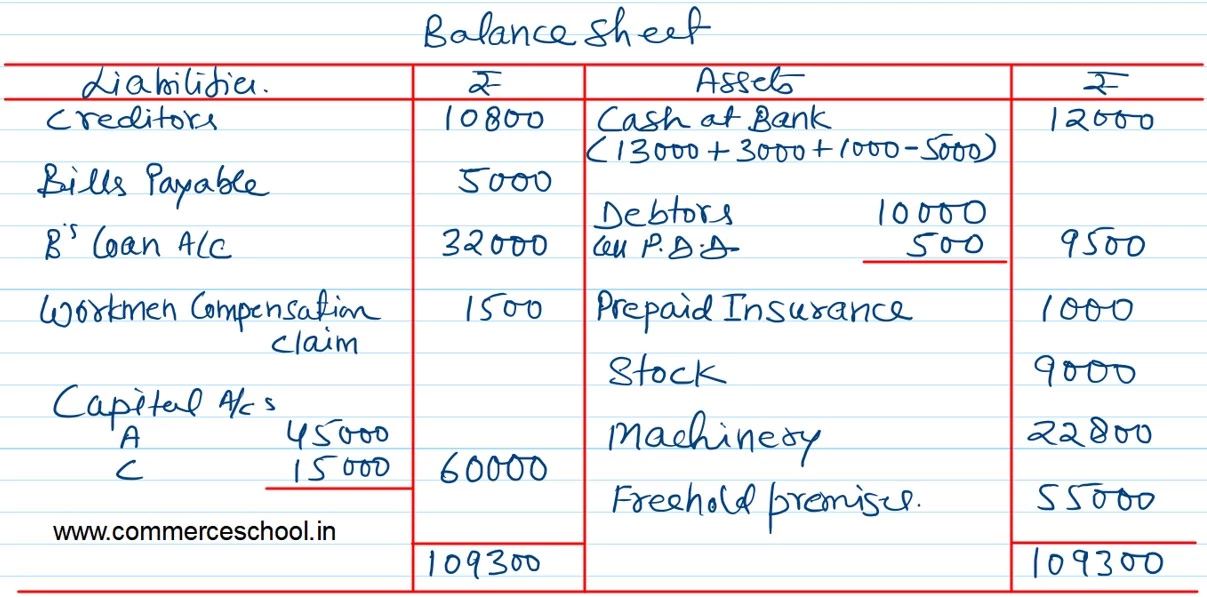

On 31st March, 2023, the Balance Sheet of A, B and C who were sharing profits and losses in proportion to their capitals stood as:

On 31st March, 2023, the Balance Sheet of A, B and C who were sharing profits and losses in proportion to their capitals stood as:

| Liabilities | ₹ | Assets | ₹ | |

| Creditors

Outstanding Expenses Capital A/cs: A B C |

10,800 5,000 45,000 30,000 15,000 |

Cash at Bank

Debtors Stock Machinery Freehold Premises |

10,000

|

13,000 9,800 9,000 24,000 50,000 |

| 1,05,800 | 1,05,800 |

B retired on 1st April, 2023 and following adjustments were agreed to determine the amount payable to B:

