X who keeps incomplete records, gives you the following information: You are also given the following information:

X who keeps incomplete records, gives you the following information:

You are also given the following information:

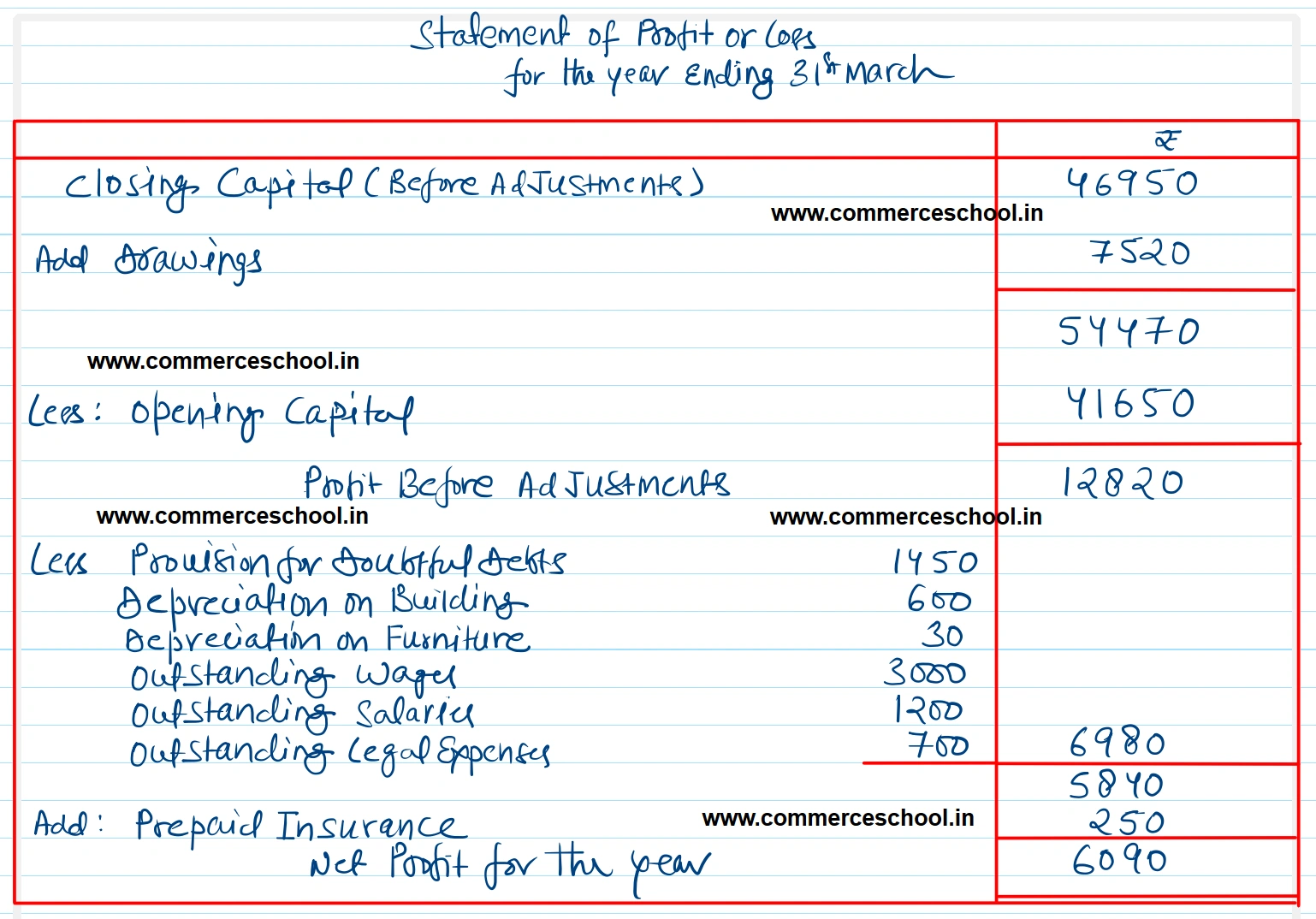

