Anubhav and Anurag are partners in a firm sharing profits and losses in the ratio of 5 : 3. On 31st March, 2023, their Balance Sheet was as follows:

Anubhav and Anurag are partners in a firm sharing profits and losses in the ratio of 5 : 3. On 31st March, 2023, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs:

Anubhav Anurag General Reserve Sundry Creditors Bills Payable |

1,20,000

1,00,000 60,000 40,000 20,000 |

Goodwill

Machinery Stock Sundry Debtors Bank Balance Cash in Hand |

50,000

1,20,000 80,000 72,000 5,000 13,000 |

| 3,40,000 | 3,40,000 |

On 1st April, 2023, the partners admit RAmesh as a partner on the following terms:

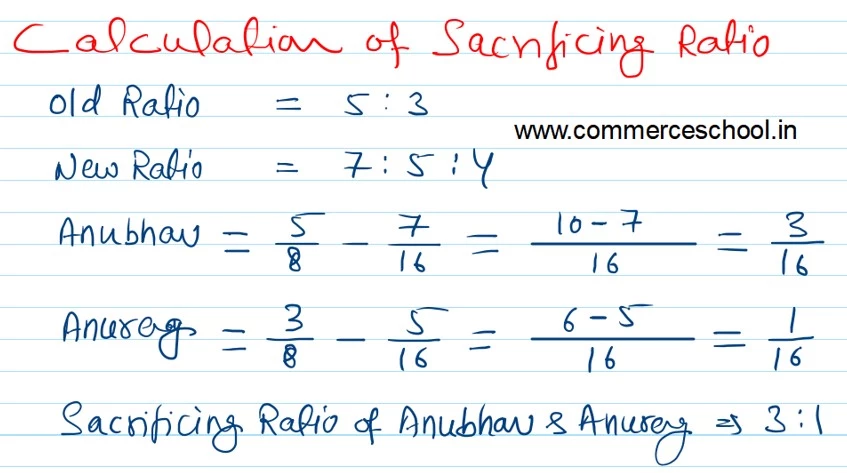

(i) New profit sharing ratio of partners will be 7 : 5 : 4.

(ii) Ramesh shall bring ₹ 80,000 as his capital and ₹ 40,000 for his share of goodwill.

(iii) Anubhav and Anurag will draw half of the goodwill.

(iv) Machinery is to be valued at ₹ 1,50,00; Stock at ₹ 1,00,000 and a Provision for Doubtful Debts of ₹ 10,000 is to be created.

(v) There is a liability of ₹ 20,000; being the outstanding salary payable to employees of the firm. This liability is not accounted. Partners decide to show this liability in the books of account of the new firm.

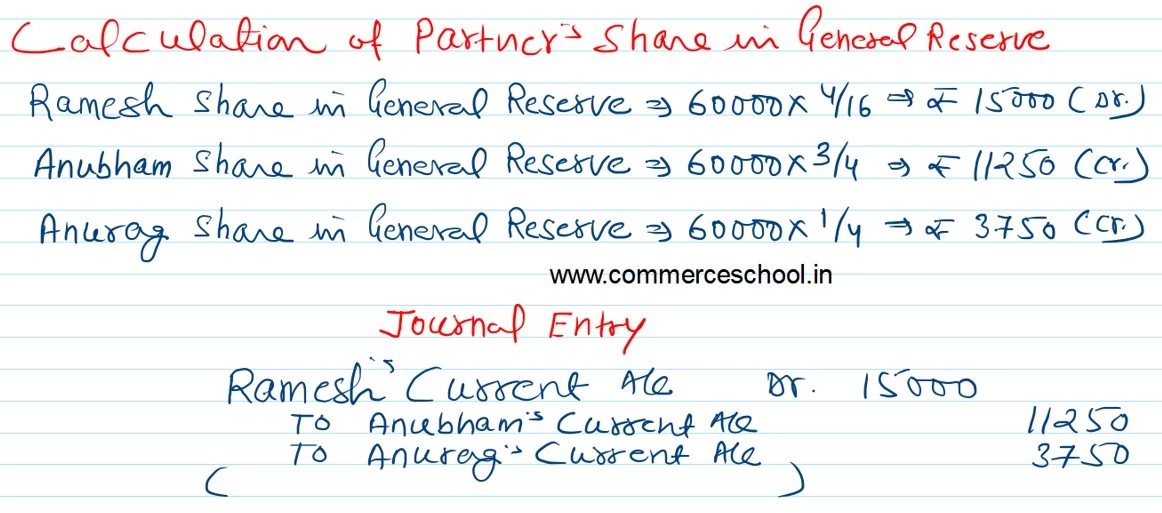

(vi) It is decided by the partners that General Reserve would continue to appear in the books and necessary adjustments shall be made through Partners’ Current Accounts.