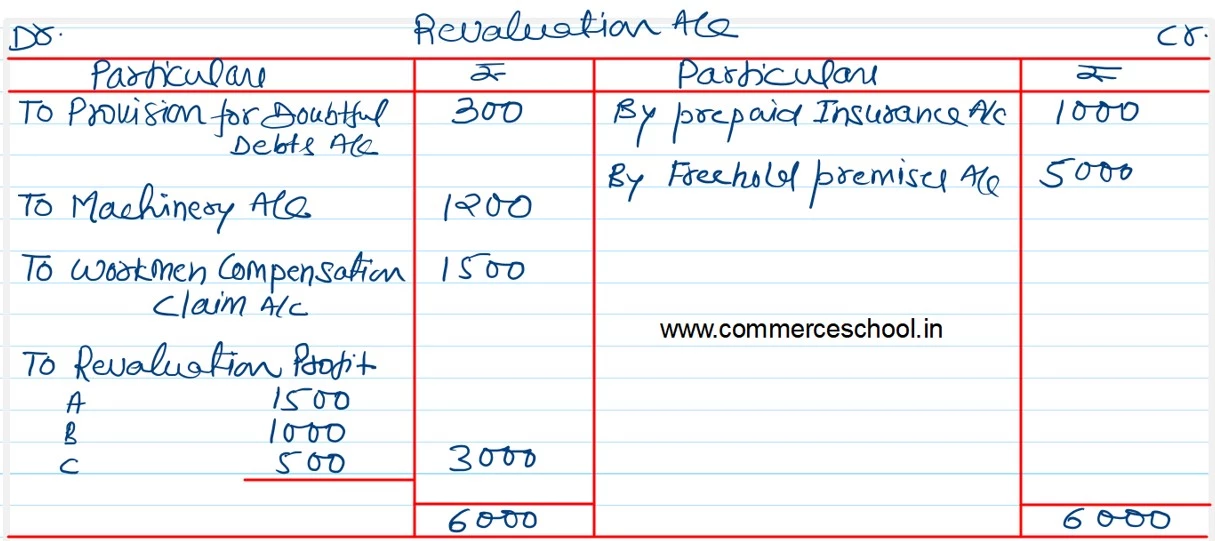

a) Out of the amount of insurance premium debited to Profit & Loss Account, ₹ 1,000 be carried forward as prepaid insurance.

b) Freehold Premises be appreciated by 10%.

c) Provision for Doubtful Debts is brought up to 5% on Debtors.

d) Machinery be reduced by 5%.

e) Liability for Workmen Compensation to the extent of ₹ 1,500 would be created.

