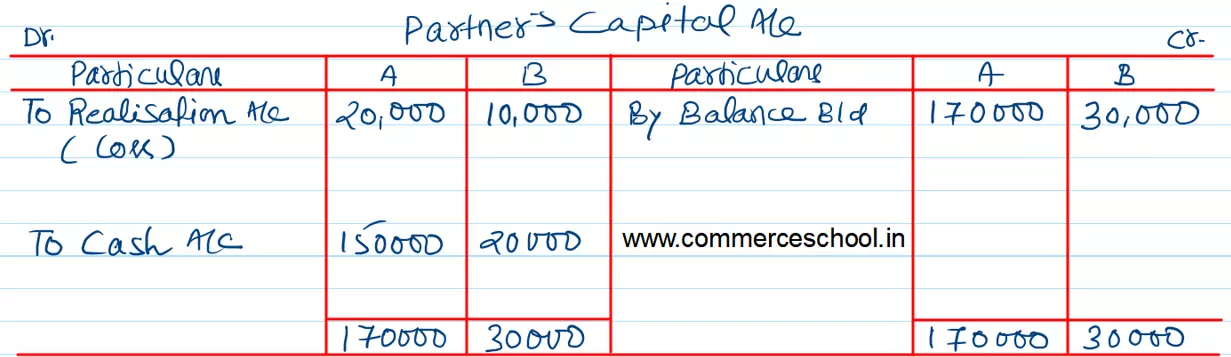

The partnership between A and B was dissolved on 31st March, 2023. On that date the respective credits to the capitals were A – ₹ 1,70,000 and B – ₹ 30,000.

