Deepika and Rajshree are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2023, their Balance Sheet was:

Deepika and Rajshree are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 31st March, 2023, their Balance Sheet was:

| Liabilities | ₹ | Assets | ₹ | |

| Sundry Creditors

Public Deposits Bank Overdraft Outstanding Liabilities Capital A/cs: Deepika Rajshree |

16,000 61,000 6,000 2,000

48,000 40,000 |

Cash in Hand

Casht at Bank Stock Prepaid Insurance Sundry Debtors Plant and Machinery Land and Building Furniture |

28,800

|

1,200 2,800 32,000 1,000 28,000 48,000 50,000 10,000 |

| 1,73,000 | 1,73,000 |

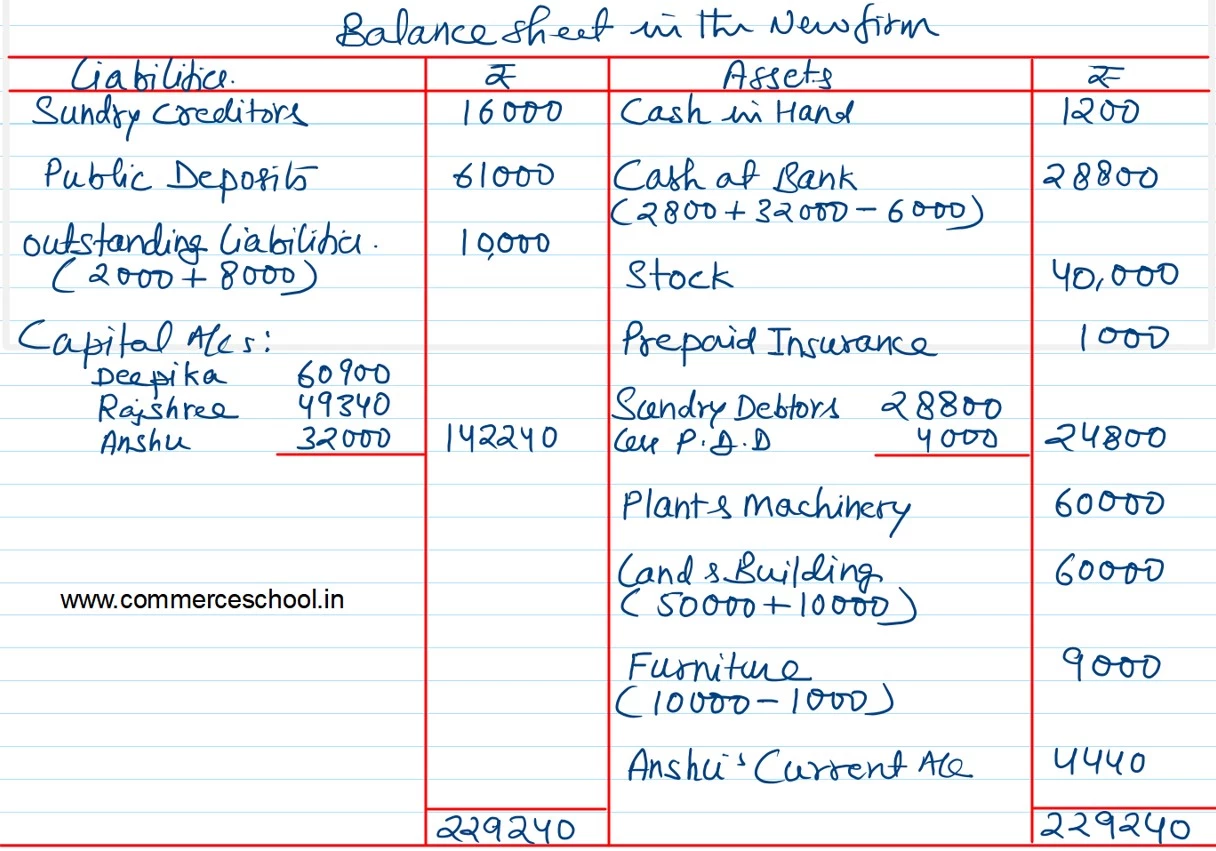

On 1st April 2023, the partners admit Anshu as a partner on the following terms:

