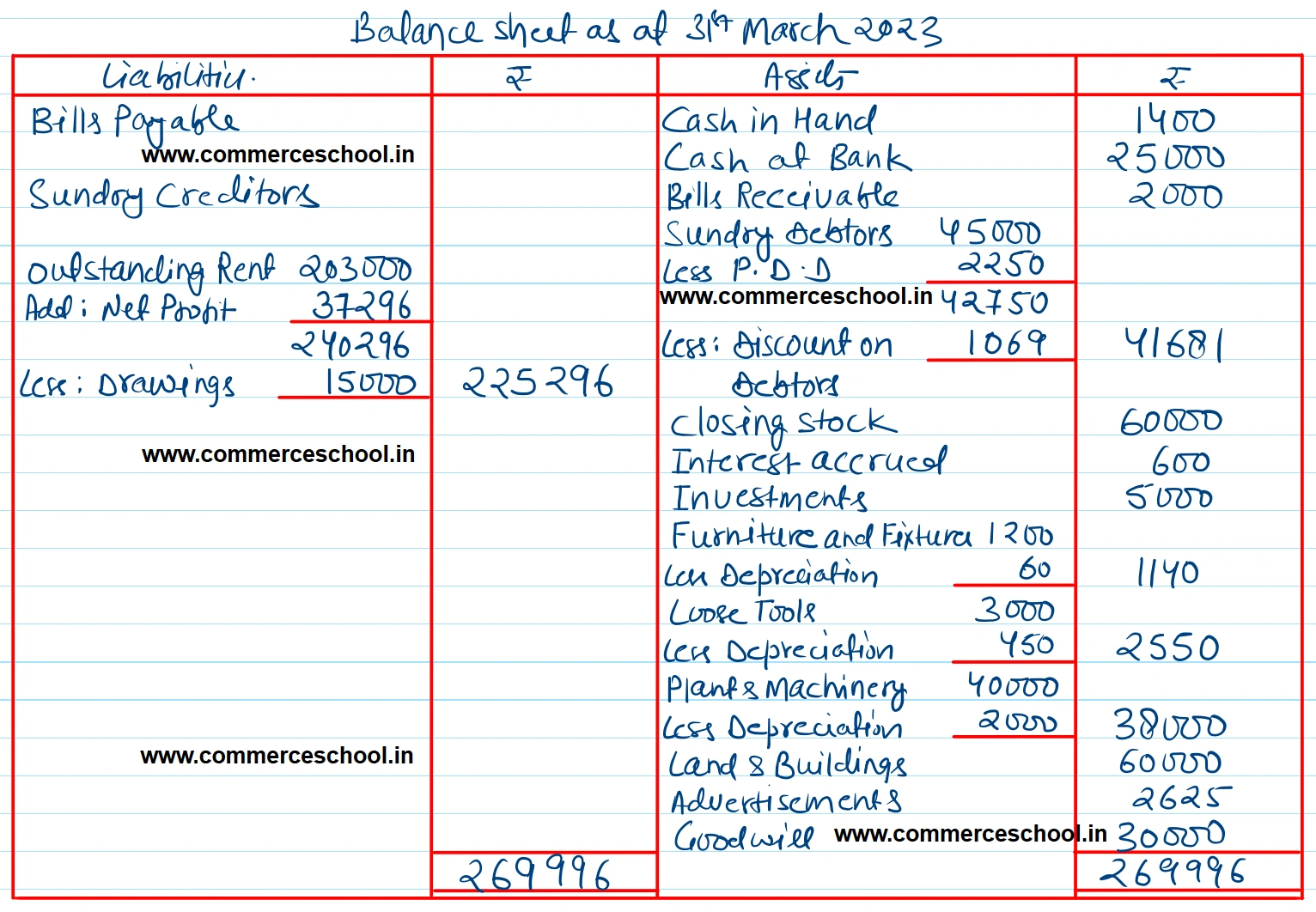

Following is the Trial Balance of Mr. Gautam as at 31st March, 2023: Goodwill ₹ 30,000 Land & Buildings ₹ 60,000

Following is the Trial Balance of Mr. Gautam as at 31st March, 2023:

You are required to prepare Final Accounts after taking into account the following adjustments:

