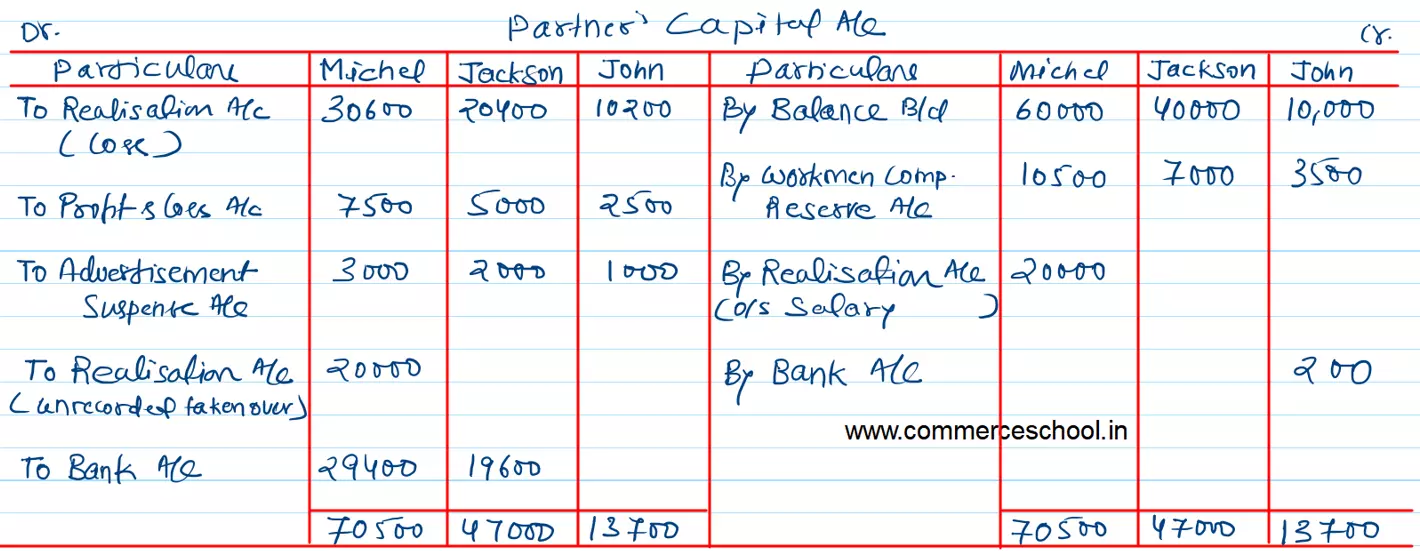

Michael, Jackson and John are in partnership sharing profits and losses in the proportion of 1/2, 1/3 and 1/6 respectively

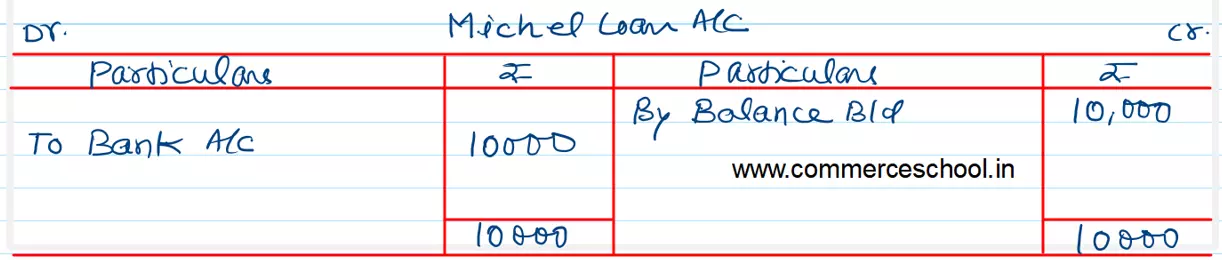

Michael, Jackson and John are in partnership sharing profits and losses in the proportion of 1/2, 1/3 and 1/6 respectively. On 31st March, 2023, they decide to dissolve the partnership and the position of the firm on this date is represented by the following Balance Sheet:

| Liabilities | ₹ | Assets | ₹ |

| Creditors

Loan by Michael Workmen Compensation Reserve Capital A/cs: Michael Jackson John |

40,000 10,000 21,000 60,000 40,000 10,000 |

Cash at Bank

Stock Sundry Debtors Land and Building Profit & Loss A/c Advertisement Suspense A/c |

