Rita and Sobha are partners in a firm, Fancy Garments Exports, sharing profits and losses equally. On 1st April, 2023, the Balance sheet of the firm was:

Rita and Sobha are partners in a firm, Fancy Garments Exports, sharing profits and losses equally. On 1st April, 2023, the Balance sheet of the firm was:

| Liabilities | ₹ | Assets | ₹ | |

| Sundry Creditors

Bills Payable Loan by Rita General Reserve Capital A/cs: Rita Sobha |

75,000 30,000 25,000 24,000 90,000 30,000 |

Cash

Bank Stock Book Debts Plant and Machinery Land and Building Loan to Sobha |

66,000 |

6,000

30,000 75,000 60,000 45,000 48,000 10,000 |

| 2,74,000 | 2,74,000 |

The firm was dissolved on the date given above. The following transactions took place:

(a) Rita took 25% of the stock at a discount of 20% in settlement of her loan.

(b) Book debts realised ₹ 54,000.

(c) Sundry Creditors were paid out at a discount of 10%. Bills payable were paid in full.

(d) Land and Building realised ₹ 1,20,000.

(e) Rita took the goodwill of the firm at a value of ₹ 30,000.

(f) An unrecorded asset of ₹ 6,900 was given in settlement of unrecorded liability of ₹ 6,000 in full settlement.

(g) Realisation Expenses were 5,250.

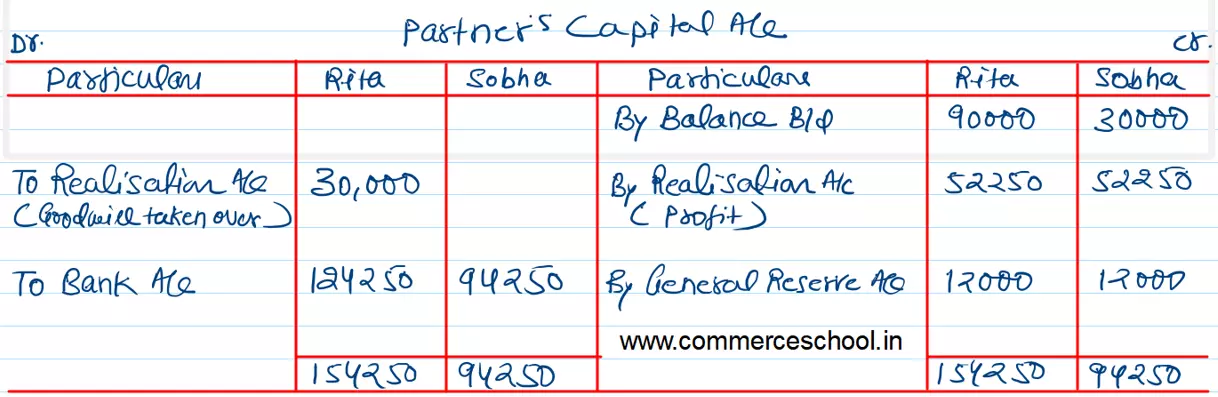

Show Realisation Account, Partner’s Capital Accounts and Bank Account in the books of the firm.

[Ans.: Gain (profit) on Realisation – ₹ 1,04,500; Amount paid to Rita – ₹ 1,24,250; Sobha – ₹ 94,250; Total of Bank Account – ₹ 3,21,250.]