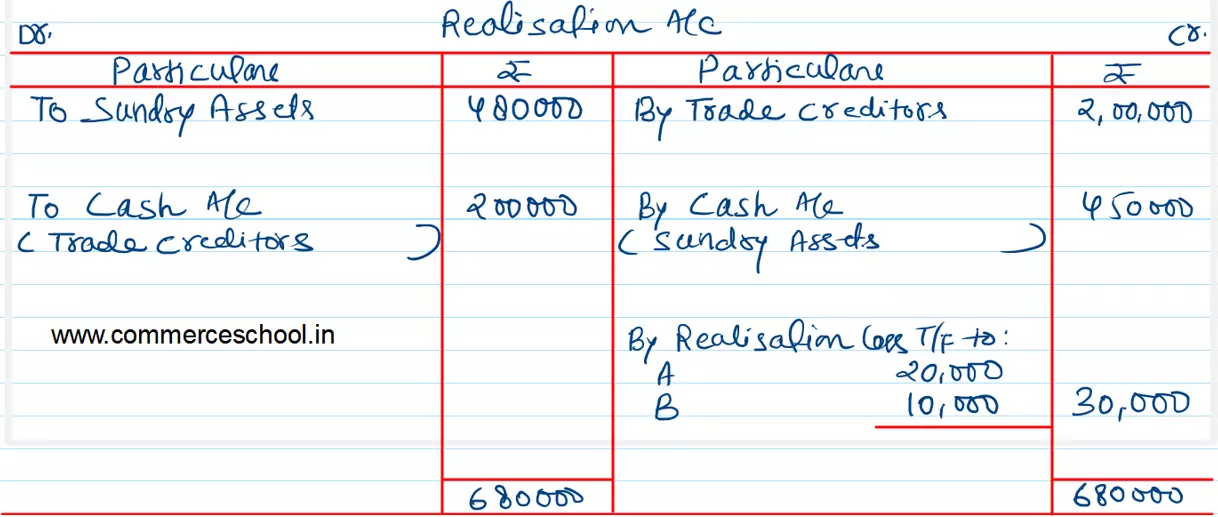

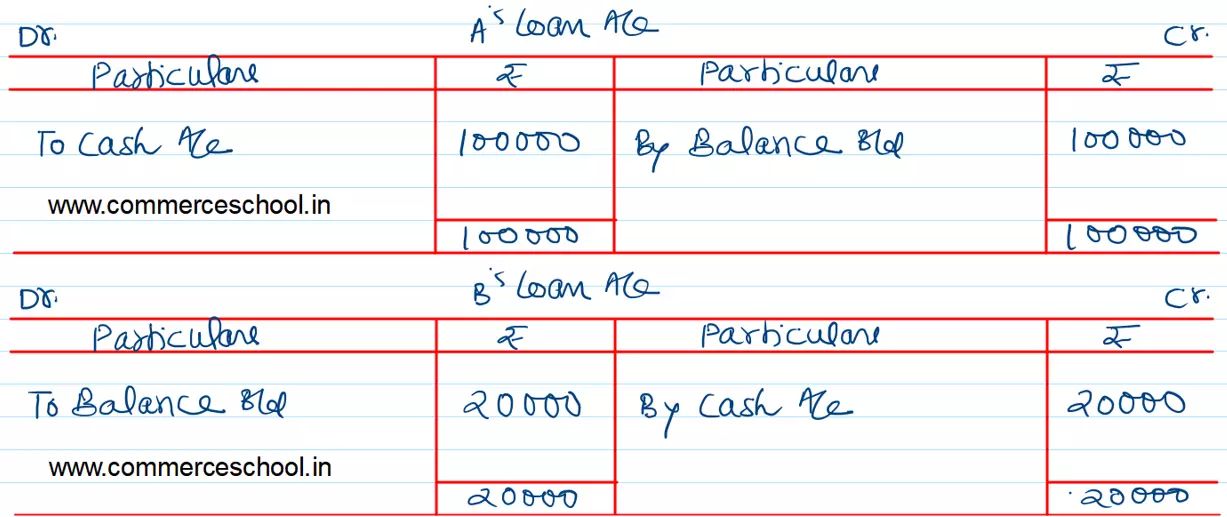

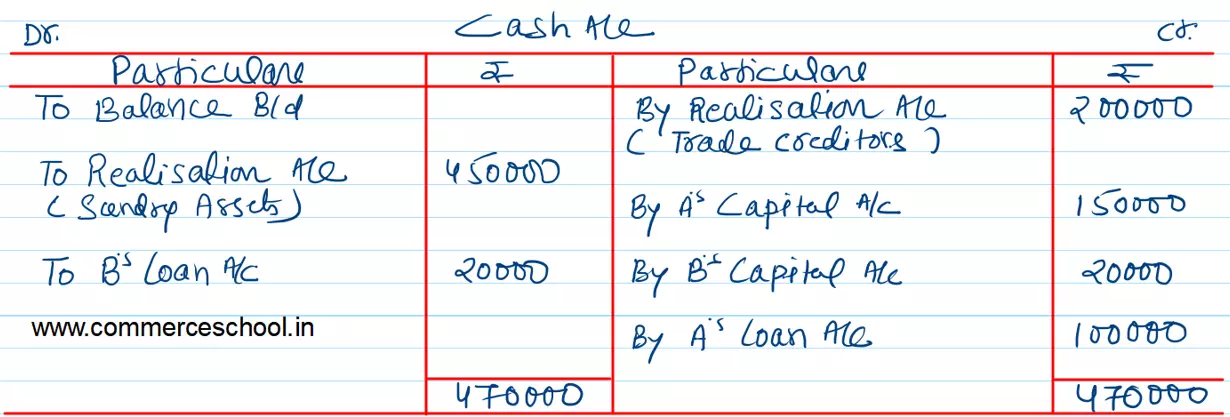

The partnership between A and B was dissolved on 31st March, 2023. On that date the respective credits to the capitals were A – ₹ 1,70,000 and B – ₹ 30,000. ₹ 20,000 were owed by B to the firm; ₹ 1,00,000 were owed by the firm to A and ₹ 2,00,000 were due to the Trade Creditors. Profits and losses were shared in the proportions of 2/3 to A, 1/3 to B. The assets represented by the above stated net liabilities realised ₹ 4,50,000 exclusive of ₹ 20,000 owed by B. The liabilities were settled at book figures. Prepare Realisation Account, Partner’s Capital Accounts and Cash Account showing the distribution to the partners.

[Ans.: Loss on Realisation – ₹ 30,000.]

Anurag Pathak Changed status to publish