Calculate Trade Receivables Turnover Ratio in each of the following alternative cases: Net Credit Sales ₹ 4,00,000; Average Trade Receivables ₹ 1,00,000

Calculate Trade Receivables Turnover Ratio in each of the following alternative cases:

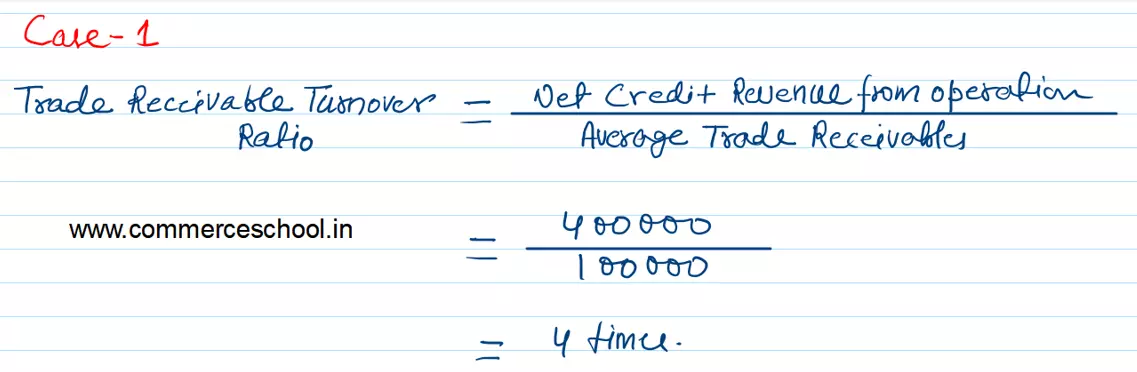

Case 1: Net Credit Sales ₹ 4,00,000; Average Trade Receivables ₹ 1,00,000.

