Following is the Trial Balance as on 31st March 2016. Prepare Trading and Profit and Loss Account and Balance Sheet: Stock (1st April 2015) ₹ 8,000 Sales ₹ 2,20,000

Following is the Trial Balance as on 31st March 2016. Prepare Trading and Profit and Loss Account and Balance Sheet:

Additional Information:

(a) Stock on 31st March 2016 is ₹ 20,600.

(b) Depreciate machinery @ 10% p.a.

(c) Make a Provision @ 5% for Doubtful Debts.

(d) Provide 21/2% for discount on sundry debtors

(e) Rent and Rates include security deposit of ₹ 400.

(f) Insurance prepaid ₹ 120.

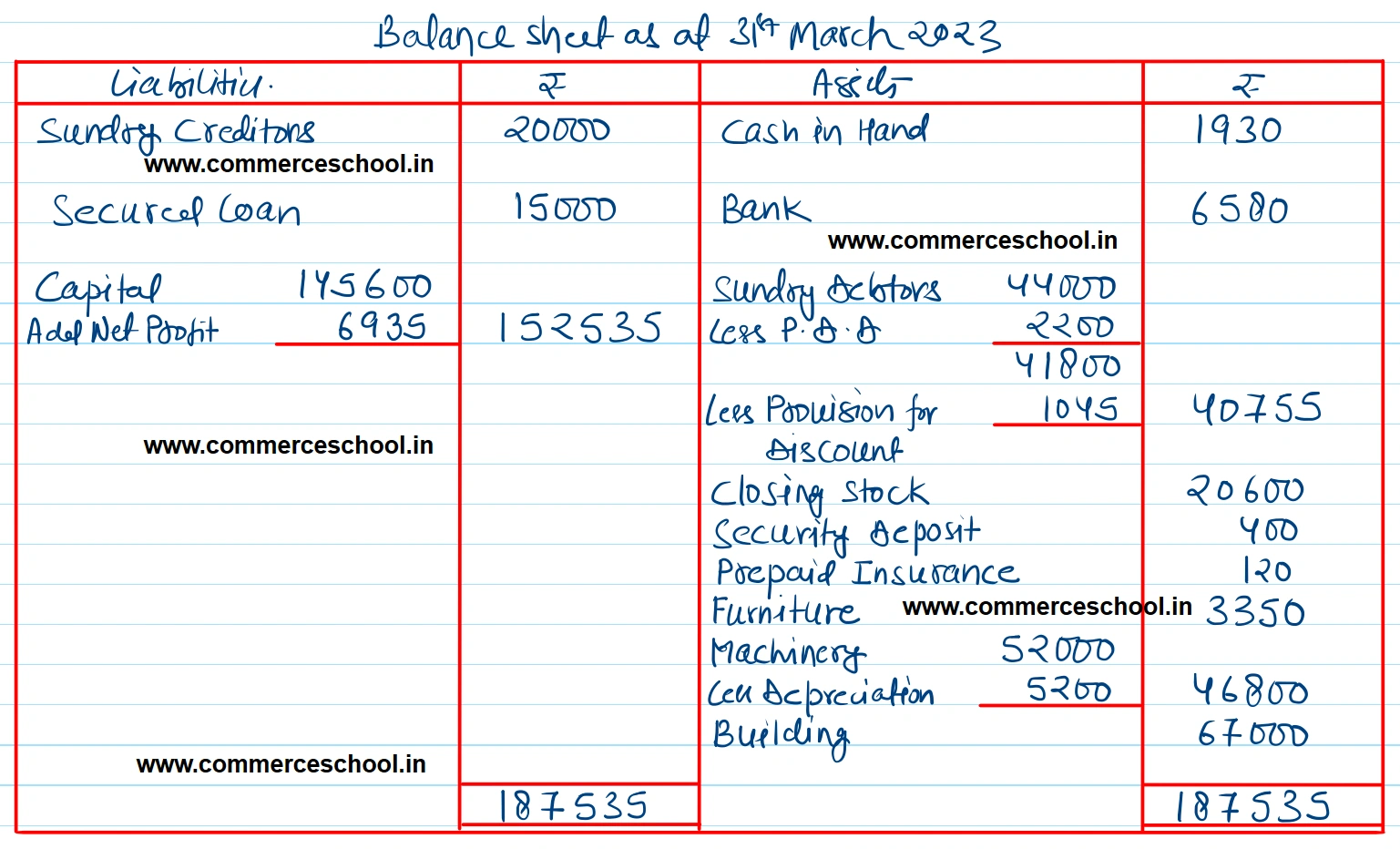

[Ans. Gross Profit ₹ 41,000; Net Profit ₹ 6,935; Balance Sheet Total ₹ 1,87,535.]