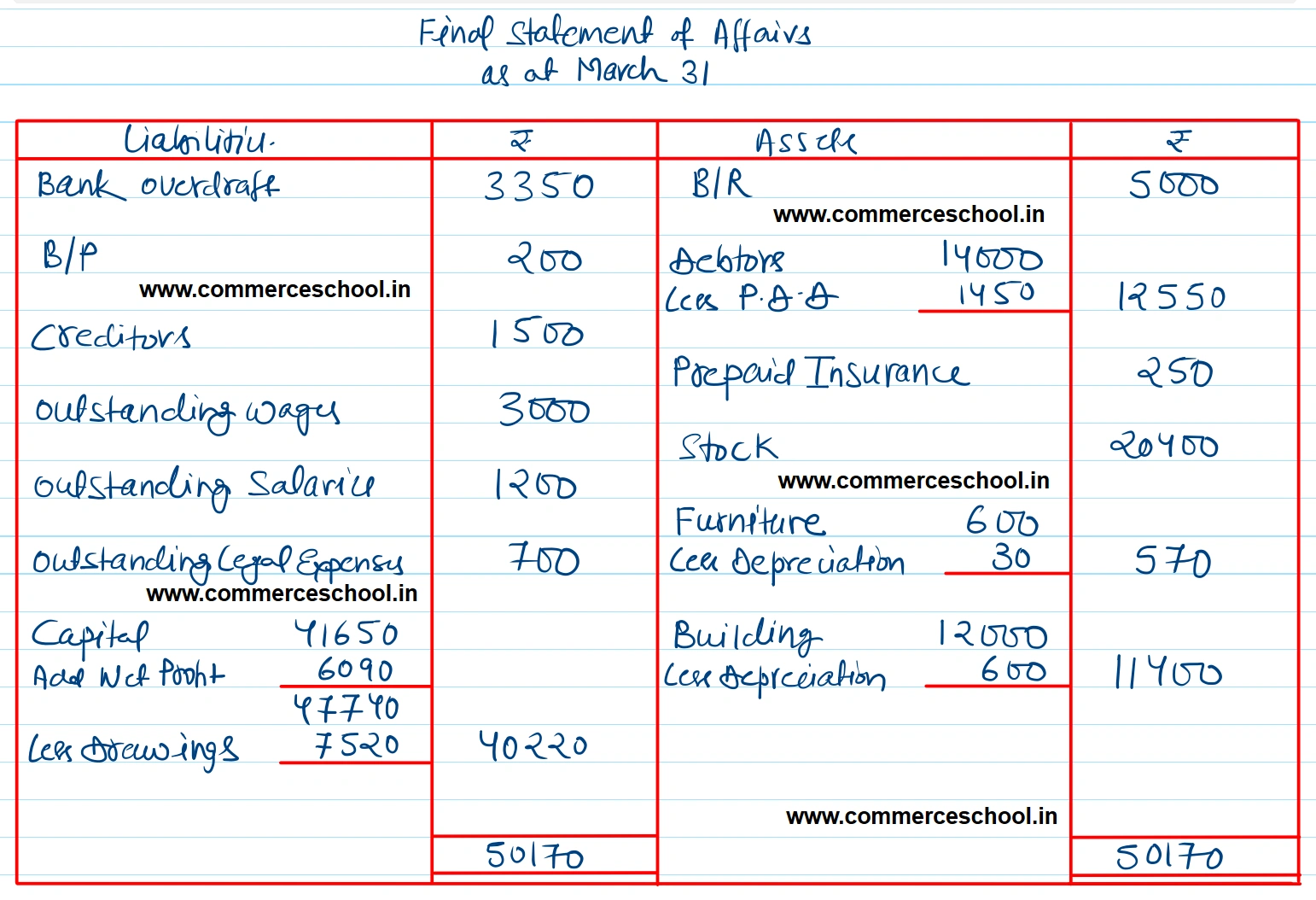

(I) A provision of ₹ 1,450 is required for bad and doubtful debts.

(ii) Depreciation @ 5% is to be written off on Building and furniture.

(iii) Wages outstanding ₹ 3,000; Salaries outstanding ₹ 1,200.

(iv) Insurance has been prepaid to the extent of ₹ 250.