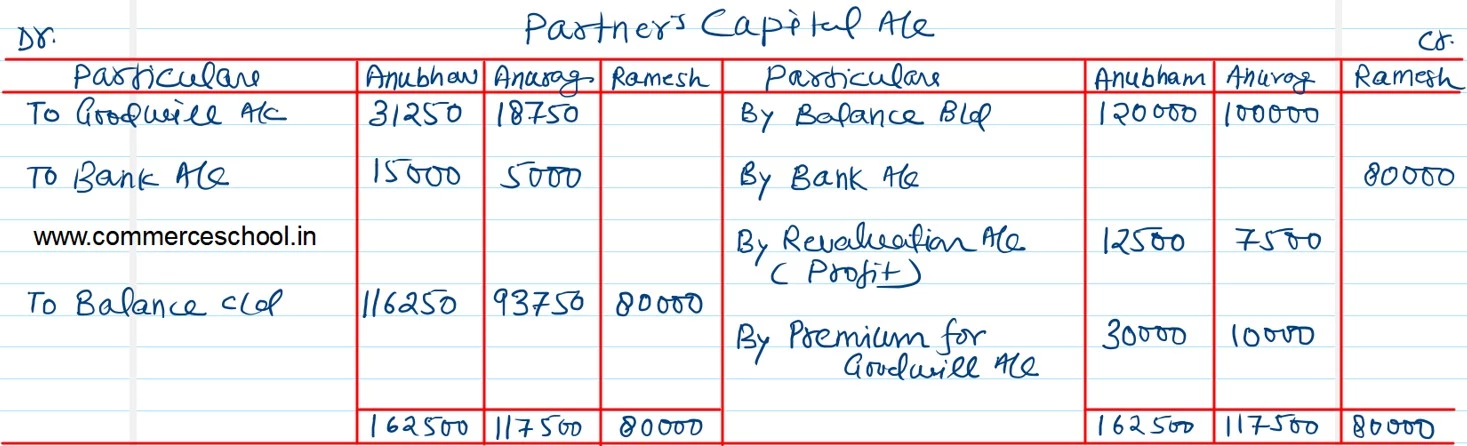

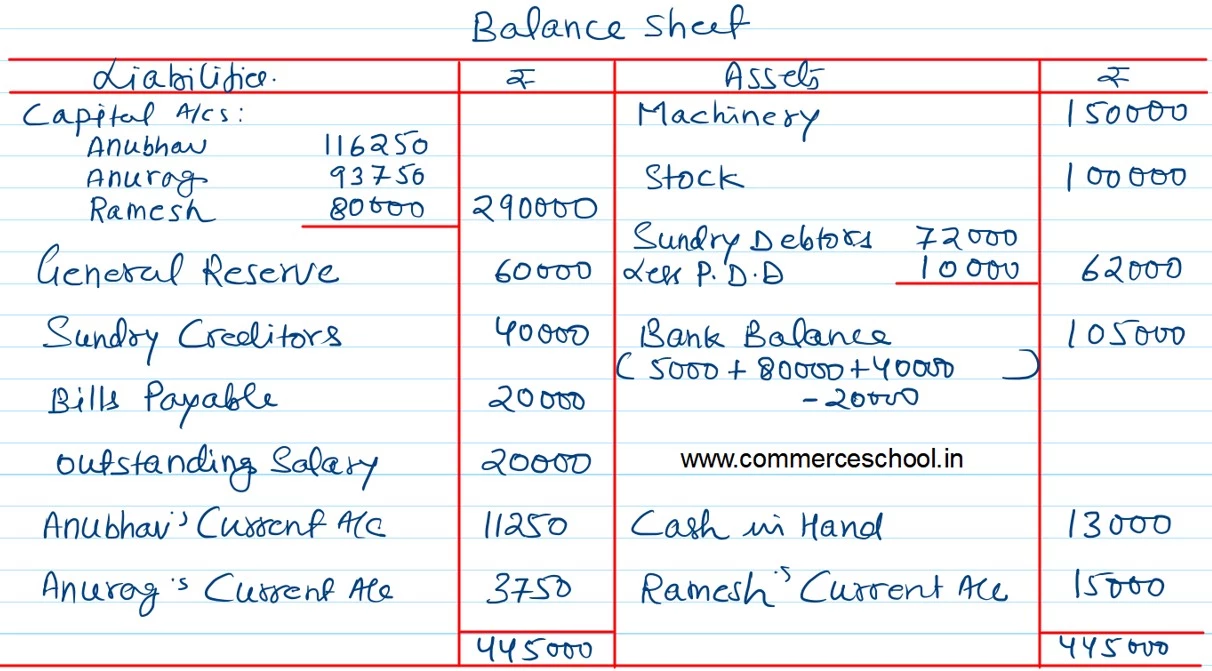

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of Anubhav, Anurag and Ramesh