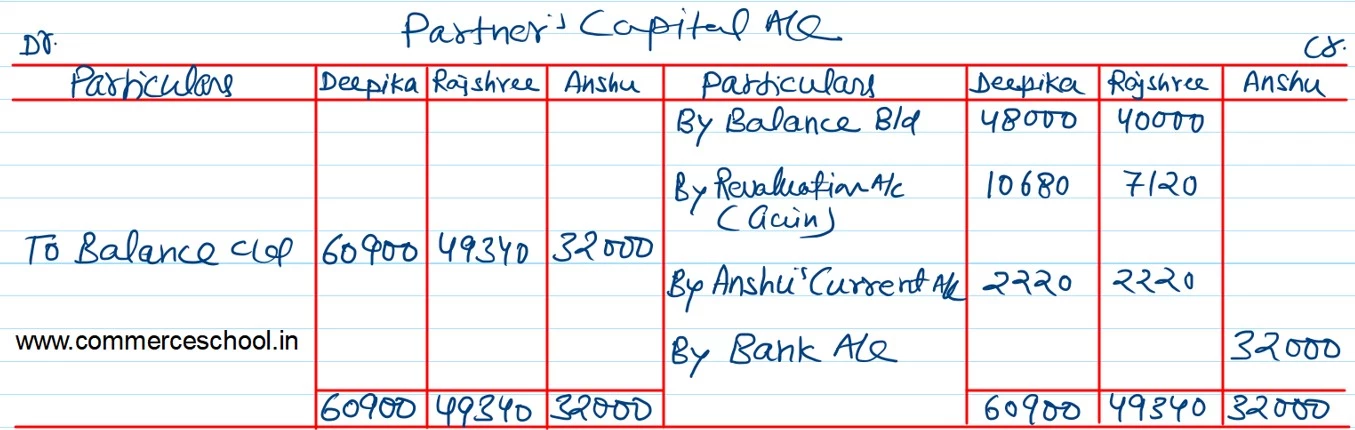

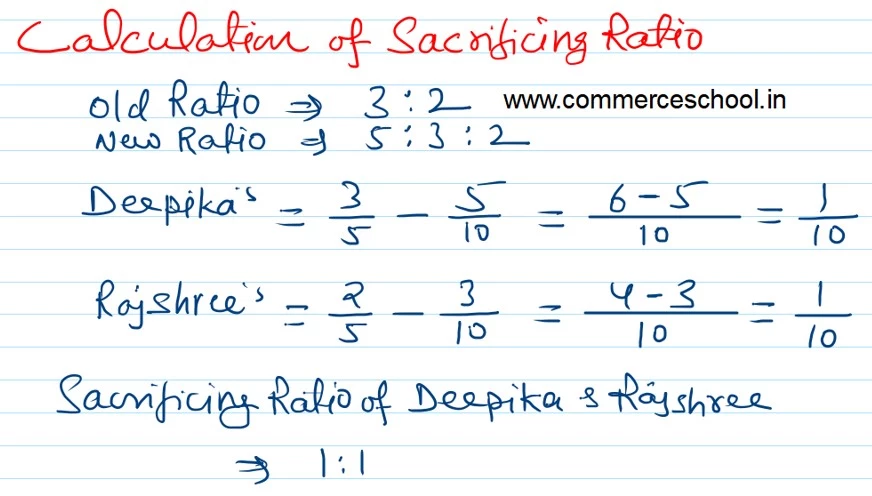

a) New Profit sharing ratio of Deepika, Rajshree, and Anshu will be 5 : 3 : 2.