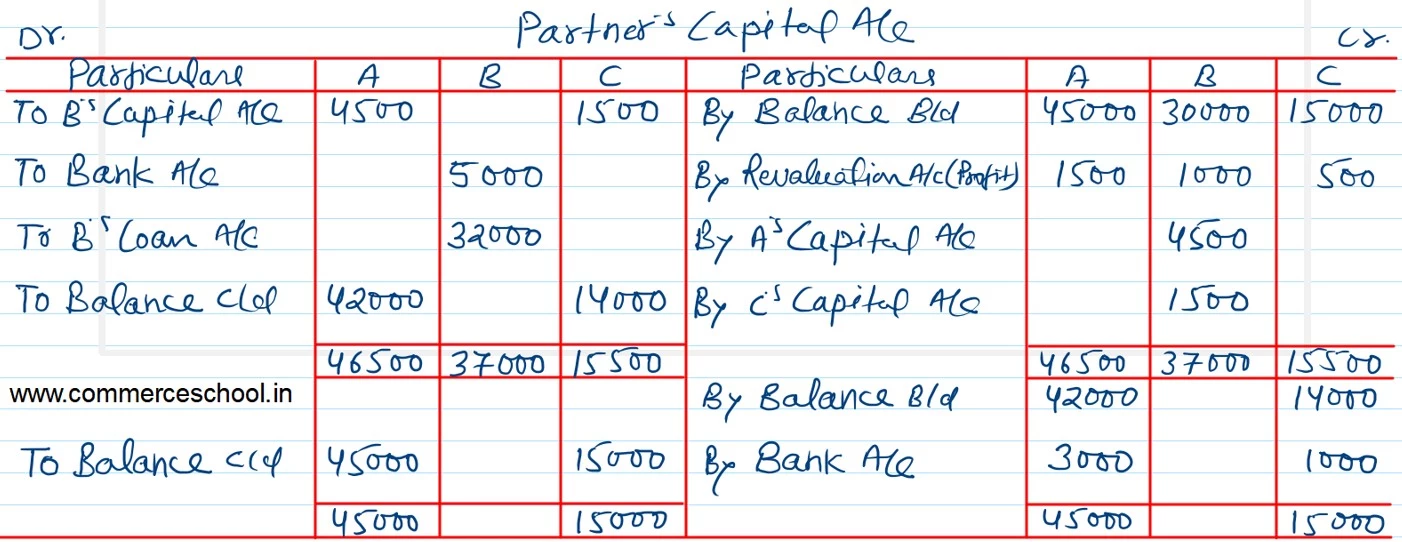

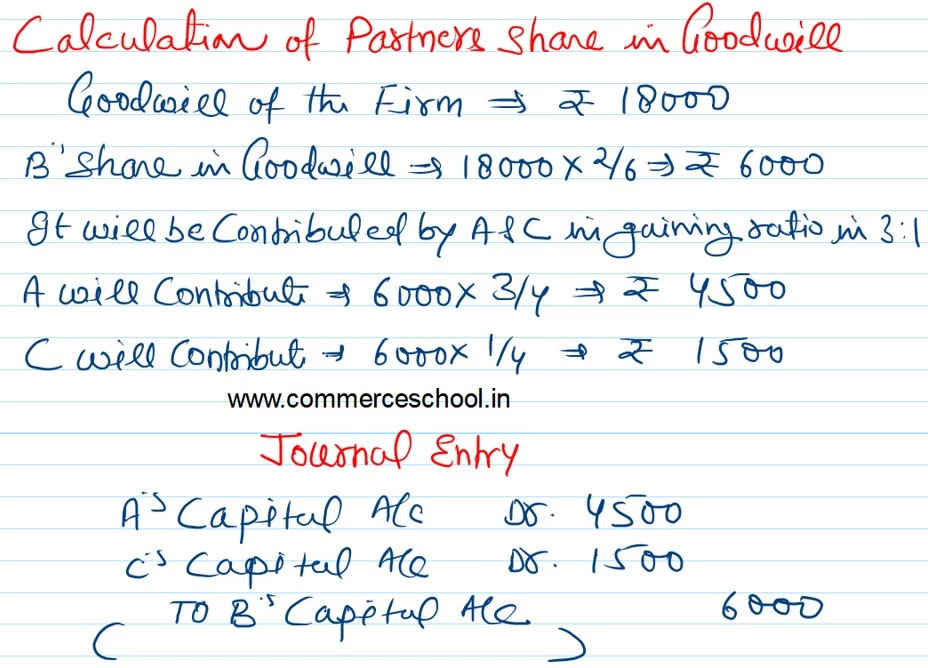

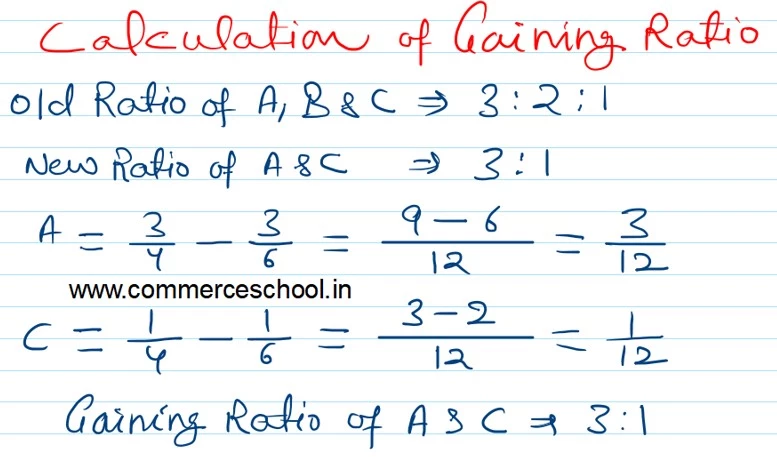

f) Goodwill of the firm be fixed at ₹ 18,000 and B’s share of the same be adjusted into the Capital Accounts of A and C who will share future profits in the ratio of 3/4th and 1/4th.

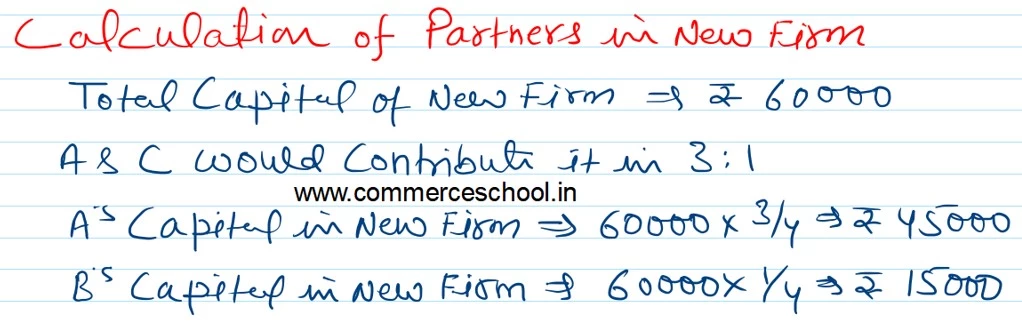

g) Total Capital of the firm as newly constituted be fixed at ₹ 60,000 between A and C in the proportion of 3/4th and 1/4th after passing entries in their accounts for adjustments, i.e., actual cash to be paid or to be brought in by continuing partners as the case may be.

h) B be paid ₹ 5,000 in cash and the balance be transferred to his Loan Account.

Prepare Capital Accounts of partners and the Balance Sheet of the firm of A and C.

[Ans: Gain (Profit) on Revaluation – ₹ 3,000; B’s Loan – ₹ 32,000; Partner’s Capital Account: A – ₹ 45,000; C – ₹ 15,000; Cash brought in by A – ₹ 3,000 and C – ₹ 1,000; Balance Sheet Total – ₹ 1,09,300.]