Raina and Meenu were partners in a firm which they dissolved on 31st March, 2023. On this date, Balance Sheet of the firm, apart from realisable assets and outside liabilities showed the following:

Raina and Meenu were partners in a firm which they dissolved on 31st March, 2023. On this date, Balance Sheet of the firm, apart from realisable assets and outside liabilities showed the following:

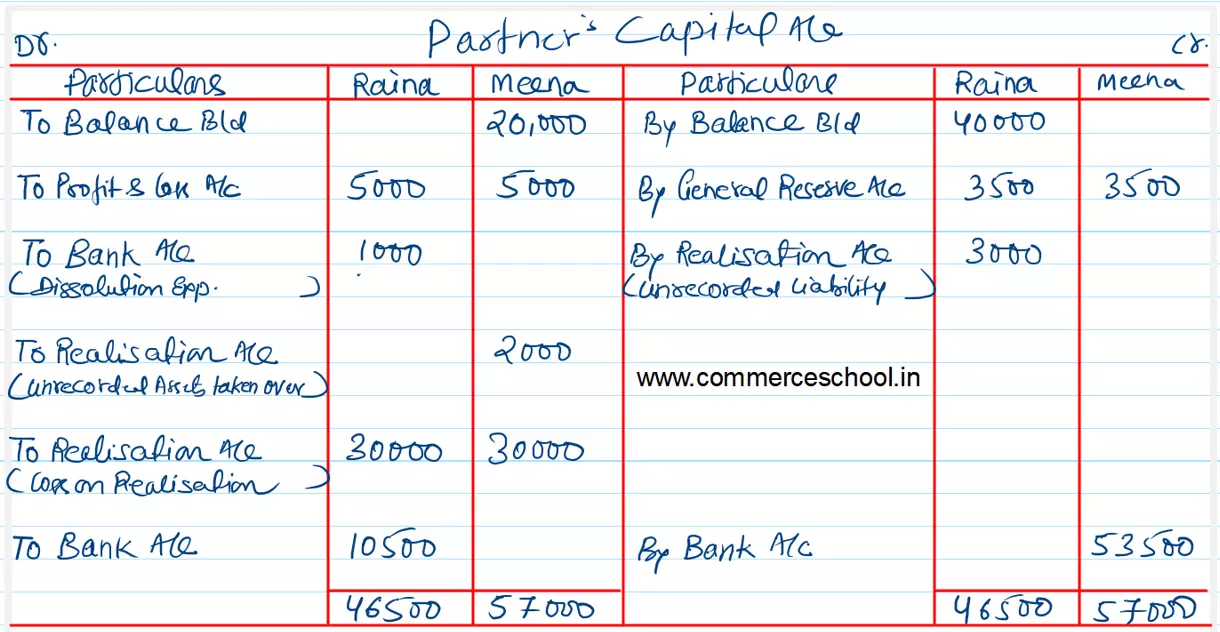

| Raina’s Capital | 40,000 (Cr.) |

| Meena’s Capital | 20,000 (Dr.) |

| Profit & Loss Account | 10,000 (Dr.) |

| Raina’s Loan to the Firm | 15,000 |

| General Reserve | 7,000 |

On the date of dissolution of the firm:

(a) Raina’s loan was repaid by the firm along with interest of ₹ 500.

(b) Dissolution expenses of ₹ 1,000 were paid by the firm on behalf of Raina.

(c) An unrecorded asset of ₹ 2,000 was taken by Meena while Raina paid an unrecorded liability of ₹ 3,000.

(d) Dissolution resulted in a loss of ₹ 60,000 from the realisation of assets and settlement of liabilities.

You are required to prepare Partner’s Capital Accounts.

[Ans.: Final Payment to Raina – ₹ 10,500; Amount brought by Meena – ₹ 53,500.]