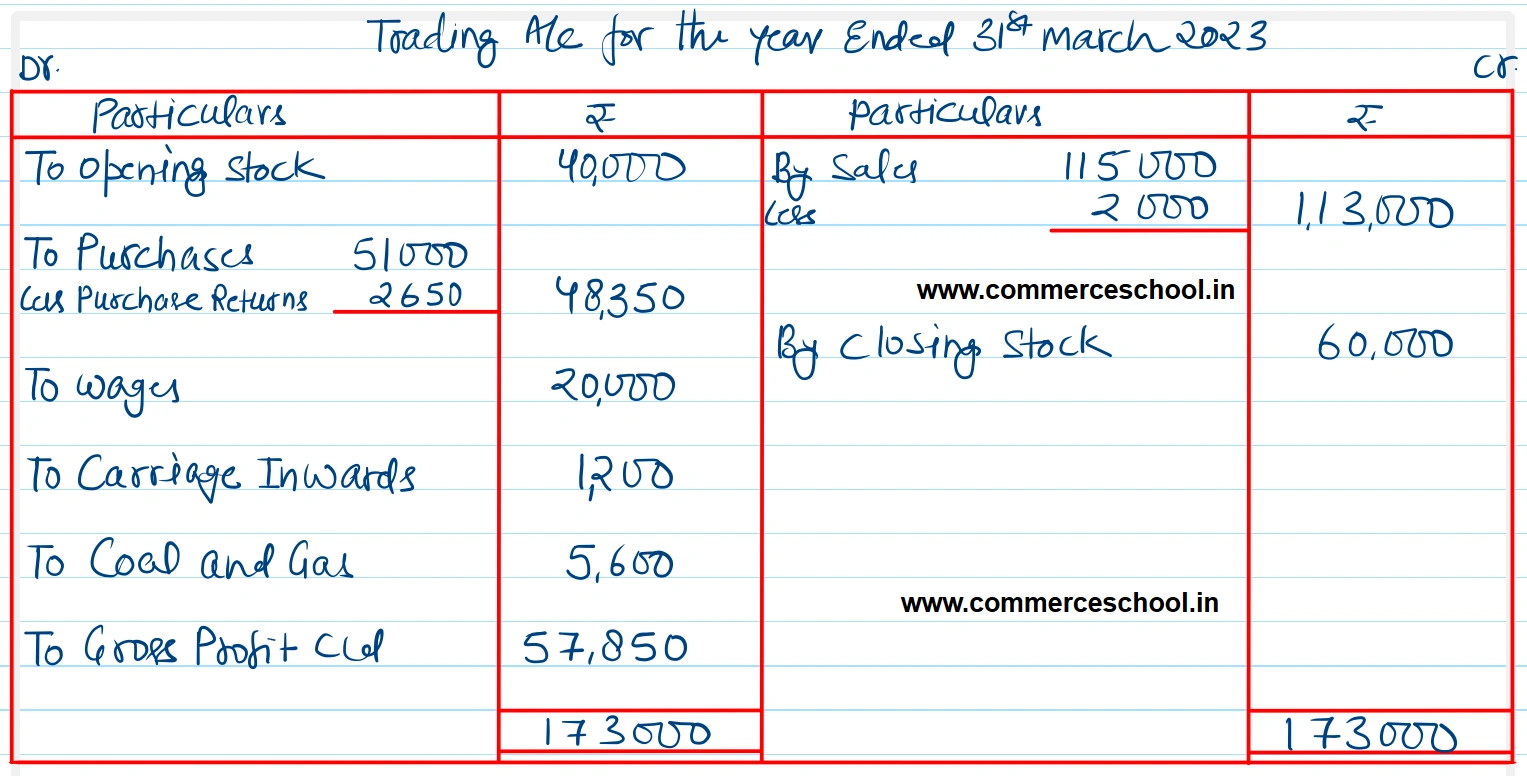

(a) Closing Stock on 31st March, 2023 was ₹ 60,000.

