From the following Trial Balance of Rahim prepare Trading and Profit & Loss Account for the year ended 31st March, 2025 and Balance Sheet as at that date:-

From the following Trial Balance of Rahim prepare Trading and Profit & Loss Account for the year ended 31st March, 2025 and Balance Sheet as at that date:-

Adjustments:-

1. Stock at 31st March, 2025 is ₹ 60,000.

2. Write off 5% Depreciation on freehold premises and 20% on office furniture.

3. Commission earned but not received ₹ 1,000.

4. Interest earned ₹ 1,500.

5. ₹400 for rent has been received in advance.

6. Charge interest on Capital @ 6% and ₹ 1,200 on Drawings.

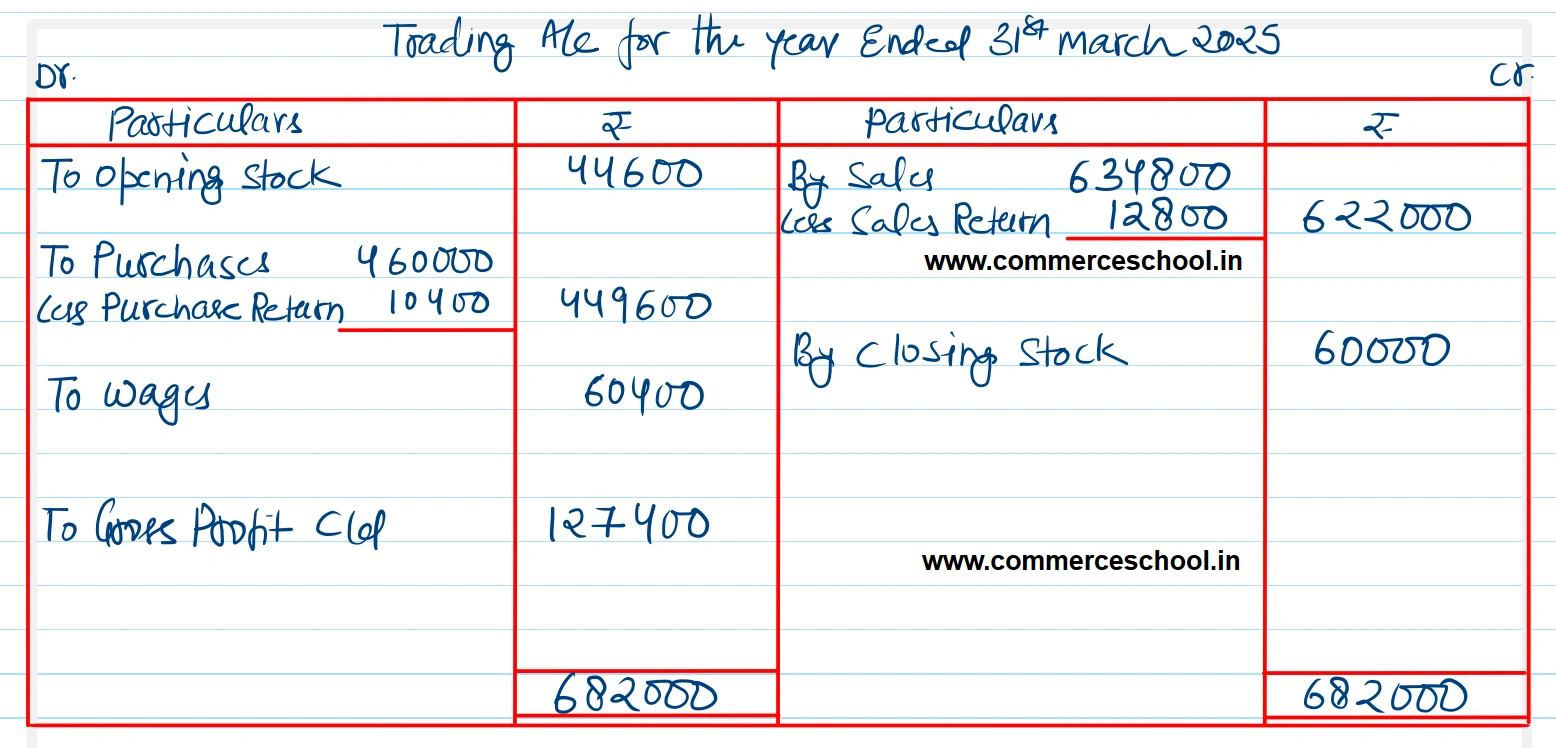

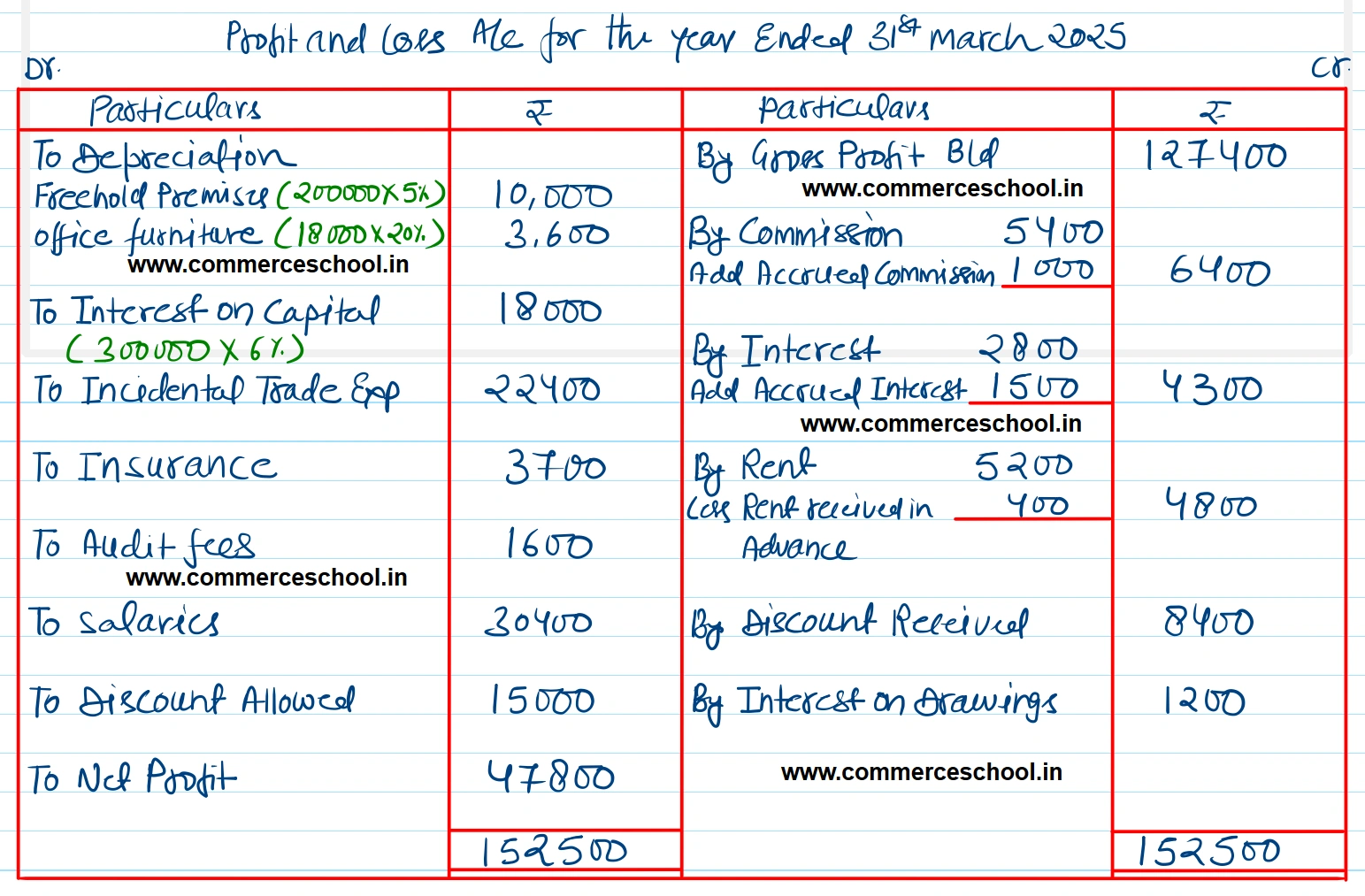

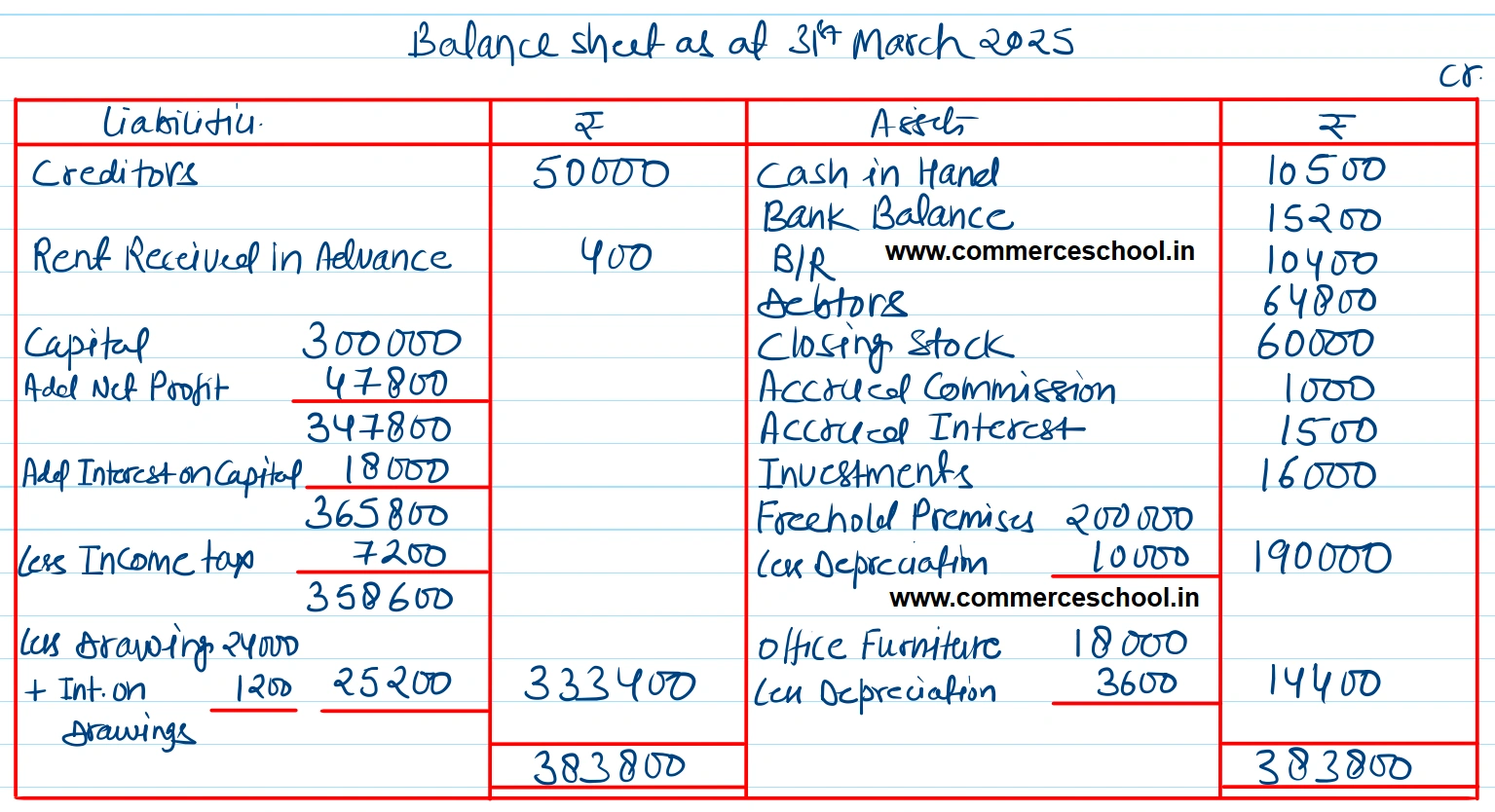

[Ans. G.P. ₹ 1,27,400; N.P. ₹ 47,800; Balance Sheet Total ₹ 3,83,800.]

| Particulars | Dr. (₹) | Cr. (₹) |

| Stock 1st April, 2024 | 44,600 | |

| Purchases and Purchases Return | 4,60,000 | 10,400 |

| Freehold Premises | 2,00,000 | |

| Incidental Trade Exp. | 22,400 | |

| Insurance | 3,700 | |

| Audit Fees | 1,600 | |

| Commission Received | 5,400 | |

| Interest | 2,800 | |

| Debtors and Creditors | 64,800 | 50,000 |

| Wages | 60,400 | |

| Salaries | 30,400 | |

| Capital | 3,00,000 | |

| Drawings | 24,000 | |

| Income-Tax | 7,200 | |

| Investments | 16,000 | |

| Discount allowed & Received | 15,000 | |

| Sales Return & Sales | 12,800 | |

| B/R | 10,400 | |

| Office Furniture | 18,000 | |

| Rent | 5,200 | |

| Cash in Hand | 10,500 | |

| Bank Balance | 15,200 | |

| 10,17,000 | 10,17,000 |

Anurag Pathak Answered question

Solution:-

Hint:- Income Tax is the ‘personal expenses’ of the Proprietor, as such it will be treated as Drawings.

Anurag Pathak Changed status to publish