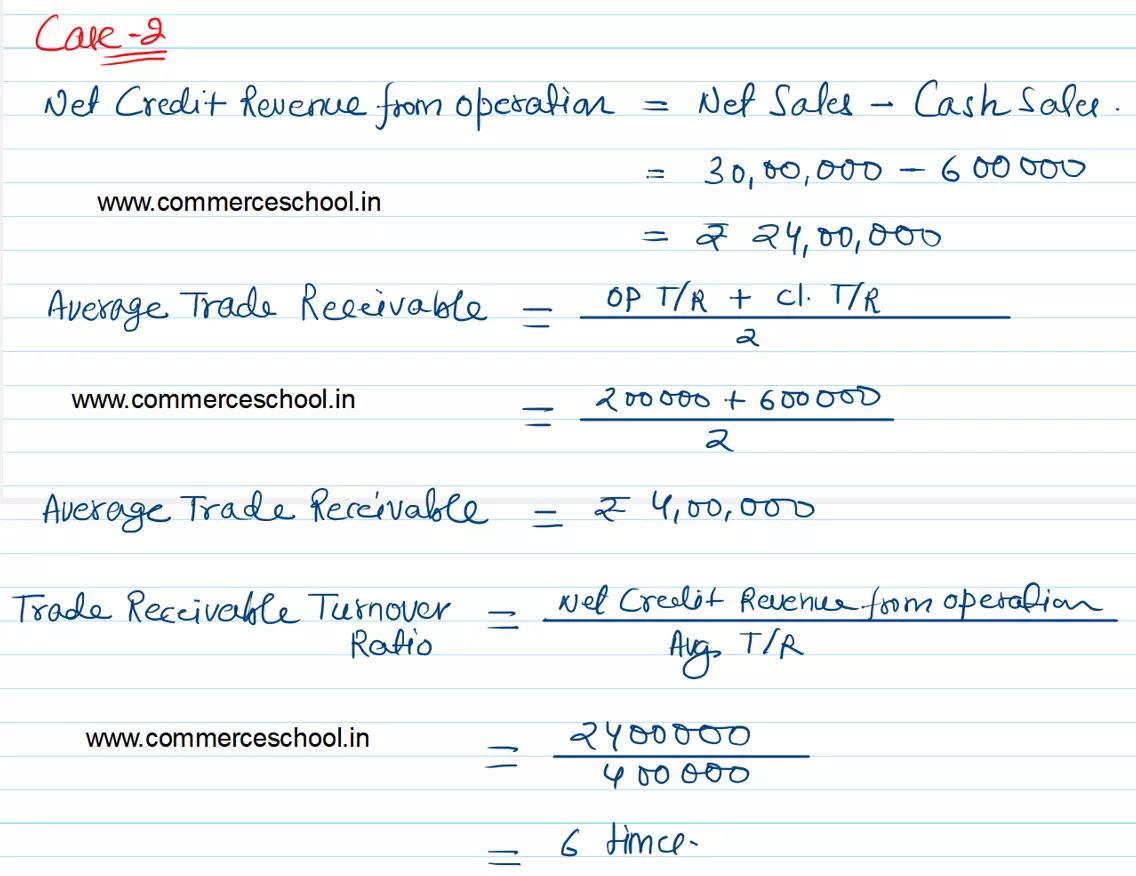

Case 2 : Revenue from Operations (Net Sales) ₹ 30,00,000; Cash Revenue from Operations, i.e., Cash Sales ₹ 6,00,000; Opening Trade Receivables ₹ 2,00,000; Closing Trade Receivables ₹ 6,00,000.