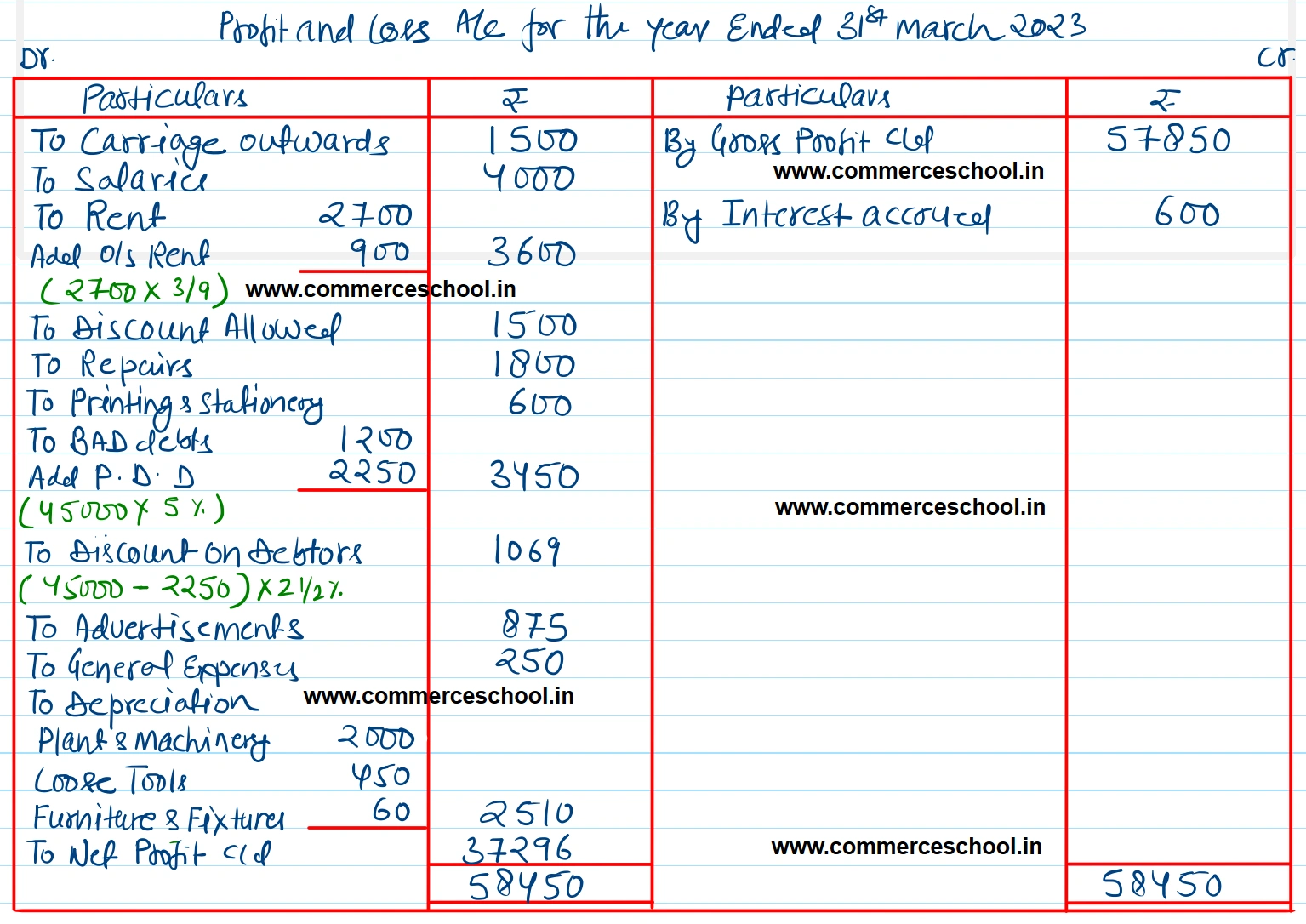

(b) Depreciate Plant and Machinery at 5%, Loose Tools at 15% and Furniture and fixtures at 5%.

(c) Provide 21/2% for discount on Sundry Debtors and also provide 5% for Bad and Doubtful Debts on Sundry Debtors.

(d) Only three quarter’s rent has been paid, the last quarter’s rent being outstanding.

(e) Interest earned but not received ₹ 600.

(f) Write off 1/4th of Advertisement expenses.

[Ans. Gross Profit ₹ 57,850; Net P

| Particulars | ₹ | Particulars | ₹ |

| Goodwill | 30,000 | Purchase Returns | 2,650 |

| Land & Buildings | 60,000 | Capital A/c | 2,03,000 |

| Plant & Machinery | 40,000 | Bills Payable | 13,800 |

| Loose Tools | 3,000 | Sundry Creditors | 30,000 |

| Bills Receivable | 2,000 | Sales | 1,15,000 |

| Opening Stock | 40,000 | ||

| Purchases | 51,000 | ||

| Wages | 20,000 | ||

| Carriage Inwards | 1,200 | ||

| Coal & Gas | 5,600 | ||

| Salaries | 4,000 | ||

| Rent | 2,700 | ||

| Discount allowed | 1,500 | ||

| Cash at Bank | 25,000 | ||

| Cash in Hand | 1,400 | ||

| Sundry Debtors | 45,000 | ||

| Repairs | 1,800 | ||

| Printing & Stationery | 600 | ||

| Bad-debts | 1,200 | ||

| Advertisements | 3,500 | ||

| Furniture and Fixtures | 1,200 | ||

| General Expenses | 250 | ||

| Investments | 5,000 | ||

| Drawings | 15,000 | ||

| Carriage Outwards | 1,500 | ||

| Sales Returns | 2,000 | ||

| 3,64,450 | 3,64,450 |

Anurag Pathak Answered question

Solution:-

Hints:

(1) Rent shown in the Trial Balance is for 3 quarters or for 9 months. As such Rent Outstanding for the remaining 3 months will be 2,700/9 x 3 = ₹ 900.

(2) First, provision for Doubtful Debts will be created on debtors and then provision for discount will be calculated on debtors remaining after deducting the provision for Doubtful Debts.

Anurag Pathak Changed status to publish