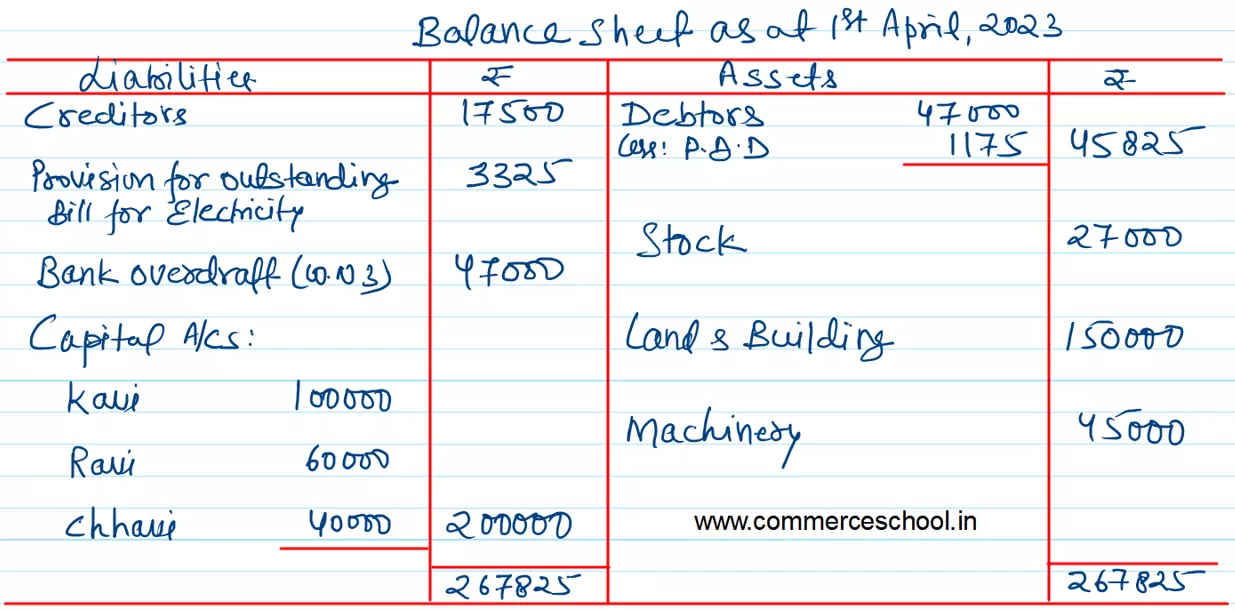

Kavi and Ravi were partners in a firm sharing profits in the ratio of 5 : 3. On 31st March, 2023, they admitted Chhavi as a partner for 1/5th share in the profit. On Chhavi’s admission, the Balance Sheet of the firm was as follows:

Kavi and Ravi were partners in a firm sharing profits in the ratio of 5 : 3. On 31st March, 2023, they admitted Chhavi as a partner for 1/5th share in the profit. On Chhavi’s admission, the Balance Sheet of the firm was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Kavi’s Capital

Ravi’s Capital Creditors Workmen Compensation Reserve |

1,50,000

90,000 20,000 32,000 |

Land and Building

Machinery Stock Debtors Less: Provision for Doubtful Debts Cash at Bank Profit & Loss |

1,50,000

45,000 27,000 45,800 4,200 20,000 |

| 2,92,000 | 2,92,000 |

On Chhavi’s admission, it was agreed that:

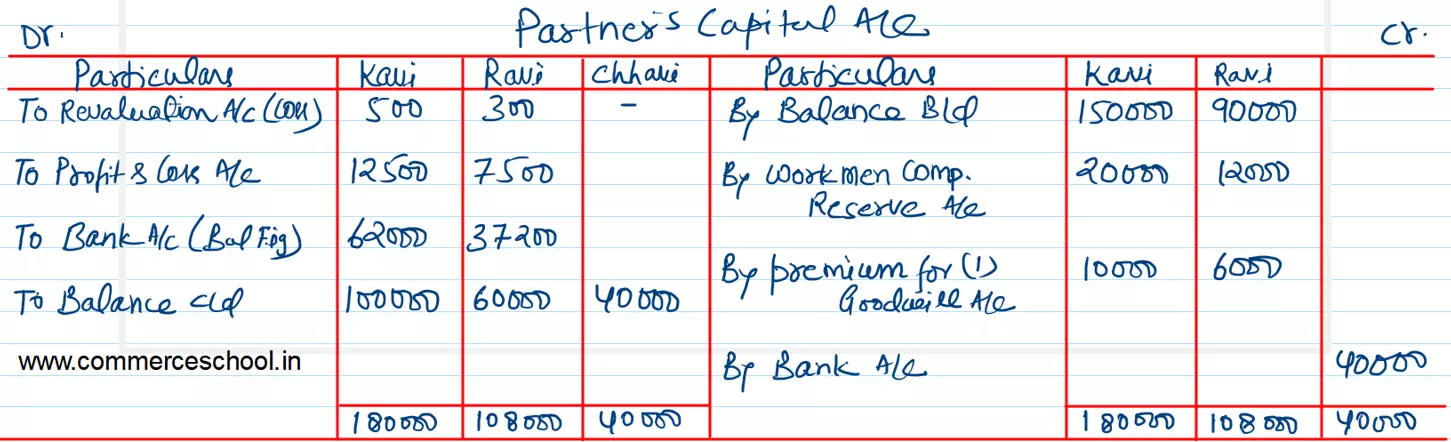

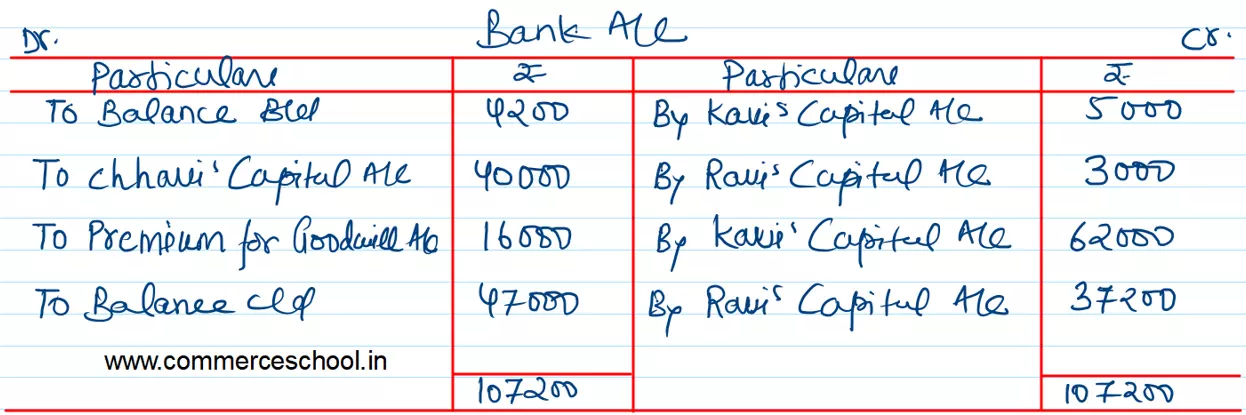

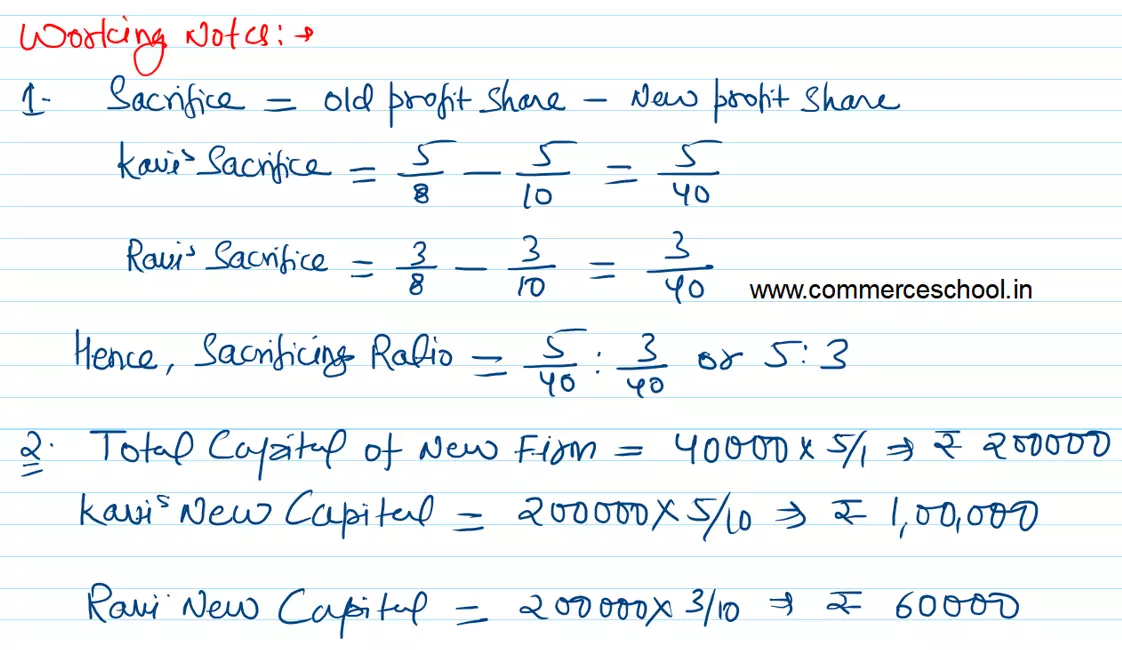

i) Chhavi will bring ₹ 40,000 as her capital and ₹ 16,000 for her share of goodwill premium, half of which was withdrawn by Kavi and Ravi

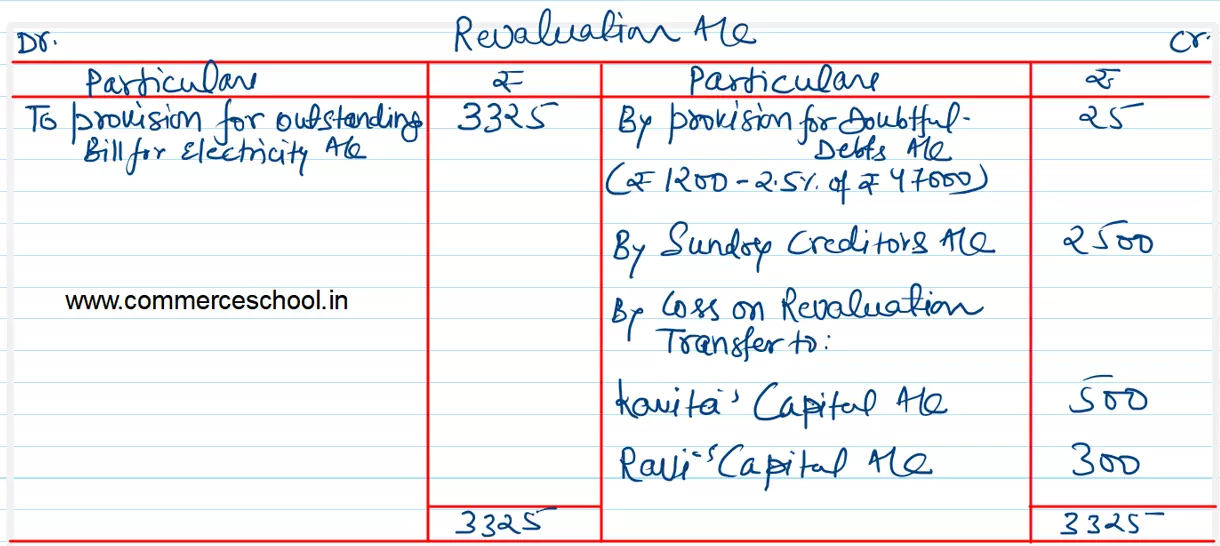

ii) A provision of 2.5% for doubtful debts was to be created.

iii) Included in the Sundry creditors was an item of ₹ 2,500 which was not to be paid

iv) A provision was to be made for an outstanding bill for electricity ₹ 3,3325.

v) The new profit-sharing ratio will be 5 : 3 : 2.

After the above adjustments, the capitals of old partners were to be adjusted on the basis of the new partner’s capital. Actual cash was to be brought in or to be paid off as the case may be.

Prepare the Revaluation Account, Capital Accounts of the partners, and the Balance Sheet of the New Firm.