Bikash, Somen and Raj are partners sharing profits and losses in the ratio of 2 : 3 : 5. On 31st March, 2023, their Balance Sheet was as follows:

Bikash, Somen and Raj are partners sharing profits and losses in the ratio of 2 : 3 : 5. On 31st March, 2023, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors

Employee’s Provident Fund Profit & Loss A/c Capital A/cs: Bikash Somen Raj |

38,400

19,200 8,400 21,600 26,400 31,200 |

Cash

Bills Receivable Furniture Stock Debtors Investments Machinery Goodwill |

10,800

14,400 16,800 26,400 25,200 19,200 20,400 12,000 |

| 1,45,200 | 1,45,200 |

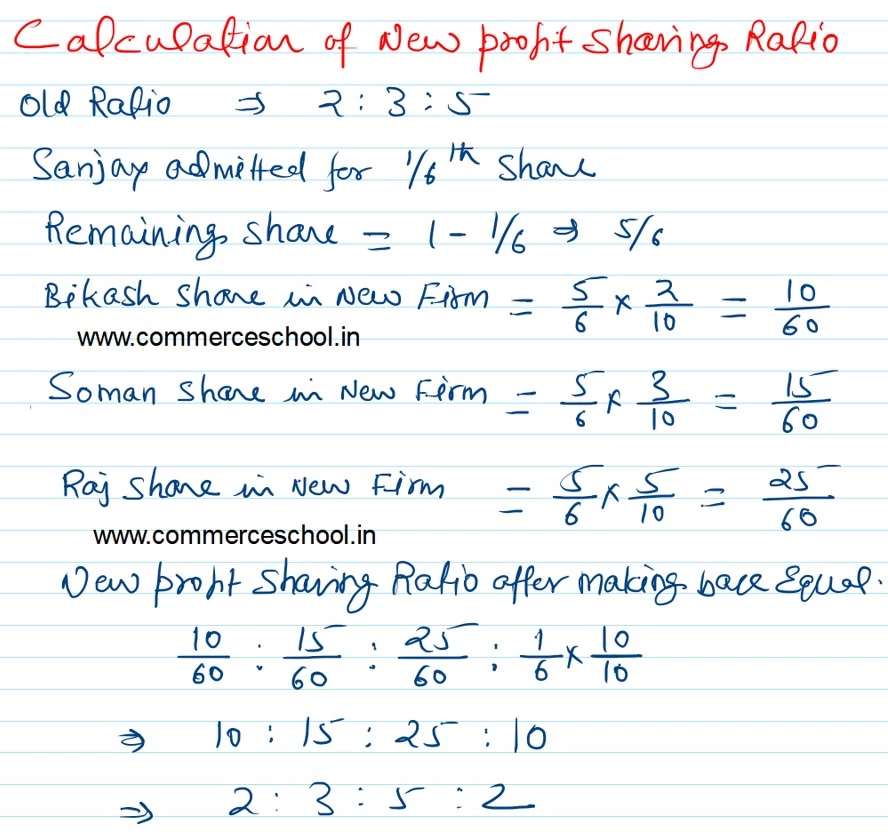

They admit Sanjoy into partnership on 1st April, 2023 on the following terms:

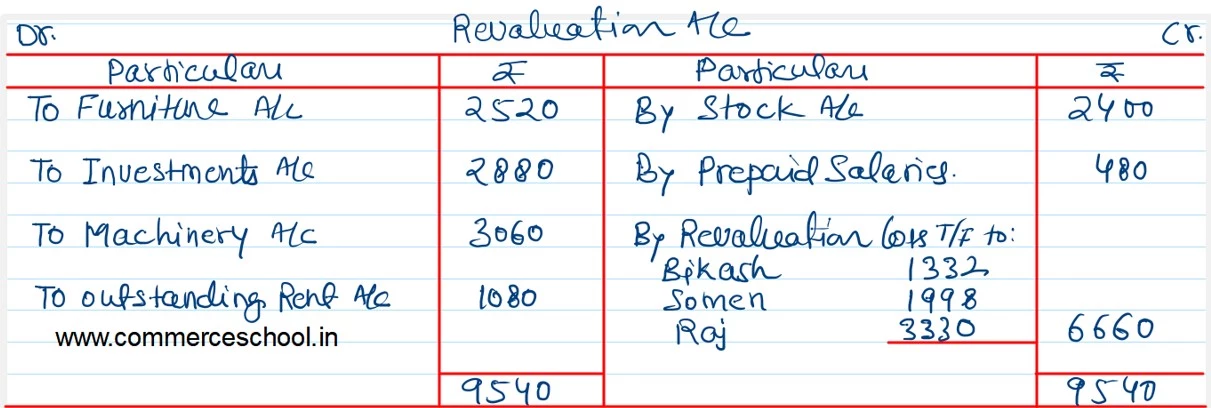

(i) Furniture, Investments and Machinery to be reduced by 15%.

