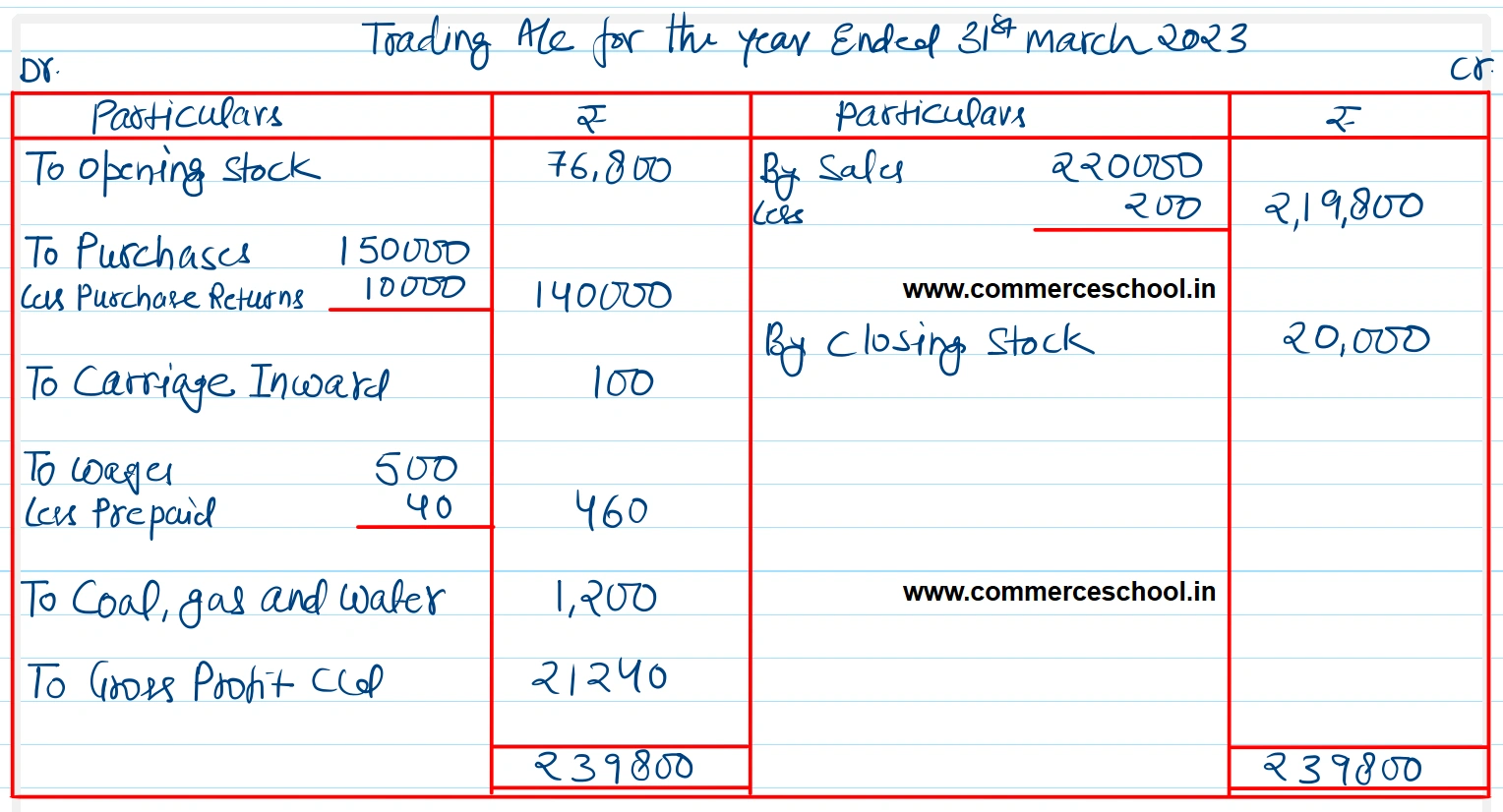

From the following Trial Balance, extracted from the books of Raga Ltd., prepare a Trading and Profit and Loss Account for the year ended 31st March, 2023 and a Balance Sheet as at that date:

From the following Trial Balance, extracted from the books of Raga Ltd., prepare a Trading and Profit and Loss Account for the year ended 31st March, 2023 and a Balance Sheet as at that date:

| Debit balances | ₹ | Credit balances | ₹ |

| Drawings Account | 20,000 | Sales | 2,20,000 |

| Land & Buildings | 12,000 | Capital | 1,01,110 |

| Plant and Machinery | 40,000 | Discount | 1,260 |

| Carriage Inward | 100 | Commission | 5,230 |

| Wages | 500 | Bills Payable | 1,28,870 |

| Salary | 2,000 | Purchase Return | 10,000 |

| Sales Return | 200 | ||

| Bank Charges | 200 | ||

| Coal, Gas and Water | 1,200 | ||

| Purchases | 1,50,000 | ||

| Trade Expenses | 3,800 | ||

| Stock (Opening) | 76,800 | ||

| Cash at Bank | 50,000 | ||

| Rates and Taxes | 870 | ||

| Bills Receivable | 24,500 | ||

| Sundry Debtors | 54,300 | ||

| Cash in Hand | 30,000 | ||

| 4,66,470 | 4,66,470 |

The additional informations are as under:

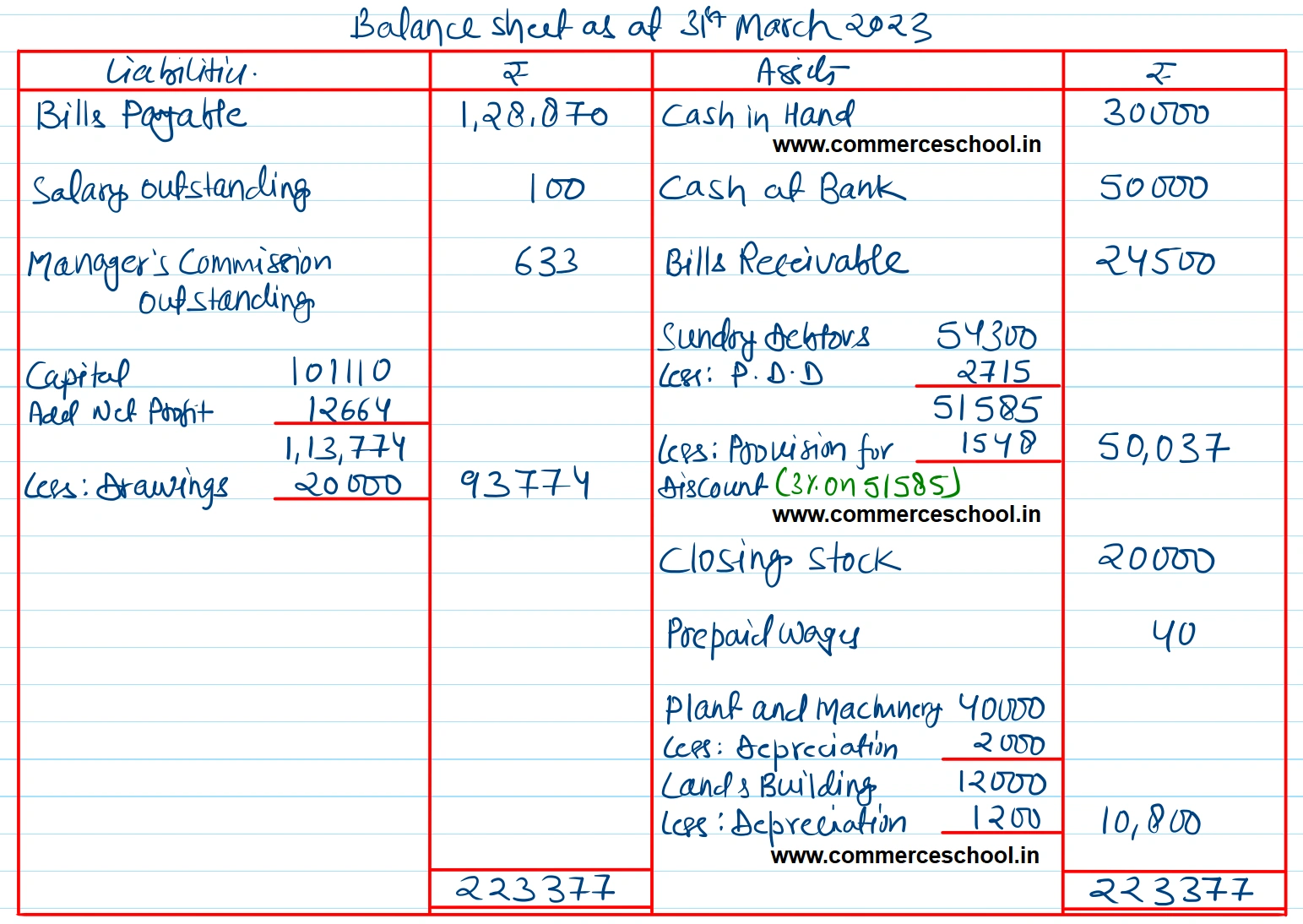

(i) Closing Stock was valued at the end of the year at ₹ 20,000.

