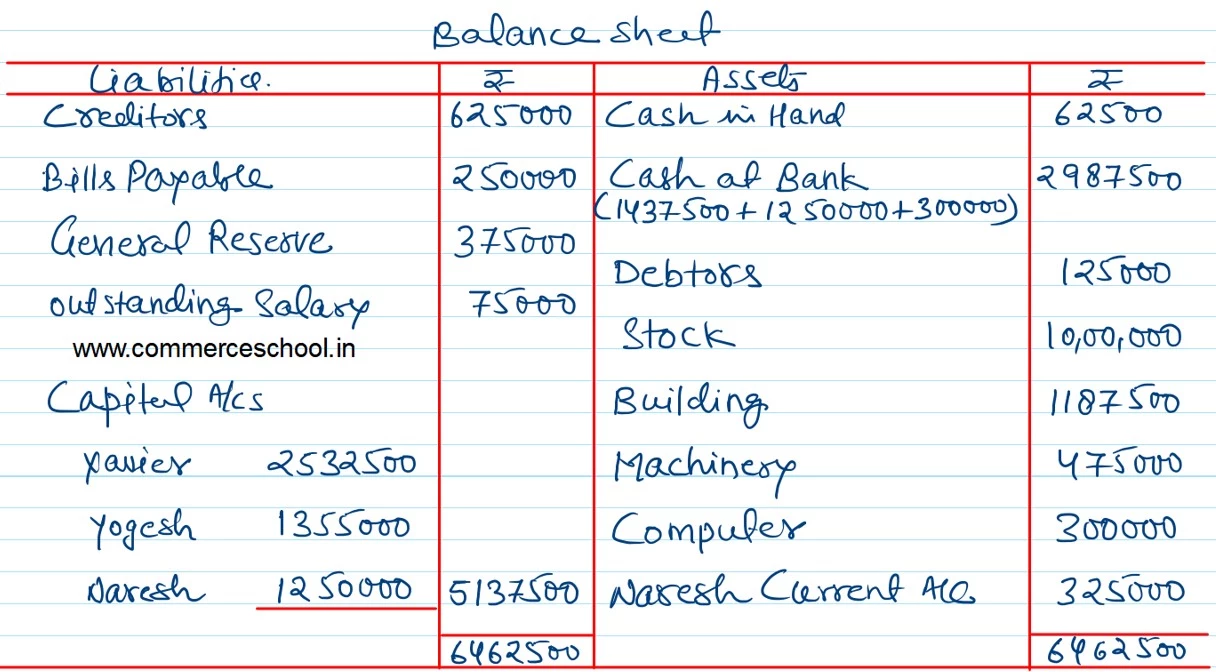

Xavier and Yogesh are partners sharing profits and losses in the ratio of 3 : 2. On 31st March, 2023, their Balance Sheet was as follows:

Xavier and Yogesh are partners sharing profits and losses in the ratio of 3 : 2. On 31st March, 2023, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors

Bills Payable General Reserve Capital A/cs: Xavier Yoesh |

6,25,000 2,50,000 3,75,000 20,00,000 10,00,000 |

Cash in Hand

Cash at Bank Debtors Stock Building Machines Goodwill |

62,500 14,37,500 1,25,000 7,50,000 12,50,000 5,00,000 1,25,000 |

| 42,50,000 | 42,50,000 |

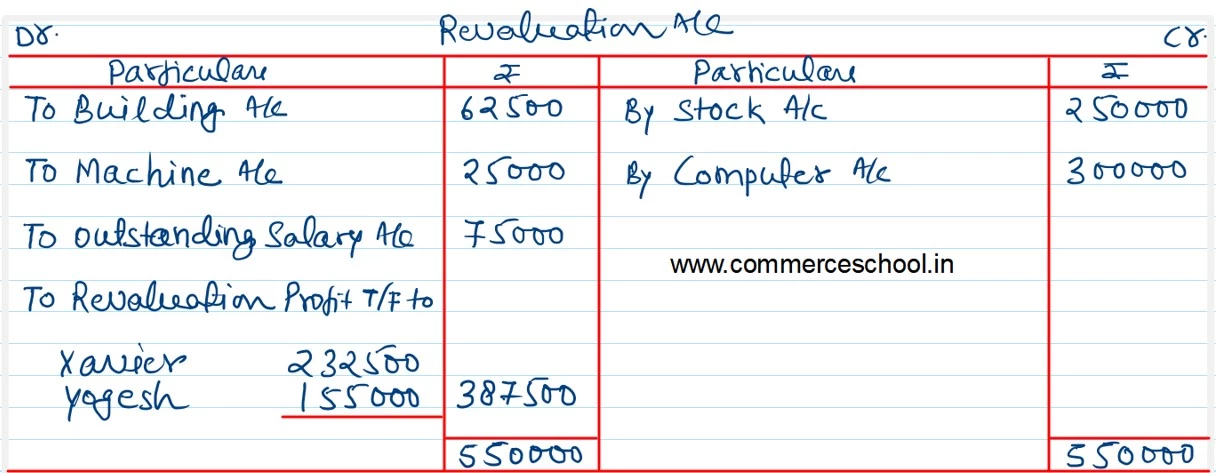

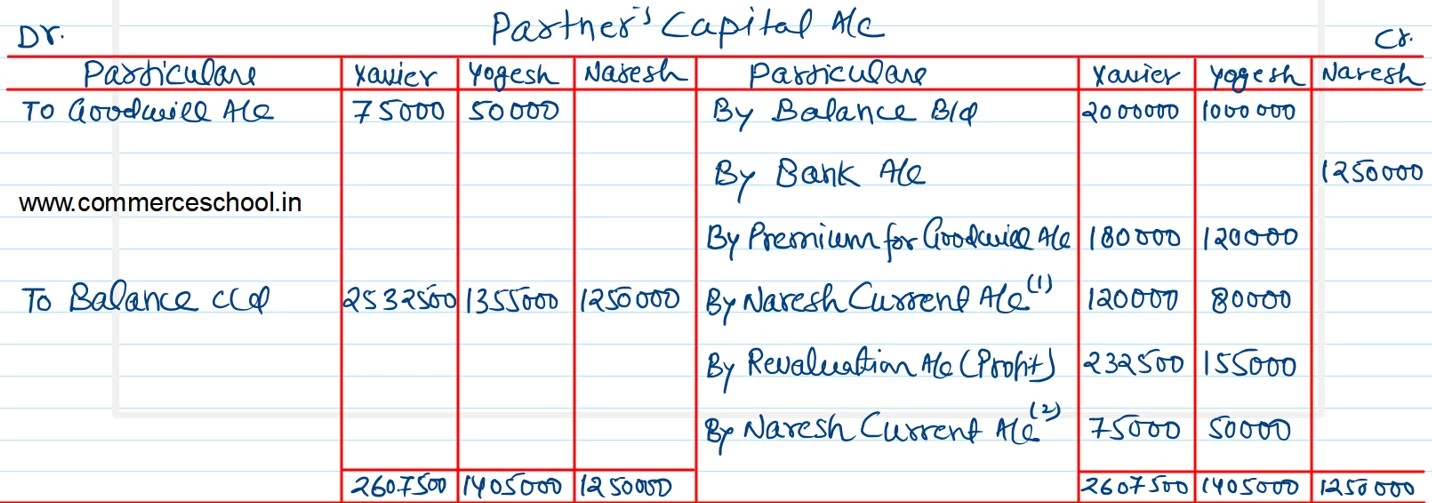

They admit Naresh as a partner with effect from 1st April, 2023 for 1/3rd share on the following terms:

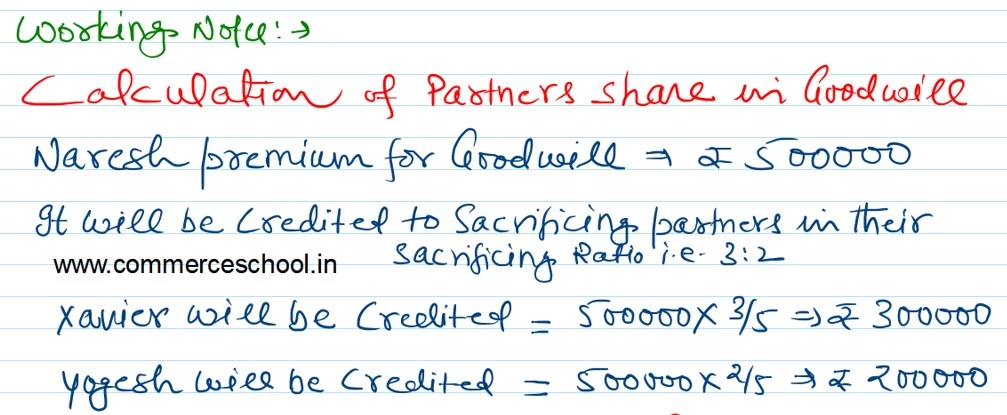

(i) Naresh will bring ₹ 12,50,000 as Capital and ₹ 5,00,000 as his share of Goodwill but he could contribute only ₹ 3,00,000 towards Goodwill.

(ii) Building and Machines to be reduced (depreciated) by 5%.

(iii) Stock to be revalued at ₹ 10,00,000.

(iv) There are unrecorded computers of ₹ 3,00,000.

(v) One month salary of ₹ 75,000 is outstanding.

(vi) A Bill of Exchange of ₹ 62,500 which was previously discounted with the bank, was dishonoured on 31st March, 2023 but entry was not passed for it.

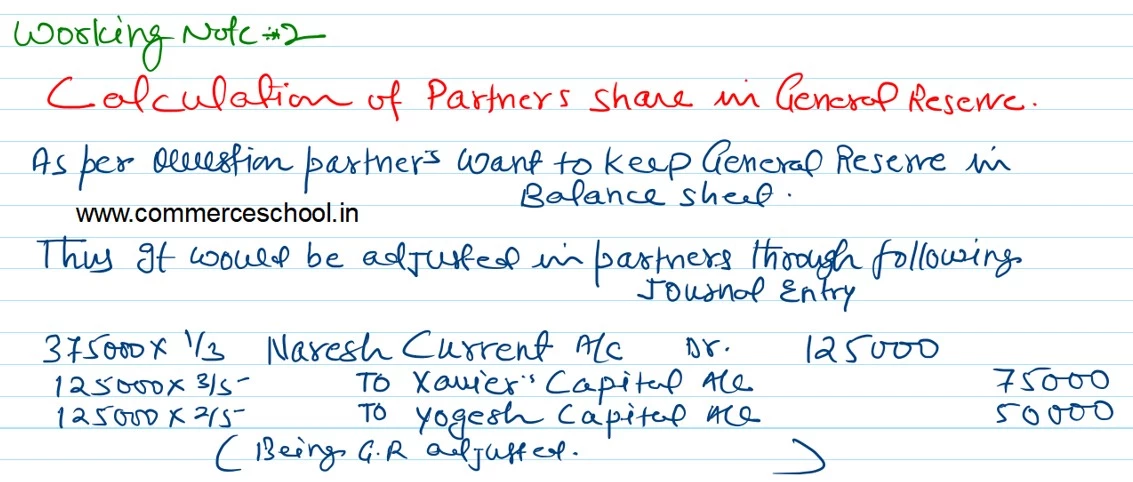

(vii) They further decided that General Reserve will continue at its original value in the Balance Sheet of New Firm.

Prepare Revaluation Account, Capital Accounts of Partners and Balance sheet of the new firm.