(ii) Stock is revalued at ₹ 28,800.

(iii) Outstanding Rent amounted to ₹ 1,080.

(iv) Prepaid Salaries ₹ 480.

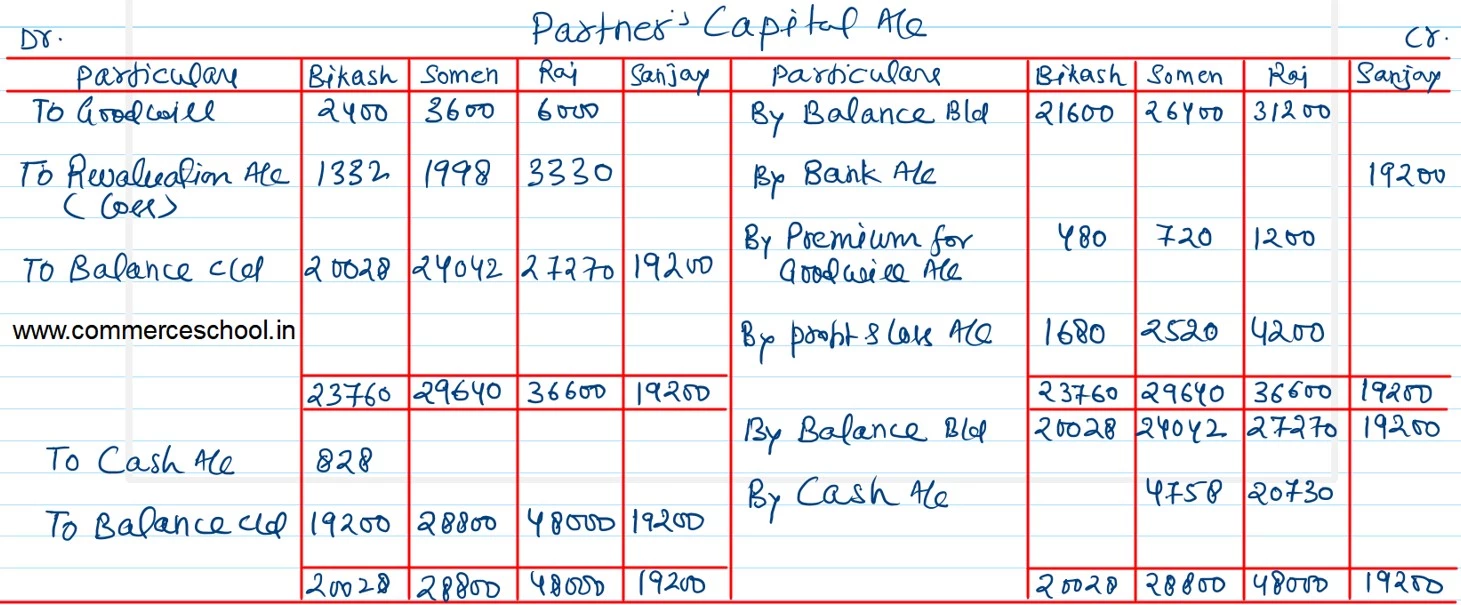

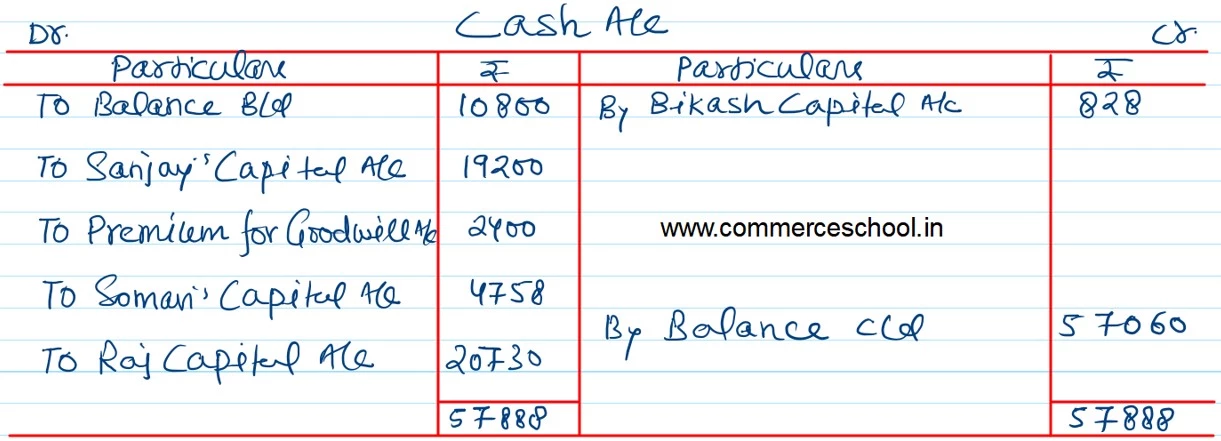

(v) Goodwill is valued at ₹ 14,400 and Sanjoy brings his share in cash.