3,000 50,000 50,000 57,000 15,000 6,000 |

| 1,81,000 | 1,81,000 |

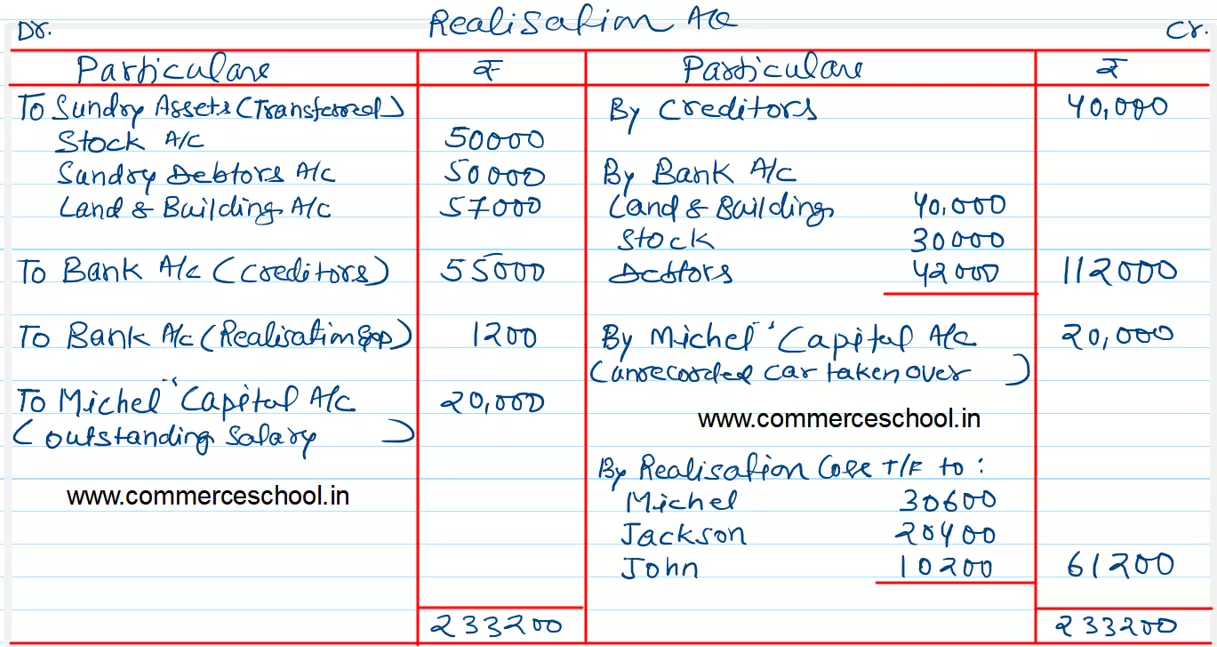

During the realisation process, a liability under a suit for damages is settled at ₹ 20,000 as against ₹ 5,000 provided for in the books of the firm.

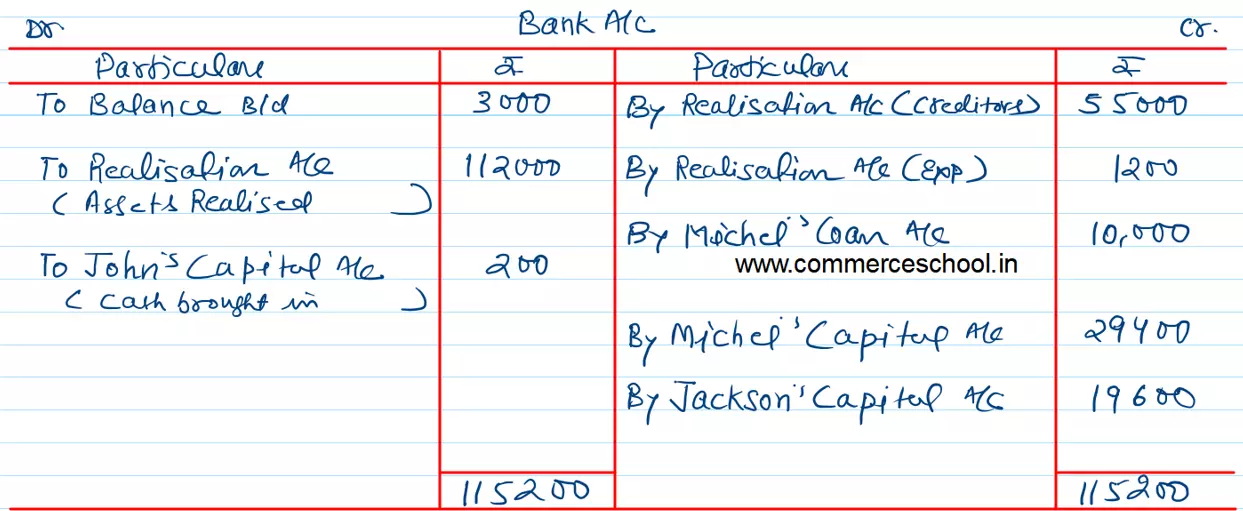

Land and Building were sold for ₹ 40,000 and the Stock and Sundry Debtors realised ₹ 30,000 and ₹ 42,000 respectively. The expenses of realisation amounted to ₹ 1,200.

There was a car in the firm, which was written off from the books. It was taken by Michael for ₹ 20,000. he also agreed to pay Outstanding Salary of ₹ 20,000 not provided in books.

Prepare Realisati 29,400; Jackson – ₹ 19,600; Cash brought in by John – ₹ 200. Total of Bank Account – ₹ 1,15,200.]