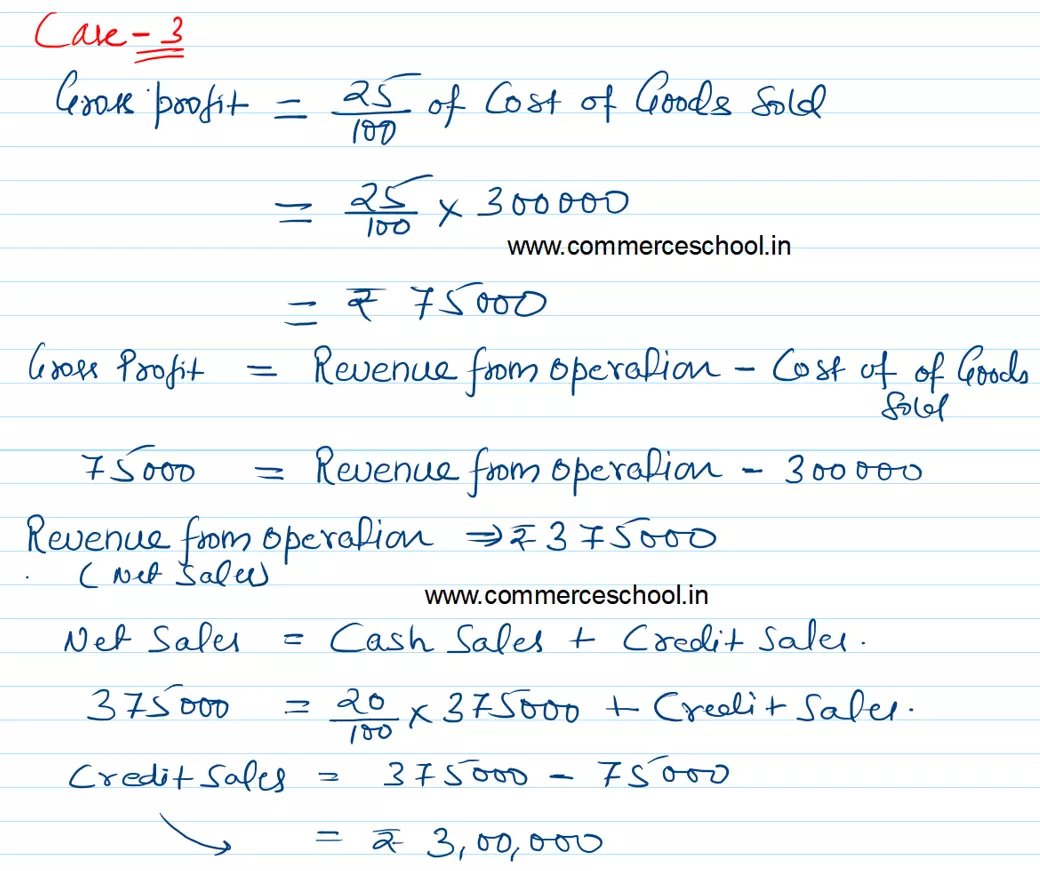

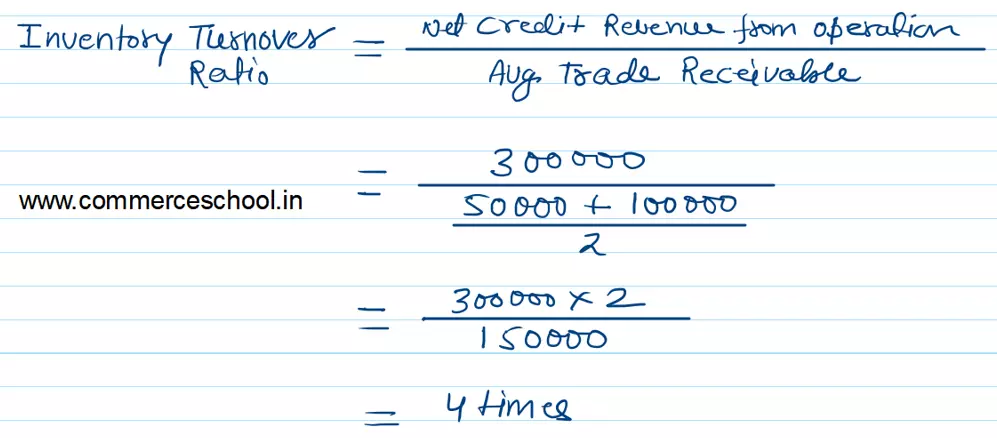

Case 3: Cost of Revenue from Operations or Cost of Goods Sold ₹ 3,00,000; Gross Profit on Cost 25%; Cash Sales 20% of Total Sales; Opening Trade Receivables ₹ 50,000; Closing Trade Receivables ₹ 1,00,000.