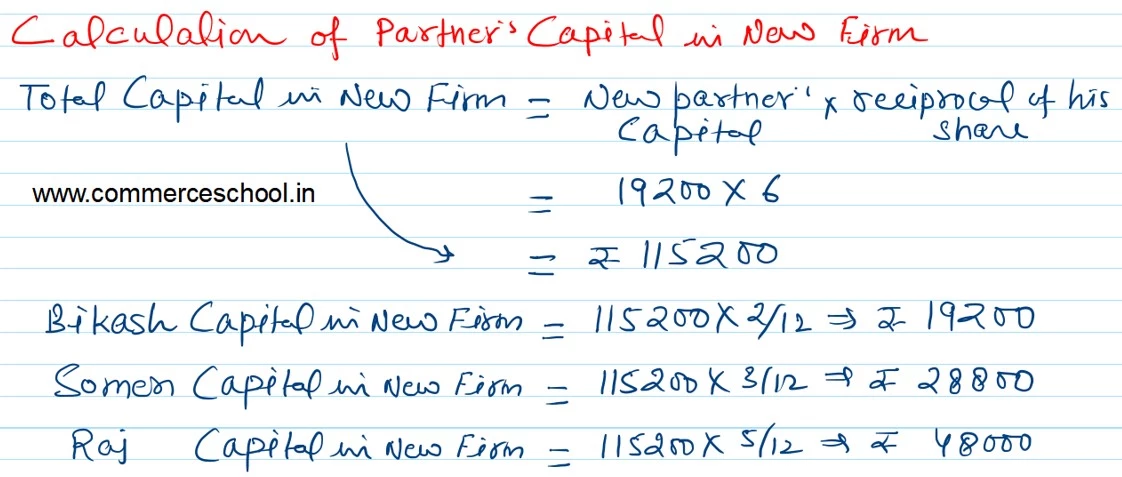

(vi) Sanjoy to bring ₹ 19,200 towards capital for 1/6th share and partners to readjust their Capital Accounts on the basis of their profit sharing ratio taking SAnjoy’s Capital as base.

(vii) Adjustment of Capital to be made through amount brought or paid.

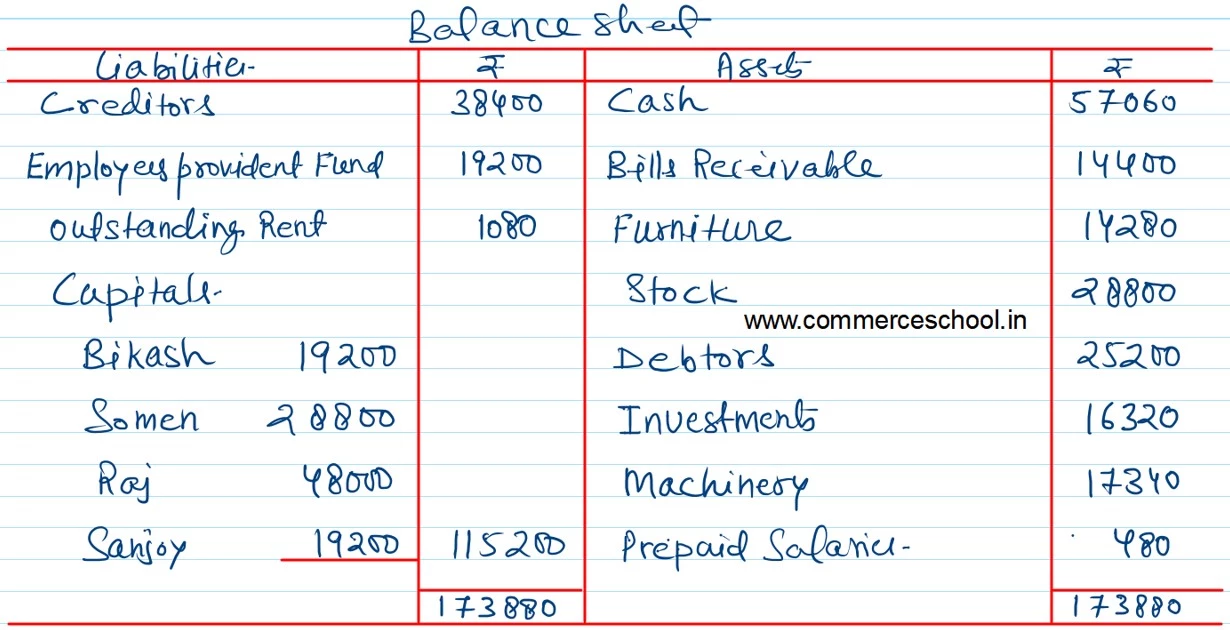

Prepare Revaluation Account, Partner’s Capital Accounts, Cash Account and Balance Sheet of the new firm.