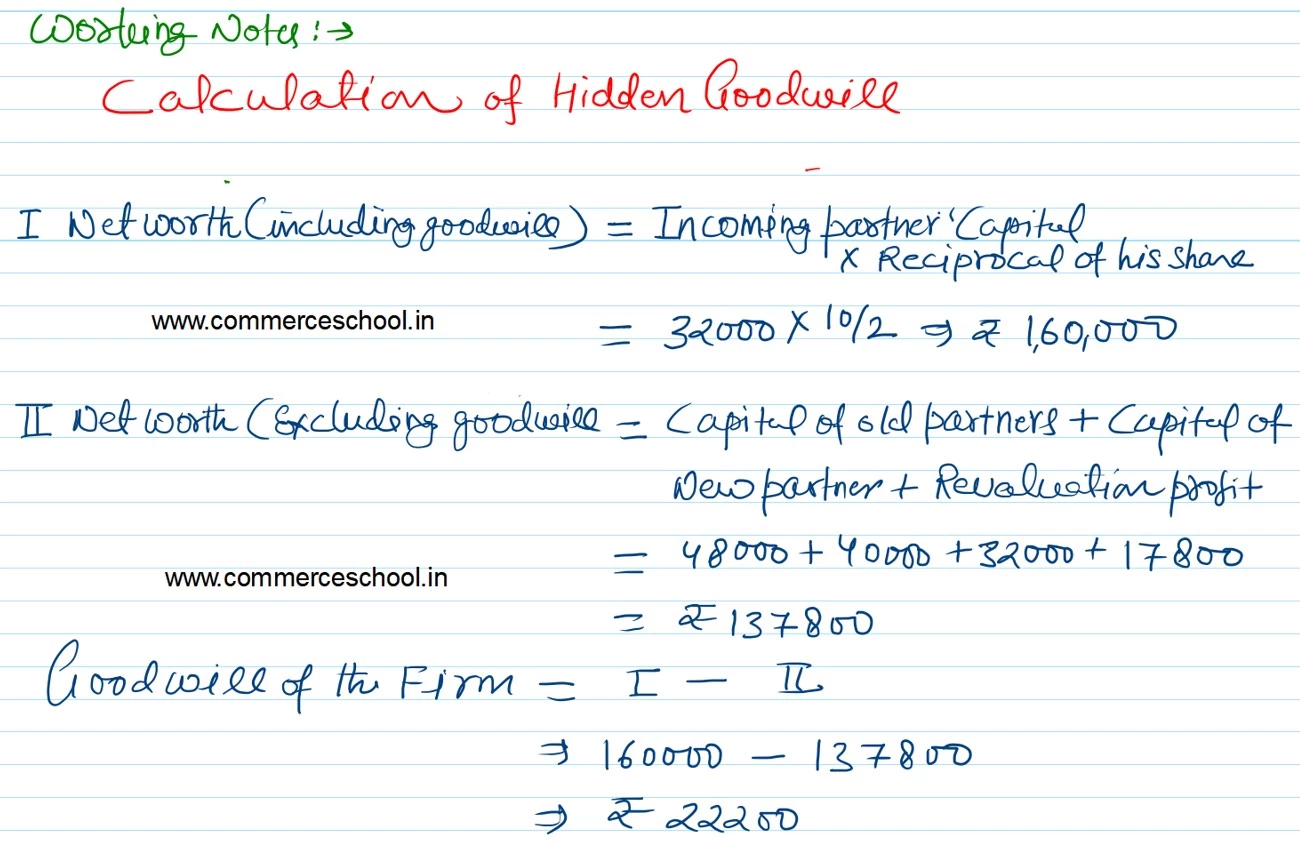

b) Anshu shall bring in ₹ 32,000 as his capital.

