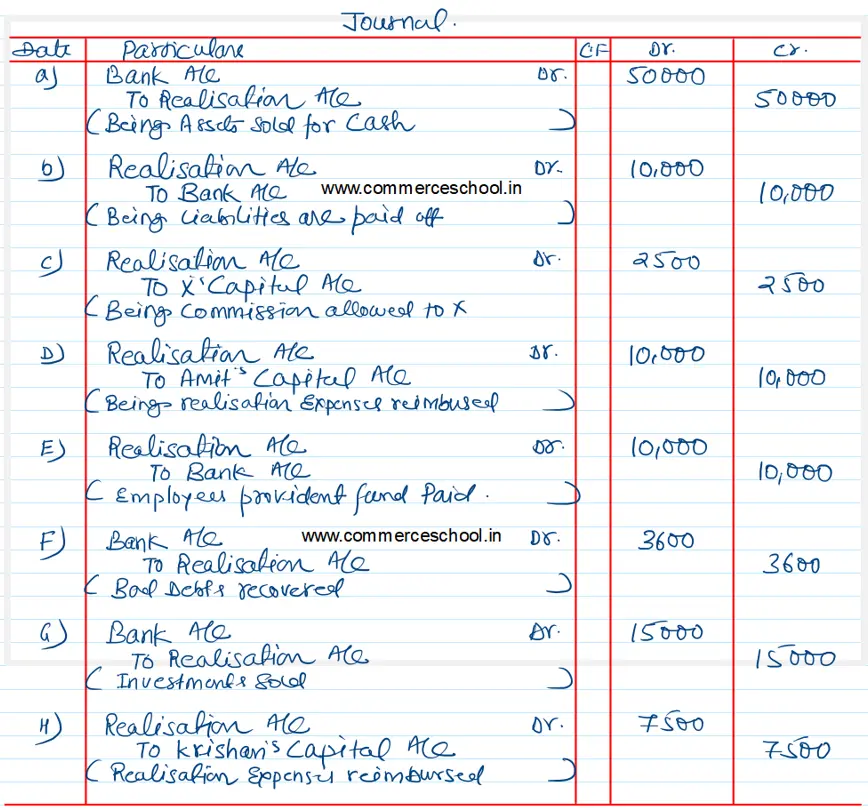

Pass, Journal entries for the following at the time of dissolution of the firm of X and Y after the various assets (other than cash) and outside liabilities have been transferred to Realisation Account:

Pass, Journal entries for the following at the time of dissolution of the firm of X and Y after the various assets (other than cash) and outside liabilities have been transferred to Realisation Account:

(a) Sale of Assets – ₹ 50,000.

(b) Payment of Liabilities – ₹ 10,000.

(c) A commission of 5% allowed to X, a partner, on sale of assets.

(d) Realisation expenses were ₹ 15,000. The firm had agreed with Amrit, to reimburse him ₹ 10,000.

(e) Employees Provident Fund ₹ 10,000.

(f) Z, a debtor, whose account of ₹ 6,000 was written off as bad earlier, paid 60% of the amount.

(g) Investment (Book Value ₹ 10,000) realised at 150%.

(h) Realisation expenses were ₹ 10,000. The firm had agreed with Krishan, a partner, to reimburse him up to ₹ 7,500.