(v) Legal Expenses outstanding ₹ 700.

(vi) Drawings of Mr. X during the year were ₹ 7,520.

Prepare a statement of Profit as on 31st March, 2023, and a final statement of affairs as at that date.

[Ans. Opening Capital ₹ 41,650; Closing Capital ₹ 46,950; Net Profit ₹ 6,090; Total of final Statement of Affairs ₹ 50,170.]

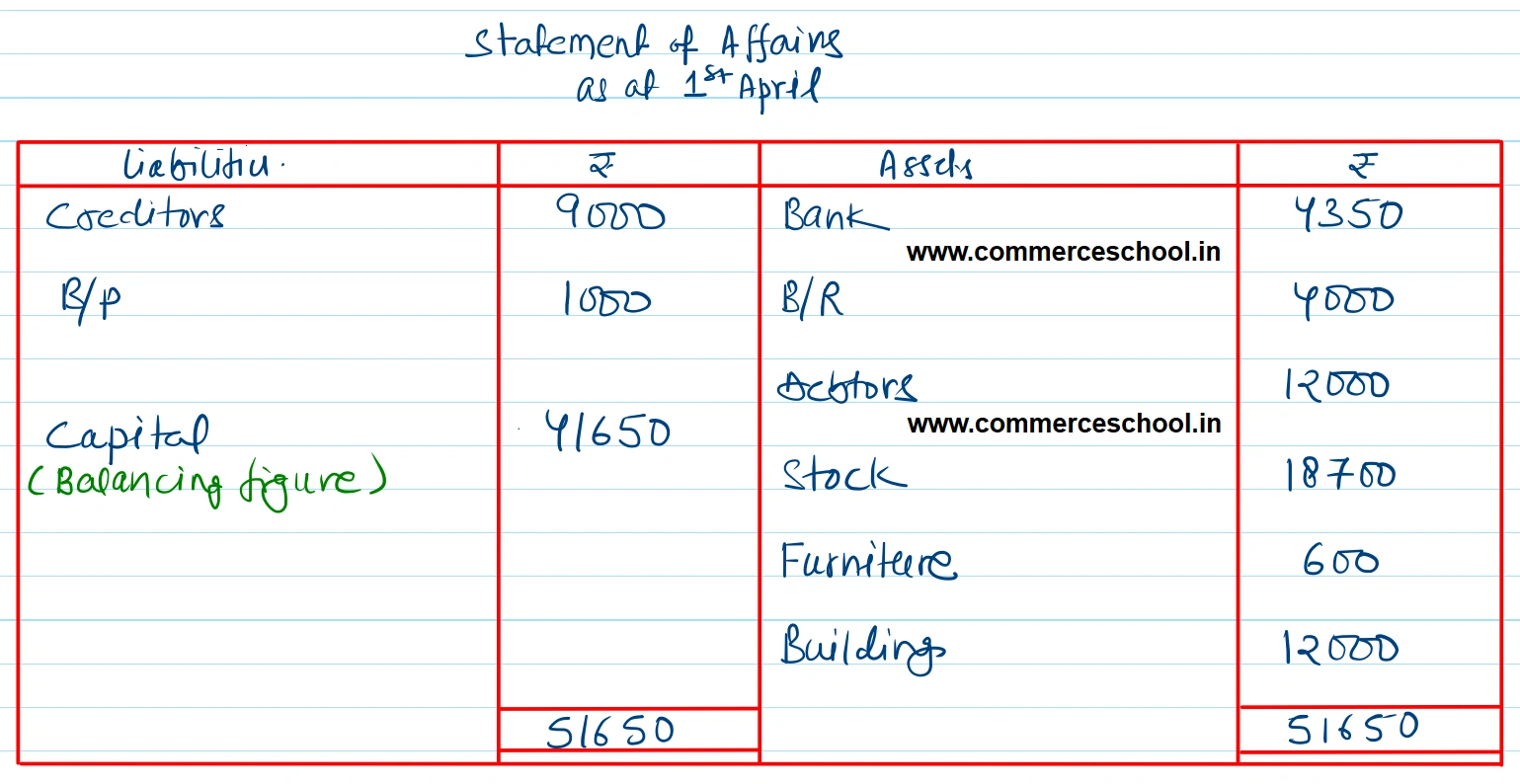