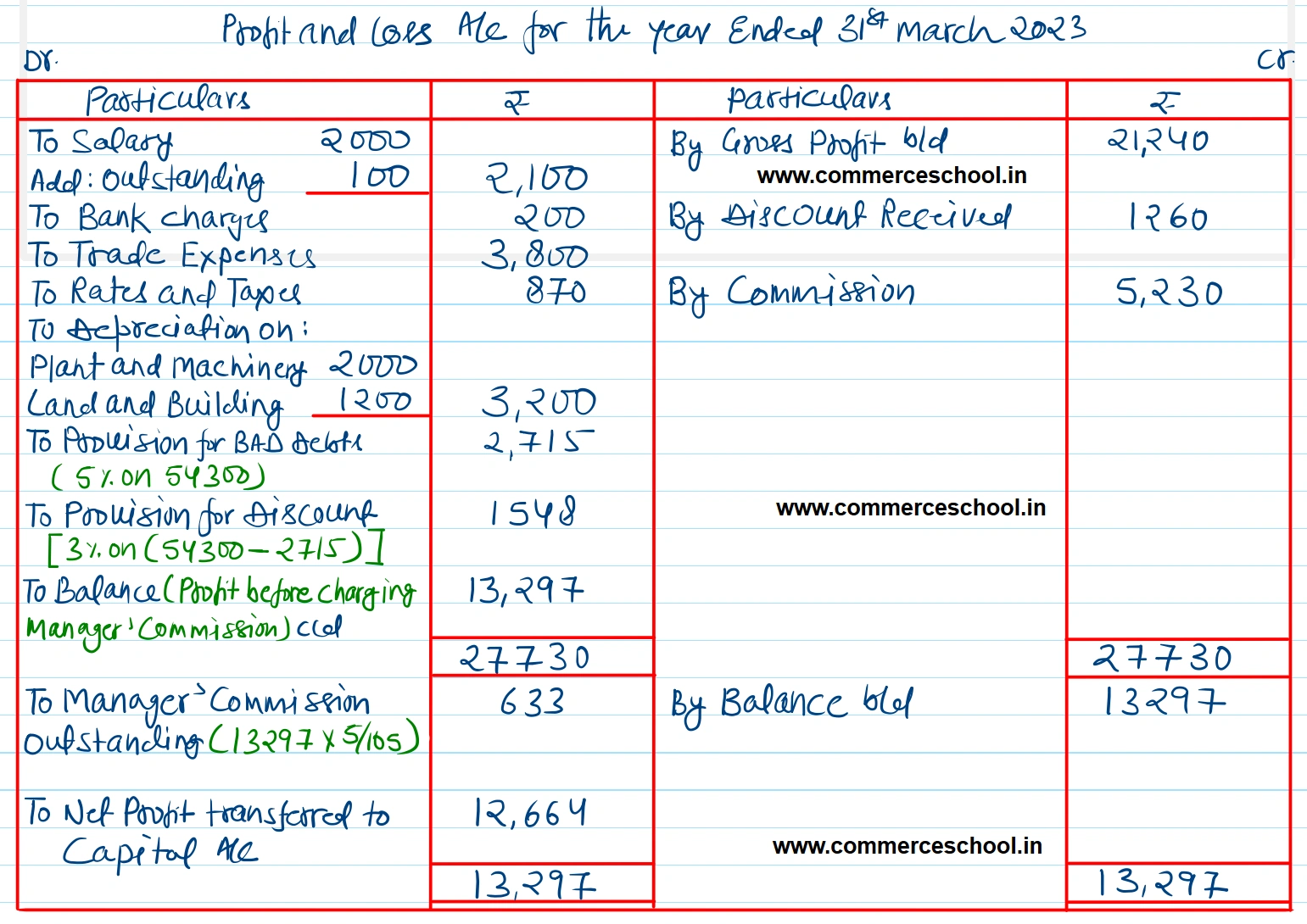

(ii) Depreciation on Plant and Machinery charged at 5% and on Land and Building at 10%.