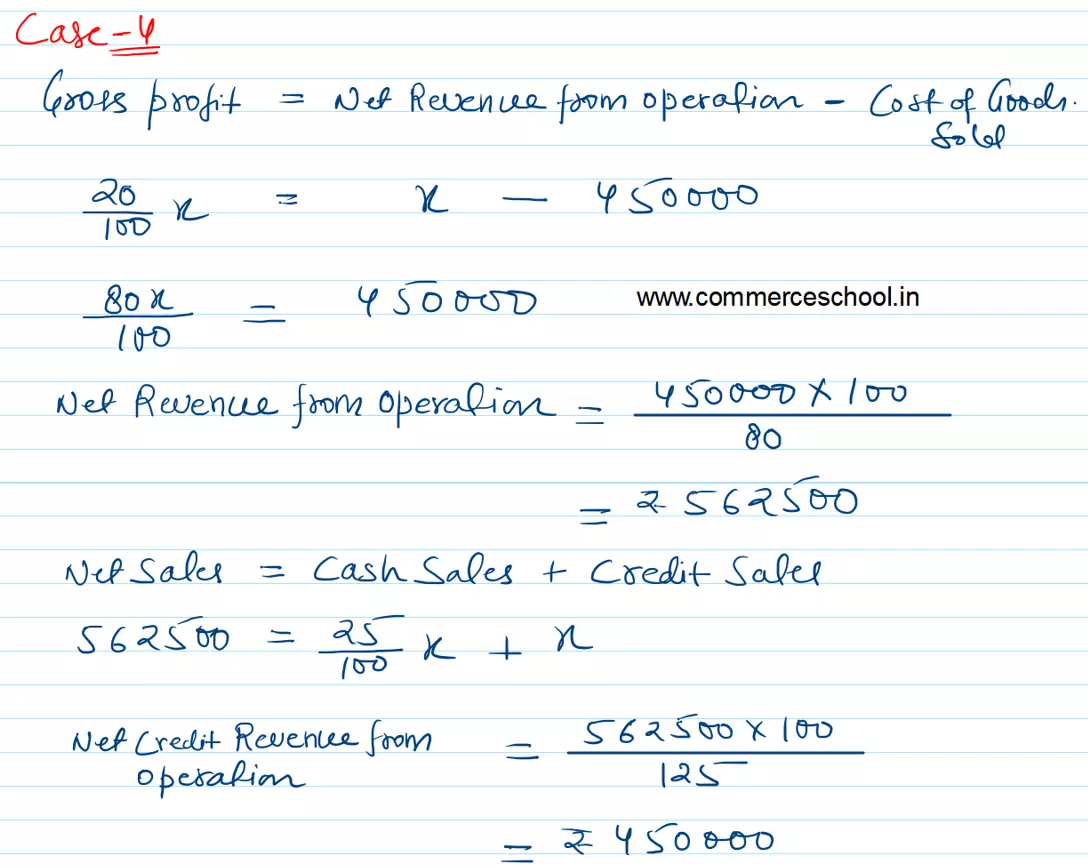

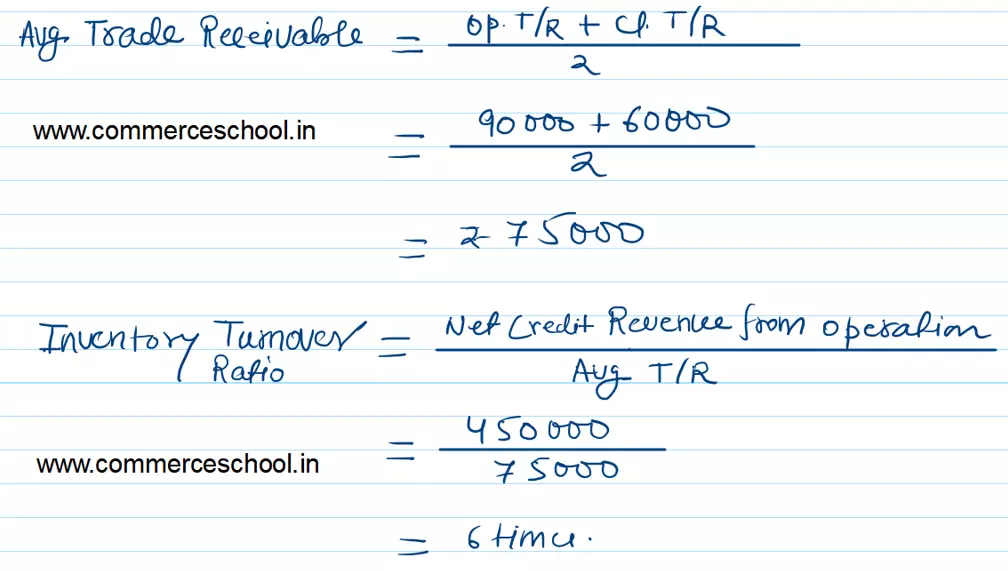

Case 4: Cost of Revenue from Operations or Cost of Goods Sold ₹ 4,50,000; Gross Profit on Sales 20%; Cash Sales 25% of Net Credit Sales, Opening Trade Receivables ₹ 90,000; Closing Trade Receivables ₹ 60,000.

[Ans.: Case 1: Trade Receivables Turnover Ratio = 4 Times; Case 2: Trade Receivables Turnover Ratio = 6 Times; Case 3: Trade Receivables Turnover Ratio = 4 Times; Case 4: Trade Receivables Turnover Ratio = 6 Times.]

😊😊so good 👍