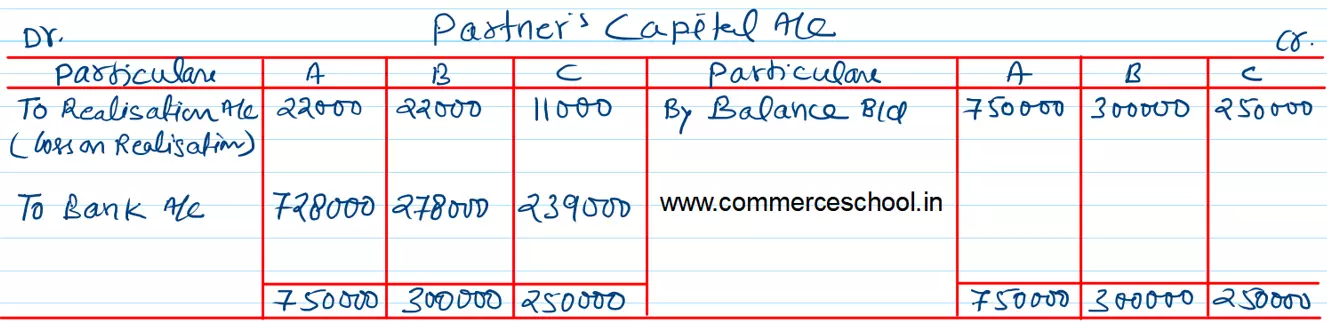

A, B and C were partners sharing profits and losses in the ratio of 2 : 2 : 1. Their Balance sheet as at 31st March, 2018 was as follows:

A, B and C were partners sharing profits and losses in the ratio of 2 : 2 : 1. Their Balance sheet as at 31st March, 2018 was as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Capitals:

A B C Creditors |

7,50,000

3,00,000 2,50,000 2,00,000 |

Cash at Bank

Sundry Debtors Stock Fixed Assets |

1,95,000 |

3,00,000

1,90,000 3,00,000 7,10,000 |

| 15,00,000 | 15,00,000 |

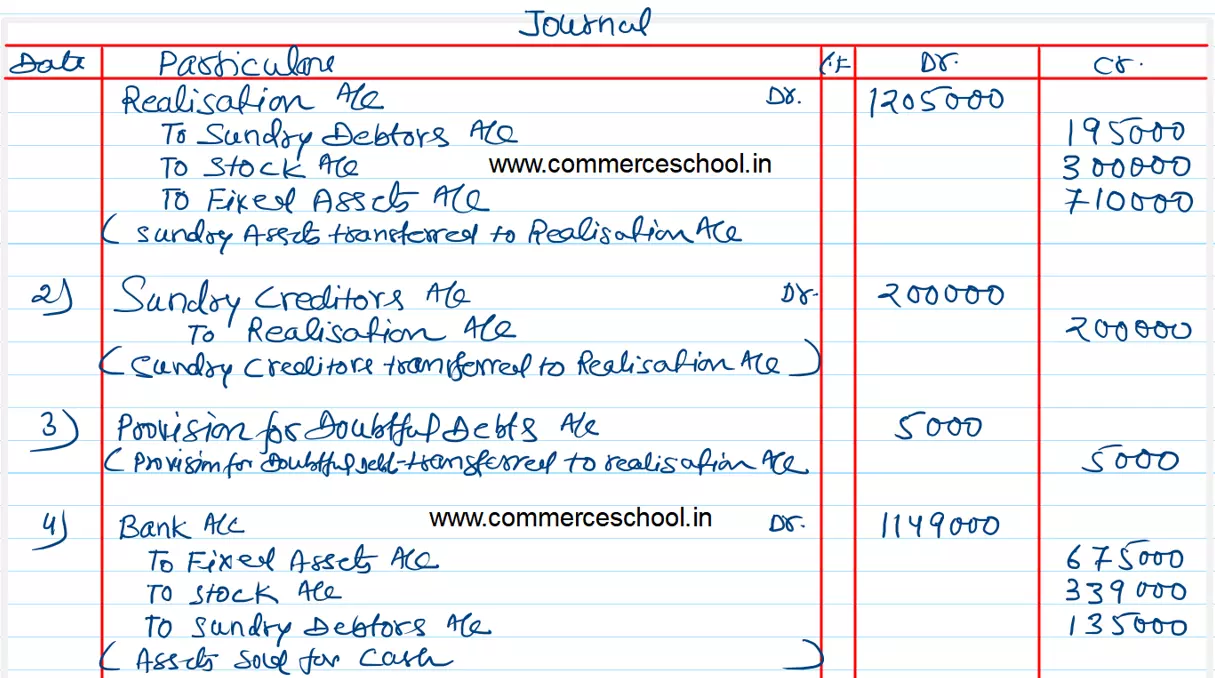

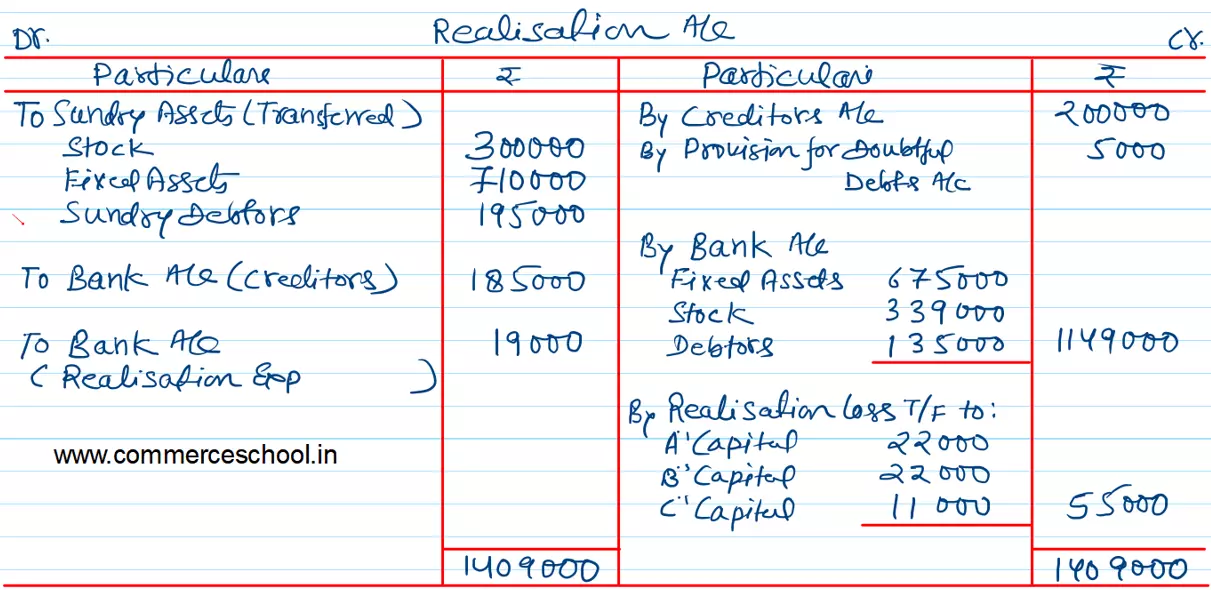

On the above date they dissolved the firm and following amounts were realised:

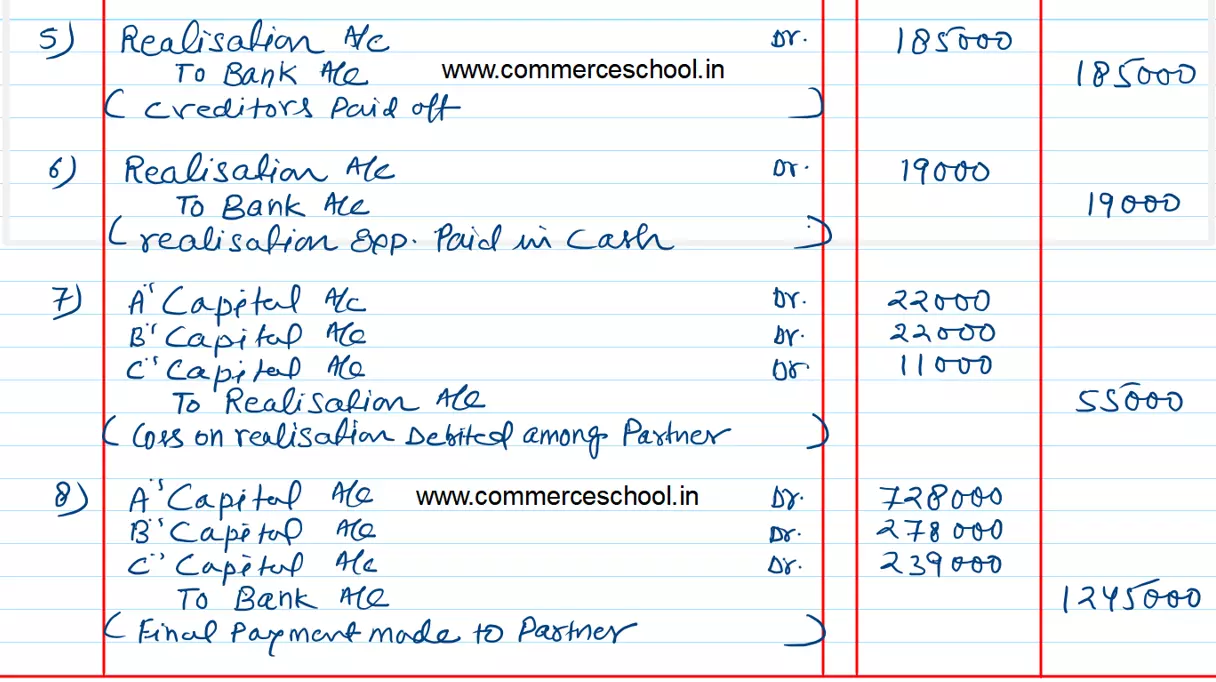

Fixed Assets ₹ 6,75,000; Stock ₹ 3,39,000; Debtors ₹ 1,35,000; Creditors were paid ₹ 1,85,000 in full settlement of their claim. Expenses on realisation amounted to ₹ 19,000.

Pass the necessary Journal entries on the dissolution of the firm.

[Ans.: Loss on Realisation – ₹ 55,000. Final Payment: A – ₹ 7,28,000; B – ₹ 2,78,000; C – ₹ 2,39,000.]

Anurag Pathak Changed status to publish