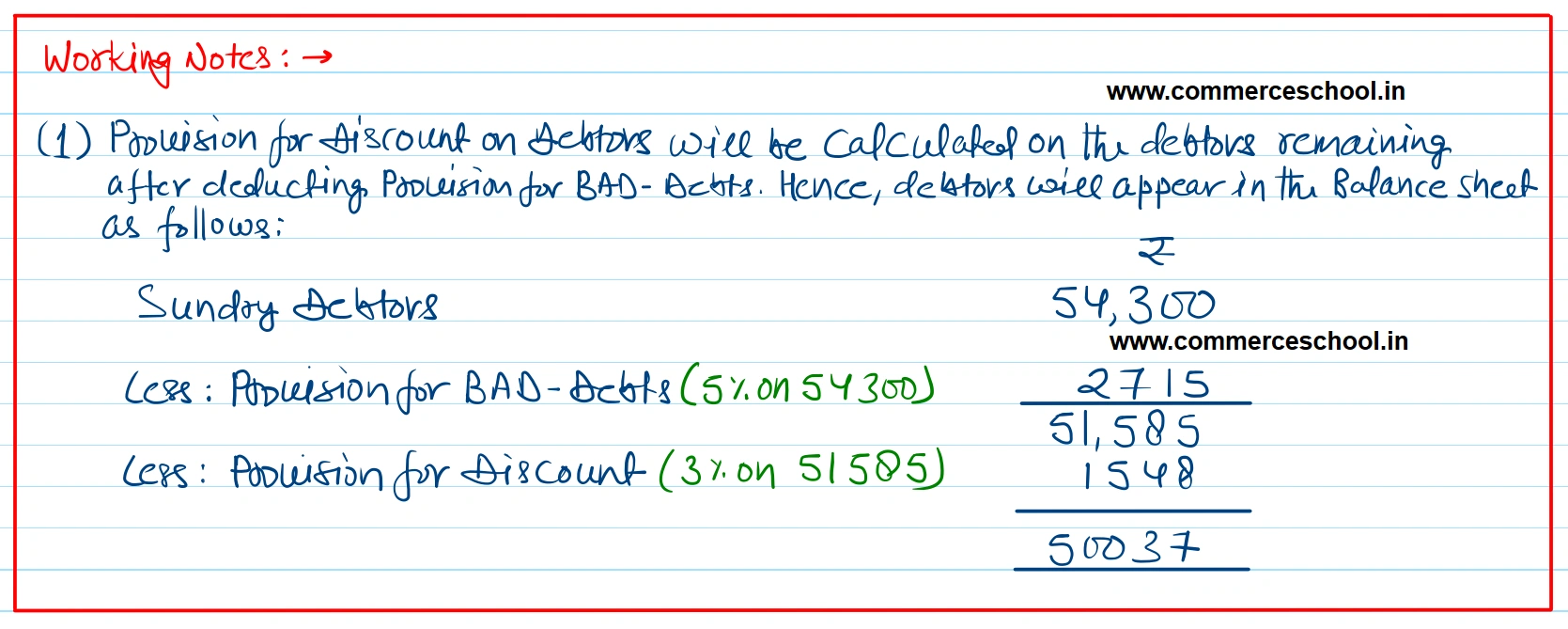

(iii) Make a provision for discount on debtors at 3%.

(iv) Make a provision at 5% on debtors for Bad-debts.

(v) Salary outstanding was ₹ 100 and Wages prepaid were ₹ 40.

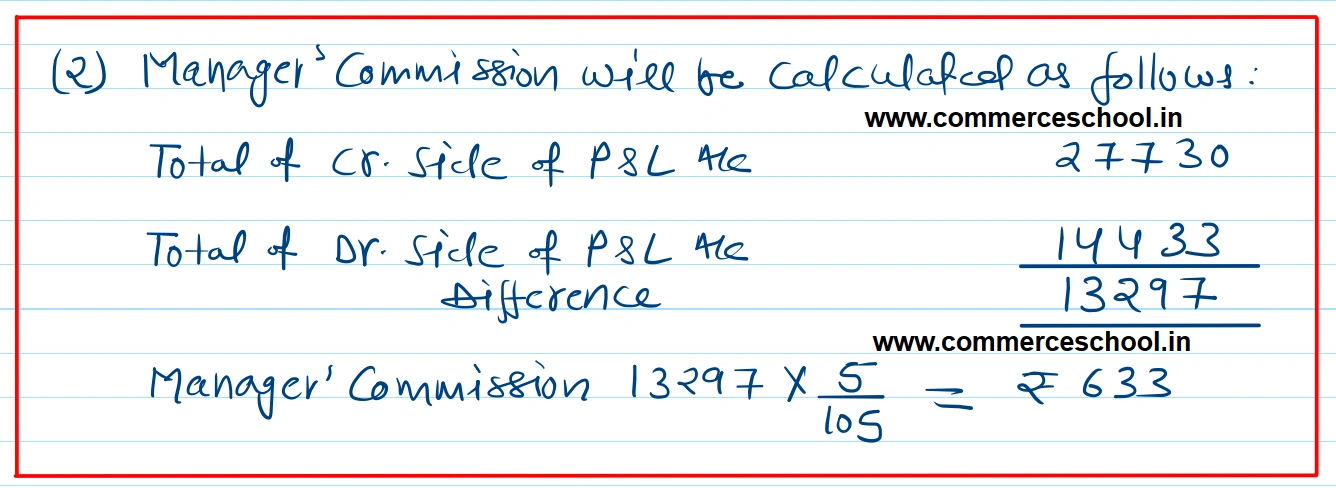

(vi) The manager is entitled to a Commission of 5% on Net Profit after charging such Commission.

[Ans. Gross Profit ₹ 21,240; Net Profit ₹ 12,664; Balance Sheet Total ₹ 2,23,377.]