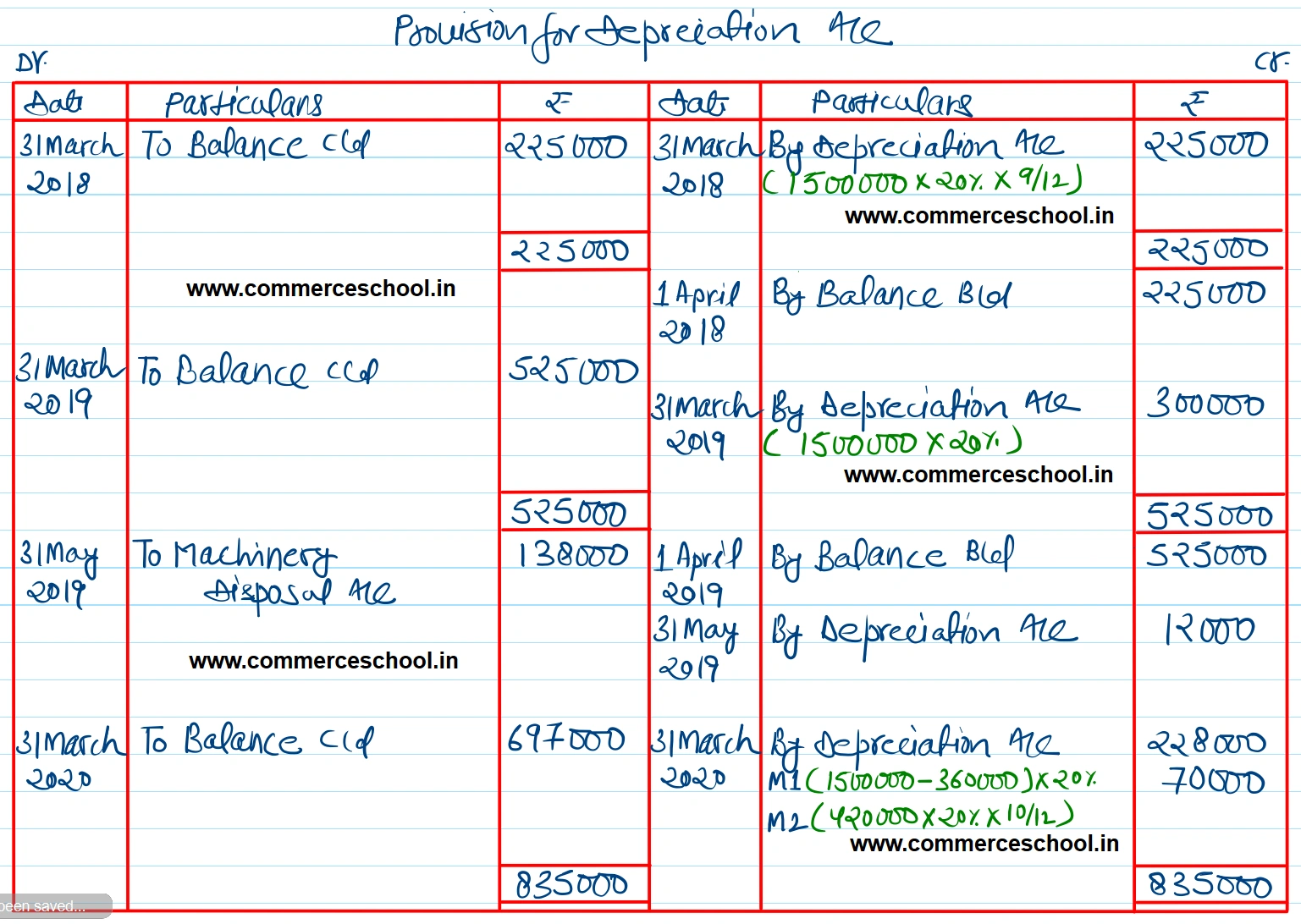

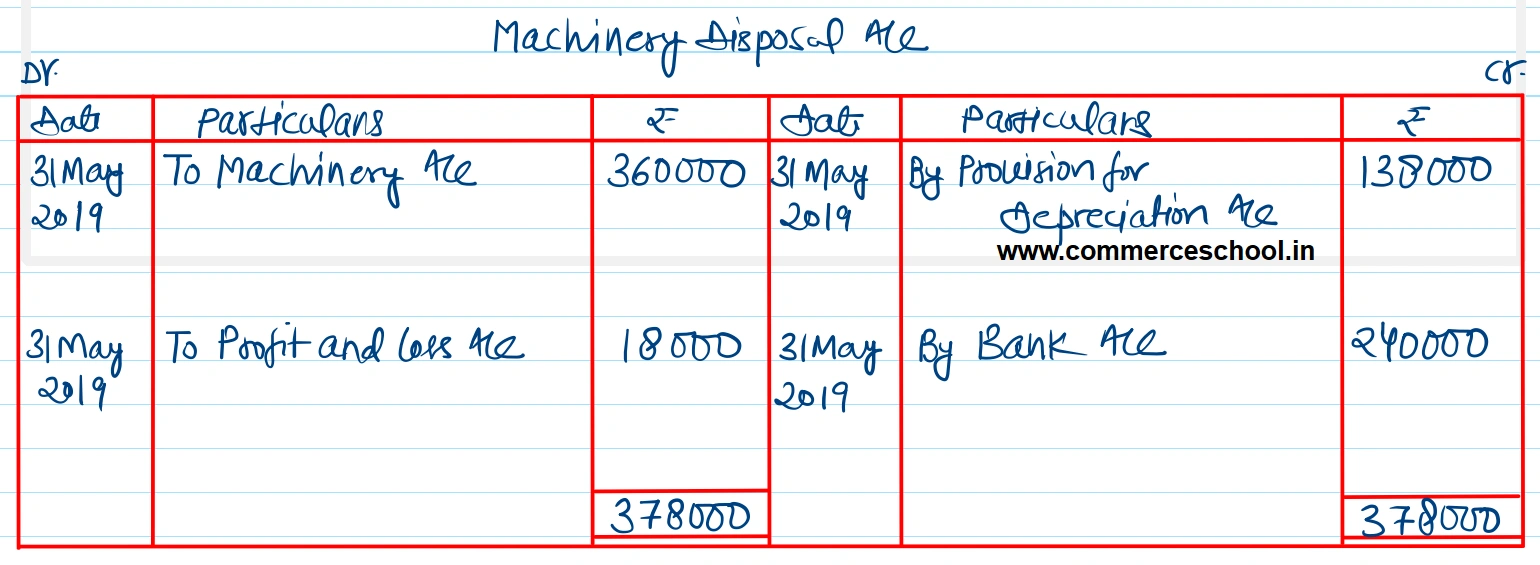

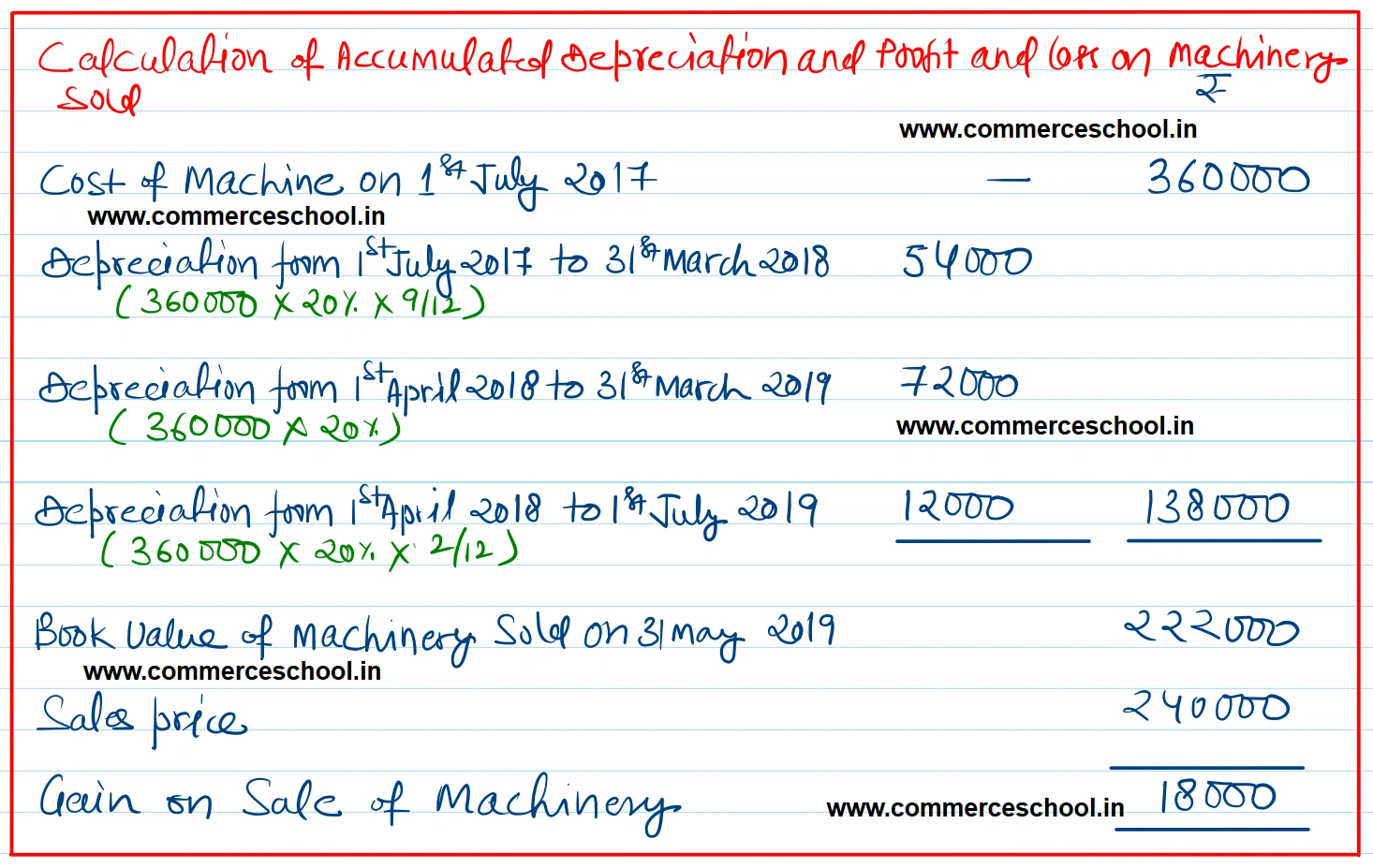

On 1st July, 2017, X Ltd. purchased a machinery for ₹ 15,00,00. Depreciation is provided @ 20% p.a. on the original cost of the machinery and books are closed on 31st March each year. On 31st May, 2019, a part of this machine purchased on 1st July 2017 for ₹ 3,60,000 was sold for ₹ 2,40,000 and on the same date new machinery was purchased for ₹ 4,20,000. You are required to prepare (a) Machinery Account, (b) Provision for Depreciation Account, and (c) Machinery Disposal Account.

[Ans. Balance of Machinery A/c on 31st March, 2020 ₹ 15,60,000; Balance of Provision for Dep. A/c on 31st March, 2020 ₹ 6,97,000; Gain on sale of Machinery ₹ 18,000.]

Anurag Pathak Answered question