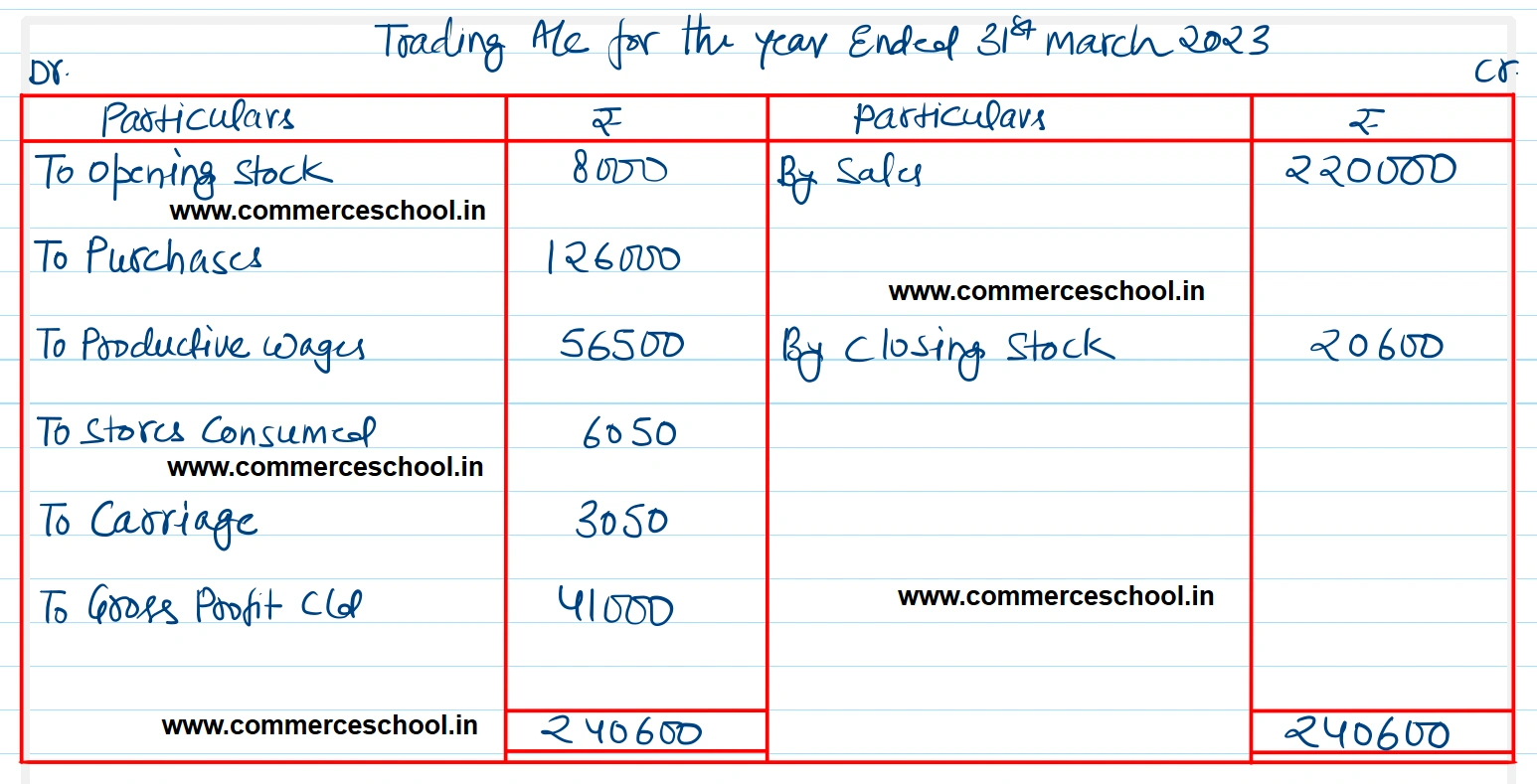

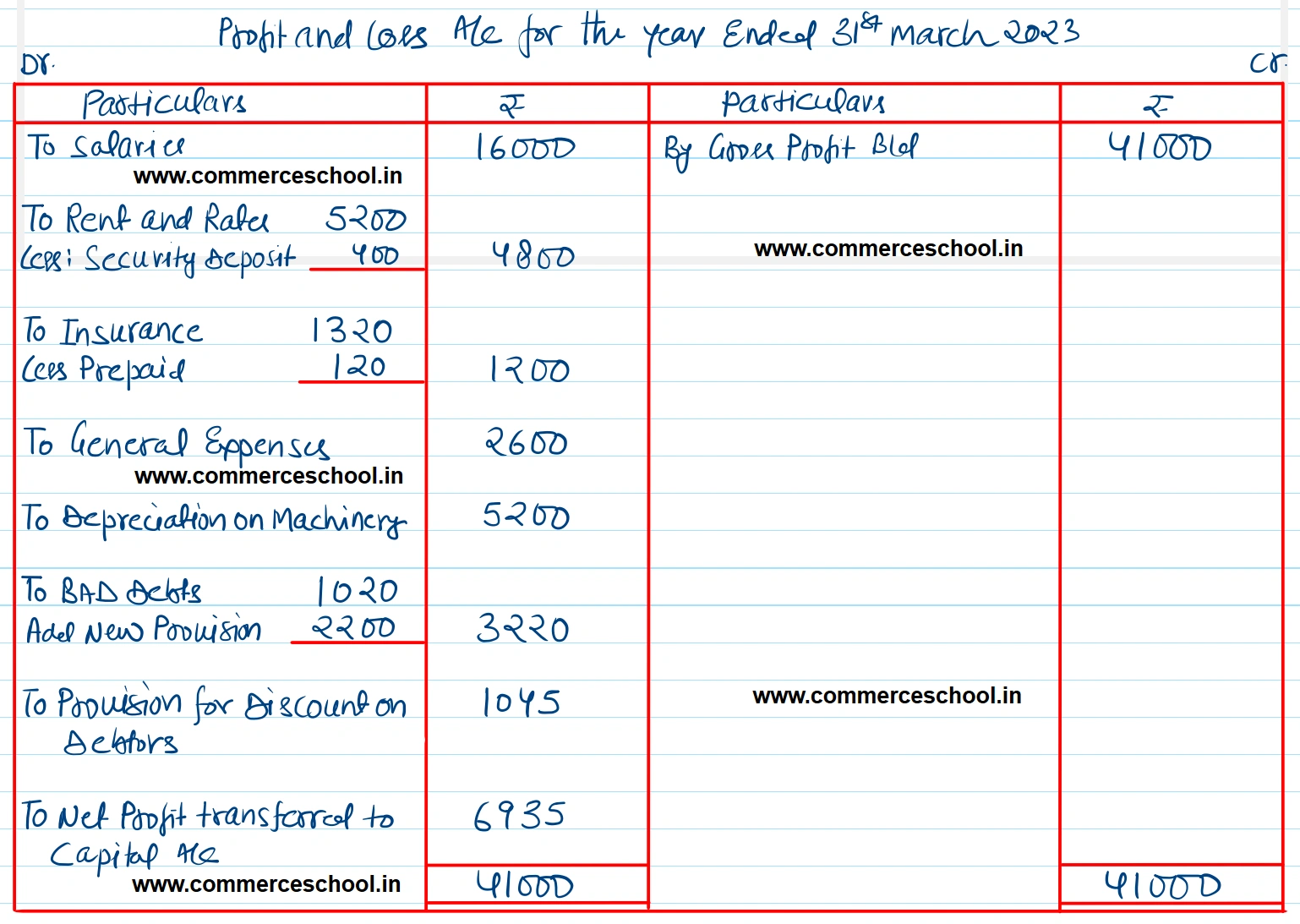

Solution:-

| Particulars | Debit (₹) | Credit (₹) |

| Stock (1st April 2015) | 8,000 | |

| Sales | 2,20,000 | |

| Purchases | 1,26,000 | |

| Productive Wages | 56,500 | |

| Salaries | 16,000 | |

| Stores Consumed | 6,050 | |

| Carriage | 3,050 | |

| Rent and Rates | 5,200 | |

| Insurance | 1,320 | |

| Machinery | 52,000 | |

| Building | 67,000 | |

| Capital less Drawings | 1,45,600 | |

| Sundry Debtors | 44,000 | |

| Sundry Creditors | 20,000 | |

| Secured Loan | 15,000 | |

| Furniture | 3,350 | |

| General Expenses | 2,600 | |

| Cash in Hand | 1,930 | |

| Bad Debts | 1,020 | |

| Bank | 6,580 | |

| 4,00,600 | 4,00,600 |

Anurag Pathak Answered question

Solution:-

Hints:

(i) Stores consumed will be shown on the Dr. side of Trading A/c

(ii) Security deposit of ₹ 400 will be deducted from rent and rates and will be shown on the assets side.

Anurag Pathak Changed status to publish