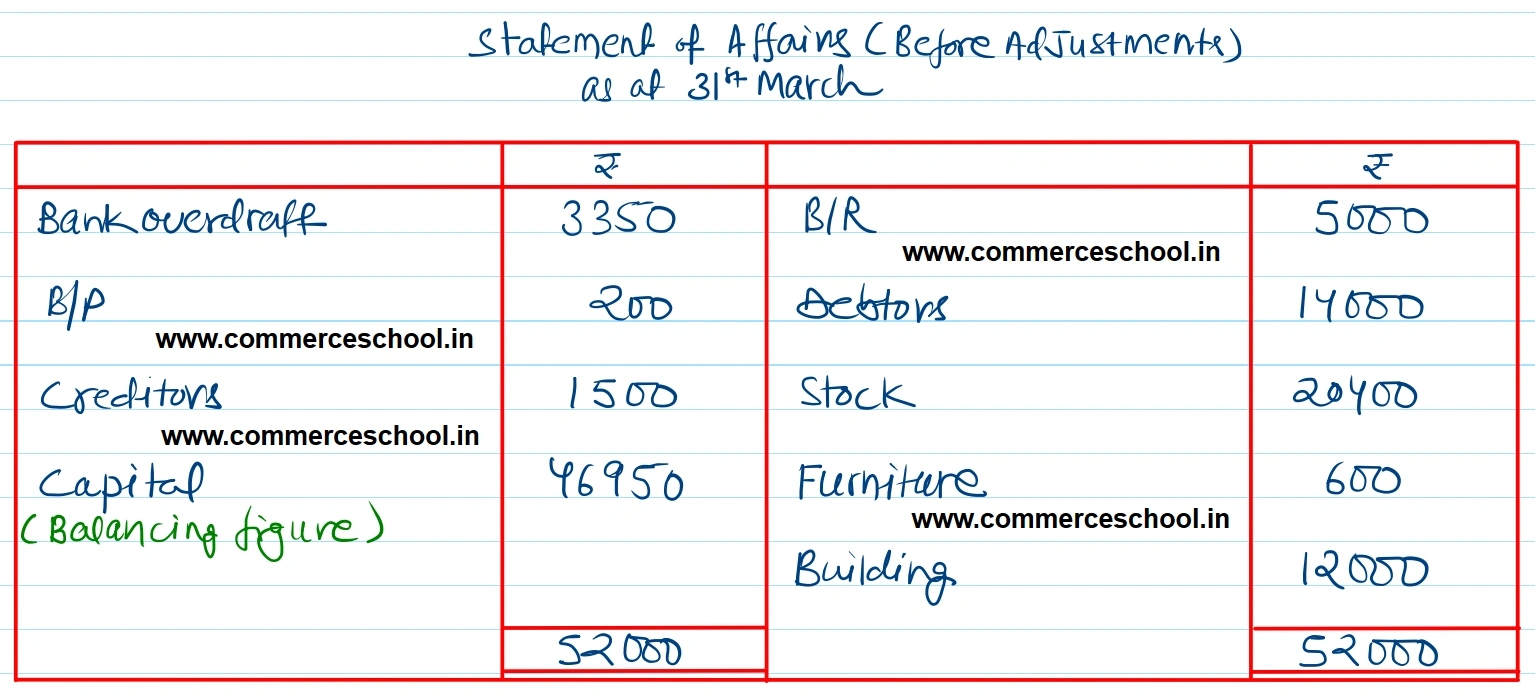

| 1st April, 2022 (₹) | 31st March, 2023 (₹) | |

| Stock in Hand | 18,700 | 20,400 |

| Debtors | 12,000 | 14,000 |

| Creditors | 9,000 | 1,500 |

| Bills Receivable | 4,000 | 5,000 |

| Bills Payable | 1,000 | 200 |

| Furniture | 600 | 600 |

| Building | 12,000 | 12,000 |

| Bank Balance | 4,350 | 3,350 (Overdraft) |

Anurag Pathak Answered question