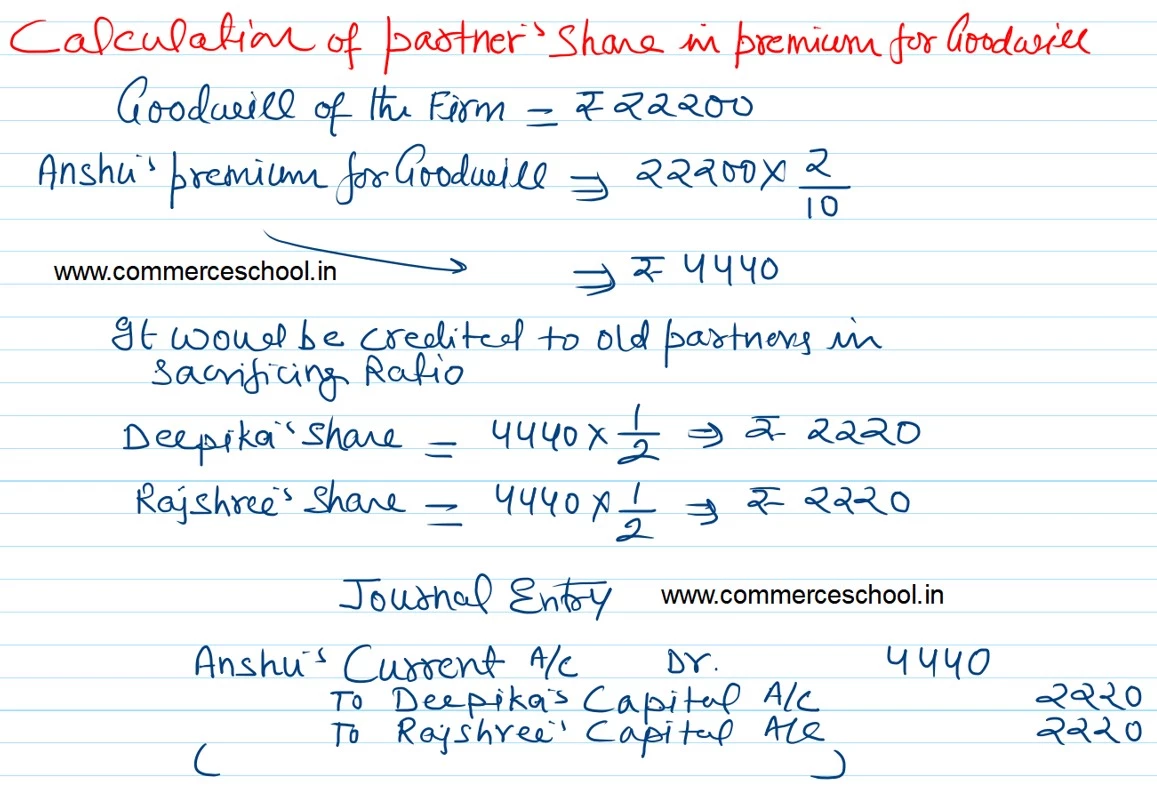

c) Anshu is unable to bring his share of goodwill. Partners, therefore, decide to calculate the goodwill on the basis of Anshu’s share in the profits and the capital contribution made by her to the firm.

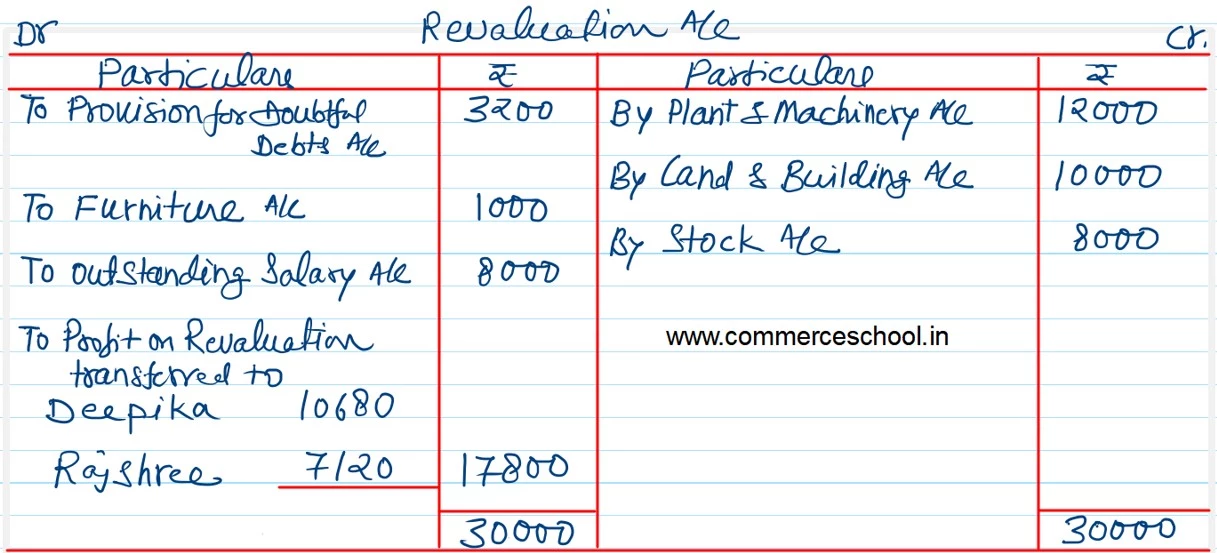

d) Plant and Machinery is to be valued at ₹ 60,000, Stock at ₹ 40,000 and the provision for doubtful debts is to be maintained at ₹ 4,000. Value of Land and Building has appreciated by 20%. Furniture has been depreciated by 10%.

e) There is additional liability of ₹ 8,000 being outstanding salary payable to employees of the firm. This liability is not included in the outstanding liabilities, stated in the above Balance Sheet. Partners decide to show this liability in the books of account of the reconstituted firm.

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of Deepika, Rajshree and Anshu.