From the following Balance Sheet of Akhil Ltd. as at 31st March, 2023, Calculate (i) Net Assets Turnover Ratio and (ii) Fixed Assets Turnover Ratio:

From the following Balance Sheet of Akhil Ltd. as at 31st March, 2023, Calculate (i) Net Assets Turnover Ratio and (ii) Fixed Assets Turnover Ratio:

| Particulars | Note. No. | ₹ |

| I. EQUITY AND LIABILITIES | ||

| 1. Shareholder’s Funds (a) Share Capital (b) Reserves and Surplus |

10,00,000 3,00,000 |

|

| 2. Non-Current Liabilities Long-term Borrowings: – 8% Debentures |

5,00,000 | |

| 3. Current Liabilities (a) Trade Payables (b) Other Current Liabilities |

1,50,000 50,000 |

|

| Total | 20,00,000 | |

| II ASSETS | ||

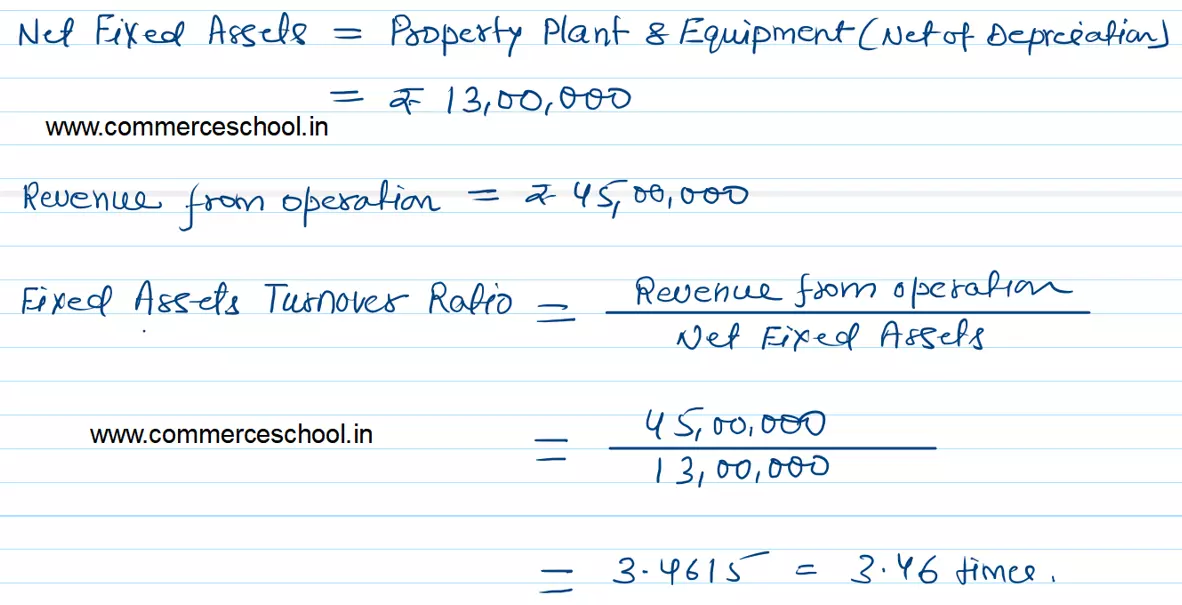

| 1. Non-Current Assets Property, Plant and Equipment and Intangible Assets: – Property, Plant, and Equipment (Net of Depreciation) |

13,00,000 | |

| 2. Current Assets (a) Inventories (b) Trade Receivables (c) Cash and Cash Equivalents |

3,00,000 2,50,000 1,50,000 |

|

| Total | 20,00,000 |

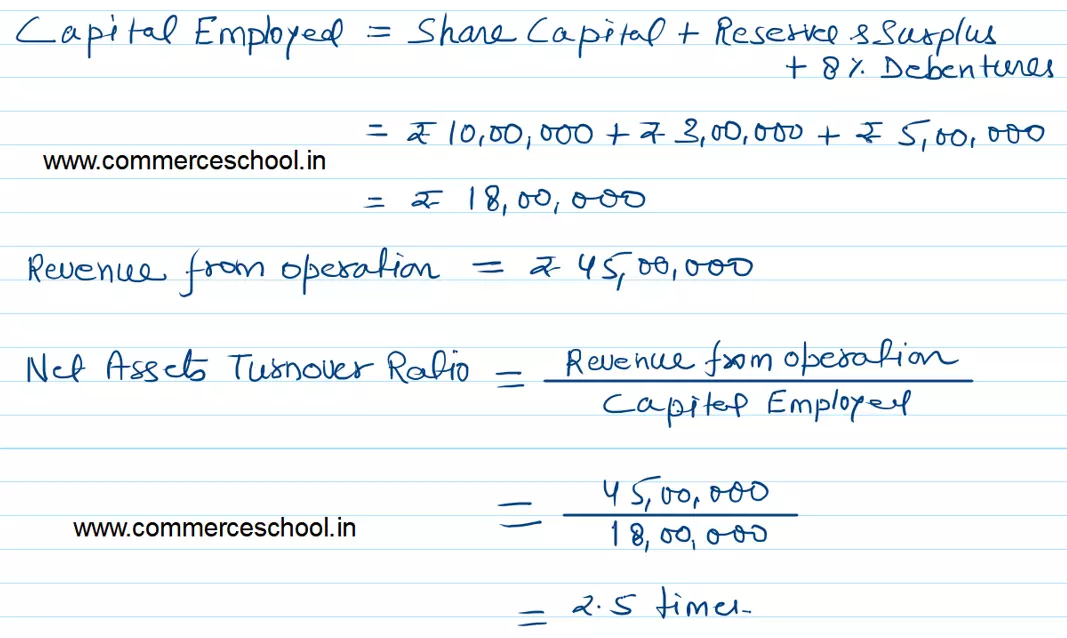

Revenue from Operations for the year was ₹ 45,00,000.

[Ans.: (i) 2.5 Times and (ii) 3.47 Times.

Anurag Pathak Changed status to publish